Notes

- The first thing Michael looks for in a chart is inefficiencies because that is the PD arrays the algorithm reaches for first.

- ICT Silver Bullet times for the forex market:

- 3 a.m. to 5 a.m. EST

- 7 a.m. to 9 a.m. EST

- 10 a.m. to 1 p.m. EST - This time range has fewer good setups than the previous two.

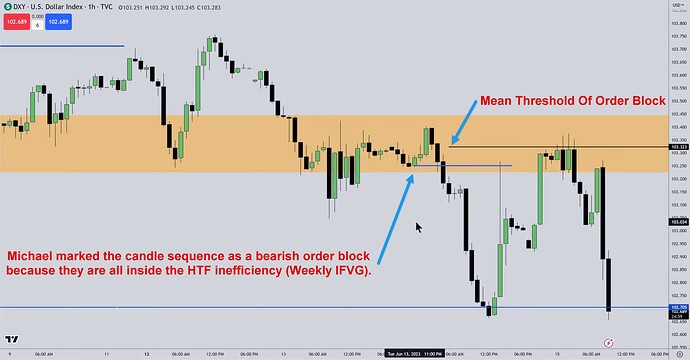

- Michael marks a sequence of candles as an Order Block if they are all within the higher time frame inefficiency (FVG, IFVG,…)

- If an inverse FVG forms, we don’t want to see the price trade beyond its Consequent Encroachment (CE).

- The best bearish setups will occur in the lower half of the HTF IFVG, while the best bullish setups will occur in the upper half of the HTF IFVG.

- If the price closes below the Mean Threshold of a bullish Order Block, there is a greater chance that it will continue lower.

- If the price closes above the Mean Threshold of a bearish Order Block, there is a greater chance that it will continue higher.

- Order Blocks serve not only as a place to enter a trade but also as an area to exit.

- If we expect higher prices, then the day’s low typically forms during the London Open session and the high during the London Close.

- If we expect lower prices, then the day’s high will typically form during the London Open session and the low during the London Close.

- The New York session often offers a continuing pattern if price expansion is expected on a given day, i.e., a trending market throughout the day.

- Sometimes, when we expect an upward expansion, the London Open low may be broken during the New York session due to news announcements, followed by a bullish reversal and a continuation of the upward price movement.

- Sometimes, when we expect a downward expansion, the London Open high may be broken during the New York session due to news announcements, followed by a bearish reversal and a continuation of the downward price movement.

- Whenever a swing high or low is formed involving a long wick, and we expect it to be broken, we must always take a partial at the Consequent Encroachment (CE) level.

- We can trade on days with important reports, such as CPI, NFP, or FOMC (red news). However, Michael recommends waiting for the report’s announcement first and the subsequent settling of the price.

- The algorithm treats wicks (or tails) as gaps.

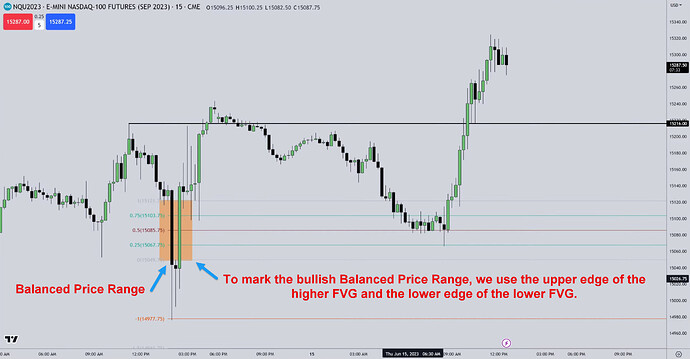

- When we want to mark a bullish balanced price range, formed by two FVGs, we select the FVG located higher.

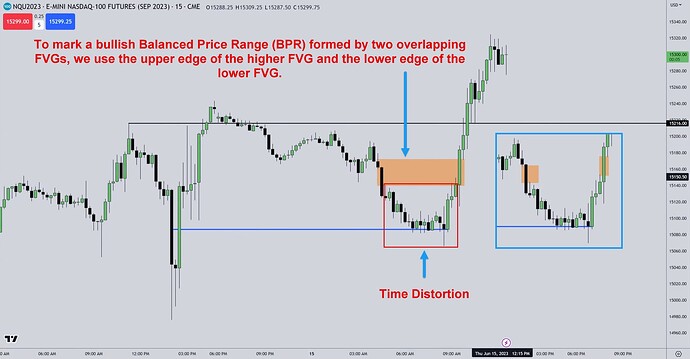

- To mark a bullish Balanced Price Range (BPR) formed by two overlapping FVGs, we use the upper edge of the higher FVG and the lower edge of the lower FVG.

