Notes

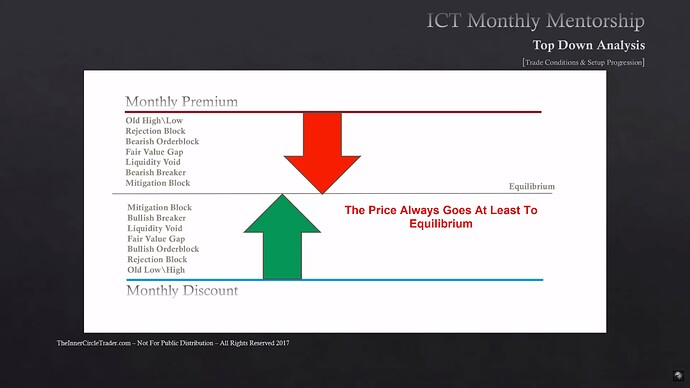

- When the market is at a premium or at a discount, it will always look to rebalance to at least the equilibrium of the last recent range.

- Every time we are in an uptrend, you want to focus on the down candles cause that’s where institutions will buy.

- Every time we are in a downtrend, you want to focus on the up candles cause that’s where institutions will sell.

- When the price is bearish and it is dropping on the daily or weekly chart, we will see small ralliers form. That’s where banks are buying. They’re long-term hedging because they can’t fill all their orders at once. The opposite is true for the bullish scenario.

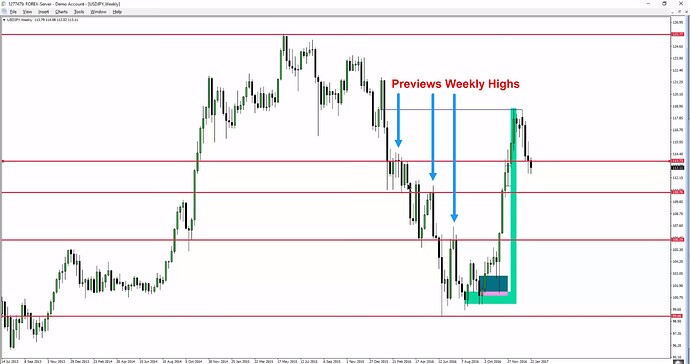

- At old weekly highs, new bullish daily order blocks form. This is how we can anticipate an order block forming, and we can buy from it, especially since the HTF objective hasn’t been reached yet.

- If you see big spikes that don’t make sense to you, switch to a higher timeframe to see what the smart money is trying to do.

- If the price does not respect our daily PD array (for example, order block or breaker), we switch to the weekly chart because it might want to retrace deeper. If you can’t find anything in this time frame, which is unlikely, then drop to the monthly chart.

- The algorithm primarily works on the daily time frame, but if the price has already absorbed all of the potential liquidity, it will go out to the larger open float. That will usually dip you into the weekly ranges.

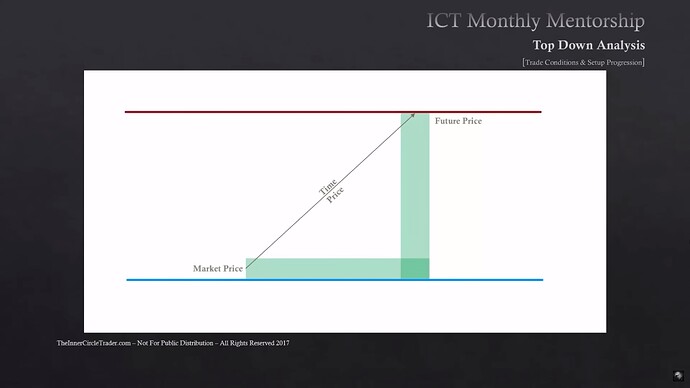

Trade Conditions & Setup Progressions - Price Movement From Discount To Premium

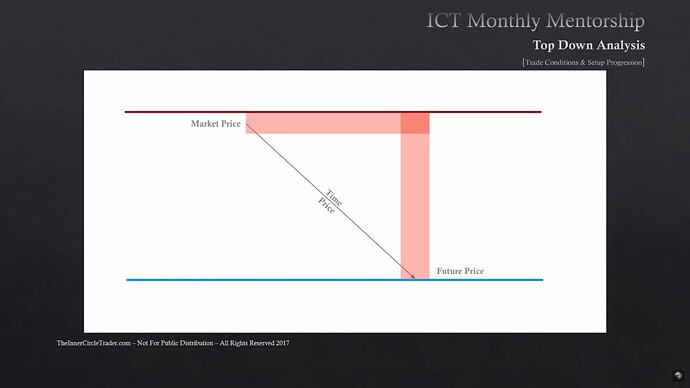

Trade Conditions & Setup Progressions - Price Movement From Premium To Discount

Trade Conditions & Setup Progressions - Equilibrium

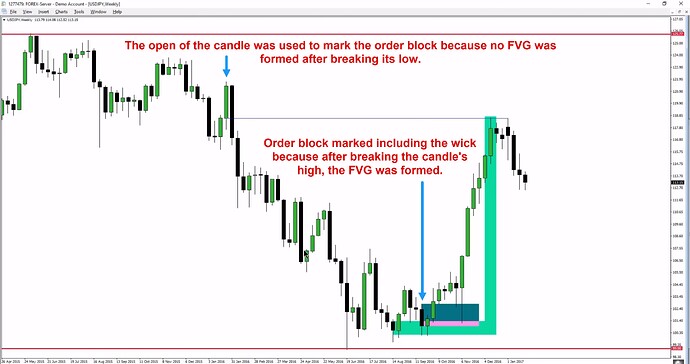

Trade Conditions & Setup Progressions - USDJPY Discount To Premium Example

Trade Conditions & Setup Progressions - Order Block Marking

Trade Conditions & Setup Progressions - Previews Weekly Highs

Trade Conditions & Setup Progressions - New Bullish Daily Order Blocks

Next lesson: ICT Mentorship Core Content - Month 5 - Stop Entry Techniques For Long Term Traders

Previous lesson: ICT Mentorship Core Content - Month 5 - Defining HTF PD Arrays