Notes

- In the case of swing trading, we will analyze the market through a PD array matrix on monthly, weekly, daily, and four-hour charts.

- During the analysis process, ask yourself the following questions:

- Which side of the market has most recently shown a displacement?

- Where has the price moved away from?

- Has the price moved aggressively away from the price levels?

- Was there speed involved?

- Was there a large range indicating that there’s been a massive push by smart money?

- Trading in the direction of displacement generates highly probable setups.

- We use the four-hour chart as an execution time frame for our swing trades.

- If we are bearish, the ideal situation is when the market is in a premium area on the monthly, weekly, daily, and four-hour charts.

- If we are bullish, the ideal situation is when the market is in a discount area on the monthly, weekly, daily, and four-hour charts.

- The easiest and most probable trades occur when these four time frames are aligned.

- We look for swing trades when our macro analysis at least partially supports the trade idea.

- The expected HTF retracement against our swing position may be a good short-term trading opportunity.

- If the market profile is consolidation, then we look to see if the price is aggressively leaving the consolidation. We want to see displacement.

- Intermarket analysis is what Michael refers to as institutional market structure.

- We look for trades with a minimum risk/reward ratio of 1:3, preferably 1:5.

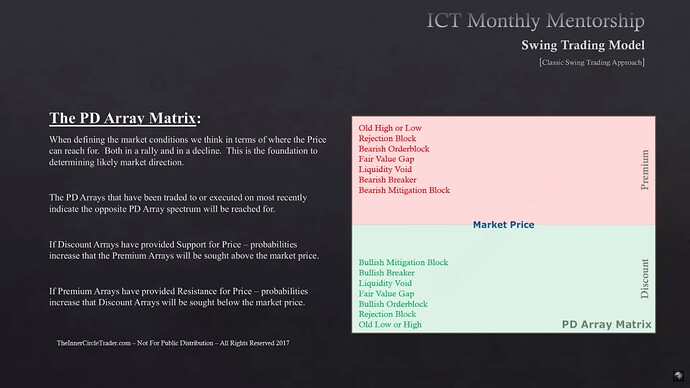

Classic Swing Trading Approach - The PD Array Matrix

Classic Swing Trading Approach - Higher Time Frame Sequence

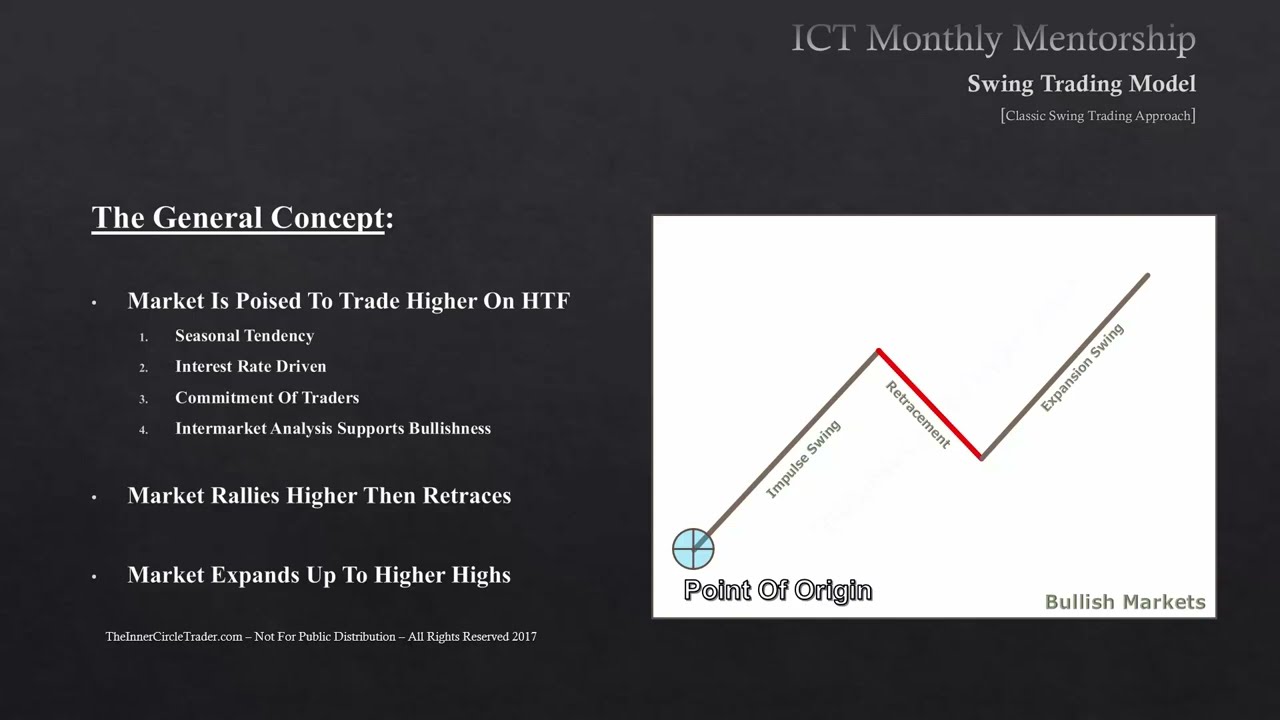

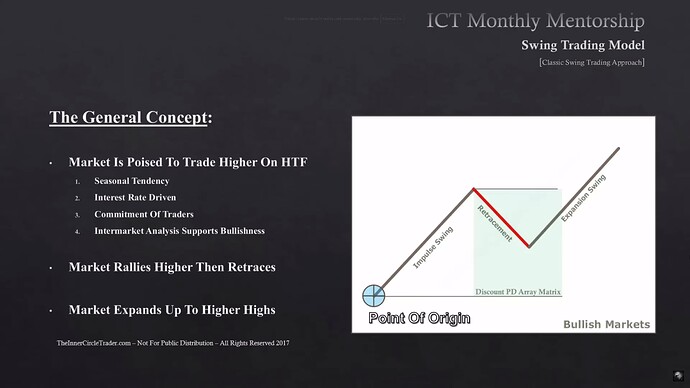

Classic Swing Trading Approach - The General Concept For Bullish Markets

