Notes

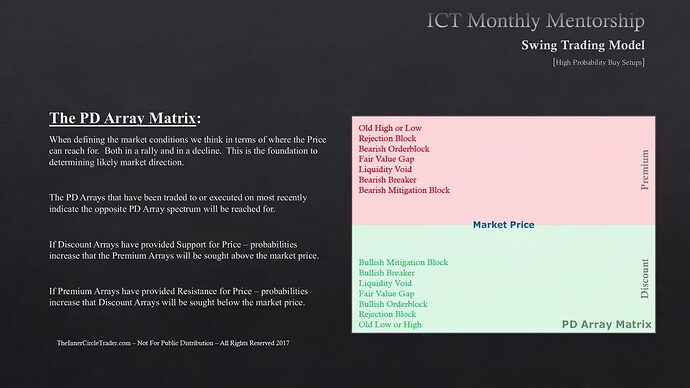

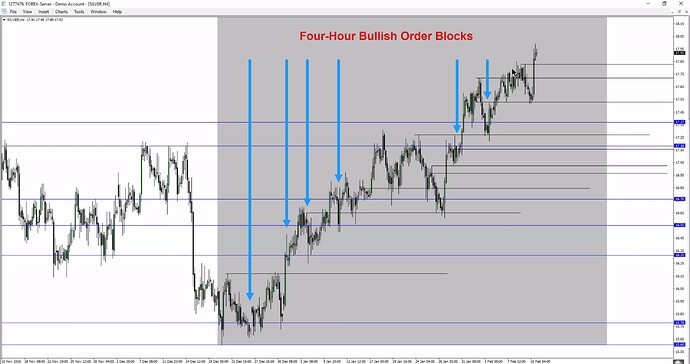

- We can buy all discount arrays on the daily and four-hour charts.

- We look at levels, not zones. To mark a bullish order block, we use a candle’s open or high price, and for a bearish order block, we use a candle’s open or low price.

- When the monthly and weekly time frames are aligned, every time the price returns to the daily bullish order block, we can be a buyer.

- Michael does not recommend buying in the premium area.

- If the bullish order block does not exist or is breached, we expect the price to fall below the short-term low.

High Probability Swing Trade Setups In Bull Markets - Bullish MWD Sequential

High Probability Swing Trade Setups In Bull Markets - Monthly, Weekly, Daily Bullish

High Probability Swing Trade Setups In Bull Markets - Monthly And Weekly Bullish, Daily Bearish

High Probability Swing Trade Setups In Bull Markets - Monthly Bullish, Weekly And Daily Bearish

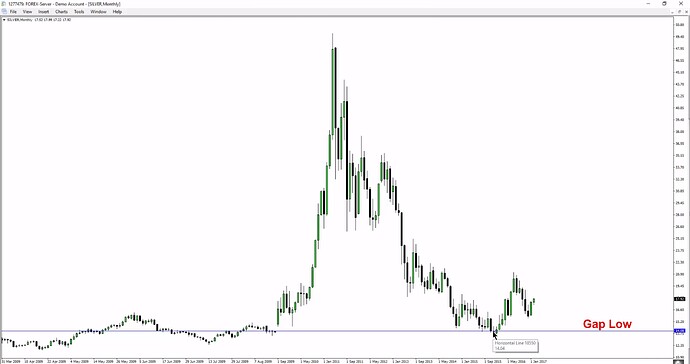

High Probability Swing Trade Setups In Bull Markets - Silver Monthly Chart Example

High Probability Swing Trade Setups In Bull Markets - Silver Monthly Chart Example

High Probability Swing Trade Setups In Bull Markets - Silver Weekly Chart Example

High Probability Swing Trade Setups In Bull Markets - Silver Daily Chart Example

High Probability Swing Trade Setups In Bull Markets - Silver Four-Hour Chart Example

Next lesson: ICT Mentorship Core Content - Month 6 - High Probability Swing Trade Setups In Bear Markets

Previous lesson: ICT Mentorship Core Content - Month 6 - Classic Swing Trading Approach