Notes

- In this lecture, Michael introduces his concept of the Market Maker Model and contrasts it with retail theories like Wyckoff, supply and demand, and Elliott Wave.

- He learned about market structure and trading from Larry Williams and credits him as a significant influence in his career.

- He claims that his method, which focuses on institutional order flow and smart money concepts, is more precise and accurate than the retail methods that many other traders follow.

- Wyckoff’s teachings rely on concepts like “buying pressure” and “selling pressure,” which Michael believes are incomplete and inaccurate for predicting price movements.

- Wyckoff’s model doesn’t align with how the central banks or smart money actually operate in the market. According to him, the Wyckoff model doesn’t consider the full market dynamics that affect price moves.

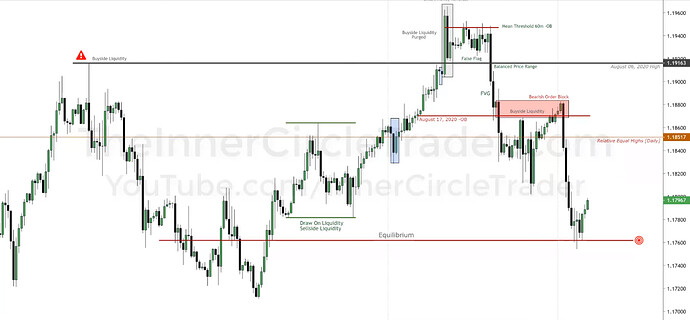

- Low-resistance liquidity runs are the easiest and quickest trades, while high-resistance liquidity runs require more time to overcome resistance to reach their targets.

- The key to success in trading lies in understanding market maker behavior and trading in line with their movements.

- Michael claims that all the key principles of his trading system are available for free on his YouTube channel. If a trader cannot succeed with the material provided in his videos, they likely will not succeed in trading at all.

- Although Michael is a student of Chris Lori, his work has nothing to do with Chris Lori’s concepts.

Market Maker Sell Model

Next lesson: ICT Forex Price Action Lesson - Seek & Destroy Profile

Previous lesson: ICT Forex Price Action Lesson - Liquidity Purge & Revert