Notes

- This lecture covers an example of an intermediate-term trading plan.

- It’s focused on a higher time frame trading strategy rather than intraday or scalping, requiring more patience.

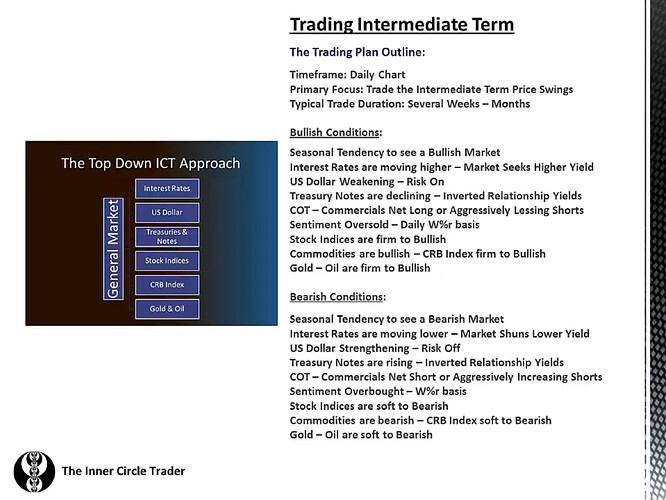

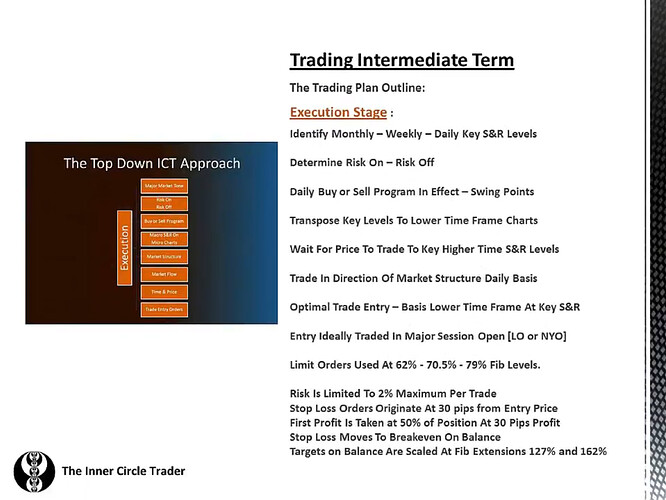

- We must determine if the market is in a risk-on or risk-off state on any given day. If it’s risk-on, we look for buy opportunities at support levels, while if it’s risk-off, we look for sell opportunities at resistance levels.

- On smaller time frames (60-minute, 15-minute, 5-minute), we look for price to trade to the key support or resistance levels identified on higher time frames.

- Michael shows a practical application of this plan, using treasuries, yields, stock indices, and selected currency pairs.

- He uses barchart.com to view bond and currency market charts.

Trading Intermediate Term - General Market

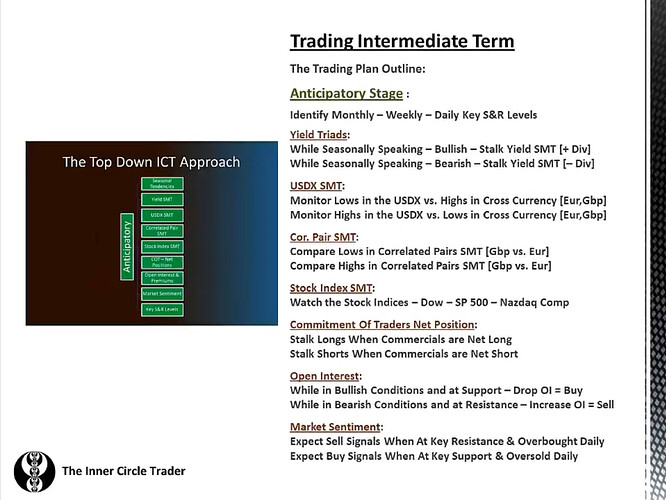

Trading Intermediate Term - Anticipatory Stage

Trading Intermediate Term - Execution Stage

Next lesson: ICT Forex - Trading Plan Development - Volume 6

Previous lesson: ICT Forex - Trading Plan Development - Volume 4