Notes

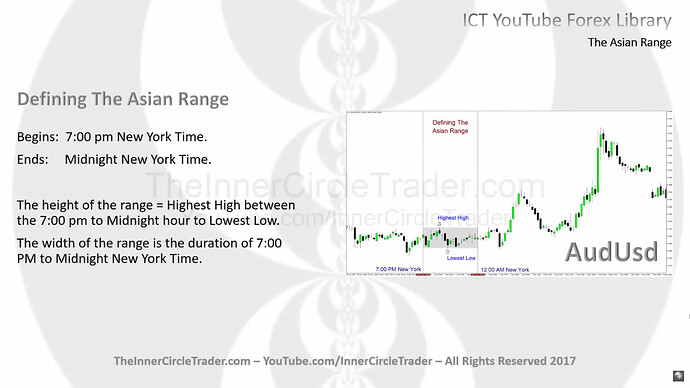

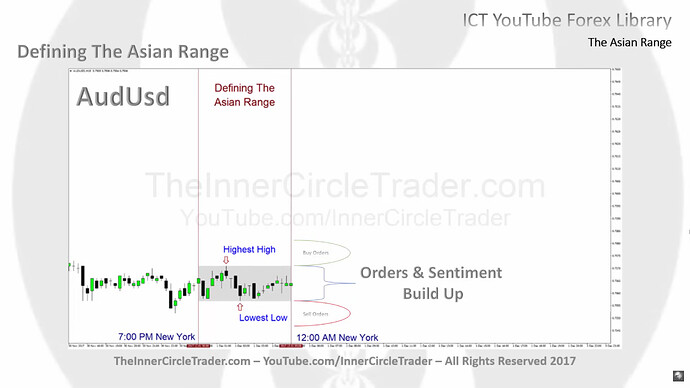

- Asian Range consists of the highest high and lowest low of the Asian session.

- This lesson states that the Asian Range starts at 7:00 a.m. EST. However, in the ICT Mentorship Core Content series, Michael advises using 8:00 a.m. and disregarding all previous time definitions.

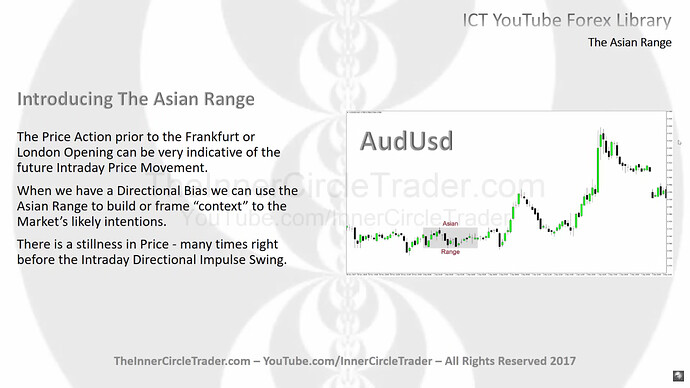

- It helps predict market behavior in the subsequent London and New York sessions.

- If the Asian Range is too narrow, there is a high probability that the market will start to trend.

- If we are bullish and miss an entry below the Asian Range, we can place a buy stop order at its high. However, we cannot place the order until liquidity below the Asian Range is taken out.

- If we are bearish and miss an entry above the Asian Range, we can place a sell stop order at its low. However, we cannot place the order until liquidity above the Asian Range is taken out.

- Michael recommends purchasing this book: Street Smarts: High Probability Short-Term Trading Strategies (Linda Bradford Raschke, Laurence A. Connors)

- Buying or selling decisions should be made based on HTF analysis. We cannot enter into trades just on the fact that the price is above or below the Asian Range.

- If our trade is in open profit, it is better to take partials than to trail a stop loss.

- Sticking to the daily bias and avoiding changing trading plans based on minor market movements is crucial to successful trading.

- Michael recommends using stop losses of at least ten pips to avoid a sudden widening of the broker’s spread. A larger stop loss also provides better protection against sudden price movements, as hitting it will not cause a large slippage, as in the case of a three- or five-pip stop loss.