- To mark a bearish Balanced Price Range (BPR) formed by two overlapping FVGs, we use the lower edge of the lower FVG and the upper edge of the higher FVG.

- We always monitor the Dollar Index to help us determine the bias for our primary market.

- Michael doesn’t like trading gold because the market is highly manipulated. He also doesn’t like Yen pairs for the same reasons.

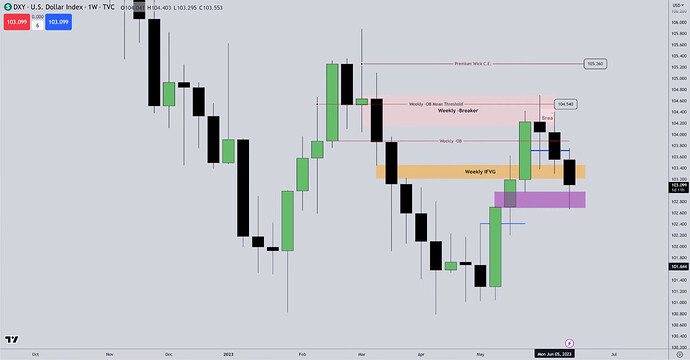

DXY - IFVG, Mean Threshold, Consequent Encroachment, And Order Block

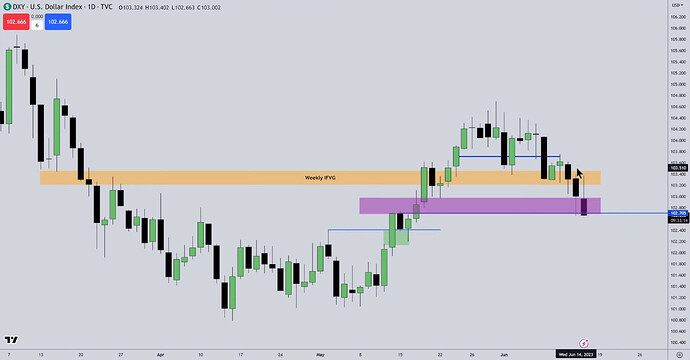

DXY - Daily Chart

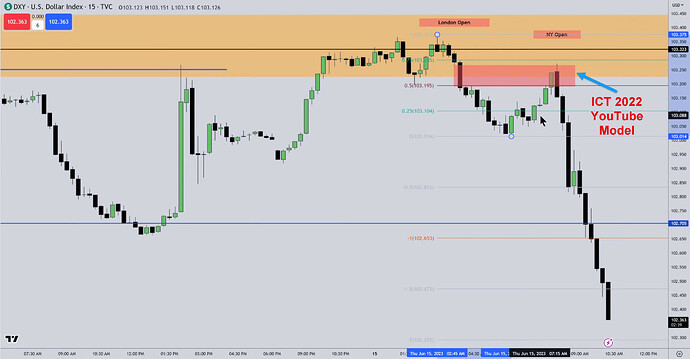

DXY - ICT 2022 YouTube Model

DXY - Marking Order Blocks

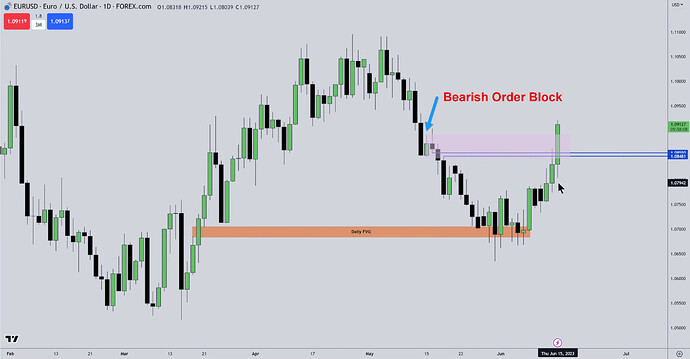

EURUSD - Bearish Order Block And FVG On Daily Chart

EURUSD - Monitoring Dollar Index To Determine Bias

EURUSD - Fulcrum Point And Measured Move

GBPUSD - Weekly Fair Value Gap

NQ - Wick And Tail

NQ - Marking Balanced Price Range

NQ - Marking Balanced Price Range And Time Distortion

NQ Trade Example - After FOMC Long Trade

Next lesson: 2023 ICT Mentorship - T.G.I.F. Setup

Previous lesson: 2023 ICT Mentorship - CPI & Price Action Lecture: June 13