Notes

- Michael emphasizes the importance of studying higher time frames, specifically daily, 4-hour, and 1-hour charts.

- Most retail traders focus on shorter time frames, which can lead to poor decision-making because they miss the higher time frame market structure and institutional trading activity, also known as institutional order flow or sponsorship.

- If we expect the weekly candle to expand lower, there is a 70% chance that the weekly high will be formed by Tuesday’s London session.

- If we expect the weekly candle to expand higher, there is a 70% chance that the weekly low will be formed by Tuesday’s London session.

- The weekly high or low should be formed by Wednesday’s London session at the latest.

- Michael usually trades with a stop loss of 30 pips.

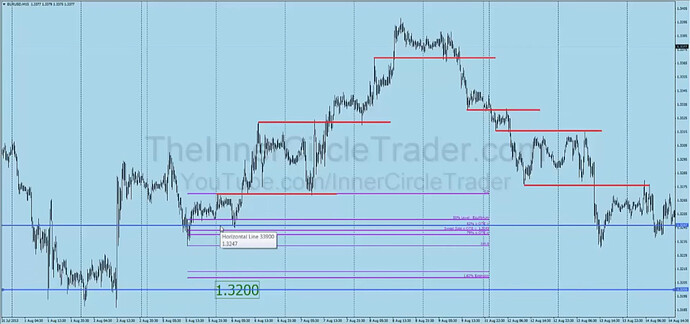

- The Fibonacci retracement tool helps to identify areas where the price might pause or reverse.

- Understanding times (Kill Zones), when significant moves occur, can help traders time their entries and exits more effectively.

- Michael shows an example of the Market Maker Sell Model, introduced as the Market Maker Business Model.

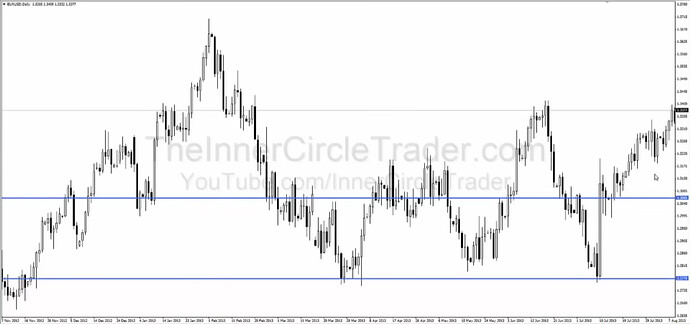

Supports And Resistances

Smart Money Cause Displacements

Market Maker Business (Sell) Model And Fibonacci Retracement Levels

Next lesson: ICT Forex - Scout Sniper Basic Field Guide - Volume 3

Previous lesson: ICT Forex - Scout Sniper Basic Field Guide - Volume 1