Notes

- Futures delivery months:

- January – F

- February - G

- March -H

- April -J

- May - K

- June - M

- July - N

- August - Q

- September -U

- October - V

- November -X

- December -Z

- Information about the currently traded futures contract can be obtained at barchart.com.

- From May to early June, short positions in stock index futures are preferred, as there is a time-tested seasonal tendency for the decline of these markets. Common market wisdom says, “Sell in May and go away”.

- While seasonal patterns can repeat, they are not guaranteed to produce consistent results.

- The trades Michael summarizes in this video were based on his knowledge about NWOG, NDOG, premium and discount, time and price, and liquidity.

- NWOGs serve as magnets for price, with the algorithm programmed to refer back to these levels over extended periods.

- The literature of classical technical analysis teaches that once a gap is filled, it is useless. However, Michael clearly shows that the algorithm uses gaps (NWOG, NDOG, ORG,…) repeatedly.

ES Trade Examples - Daily Chart

ES Trade Examples - 15-Minute Chart

ES Trade Examples - New Day Opening Gap

ES Trade Examples - Volume Imbalance

ES Trade Examples - Trades

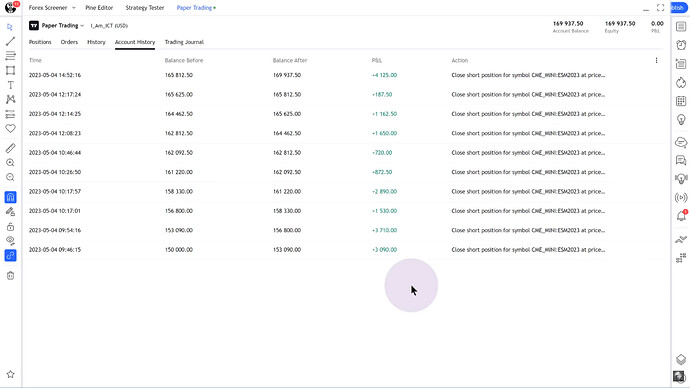

ES Trade Examples - Trade Executions

Next lesson: 2023 ICT Mentorship - NWOG - New Week Opening Gap [Part 2]

Previous lesson: 2023 ICT Mentorship - NQ Futures Review: May 2