Notes

- This lesson is a micro version of the Trading Plan Development series.

- ICT Forex - Trading Plan Development - Volume 1

- ICT Forex - Trading Plan Development - Volume 2

- ICT Forex - Trading Plan Development - Volume 3

- ICT Forex - Trading Plan Development - Volume 4

- ICT Forex - Trading Plan Development - Volume 5

- ICT Forex - Trading Plan Development - Volume 6

- ICT Forex - Trading Plan Development - Volume 7

- Michael uses only some things from the Trading Plan Development series.

- A narrative has to be binary and very defined. If you don’t have a plan, this will lead to impulsive emotional trading.

- Stop looking to do something right now. Professional traders are not in a rush. They sit back and wait for a scenario that makes sense.

- When your big picture, intermediate, and short-term perspectives agree, that’s what makes a high-reward trading setup.

- Not all four components of the big picture perspective have to agree. Two of them are enough.

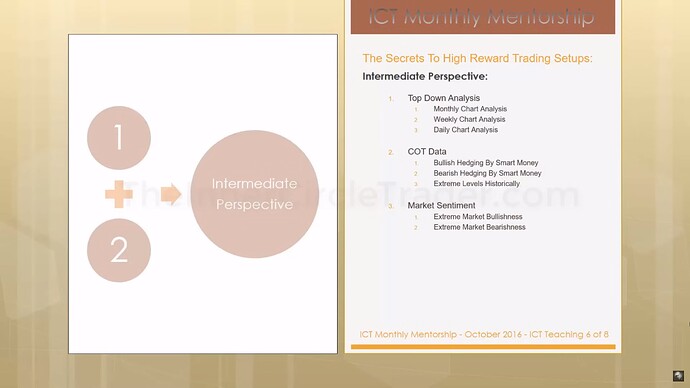

- For the intermediate perspective, only two of the three components must agree.

- The least important component is market sentiment.

- Monthly, weekly, and daily time frames are what stand behind the price movements.

- Hedge funds (smart money) perform most of their analysis on monthly and weekly charts and execute trades on daily charts.

- In the case of the short-term perspective, we need all three components to be in agreement.

- Michael only needs a short-term perspective for his way of trading.

- Michael claims that his win rate is around 90%.

- The big perspective and intermediate perspective will be set on the weekend before the next trading week.

- The short-term perspective can change daily.

- In total, at least seven components must agree to generate a high-probability trade.

The Secrets To Selecting High Reward Trading Setups

The Secrets To Selecting High Reward Trading Setups - Steps

The Secrets To Selecting High Reward Trading Setups - Big Picture Perspective

The Secrets To Selecting High Reward Trading Setups - Intermediate Perspective

The Secrets To Selecting High Reward Trading Setups - Short-Term Perspective

Next lesson: ICT Mentorship Core Content - Month 2 - Market Maker Trap - False Flag

Previous lesson: ICT Mentorship Core Content - Month 2 - How To Mitigate Losing Trades Effectively