Introducing The Asian Rabge

Defining The Asian Range

Defining The Asian Range Example

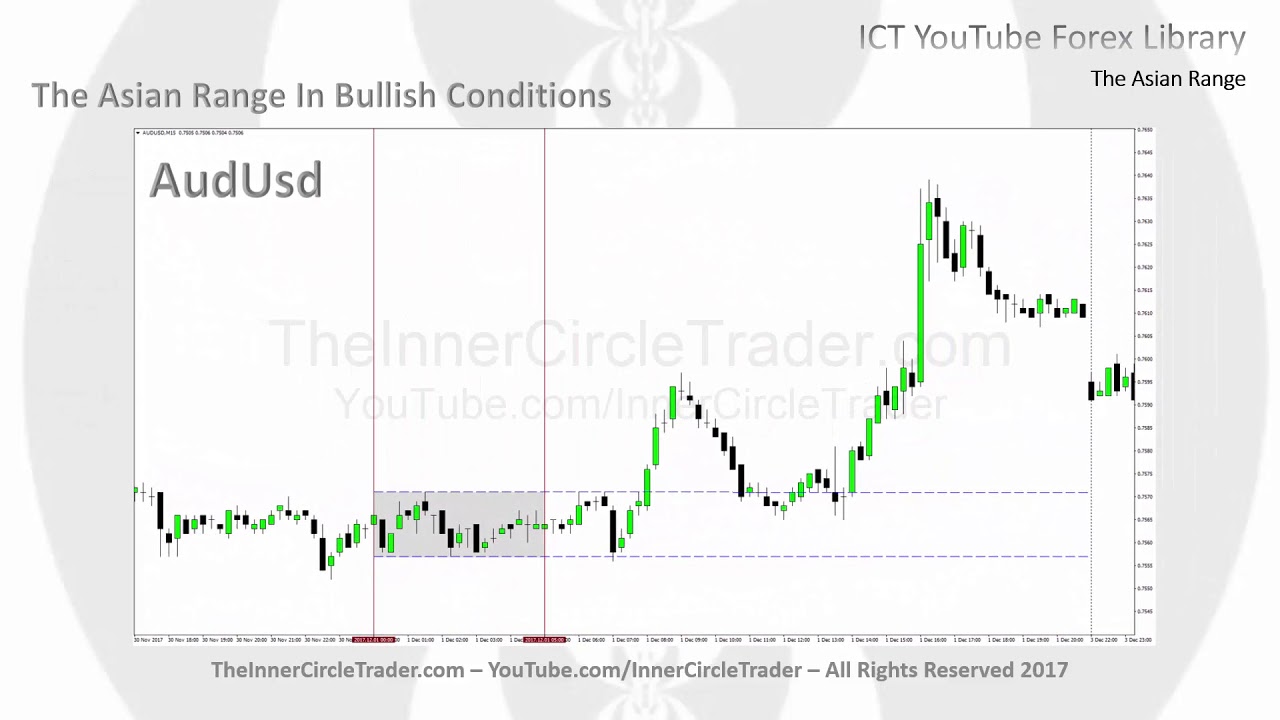

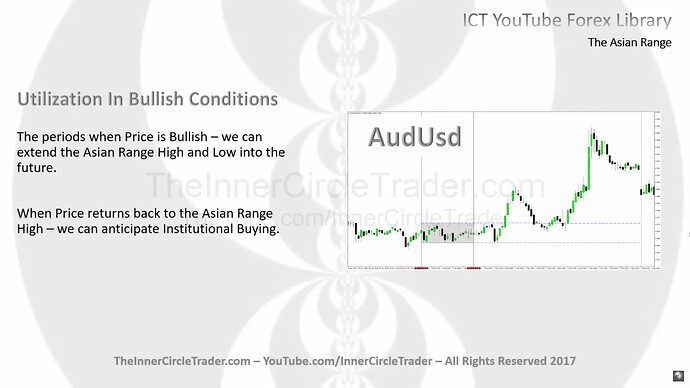

Utilization Of Asian Range In Bullish Conditions

The Asian Range In Bullish Conditions

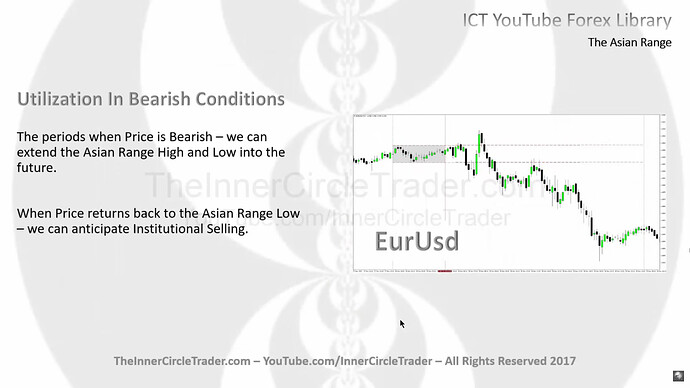

Utilization Of Asian Range In Bearish Conditions

The Asian Range In Bearish Conditions

Next lesson: ICT Forex - Market Maker Primer Course - Understanding The ICT Judas Swing

Previous lesson: ICT Forex - Market Maker Primer Course - Accumulation - Manipulation - Distribution