Notes

- Vacuum blocks can form during these occasions:

- Terrorist attack.

- Non-farm payrolls.

- Futures open.

- Stock market open.

- FOMC related event.

- Forex market opening on Sunday.

- If you identify a vacuum block in a market that has been trending for some time, it is likely to be an exhaustion gap. Such a vacuum block is considered low probability.

- The exhaustion gap is the last bit of momentum in the underlying trend or direction.

- Best conditions for bullish vacuum block trading:

- An uptrend market makes a correction (retracement) into the discount area.

- A downtrend market is in the discount area, and bullish news has been announced.

- A market is in the discount area and is about to reach the liquidity above.

- Best conditions for bearish vacuum block trading:

- A downtrend market makes a correction (retracement) into the premium area.

- An uptrend market is in the premium area, and bullish news has been announced.

- A market is in the premium area and is about to reach the liquidity below.

- If an order block exists in the area where the vacuum block was created, then we don’t expect the gap to be entirely filled.

- If the time of day permits more trading then it’s likely filling the gap, regardless of the presence of an order block.

- These gaps often appear at 8:30 New York time.

- When we close the gap and see a rally, we never want the price to come back below the level that closed the gap. There is no reason for it. The opposite is true for the bearish scenario.

- A vacuum block is nothing more than a breakaway gap.

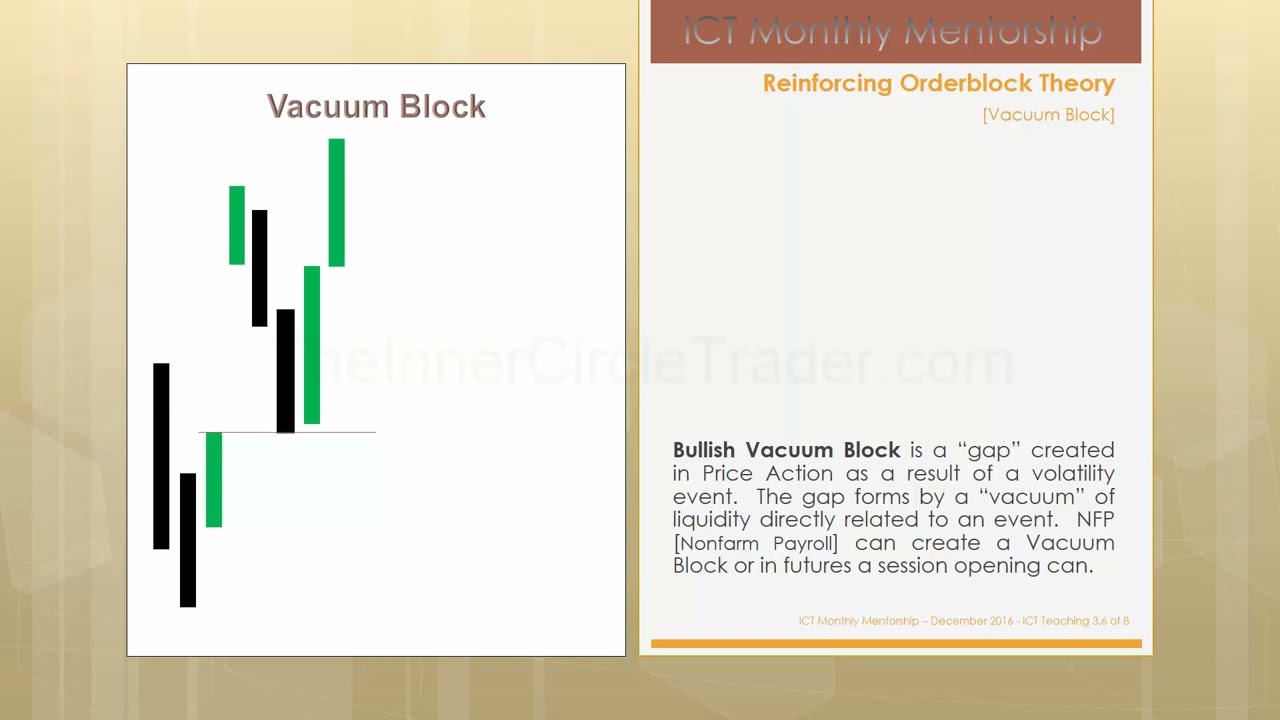

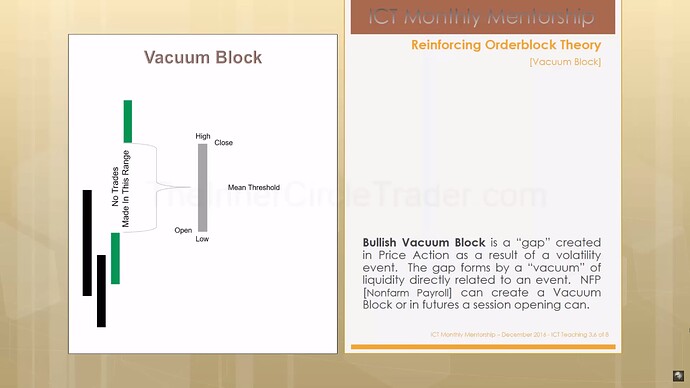

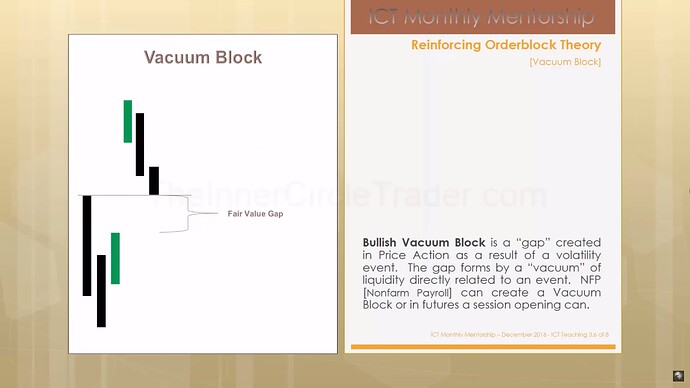

ICT Bullish Vacuum Block

ICT Bullish Vacuum Block - Order Block Entry

ICT Bullish Vacuum Block - Fair Value Gap

ICT Bullish Vacuum Block Entry

Next lesson: ICT Mentorship Core Content - Month 4 - Liquidity Voids

Previous lesson: ICT Mentorship Core Content - Month 4 - Propulsion Block