Notes

- Emotion-driven results come from a lack of planning. Professional traders rely on organized trading plans that are well-constructed, memorized, and reviewed regularly.

- A trading plan is essential for consistently profitable trading.

The Need For A Trading Plan

The Majority Of The Time

The Least Important Process

The General Overview

The Paradigm Shift

Pack Small Play Big

Keeping Realistic Goals In Focus

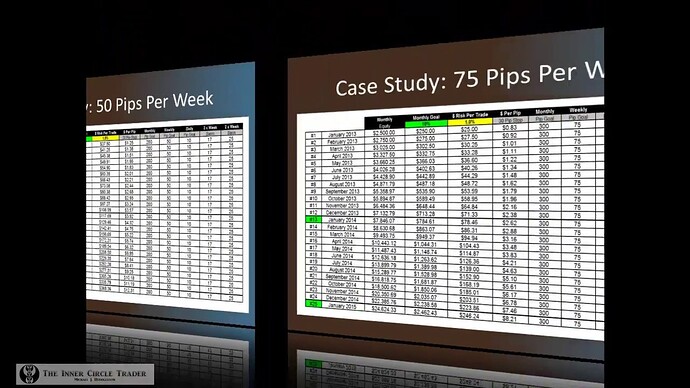

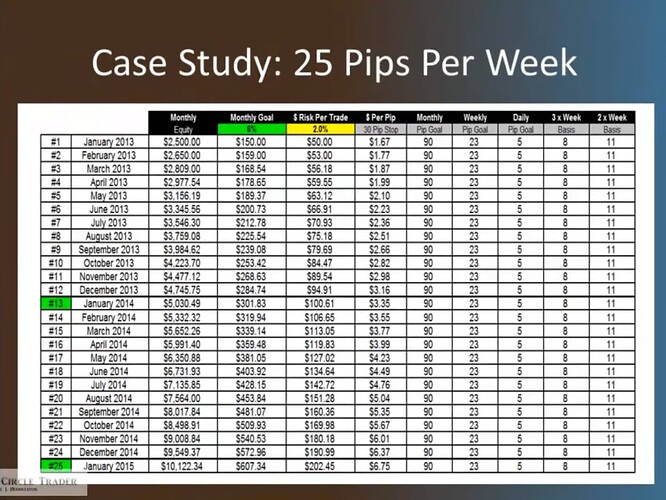

Case Study - 25 Pips Per Week

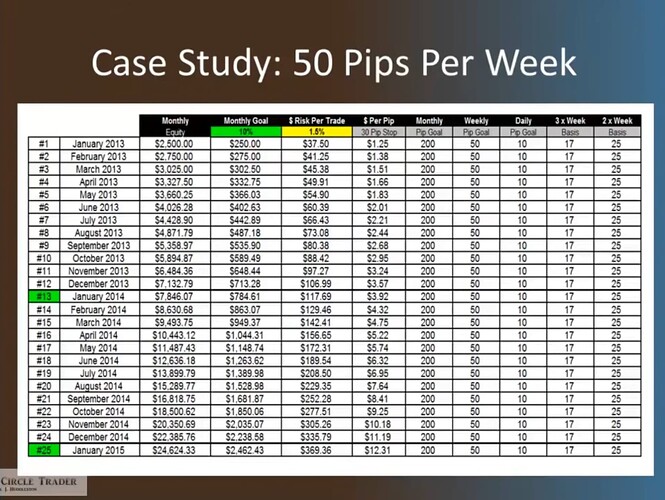

Case Study - 50 Pips Per Week

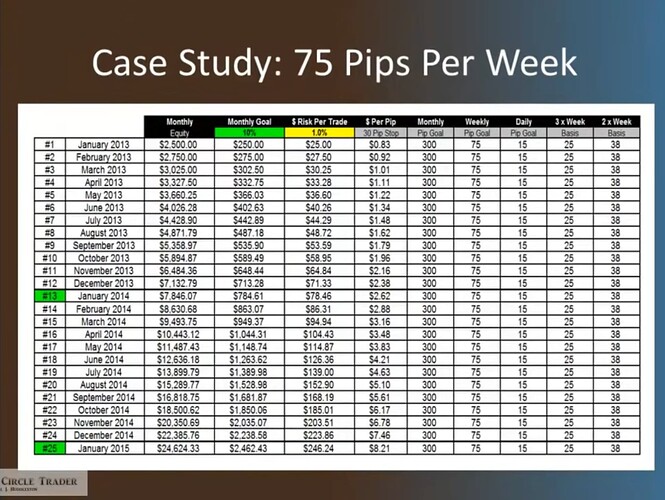

Case Study - 75 Pips Per Week

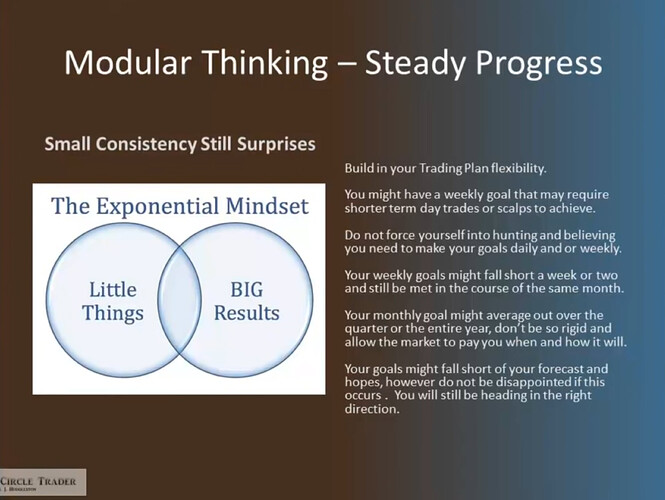

Modular Thinking - Steady Progress

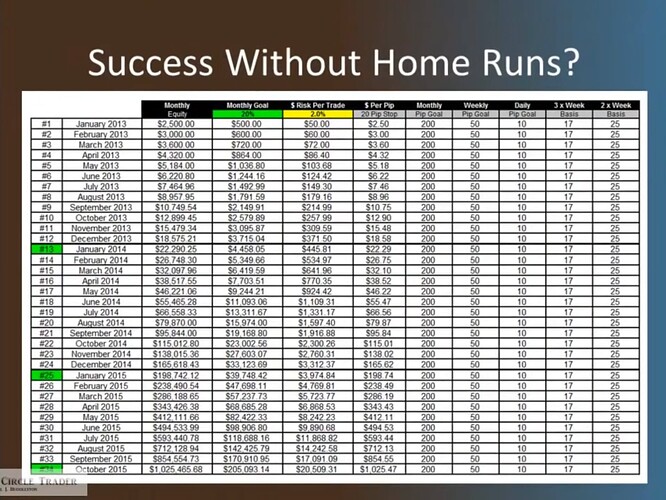

