Notes

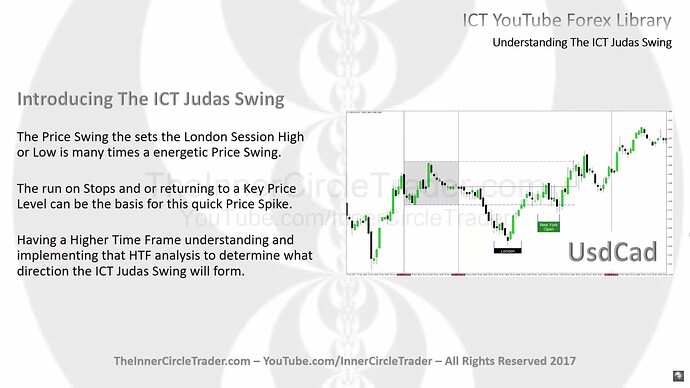

- A Judas Swing is a form of price manipulation where both buyers and sellers are purposely driven to the wrong side of the market to create liquidity for smart money.

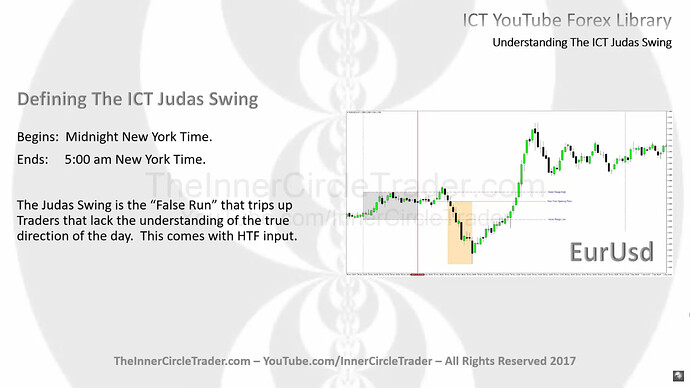

- The Judas Swing is formed between midnight and 5 a.m. New York Time.

- This concept is fractal and can be applied to all time frames.

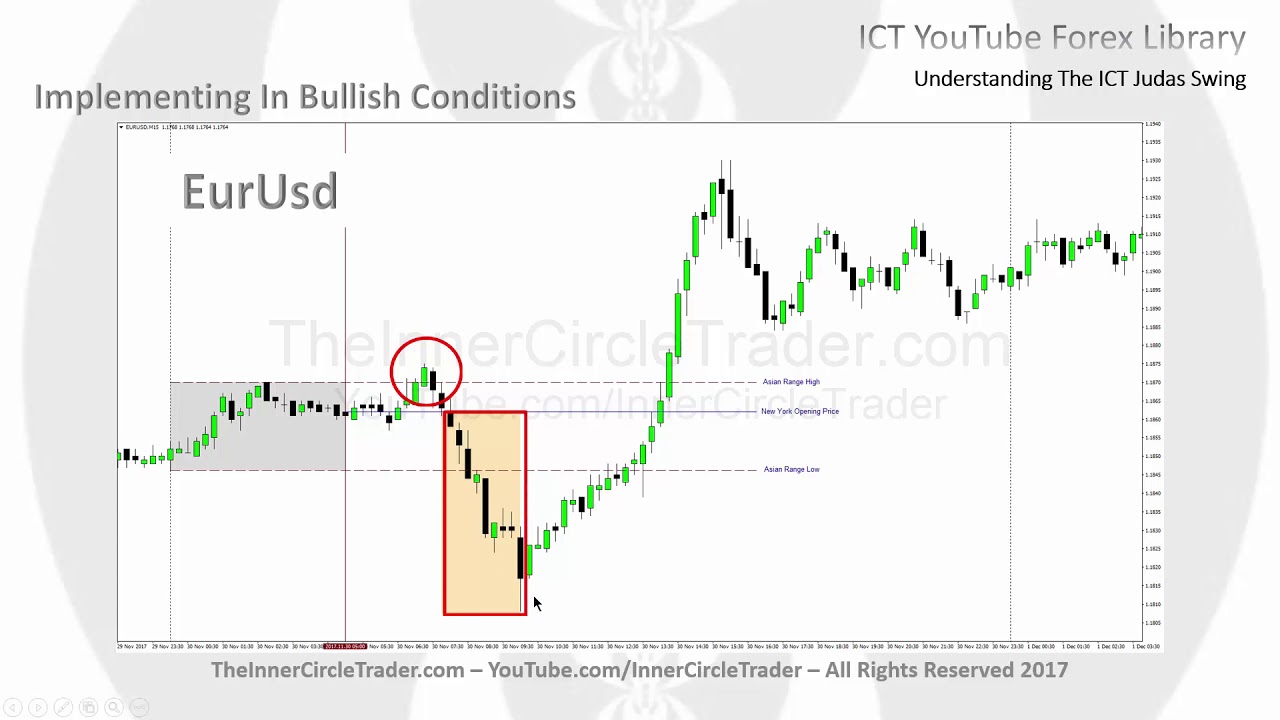

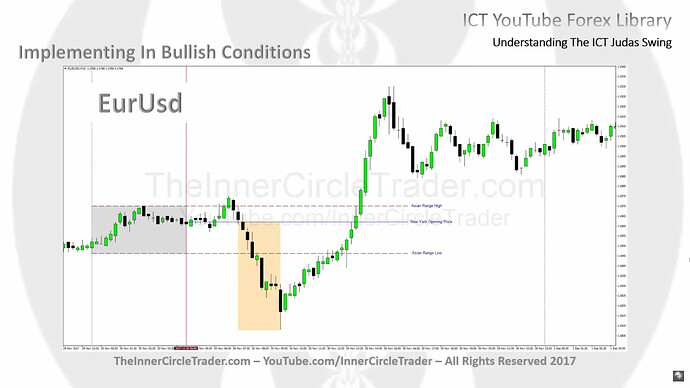

- A bullish Judas Swing occurs when the price first rises above the Asian range high, then falls below the New York Midnight Open, and then below the Asia range low. After that, the price starts to trend upwards.

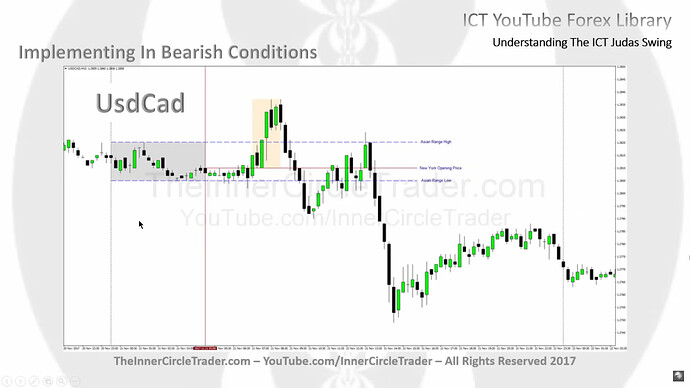

- A bearish Judas Swing occurs when the price first falls below the Asian range low, then rises above the New York Midnight Open, and then above the Asia range high. After that, the price starts to trend downwards.

Introducing The ICT Judas Swing

Defining The ICT Judas Swing

Implementing ICT Judas Swing In Bullish Conditions

Implementing ICT Judas Swing In Bearish Conditions

Next lesson: ICT Forex - Market Maker Primer Course - Essentials To Trading The Daily Bias

Previous lesson: ICT Forex - Market Maker Primer Course - Implementing The Asian Range