Notes

- In this lesson, Michael teaches how to trade in the premarket during times when the market goes sideways.

- This model uses an overnight range, starting at 12 a.m. and ending at 5 a.m. EST.

- We apply a Fibonacci tool with values of 0, 0.25, 0.5, 0.75, and 1 to the above overnight range to obtain quadrants for price assessment. Michael calls this procedure “grading”.

- If we are bullish, we look for entries in the lower half of the overnight range.

- If we are bearish, we look for entries in the upper half of the overnight range.

- Our trade entries should take place during these macro intervals:

- 5:50 to 6:10.

- 6:50 to 7:10.

- 7:50 to 8:10.

- 8:50: to 9:10.

- Michael uses this model on days when there is no trend during the Asian session.

- Every trading day at 8:30, the algorithm starts to spool the price in a specific direction. This particular time is as significant as the macro intervals or the 9:30 opening.

- When the Opening Range Gap is more than 75 handles (points), Michael looks for a reason to open a trade and does not wait for the first FVG to form.

- When the Opening Range Gap is too small, there is a chance that price delivery will be terrible during the AM session.

- High-probability bullish PD arrays are always in the discount area, while high-probability bearish PD arrays are always in the premium area.

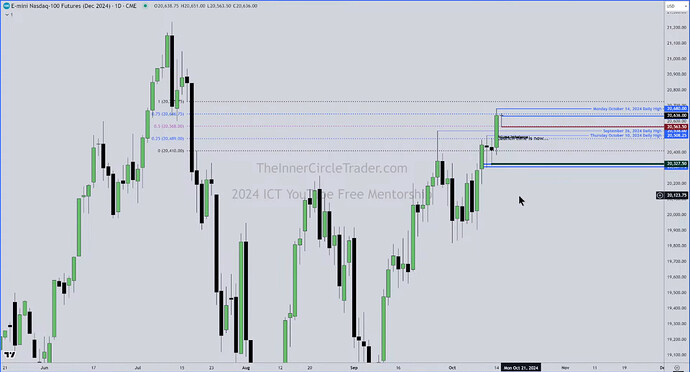

NQ - Daily Chart

NQ - Overnight Range

NQ - High-Probability PD Arrays

NQ Trade Example - Trade 1 Entries

NQ Trade Example - Trade 1 Exit

NQ Trade Example - Trade 2 Entries

NQ Trade Example - Trade 2 Exit

Next lesson: 2024 ICT Mentorship - How To Navigate Decoupled Markets: October 16

Previous lesson: 2024 ICT Mentorship - NQ High Resistance Liquidity Conditions Tape Reading: October 7