Notes

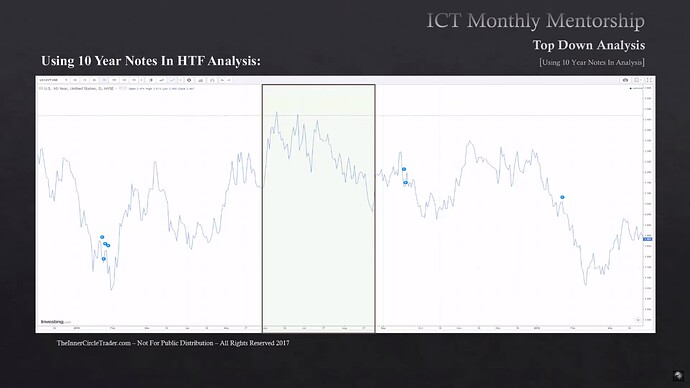

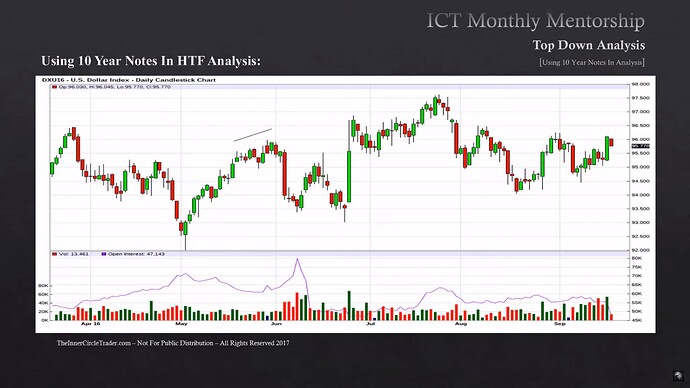

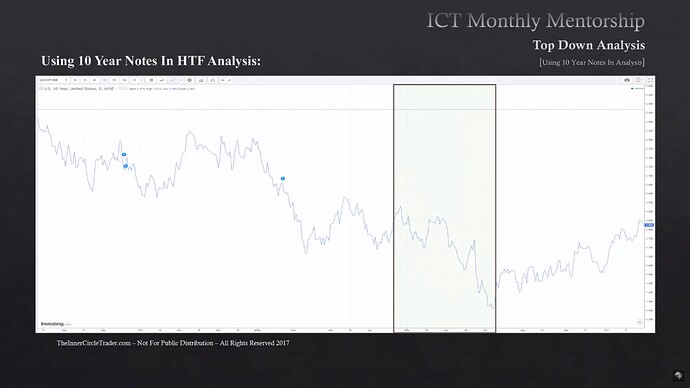

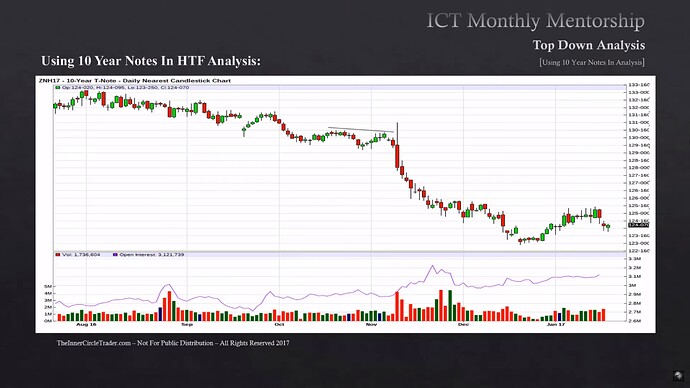

- Michael analyses the swings to confirm or negate a trade idea based on seasonal tendencies. He looks for the crack in correlation, i.e., the smart money technique.

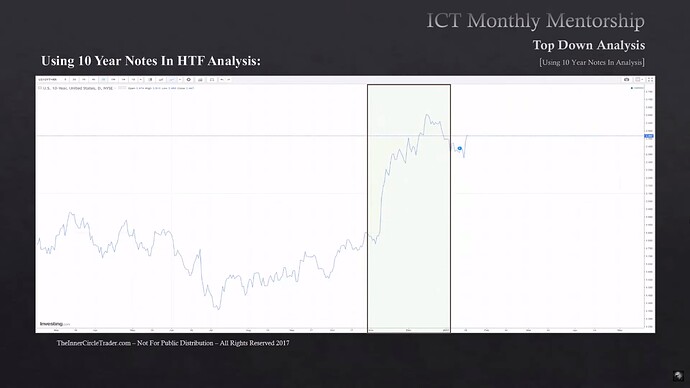

- Open interest and 10-year yield analysis are used to confirm the trade idea further.

- There should be perfect symmetry between 10-year notes and the dollar index. When that symmetry is broken, it indicates that an underlying trend or manipulation is underway.

- Michael looks for three-month trends.

- When we see our trade idea is being validated based on the abovementioned things, we’ll blend it with quarterly shifts.

Qualifying Trade Conditions With 10-Year Yields - 10-Year T-Note 2015

Qualifying Trade Conditions With 10-Year Yields - US Dollar Index 2015

Qualifying Trade Conditions With 10-Year Yields - 10-Year Yields 2015

Qualifying Trade Conditions With 10-Year Yields - 10-Year T-Note 2016

Qualifying Trade Conditions With 10-Year Yields - US Dollar Index 2016

Qualifying Trade Conditions With 10-Year Yields - 10-Year Yields 2016

Qualifying Trade Conditions With 10-Year Yields - 10-Year T-Note 2017

Qualifying Trade Conditions With 10-Year Yields - US Dollar Index 2017

Qualifying Trade Conditions With 10-Year Yields - 10-Year Yields 2017

Next lesson: ICT Mentorship Core Content - Month 5 - Interest Rate Differentials

Previous lesson: ICT Mentorship Core Content - Month 5 - Using 10 Year Notes In HTF Analysis