Notes

- This lesson focuses on essential concepts rather than a complete guide to predicting daily bias.

- One of the elements that Míchael uses to determine daily bias is an analysis of the long-term, intermediate-term, and short-term highs and lows. This approach is also known in the ICT community as Advanced Market Structure.

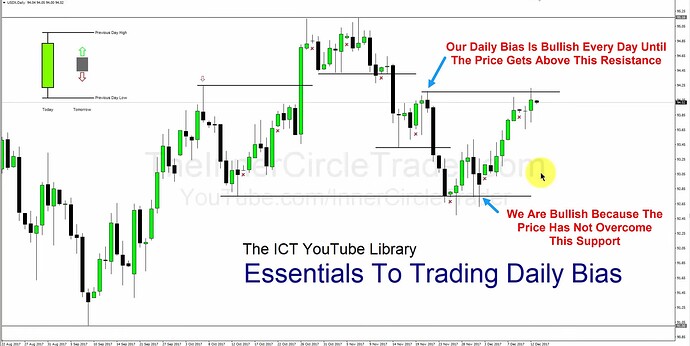

- Identifying significant highs and lows helps in predicting potential market reversals.

- After a significant move, the market often consolidates, deciding whether to continue the trend or reverse.

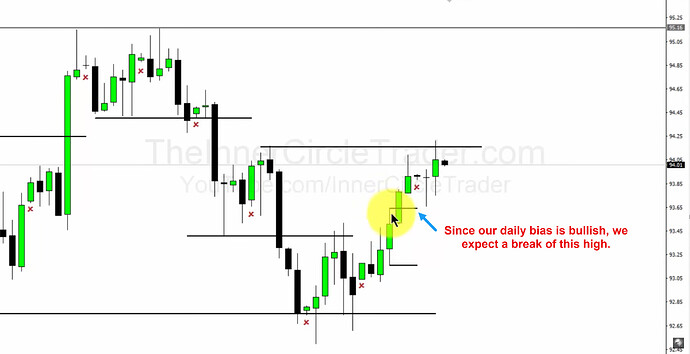

- If we are bullish, we expect the previous day’s high to be broken and the previous day’s low to act as support.

- If we are bearish, we expect the previous day’s low to be broken and the previous day’s high to act as resistance.

- Outside day is a day where both the high and low of the previous day are violated.

- It often signals a potential reversal or strong continuation pattern.

Essentials To Trading The Daily Bias

Essentials To Trading The Daily Bias - Example

Next lesson: ICT Forex - Market Maker Primer Course - Trading The Key Swing Points

Previous lesson: ICT Forex - Market Maker Primer Course - Understanding The ICT Judas Swing