Notes

- This entry technique is designed for higher time frames, i.e., for long-term traders. We will apply it to daily charts in our case.

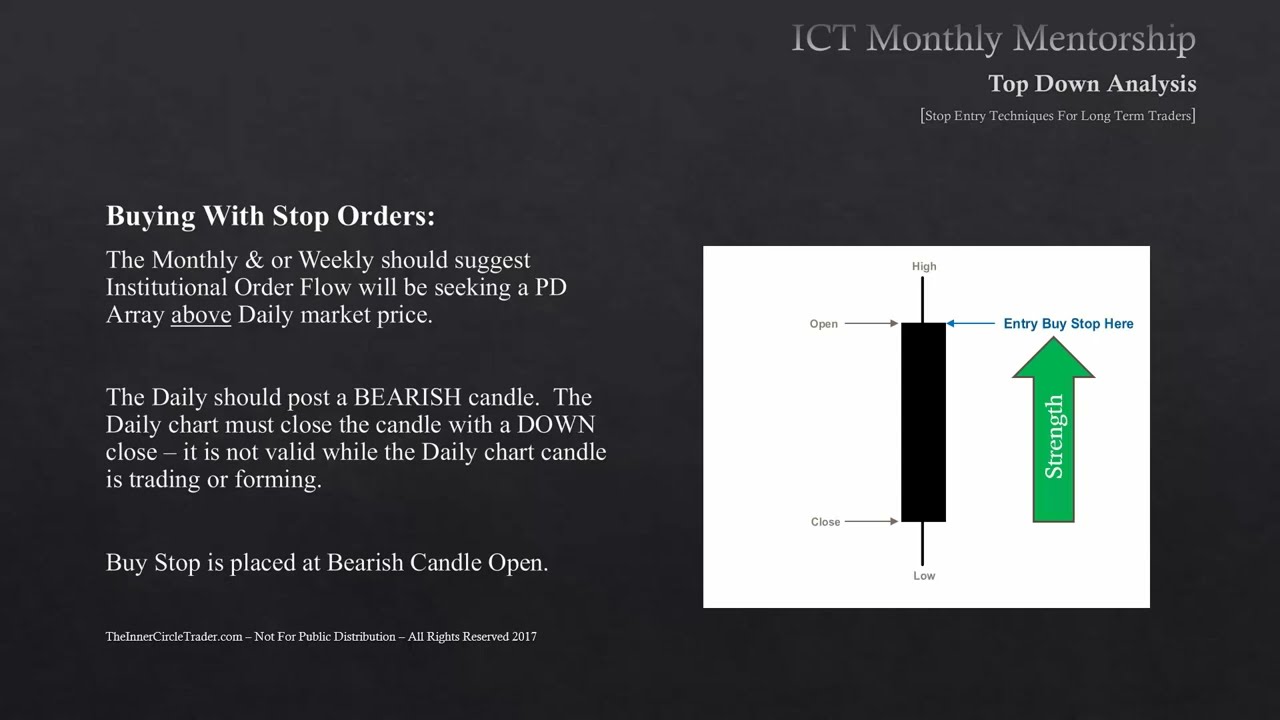

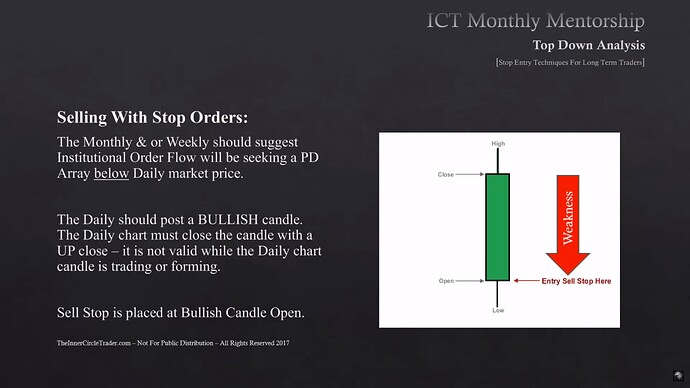

- If we want to enter a long position, then every time a new down candle is formed, we move our buy stop order to its open price.

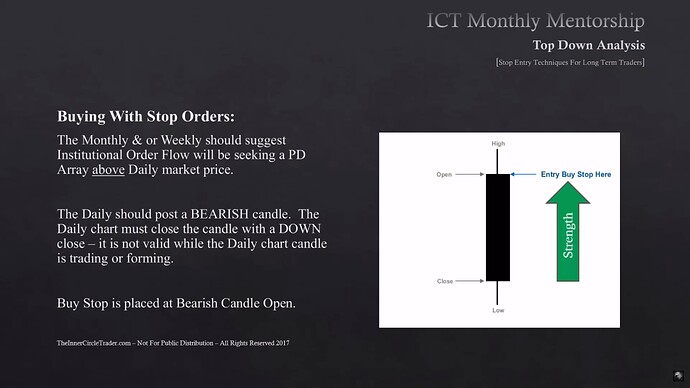

- If we want to enter a short position, then every time a new up candle is formed, we move our sell stop order to its open price.

- The higher we get and the closer we get to the monthly and weekly objectives/PD arrays, the less likely it is that these candles will promote buying. We prefer to buy at equilibrium or below.

- The lower we get and the closer we get to the monthly and weekly objectives/PD arrays, the less likely it is that these candles will promote selling. We prefer to sell at equilibrium or above.

- If you enter a long position, your stop loss will be below the last swing low and the specific reference point described in the position trade management lesson.

- If we have realized a partial profit and the market returns to our entry, which is now a confirmed order block, we can buy/sell again if we expect further movement in the expected direction.

Stop Entry Techniques For Long-Term Traders - Buying With Stop Orders

Stop Entry Techniques For Long-Term Traders - Selling With Stop Orders

Stop Entry Techniques For Long-Term Traders - Buy Stops On Open Price

Stop Entry Techniques For Long-Term Traders - USDJPY Example - Monthly Chart

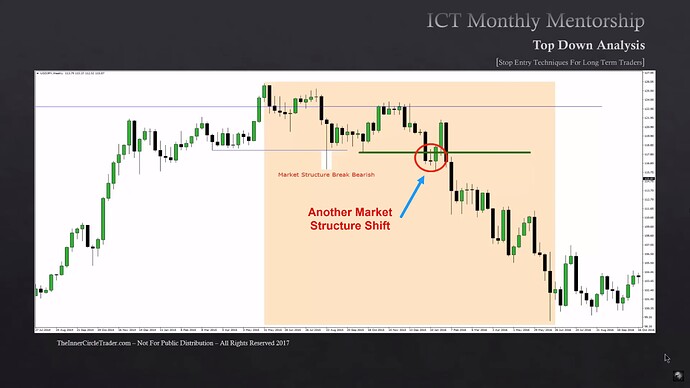

Stop Entry Techniques For Long-Term Traders - USDJPY Example - Market Structure Shift

Stop Entry Techniques For Long-Term Traders - Sell Stops On Open Price

Next lesson: ICT Mentorship Core Content - Month 5 - Limit Order Entry Techniques For Long Term Traders

Previous lesson: ICT Mentorship Core Content - Month 5 - Trade Conditions & Setup Progressions