Trading opportunities of Thursday, January 30.

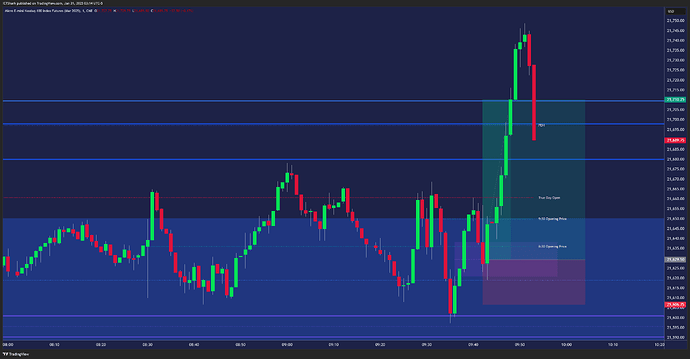

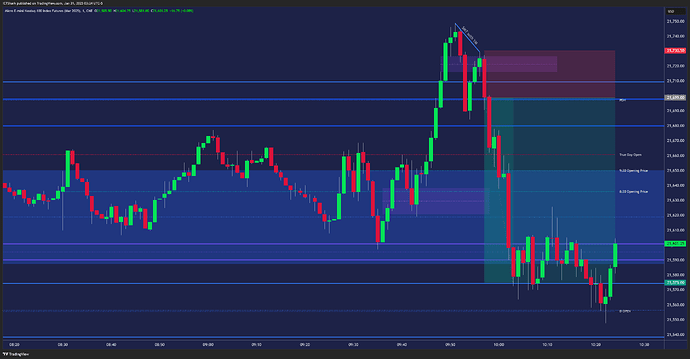

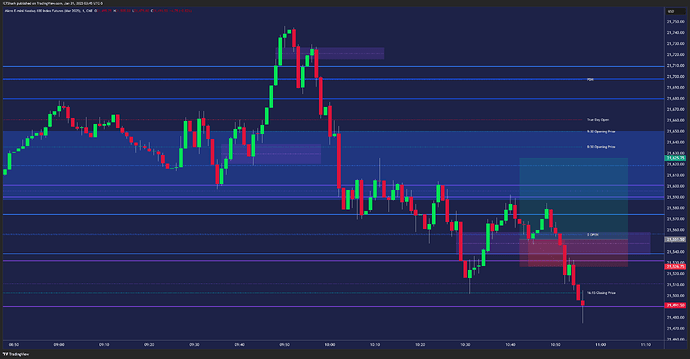

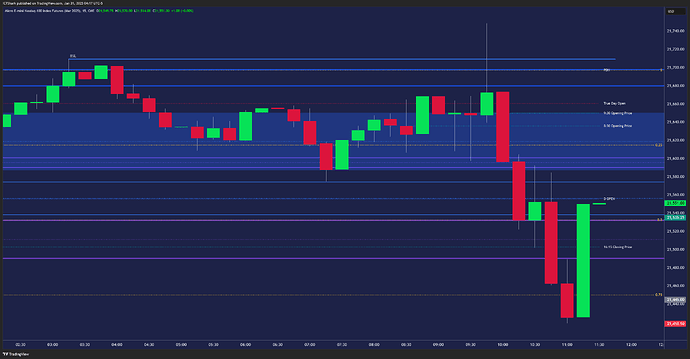

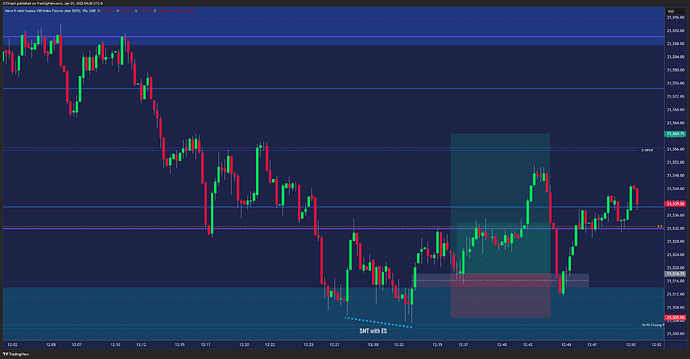

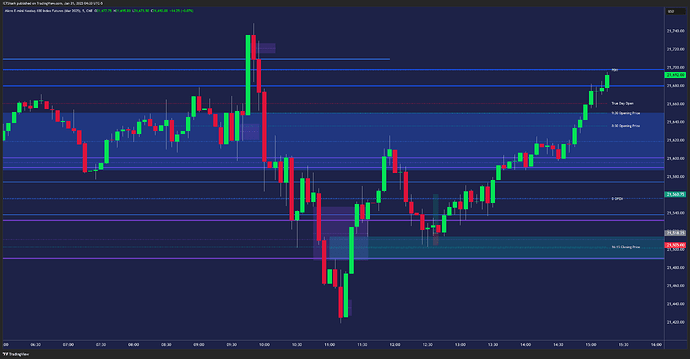

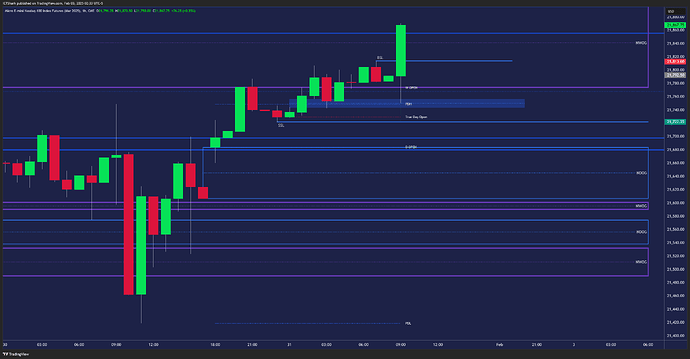

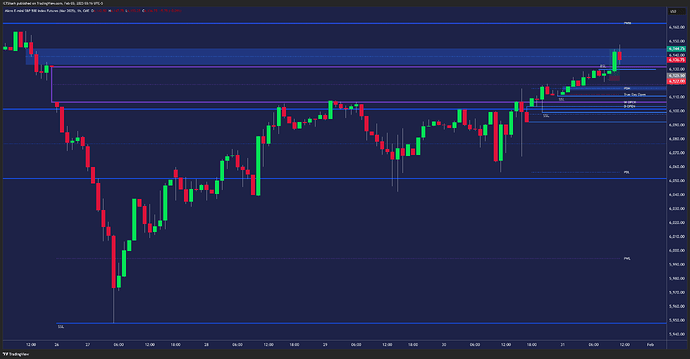

