Notes

- In this lecture, Michael teaches how to overcome the fear of placing limit orders.

- Macro times indicate when the algorithm starts spooling the price but do not specify when the movement should end.

- Each ICT model is based on three pillars:

- Time - Why should the price move? Why did the price move?

- Price is going for inefficiency or buy-side liquidity.

- Price is going for inefficiency or sell-side liquidity.

- The Indigo model consists of Order Block and Volume Imbalance. We will learn more about it in Michael’s future book.

- A high-probability, successful, and profitable trading is done by simply understanding where the market will go next at the right time of the day.

NQ - Daily Chart

NQ - Bullish Order Block And Volume Imbalance

![NQ - Bullish Order Block And Volume Imbalance|690x372]

(upload://3N4IbPxBziF2xbUg09mD9aiqyjV.jpeg)

NQ Trade Example - Indigo Model

NQ Trade Example - Trade Entries And Exits

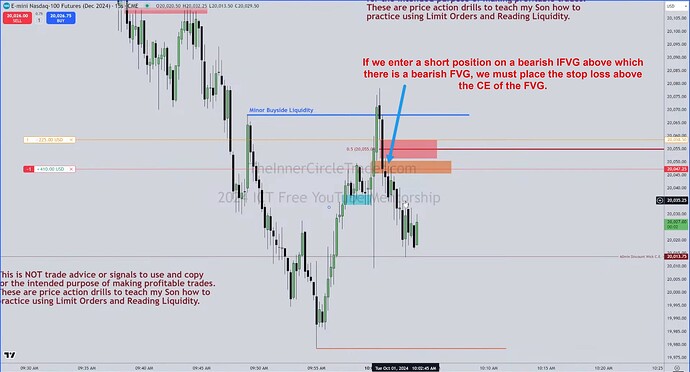

NQ Volatility Pinball Drill - Correct Stop Loss Placement

NQ Volatility Pinball Drill - Good Places To Take Partials

NQ Volatility Pinball Drill - Trade Entries And Exits

Next lesson: 2024 ICT Mentorship - Tape Reading NQ: October 2

Previous lesson: 2024 ICT Mentorship - Premarket Concepts: September 30