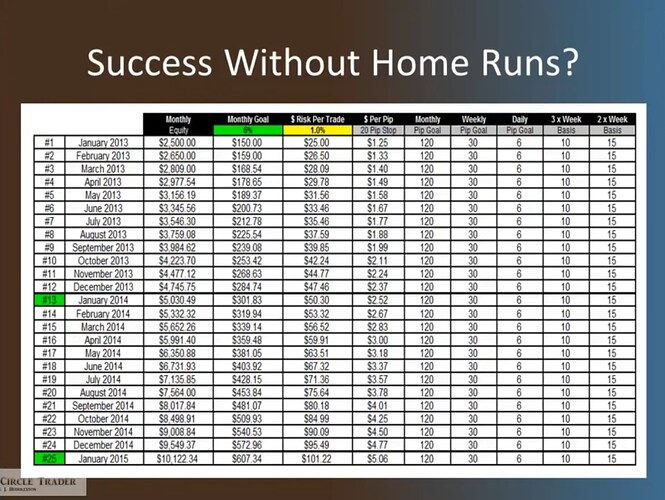

Success Without Home Runs

Keep Something - Pay Yourself

Success Without Home Runs - 6%

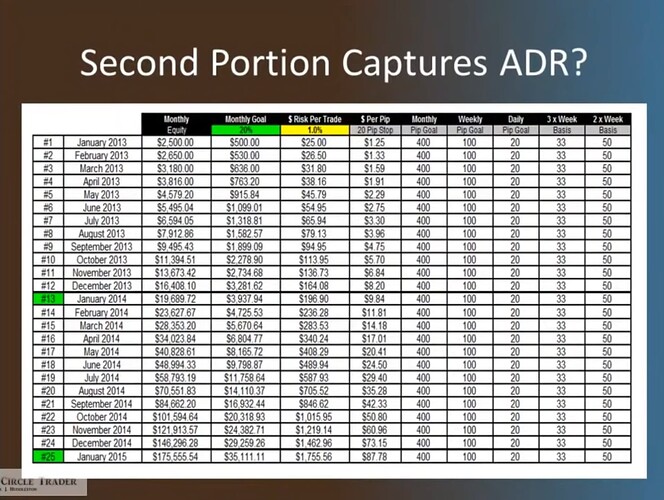

Second Portion Captures ADR

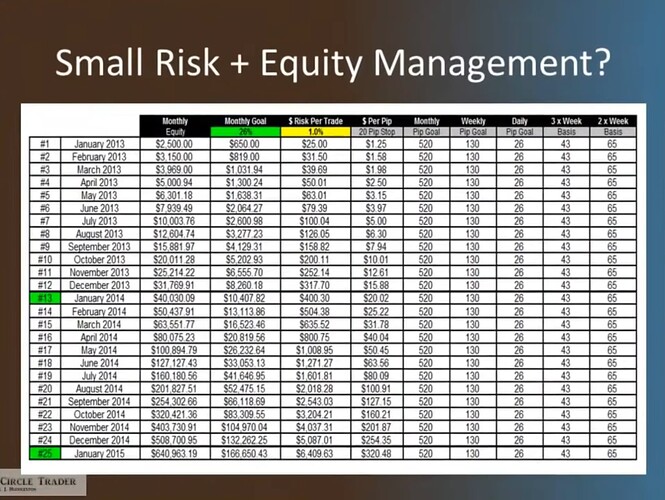

Small Risk + Equity Management

Interest Rates

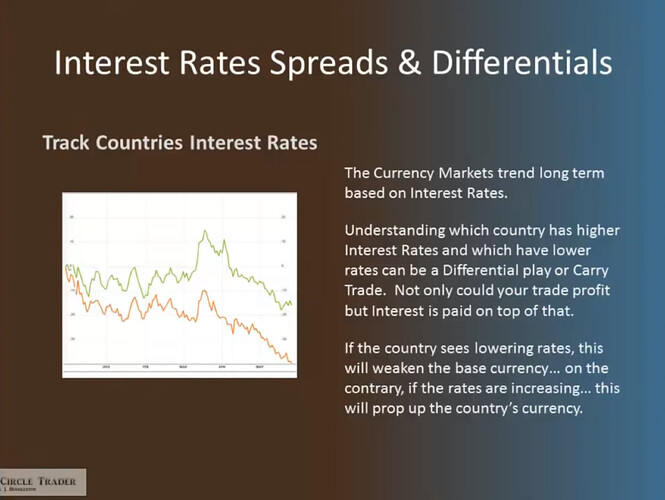

Interest Rates Spreads And Differentials

Million Dollar Futures Insights

COT And Commercial Trends