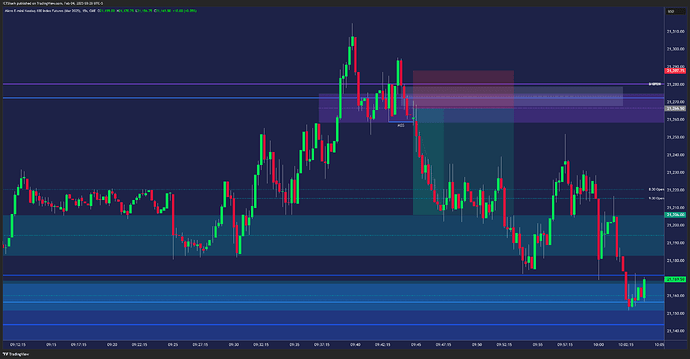

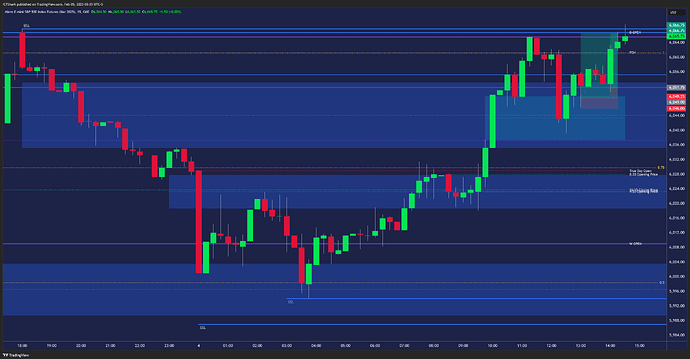

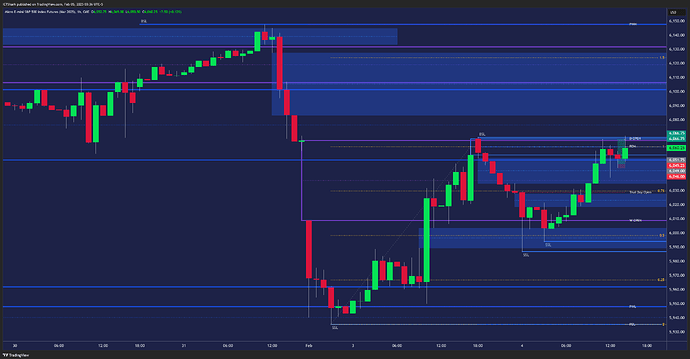

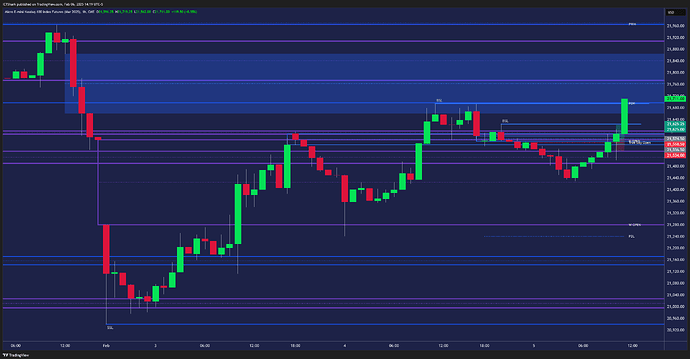

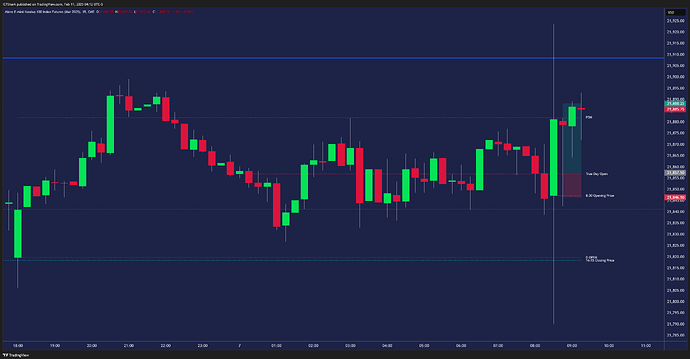

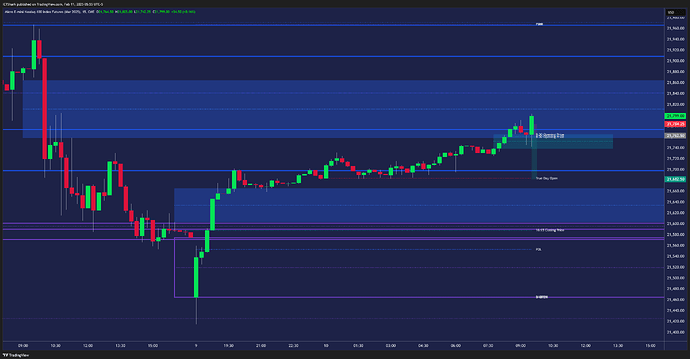

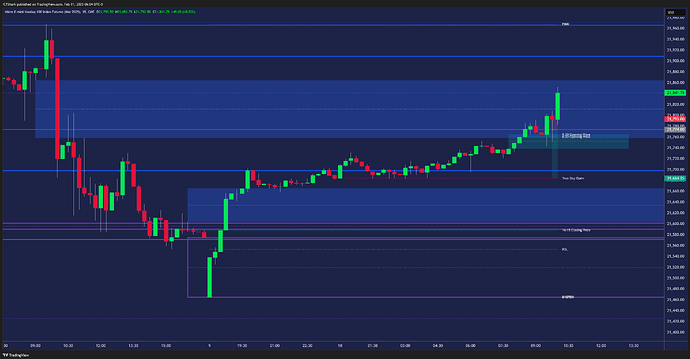

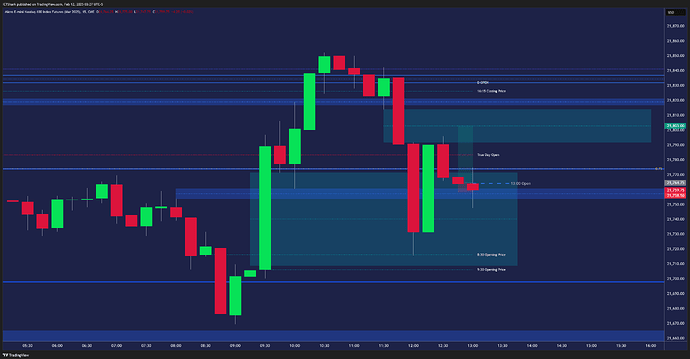

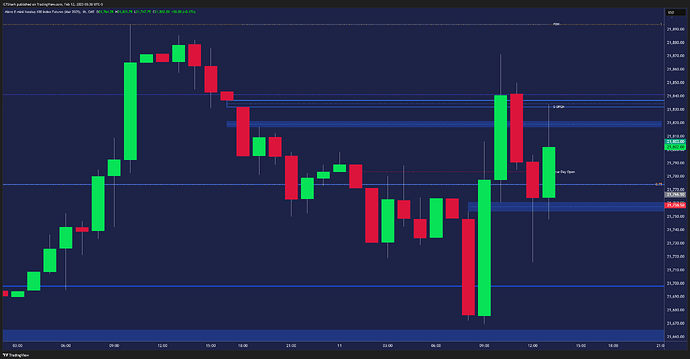

