Notes

- If we are bullish, we want to see that the upper half of the PD array is respected.

- If we are bearish, we want to see that the lower half of the PD array is respected.

- Michael does not recommend using LuxAlgo indicators as he believes they are inaccurate.

- Whenever the market opens in the lower half of the previous day’s range, we should expect a run on liquidity below the previous day’s low.

- Whenever the market opens in the upper half of the previous day’s range, we should expect a run on liquidity above the previous day’s high.

- The term “spooling” describes irregular, sudden price movements, where price jumps to key levels in fast bursts. This is a sign of algorithmic manipulation or programmed market actions aimed at quickly reaching liquidity.

- Journaling is not just about tracking trades but also about fostering positive emotions. By writing down your thoughts, reflections, and successes, you’re building positive reinforcement for your future self.

- When we review past successful trades, we strengthen our emotional resilience and boost confidence.

- It’s important to filter out negative thoughts and toxic reflections in our trading journal. Instead of focusing on failures, we should embrace the learning opportunities from those moments. We must avoid the temptation to self-criticize, especially after mistakes, because it can harm our development.

- Traders who journal their trades have a clearer understanding of their behavior, strategy, and what works or doesn’t work.

- Michael recommends listening to the song Low Rider before the trading session starts

NQ - First Presented FVG

NQ - Bullish Breaker

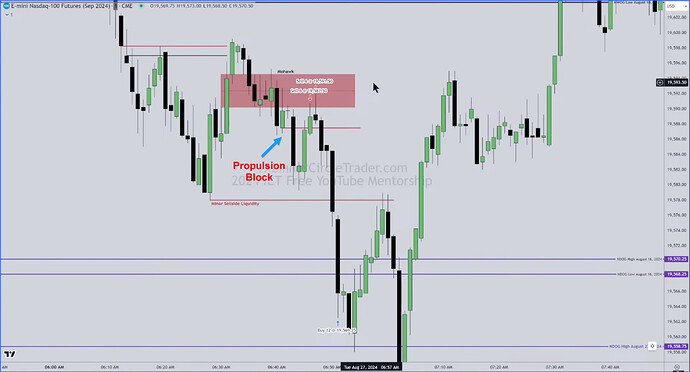

NQ Trade Example - Propulsion Block

ES Trade Example - Bearish Order Block And Propulsion Block

Next lesson: 2024 ICT Mentorship - Lecture 19: August 28

Previous lesson: 2024 ICT Mentorship - Lecture 17: August 26