Foundation Presentation

Trade Plan & Algorithmic Theory

Notes

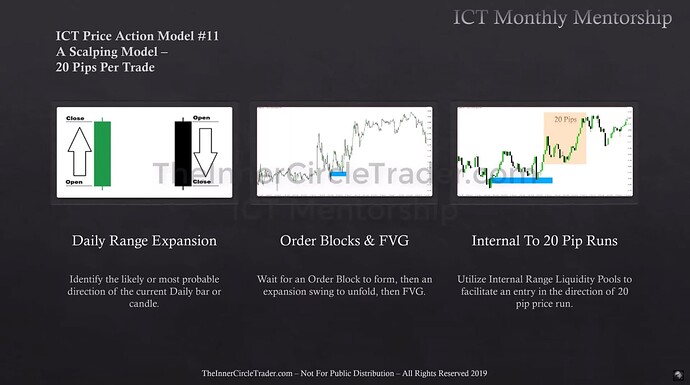

- This scalping model targets 20 pips per trade.

- In periods of high volatility, it may not be necessary to determine the expected daily expansion, i.e., daily bias.

- The model is straightforward, making it accessible even for those who find real-time market analysis challenging. It is highly visual, relying on simple principles of price action and liquidity.

- High-probability order blocks are identified by their proximity to a fair value gap, but this model allows for FVGs within price swings not directly linked to order blocks.

- Although this strategy is presented as the scalping model, it can be scaled to higher timeframes for larger pip gains. It is versatile and can be used across various markets and asset classes.

- Using a 5-pip or even a 2-pip stop loss is nonsense. Michael recommends using a stop loss of at least 15 pips.

- The retracement to 15-minute FVG with OB must be within the London or New York Kill Zone.

- This setup occurs frequently, often twice a day.

- We should understand that this model is about consistent, small gains rather than big wins.

- Michael advises us to be cautious and not to become a “gambling junkie” by overtrading. We should stick to the plan and avoid the temptation to always be in the market.

- Success comes from disciplined practice and understanding the nuances of market behavior.