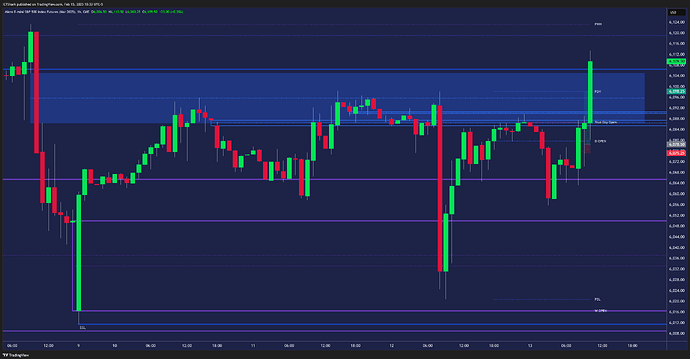

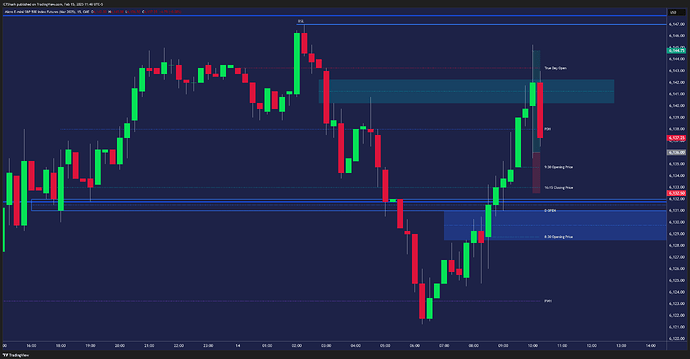

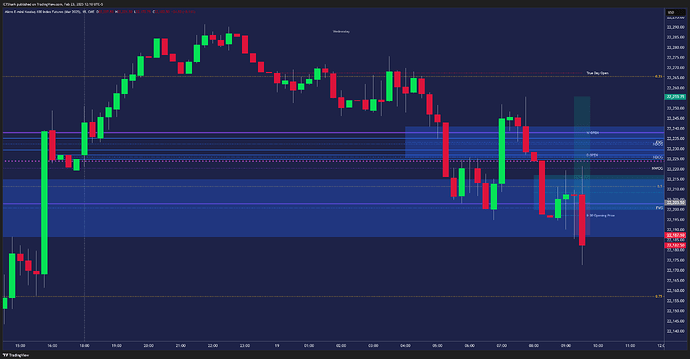

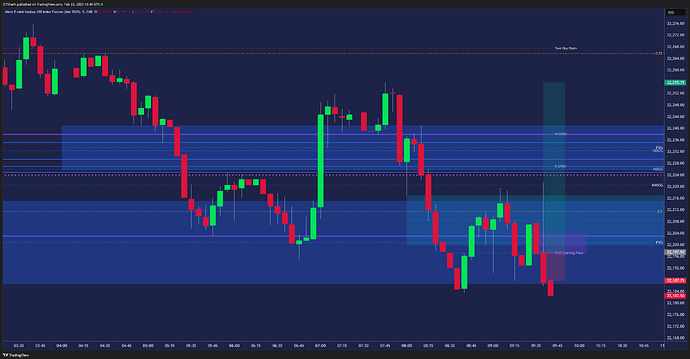

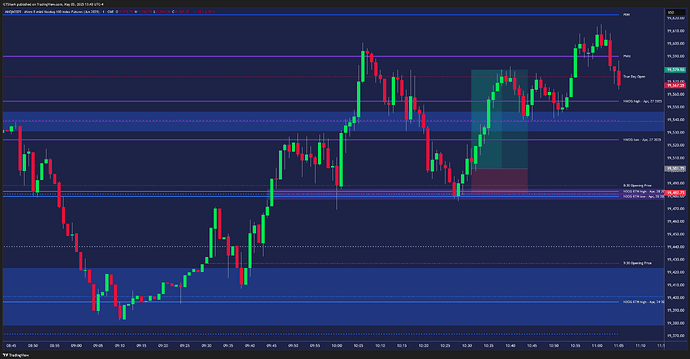

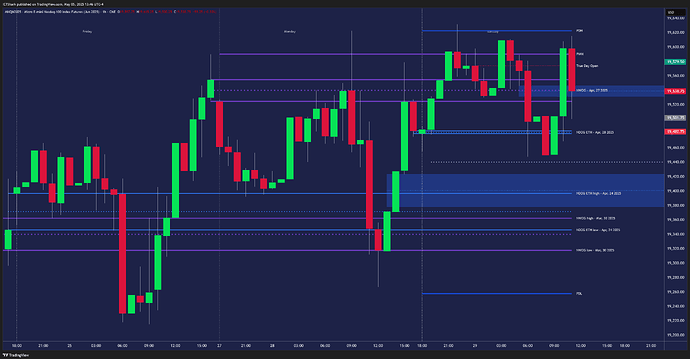

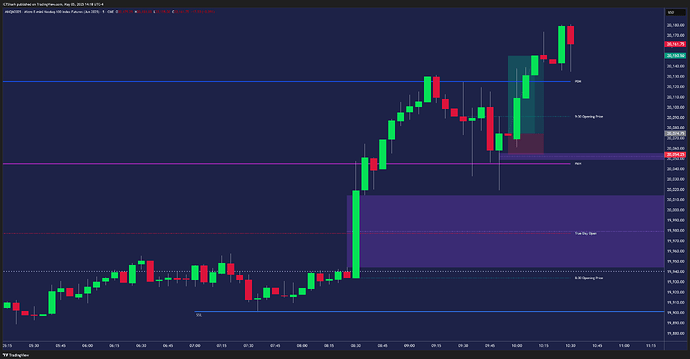

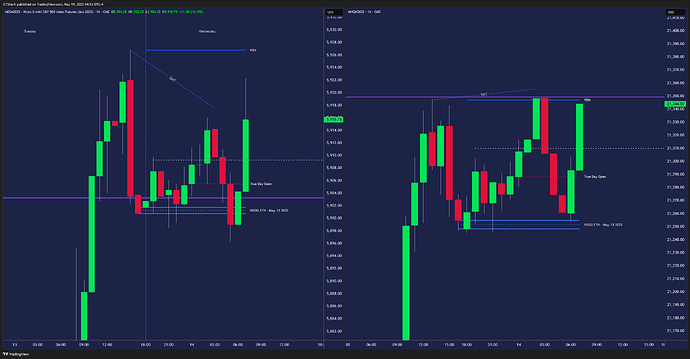

