Notes

- This series is a continuation of the ICT Forex - Scout Sniper Basic Field Guide.

- In this lecture, Michael shows many examples of hypothetical trades using hourly Order Blocks.

- The larger part of the candle forming an order block should be made up of the candle body, not the wicks.

- Determining order flow (trend) on weekly charts by exponential moving averages:

- Bullish bias - If the 9-period EMA is above the 18-period EMA.

- Bearish bias - If the 9-period EMA is below the 18-period EMA.

- After we determine the order flow on the weekly time frame, we will look for order blocks on the 4-hour and hourly charts.

- Once price creates an order block, it should trade aggressively and quickly away from it, i.e., create a displacement.

- Institutional market moves are key drivers in the forex market, and aligning our trades with these moves increases the likelihood of consistent profits.

Weekly Order Blocks And Order Flow

Exponential Moving Averages On Weekly Chart

Bullish Order Block Example #1

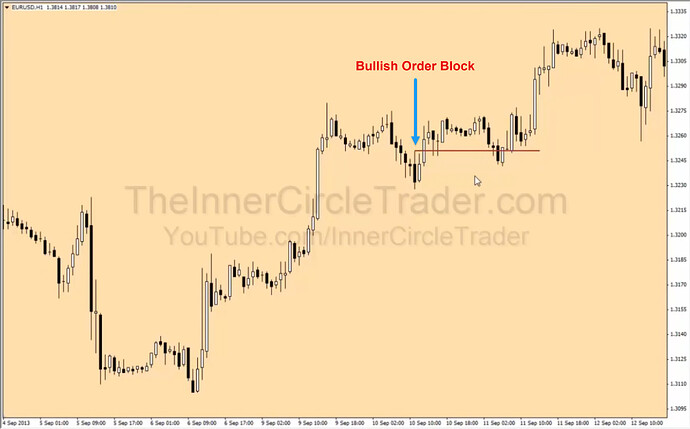

Bullish Order Block Example #2

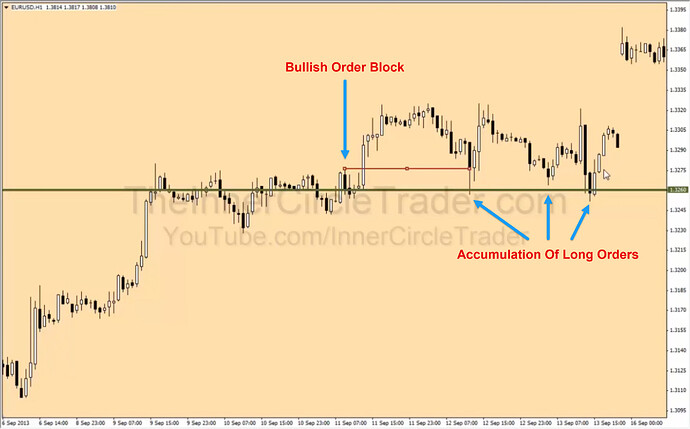

Bullish Order Block Example #3

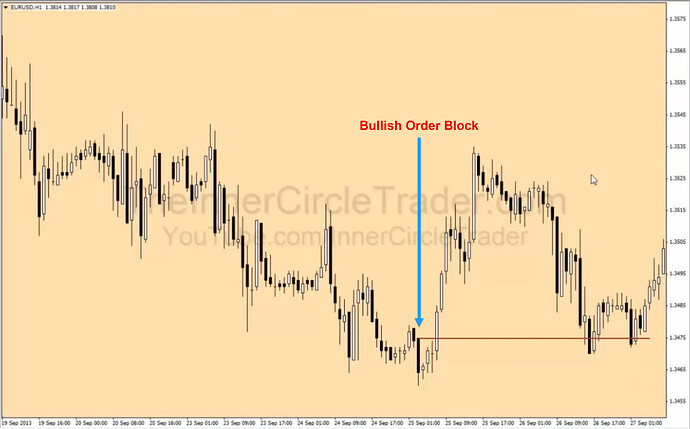

Bullish Order Block Example #4

Next lesson: ICT Forex - Precision Trading Concepts - Volume 2

Previous lesson: ICT Forex - Scout Sniper Basic Field Guide - Volume 8