Notes

- Risk-off scenario: If the US dollar’s value rises, foreign currencies will fall, and all other asset classes are likely to fall as well.

- Risk-on scenario: If the US dollar’s value falls, foreign currencies will rise, and all other asset classes are likely to rise as well.

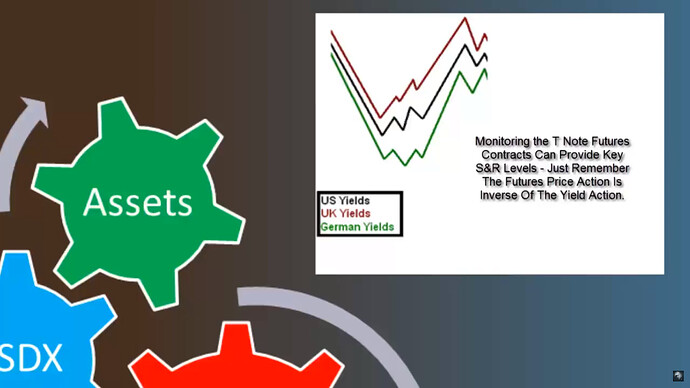

- Yields should typically move in tandem, and any divergence between them (e.g., US, UK, and German yields) can indicate a shift.

- Once the yields start to rise after a period of falling, it generally signals bullish sentiment for foreign currencies and bearish sentiment for the USD.

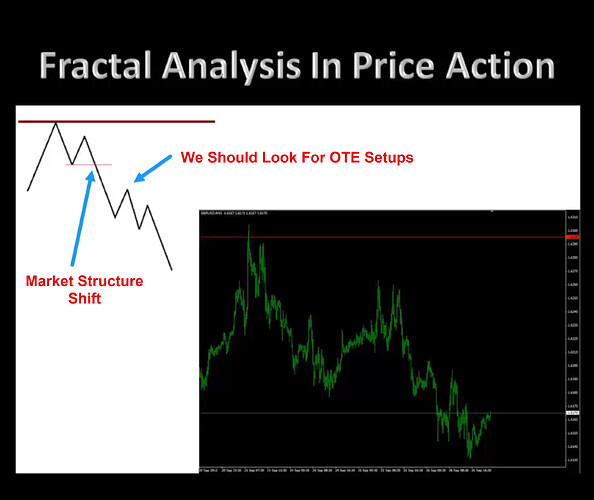

- Fractal analysis is a method of identifying repeating price patterns, both on smaller and larger time frames.

Yields

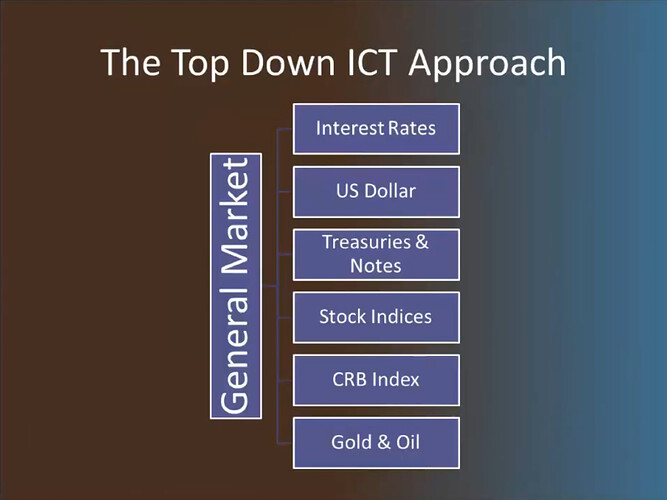

The Top Down ICT Approach - General Market

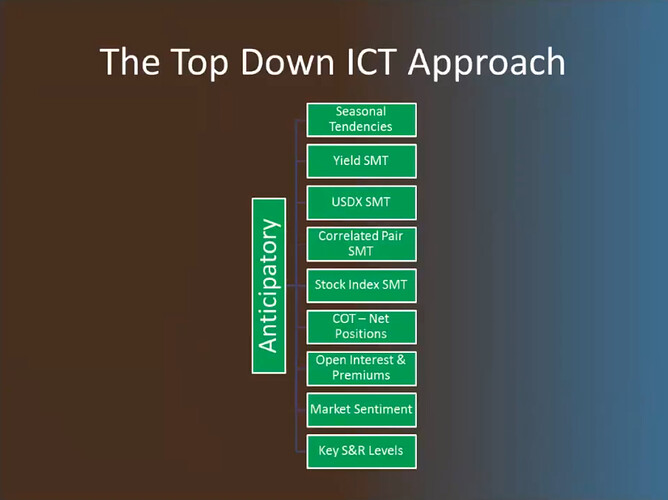

The Top Down ICT Approach - Anticipatory Stage

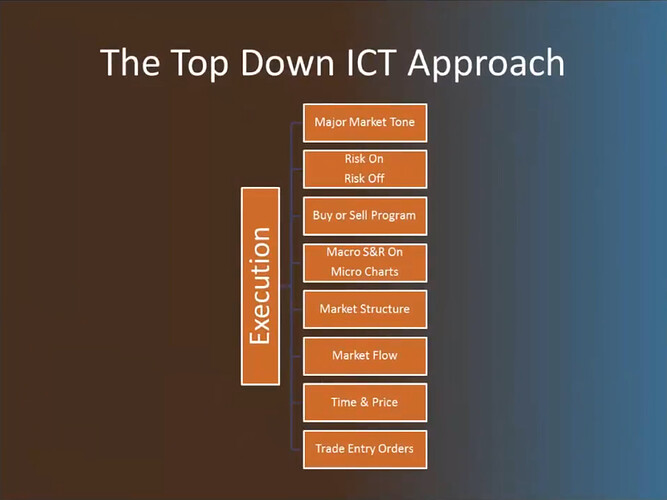

The Top Down ICT Approach - Execution Stage

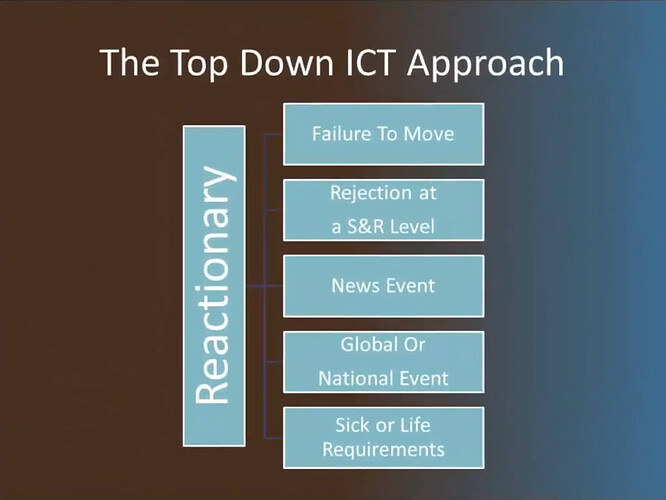

The Top Down ICT Approach - Reactionary Stage

Fractal Analysis In Price Action

Next lesson: ICT Forex - Trading Plan Development - Volume 4

Previous lesson: ICT Forex - Trading Plan Development - Volume 2