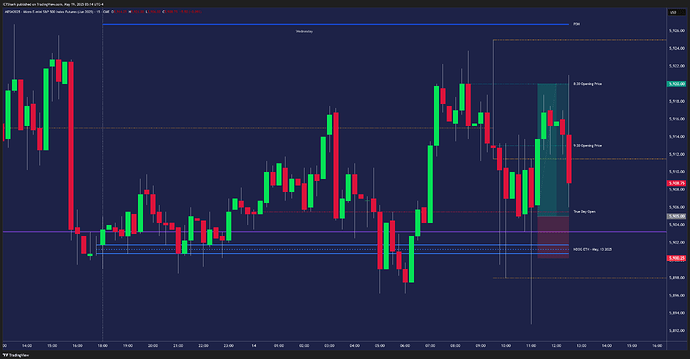

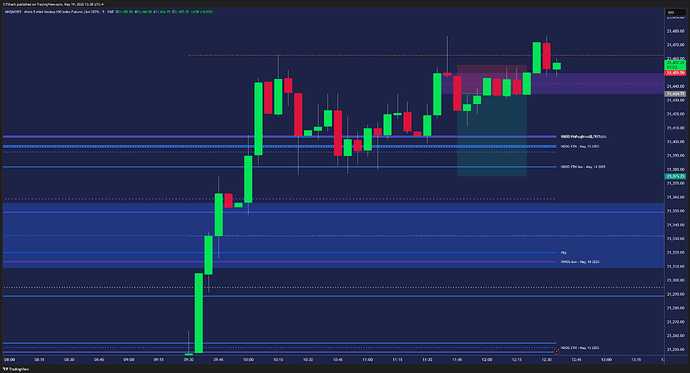

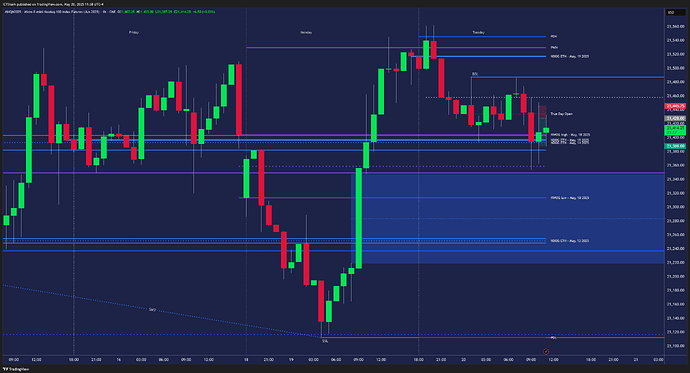

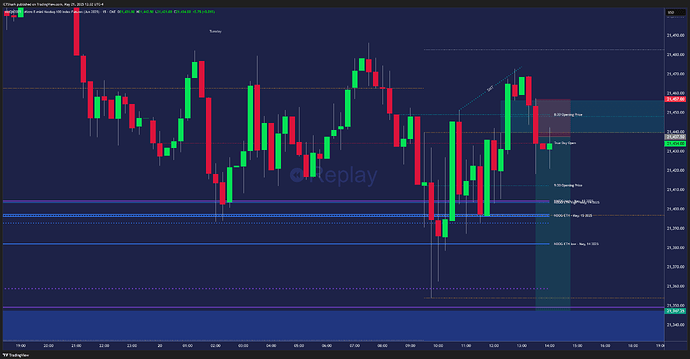

Missed Trade #1

I did not enter this long trade because of the divergence between NQ and ES. While NQ removed liquidity above PDH during the London session, ES did not. I saw this as a sign of weakness at the time.

