Notes

- In this lecture, Michael recaps many of his concepts, such as Change In The State of Delivery, Order Blocks, Market Maker Models, and more.

- According to Michael, the Quarters Theory is nonsense.

- He states that not every FVG can become an inverse FVG (IFVG). Unfortunately, he does not provide an example to support this statement.

- Many of Michal’s intraday trades are based on the expectation that an hourly candle will expand in a certain direction (hourly bias).

- Wicks should be treated in the same way as gaps (FVG, NDOG, NWOG…).

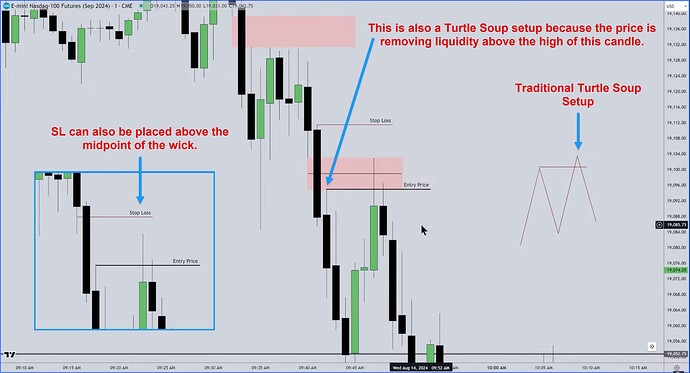

- If a candle forms with a wick at the bottom and the price cannot trade below the lower half of the wick, it is a sign of strength (bullishness).

- If a candle forms with a wick at the top and the price cannot trade above the higher half of the wick, it is a sign of weakness (bearishness).

- The candle wick can be divided into quarters like a gap, with the consequent encroachment (midpoint) being the most important part.

- Michael explains how to enter on order blocks while they are being created, i.e., before they are confirmed [2:31:50].

NQ - Bearish Order Block And Consequent Encroachment Of Wick

NQ - Sign Of Strength

NQ - Turtle Soup Setups And Stop Loss Placements

NQ - Price Reaction To The Consequent Encroachment Of The Wick

Next lesson: 2024 ICT Mentorship - Lecture 9: August 15

Previous lesson: 2024 ICT Mentorship - Lecture 7: August 13