Notes

- New Day Opening Gap (NDOG) refers to the difference between the 5 p.m. closing and the 6 p.m. opening price (New York time).

- While the NDOG may sometimes involve a significant visual change, it could also be minimal, like the one-tick difference.

- Michael trades pre-market when news drivers (medium- or high-impact news events) are expected to cause market difficulty later in the day.

- The trading window from 7 a.m. to 8:30 a.m. is preferred, where there is a chance to enter a trade before 8:30 AM, after which the news often moves the market.

- If Michael likes the market structure that’s in play at 7:00 a.m. going into 8:30 a.m., he has no fear of getting in a trade and using the 8:30 a.m. hour to roll right into his targets.

- Risk-off scenario: If the US dollar’s value rises, foreign currencies will fall, and all other asset classes are likely to fall as well.

- Risk-on scenario: If the US dollar’s value falls, foreign currencies will rise, and all other asset classes are likely to rise as well.

- A buy program is not a Market Maker Buy Model (MMBM). The buy program is when the algorithm starts going into buy-side delivery, meaning it will keep booking prices higher and higher, and it will do this even on low volume.

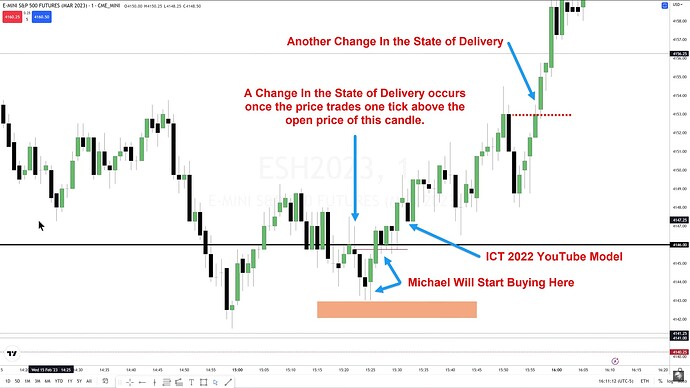

- Change In the State of Delivery (CISD) determines whether we mark a single candle or a sequence of candles as an Order Block.

New Day Opening Gap

ES Trade Example - Trade Entries

ES Trade Example - Trade Executions

Bullish Breaker Block

Divergence Between Dollar Index And Stock Indices

Change In The State Of Delivery

Last Hour Macro

Next lesson: 2023 ICT Mentorship - ES Opening Session Commentary: February 16

Previous lesson: 2023 ICT Mentorship - ES Live Commentary AM Opening Session: February 15