In hindsight and after more rigorous study, I must conclude that I should have ignored this fact because the retracement caused by the divergence (SMT) had already occurred before the market opened.

It was, therefore, a valid setup. The entry should have taken place at FVG or IFVG (BPR)

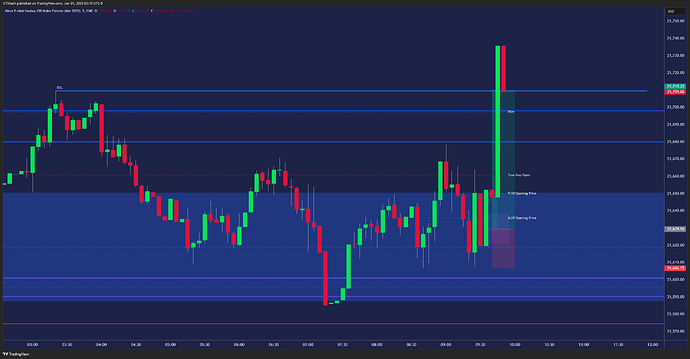

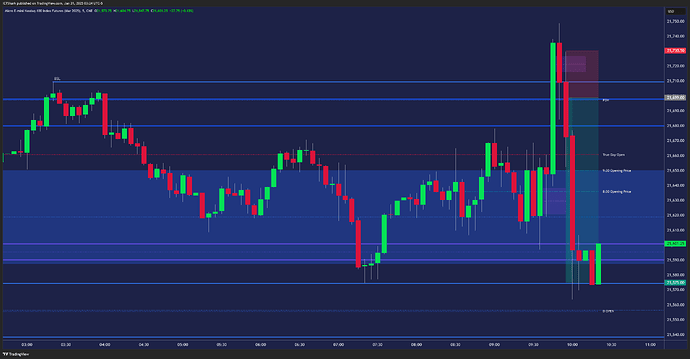

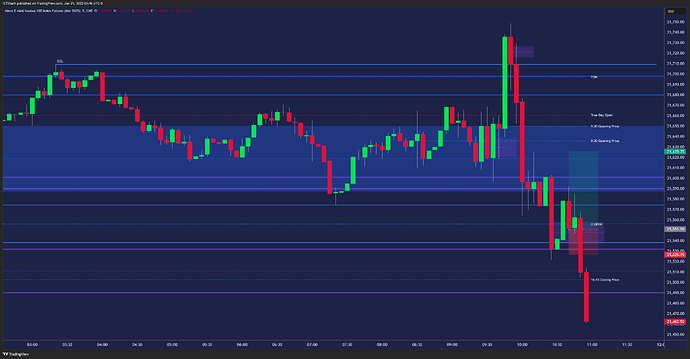

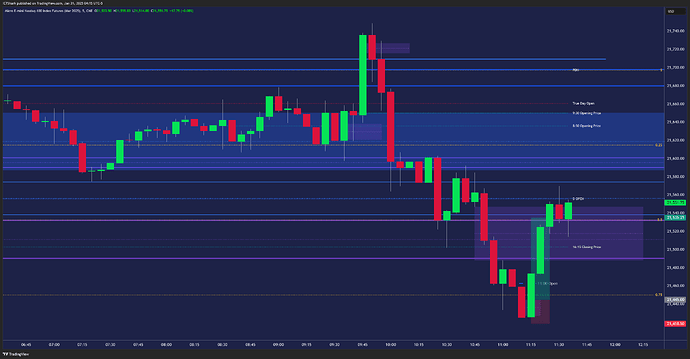

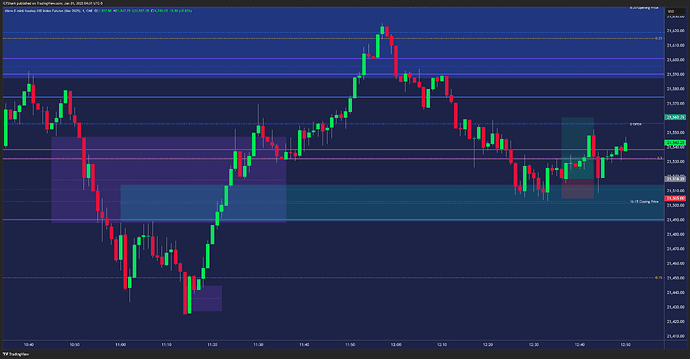

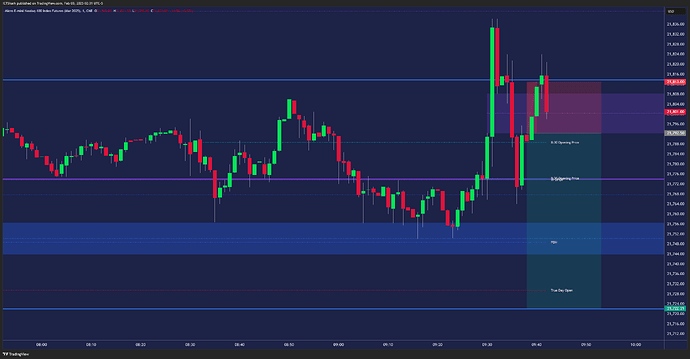

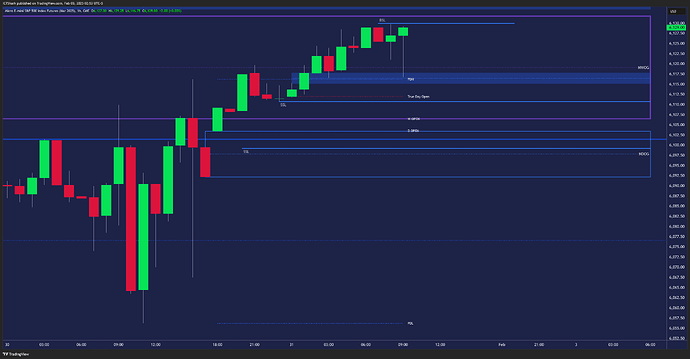

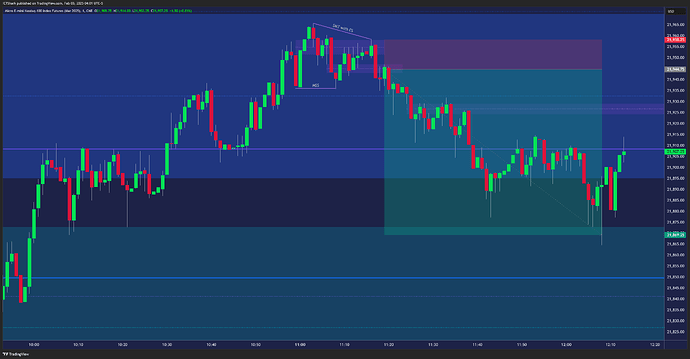

