Notes

- If we expect a TGIF setup and it doesn’t happen, the price will usually retrace on Monday.

- The size of the retracement is typically 20 to 30% of the weekly range.

- High Resistance Liquidity Run conditions are more likely to occur when the Opening Range Gap is less than 75 handles (points).

- Trading in the HRLR environment requires sufficient experience.

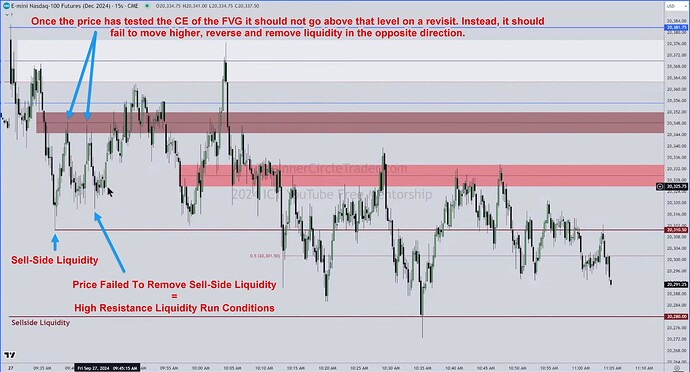

- If the price spends too much time in inefficiencies (FVG, BPR,…) or returns to them frequently, it is a sign of an HRLR environment.

- During Low Resistance Liquidity Run conditions, the price moves smoothly without prolonged consolidations inside inefficiencies.

- A partially filled FVG (inefficiencies) indicates that the algorithm wants to take out liquidity in the opposite direction.

- If we are bullish and the price gets into a bullish FVG, we want to see the lower half not completely filled.

- If we are bearish and the price gets into a bearish FVG, we want to see the upper half not completely filled.

- If we enter a position inside the FVG during HRLR conditions, our stop loss should be at a distance twice the width of the FVG.

- Michael believes that the loss of PD arrays’ precision during HRLR conditions results from manual intervention in the algorithm.

- Low Resistance Liquidity Run markets are purely driven by AI (the algorithm).

- We have to reduce our risk when the market is in HRLR mode.

- Recognizing HRLR and LRLR conditions in real time is the key to effective trading.

- Michael recommends classifying each trading day in our journal.

NQ - Opening Range Gap

NQ - Price Failed To Remove Opposing Liquidity

NQ Trade Example - First Presented FVG And Judas Swing

Next lesson: 2024 ICT Mentorship - Premarket Concepts: September 30

Previous lesson: 2024 ICT Mentorship - Tape Reading: September 25