ICT Scalping Model - Procedure

ICT Scalping Model - Procedure

ICT Scalping Model - EURUSD Trade Example

ICT Scalping Model - EURUSD Trade Example 2

ICT Scalping Model - EURUSD Trade Example 3

ICT Scalping Model - EURUSD Trade Example 4

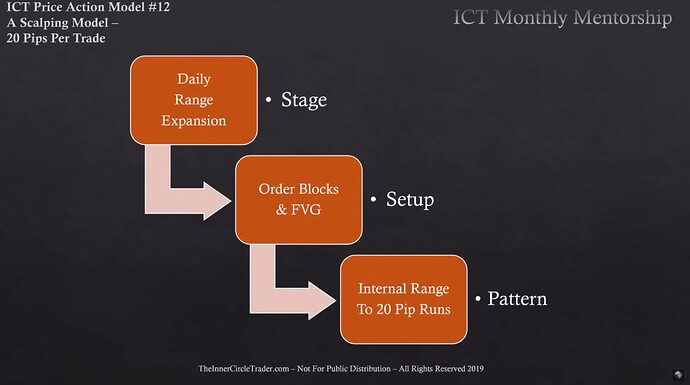

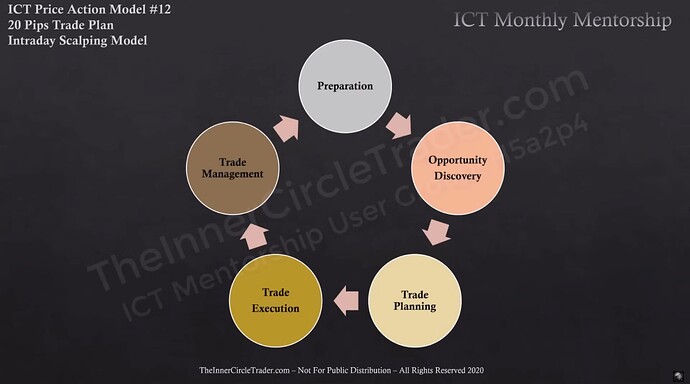

ICT Scalping Model - Trade Stages

Preparation - Medium And High Events

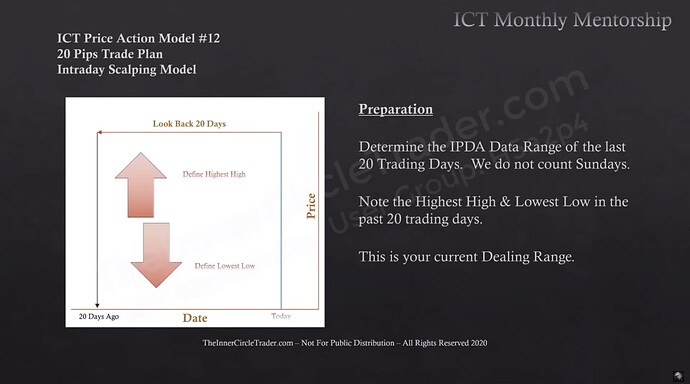

Preparation - IPDA Data Ranges

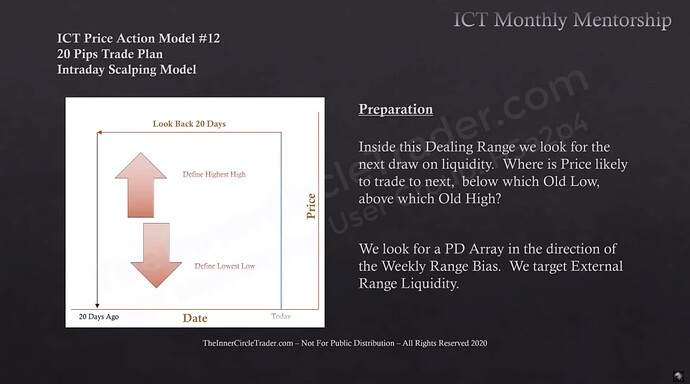

Preparation - PD Arrays

Preparation - Anticipating Price Movement

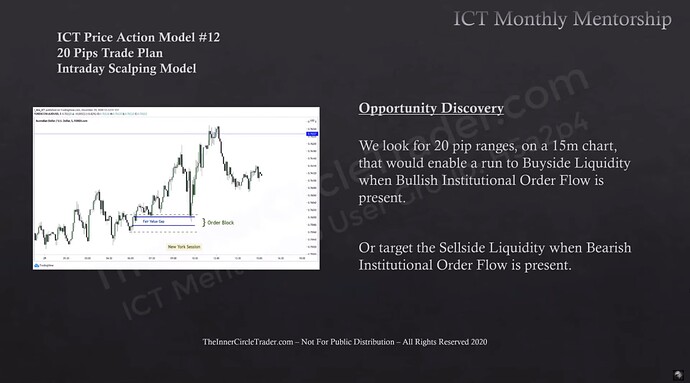

Opportunity Discovery - Buy-Side and Sell-Side Liquidity

Trade Planning - Bearish Conditions

Trade Planning - Bullish Conditions

Trade Executions - Bearish Setup

Trade Executions - Bullish Setup

Short Trade Management - Trade Entry

Short Trade Management - Trade Target

Long Trade Management - Trade Entry

Long Trade Management - Trade Target

Stop Loss Management

Money Management - Position Size Calculation Formula

Money Management - Micro Lots

Money Management - Mini Lots

Money Management - Standard Lots

Backtesting

USDCAD Scalp Trade Example - Daily Chart

USDCAD Scalp Trade Example - IOFED Buying Opportunity

Next lesson: ICT Price Action Model 13 - 2022 YouTube Model

Previous lesson: ICT Price Action Model 11 - Day Trading Model