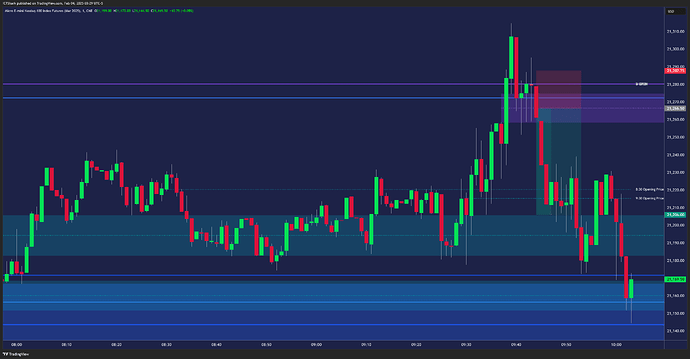

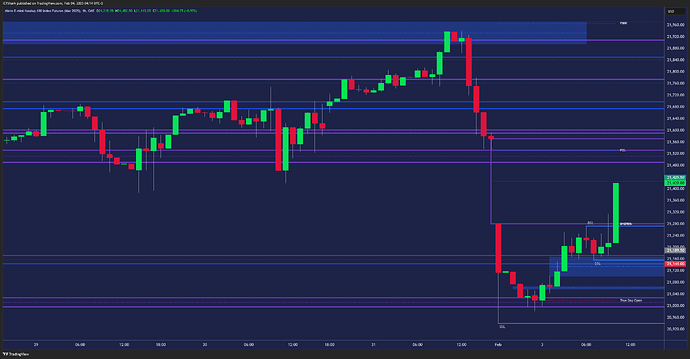

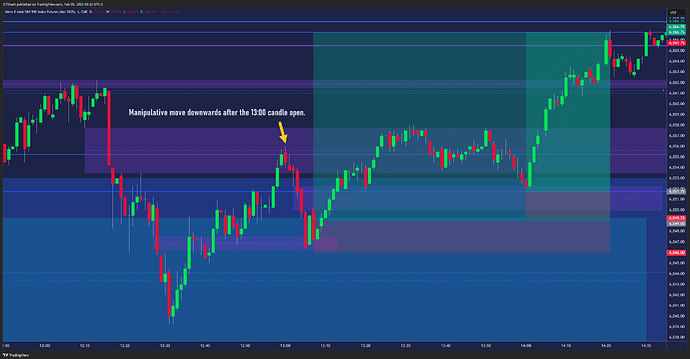

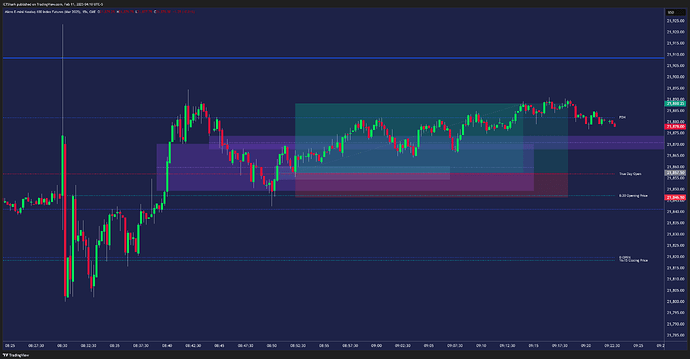

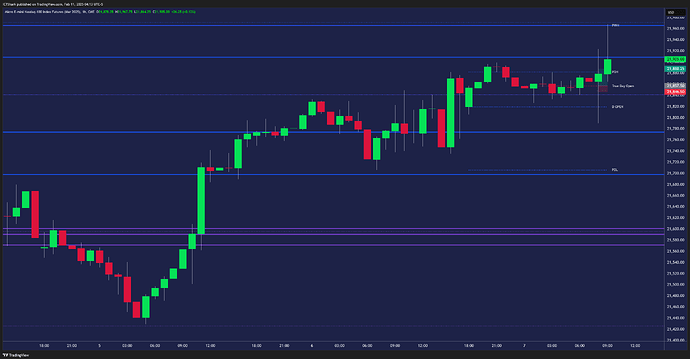

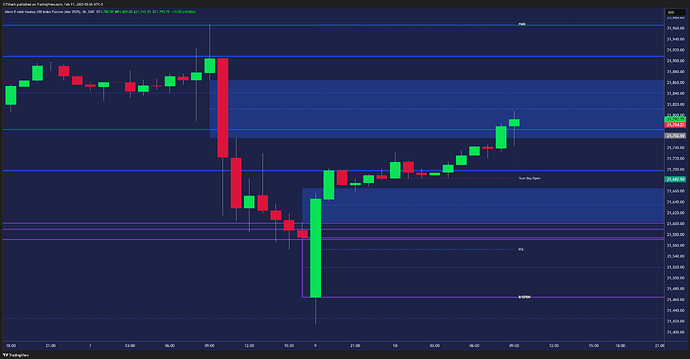

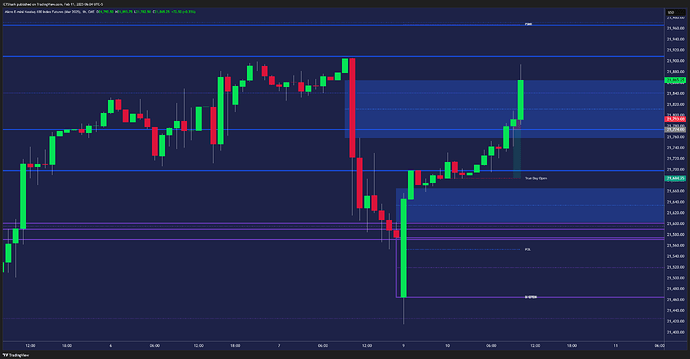

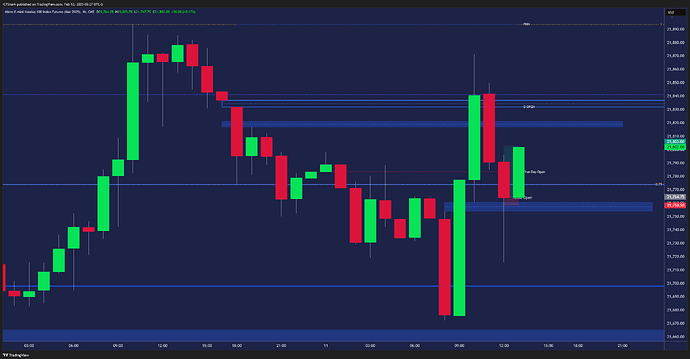

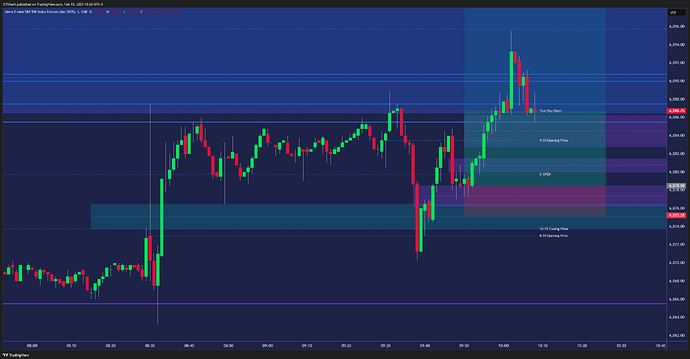

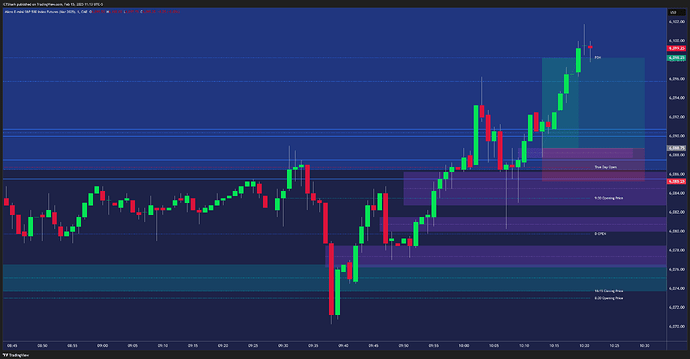

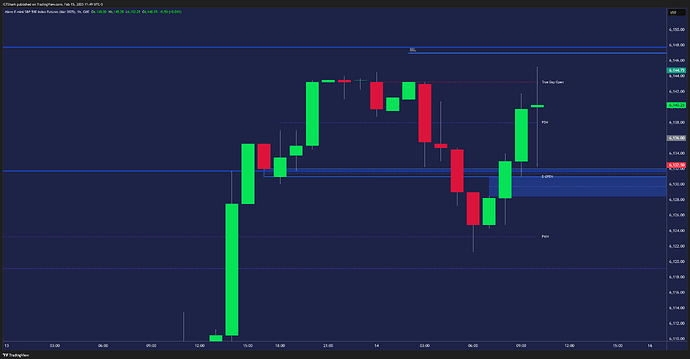

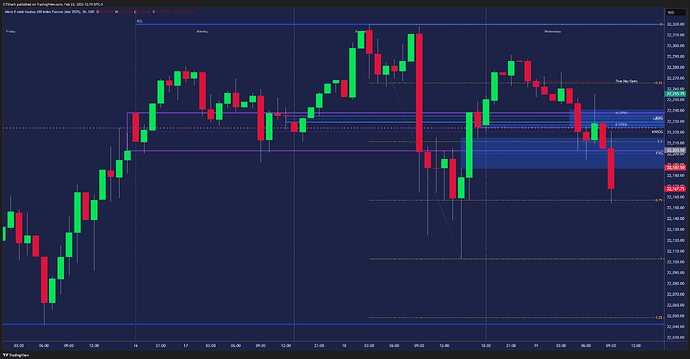

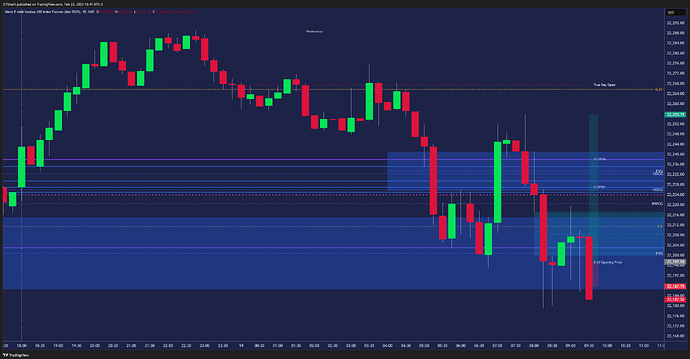

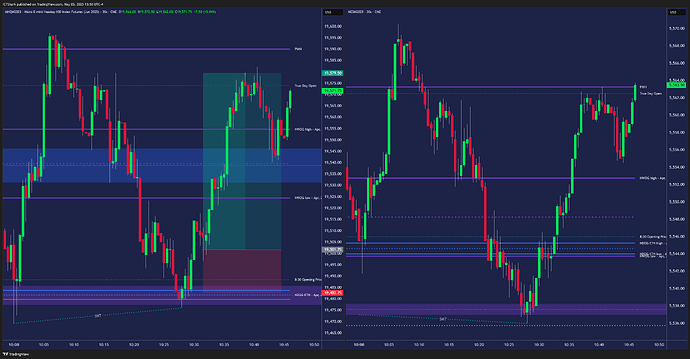

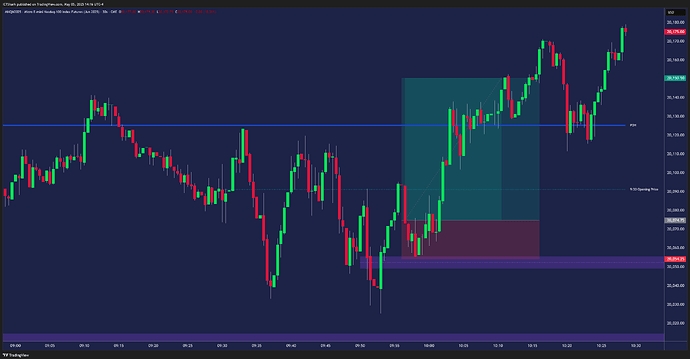