Trading The News

Key Market Moving Indicators - British Pound

Key Market Moving Indicators - US Dollar

Key Market Moving Indicators - Euro

Plan For News Impact

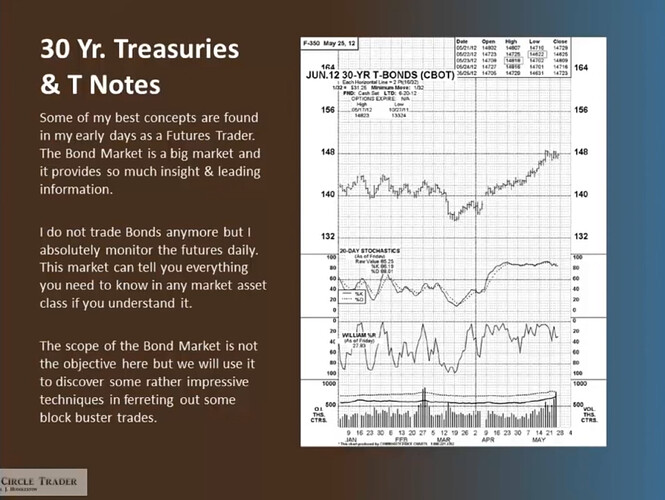

30-Year Treasuries And T-Notes

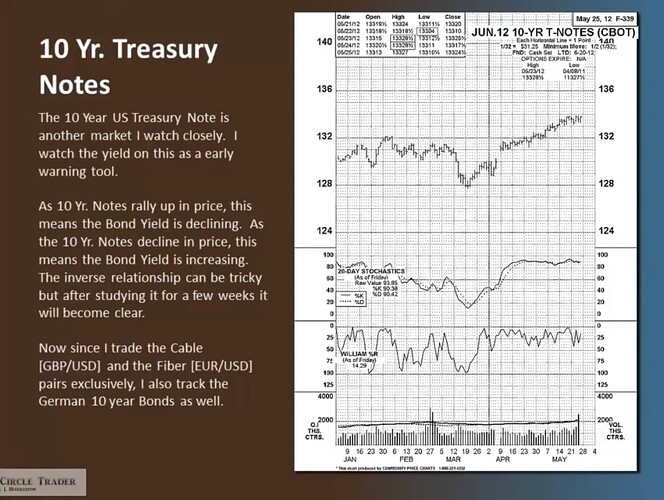

10-Year Treasury Notes

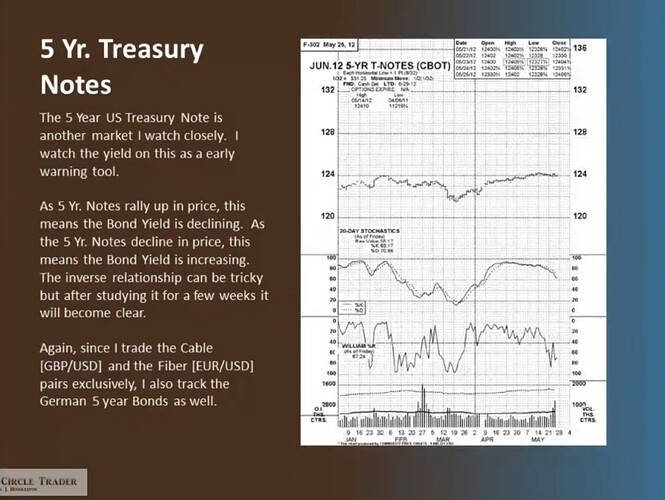

5-Year Treasury Notes

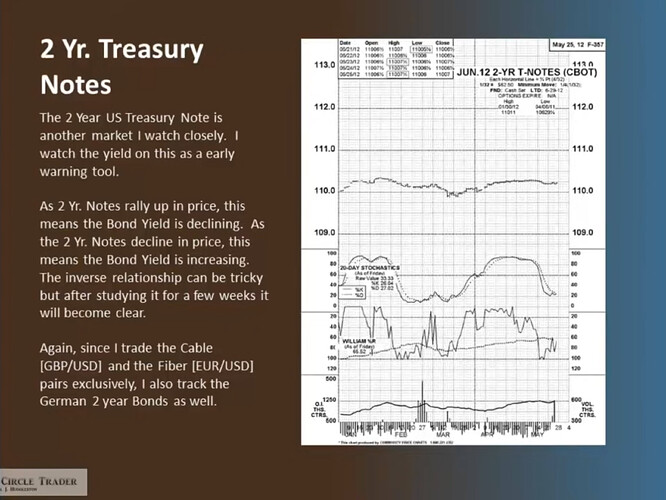

