Notes

- The determination of open float is used to identify where the liquidity pools of large funds are located.

- Open float types:

- Near-term open float - The highest high and lowest low of the last 20 trading days.

- Short-term open float - The highest high and lowest low of the last 40 trading days.

- intermediate-term open float - The highest high and lowest low of the last 60 trading days.

- Total open float - The highest high and lowest low of the 120 trading days (60 days look back and 60 days cast forward).

- Low open interest at a support level at a time when the stops have been run out below the market indicates potential strength.

- Low open interest at a resistance level at a time when the stops have been run out above the market indicates potential weakness.

Defining Open Float Liquidity Pools - 60-Day Range

Defining Open Float Liquidity Pools - 120-Day Range

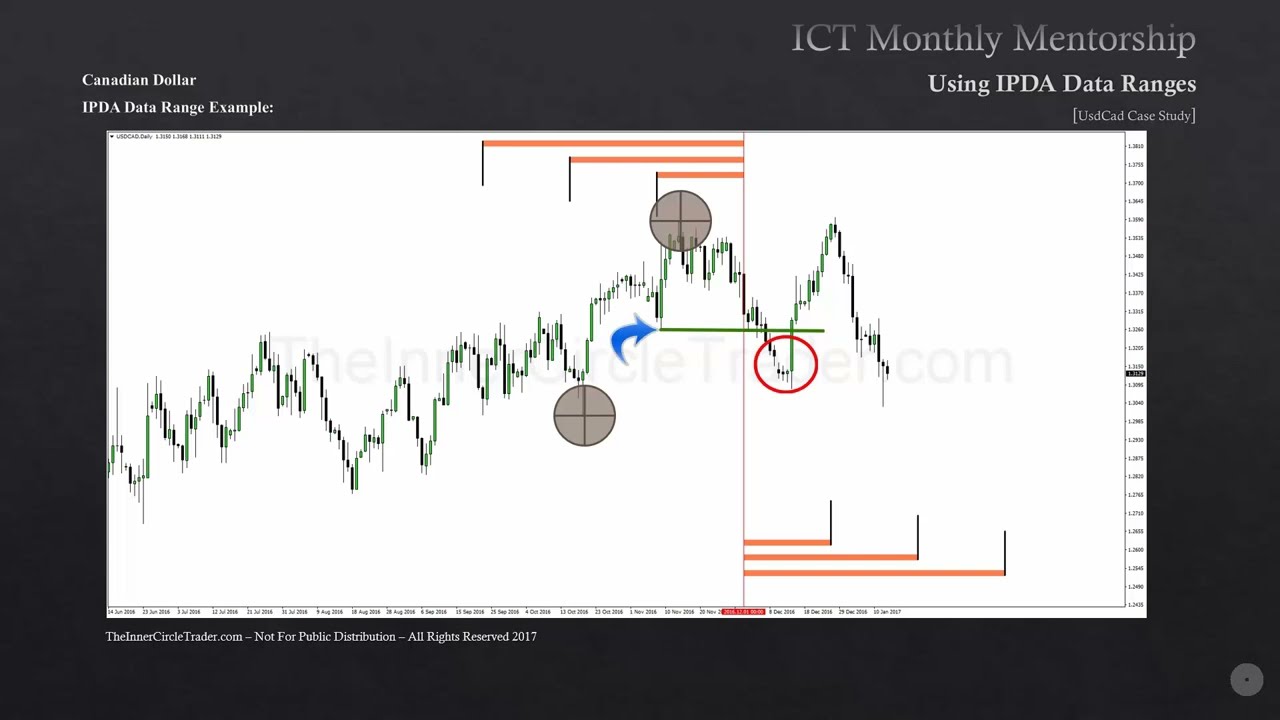

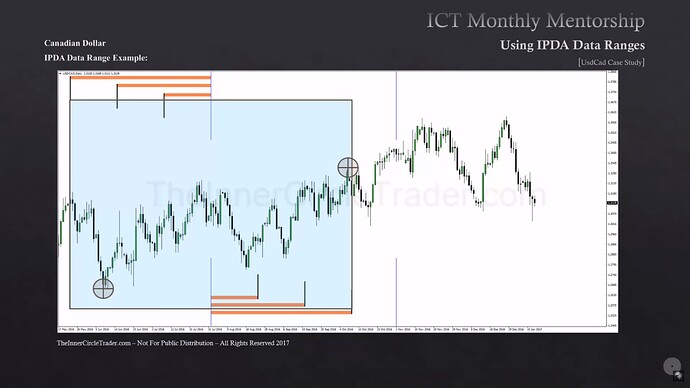

Defining Open Float Liquidity Pools - USDCAD Example

Defining Open Float Liquidity Pools - Smart Money Disinterest

Next lesson: ICT Mentorship Core Content - Month 5 - Defining Institutional Swing Points

Previous lesson: ICT Mentorship Core Content - Month 5 - Using IPDA Data Ranges