Notes

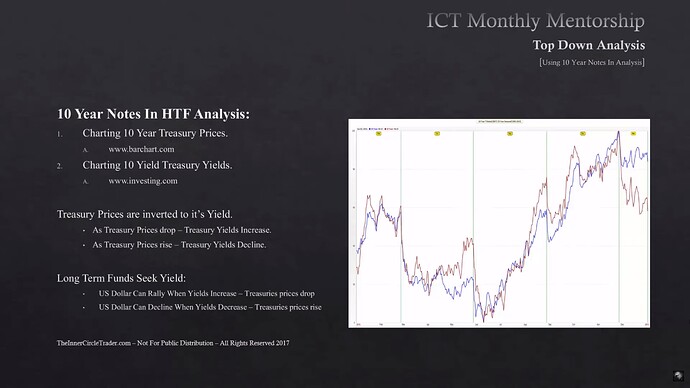

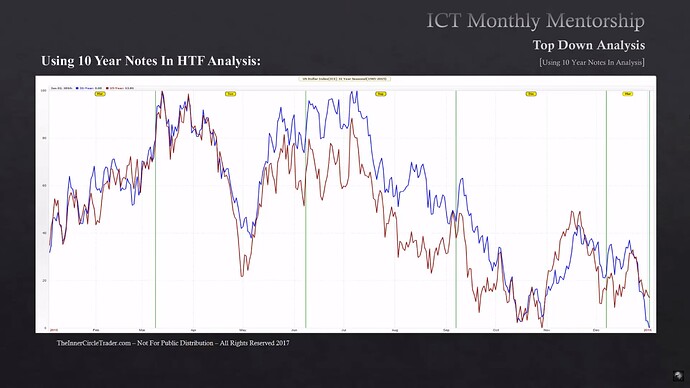

- The 10-year T-notes and the dollar are inversely correlated.

- If the dollar and 10-year notes move in the same direction, we are going to be in a large consolidation. In such an environment, we will trade the extremes of the range, i.e., the previous highs and lows, towards its middle.

- A consolidating dollar means that foreign currencies will also enter a long-term consolidation.

- If the 10-year notes and dollar move in the direction of their seasonal tendency, then we have a strong probability of a long-term trend. And that’s where the large funds place their money. The market will go in one direction for several months.

- If the dollar and 10-year notes move in tandem (in the same direction), we will focus on short-term trading, day trading, and scalping.

Using 10-Year Notes In HTF Analysis

10-Year T-Notes Seasonal Tendencies

US Dollar Index Seasonal Tendencies

10-Year T-Notes 2015

US Dollar Index 2015

10-Year T-Notes 2016

US Dollar Index 2016

10-Year T-Notes 2017

US Dollar Index 2017

Next lesson: ICT Mentorship Core Content - Month 5 - Qualifying Trade Conditions With 10 Year Yields

Previous lesson: ICT Mentorship Core Content - Month 5 - Defining Institutional Swing Points