Notes

- Many ICT traders fail because they don’t listen to or follow Michael’s guidance. Even though they might clone his trades, they make the mistake of ignoring the discipline needed.

- The market (ES, NQ, or YM) doesn’t move based on buying or selling pressure. Instead, it seeks liquidity pools or fills inefficiencies. Understanding this concept is critical for long-term success.

- New traders must practice in demo accounts until they stop caring about being right and focus on following their rules. Real trading requires removing the emotional need to be correct and learning to reduce risk properly.

- Stop losses should never be widened once placed. If a trader feels the need to widen their stop, it’s better to exit the trade entirely because they’ve already lost control of their discipline.

- Macros are time intervals during which we can expect the price to start moving in one direction. Most of this movement may occur outside the macro time but always begins in this interval.

- New York morning session macros:

- 9:50 to 10:10 a.m.

- 10:50 to 11:10 a.m.

- The Silver Bullet is a scalping trade that captures a short-term, high-probability move, typically for a profit of 5 points.

- The Silver Bullet trade will form daily between 10 and 11 a.m. However, there is also an afternoon setup, the timing of which Michael will outline in a future video.

- The Silver Bullet setup:

- Potential to buy-side or sell-side liquidity of at least 5 points (5 handles).

- Displacement.

- Enter on imbalance (FVG, IFVG).

- It’s better to stay out of the market on difficult days. If conditions are tough, experienced traders prefer to avoid trading and let the market resolve its behavior.

- Michael emphasizes that learning when not to trade is a key lesson that is often ignored. He teaches not just how to trade but when to recognize that the market conditions are not conducive to trading.

- When markets are unpredictable, risk, leverage, and frequency of trades must be reduced. A less-is-more approach during these times is advised to avoid unnecessary losses.

- On “Seek and Destroy” days, markets may repeatedly hit stop losses, leaving traders demoralized. Traders may try to chase losses using more leverage, leading to catastrophic results.

- Managing expectations is essential during periods of difficult trading. Accepting that some days are meant for learning or observing rather than trading is vital.

- We must learn to avoid blowing our accounts on tough days to stay in the game long enough for the easy days. Markets will provide better opportunities, but only disciplined and patient traders will be ready when those opportunities arise.

- When the market isn’t providing clear opportunities, it’s best to step away and spend time with family or other activities. Missing a trade won’t matter as long as we stay disciplined.

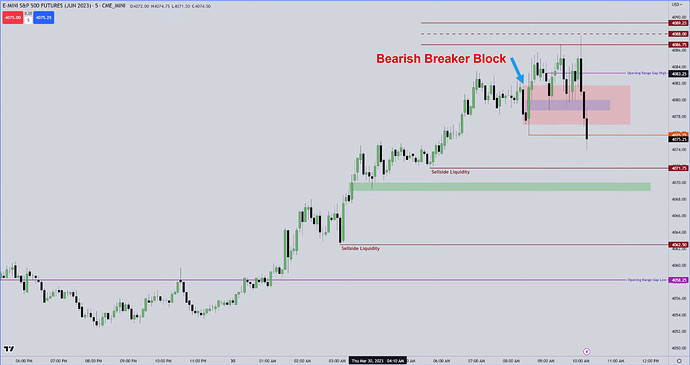

ICT Bearish Breaker Block

ICT Silver Bullet Short Trade

Next lesson: 2023 ICT Mentorship - AM Session Live Tape Reading: March 31

Previous lesson: 2023 ICT Mentorship - E-mini S&P 500 Review: March 27