Notes

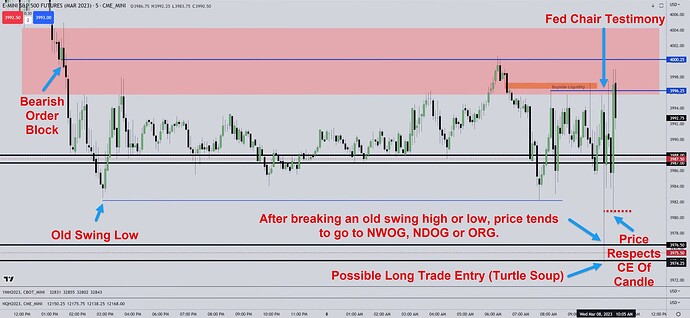

- After breaking an old swing high or low, the price tends to go to NWOG, NDOG, or ORG. These are the places where we can then expect a market reversal.

- After breaking the old swing high or low, the price tends to go to NWOG, NDOG, or ORG. At these locations, we can expect a market reversal, creating a buying and selling opportunity, i.e., a turtle soup setup.

- Michael claims the algorithm doesn’t know where our stop loss is placed. However, it understands the principles of its placement and can estimate very accurately where the price should go to get it hit.

- He also points out that we will lose despite perfect knowledge of ICT concepts. Losses are part of the business.

- Michael advises students against trading on Thursdays and Fridays during NFP weeks due to the decreased precision of ICT concepts and the unpredictability of those market days.

- We should complete all our trades by Wednesday morning during NFP weeks, particularly before 11:00 a.m. on Wednesday. After that, we should refrain from engaging in live trades.

- Each of us is made up of three roles - analyst, trader, and gambler. The analyst is responsible for planning and setting rules, the trader executes, and the gambler is impulsive. A successful trader must control the gambler to avoid poor decision-making.

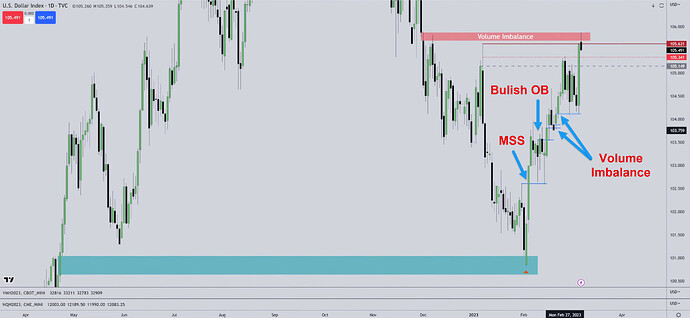

Bullish Order Block And Market Structure Shift

ES Turtle Soup Setup

Next lesson: 2023 ICT Mentorship - NWOG - New Week Opening Gap [Part 1]

Previous lesson: 2023 ICT Mentorship - Live Tape Reading And Fed Chair Testimony: March 7