2-Year Treasury Notes

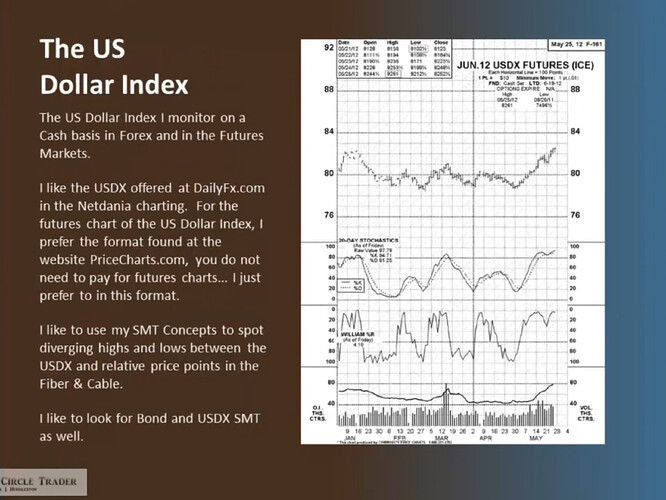

US Dollar Index

The Major Stock Market Indices

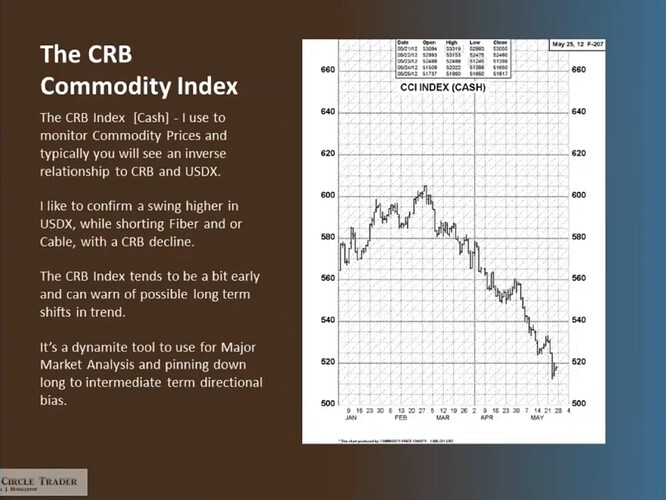

CRB Commodity Index

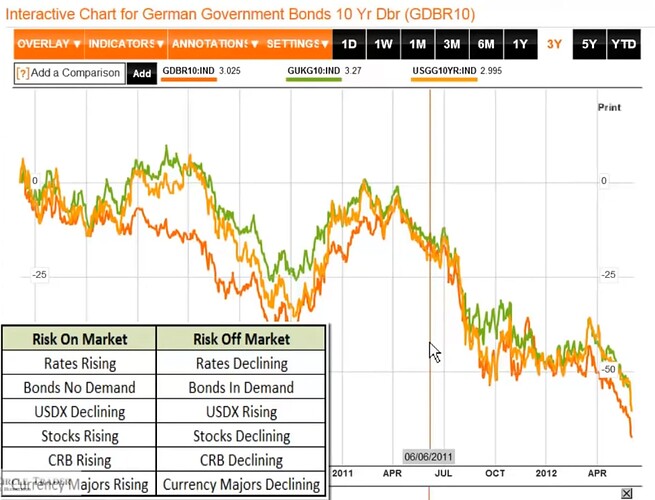

Risk-On And Risk-Off Scenario

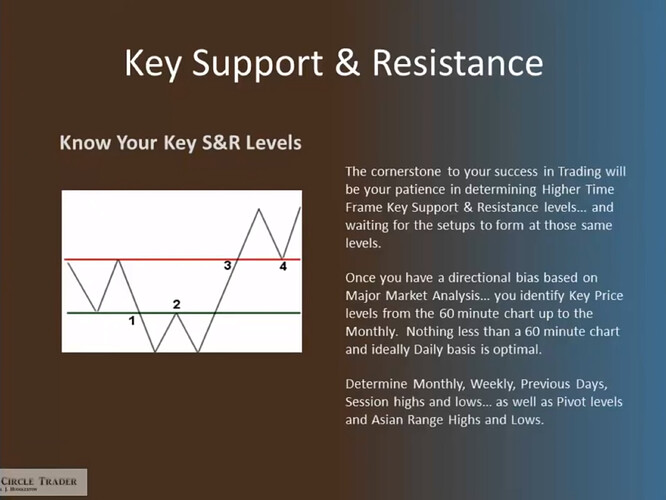

Key Support And Resistance

Market Sentiment

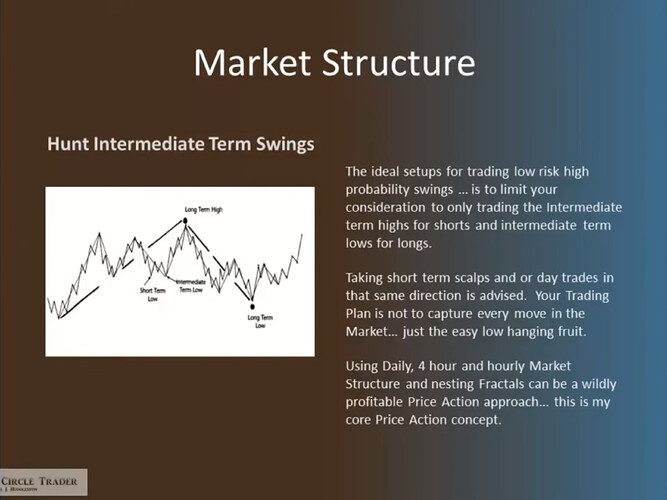

Market Structure