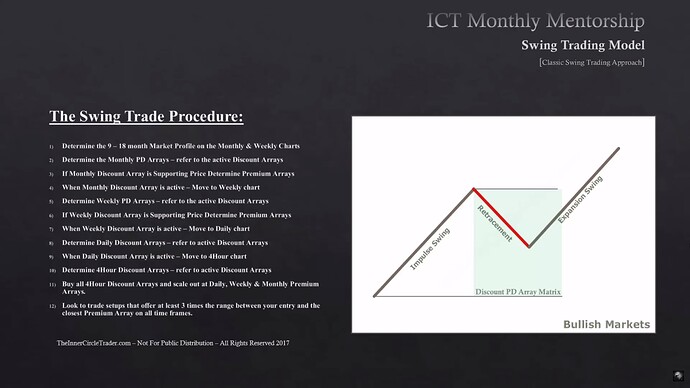

Classic Swing Trading Approach - The Swing Trade Procedure For Bullish Markets

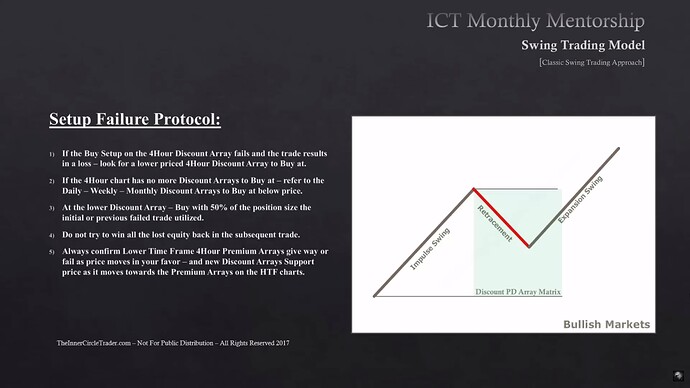

Classic Swing Trading Approach - Buy Setup Failure Protocol

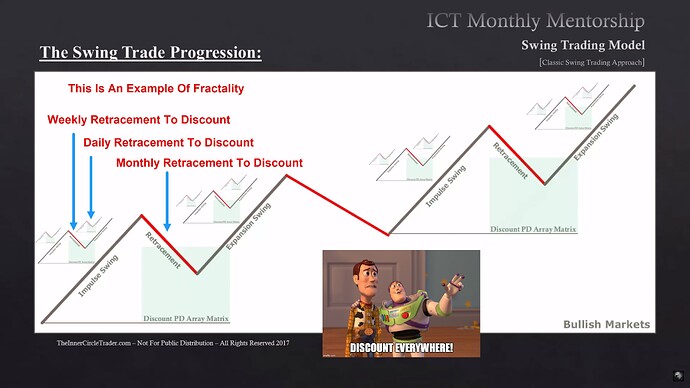

Classic Swing Trading Approach - The Swing Trade Progression

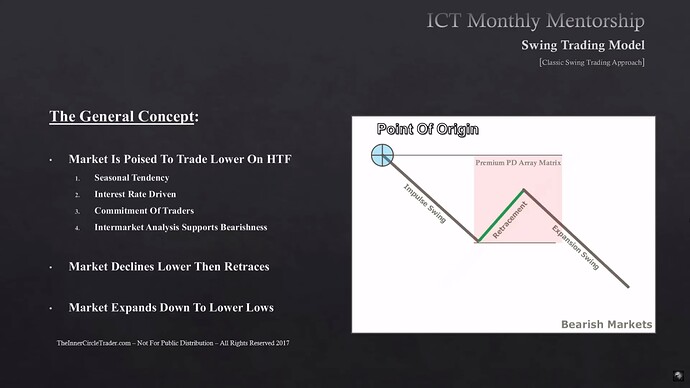

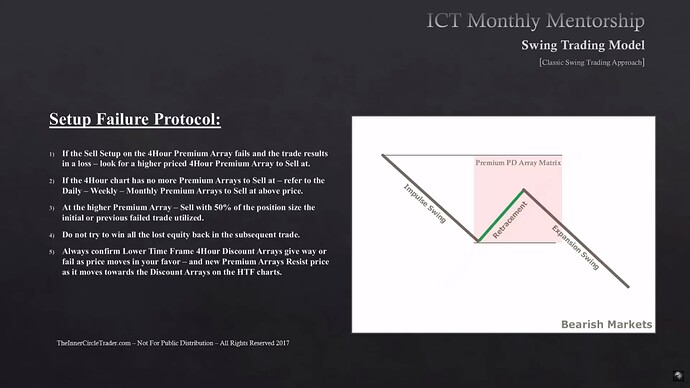

Classic Swing Trading Approach - The General Concept For Bearish Markets

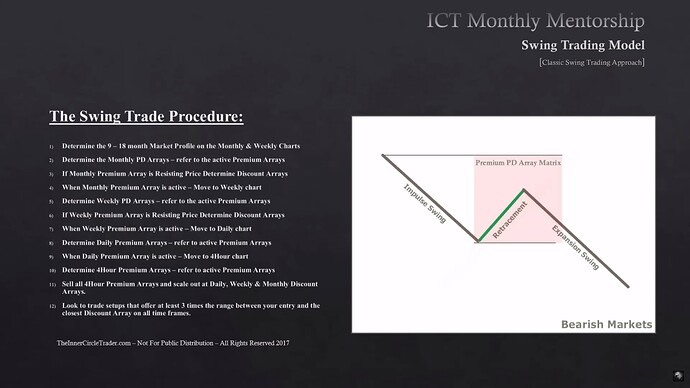

Classic Swing Trading Approach - The Swing Trade Procedure For Bearish Markets

Classic Swing Trading Approach - Sell Setup Failure Protocol

Next lesson: ICT Mentorship Core Content - Month 6 - High Probability Swing Trade Setups In Bull Markets

Previous lesson: ICT Mentorship Core Content - Month 6 - Elements To Successful Swing Trading