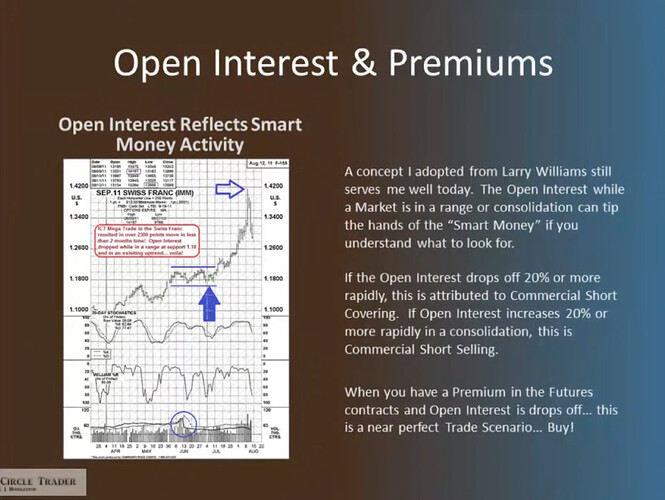

Open Interest And Premiums

Higher Time Frame Directional Bias

General Market - Risk-On Or Risk-Off

Anticipatory Stage Of Analysis

Execution Stage Of Analysis

Management Stage Of Analysis

Reactionary Stage Of Analysis

Documentation Stage Of Analysis

Next lesson: ICT Forex - Trading Plan Development - Volume 2

Previous lesson: ICT Forex - Precision Trading Concepts - Volume 3