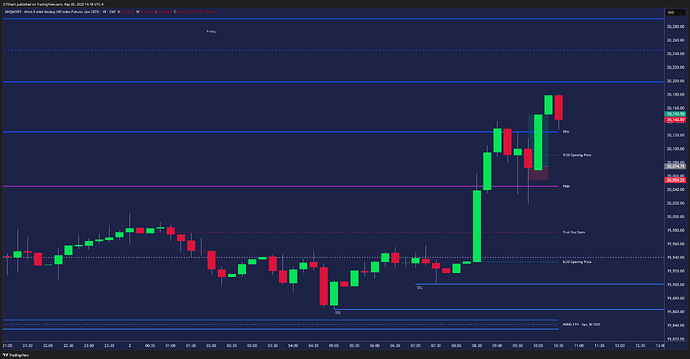

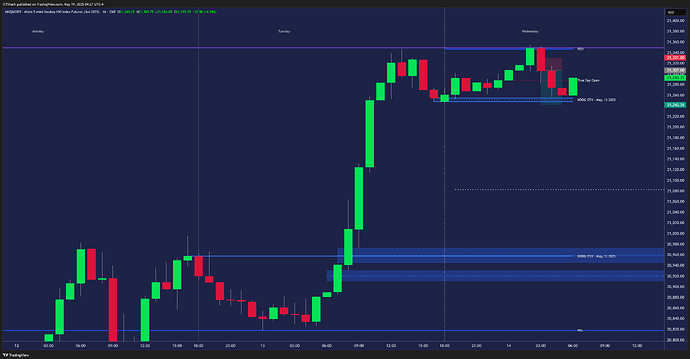

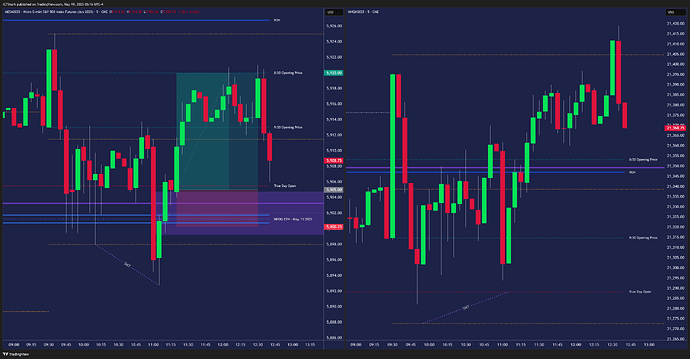

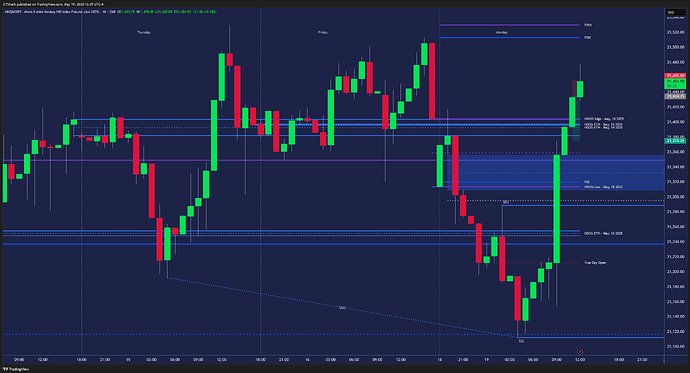

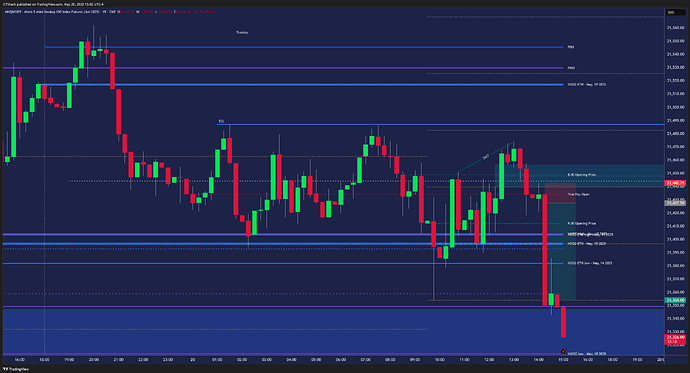

Missed Trade #2

When this short trade was forming, I was frustrated with missing the previous long trade, so I wasn’t focused enough on what was to come.

Both ES and NQ removed liquidity above the London session high and formed a divergence with YM. Subsequently, the NQ formed a bearish FVG, and the price showed that it respects it and thus will continue to the downside, at least for a while.

Since the market opened with a gap up and there was an hourly FVG below the swing low, it made sense that the price would want to look in that direction.

It should be noted, however, that this was a generally aggressive trade, as there was no MSS before the theoretical entry, nor was the 1-minute bullish FVG (bullish inefficiency sequence) completely overcome. However, Michal also executes such trades, which is undoubtedly due to his greater knowledge and experience.

Note: In unclear cases, it is better to wait for confirmation of the PD array in the form of a momentum candle forming in the expected direction (see screenshot of the 1-minute chart).

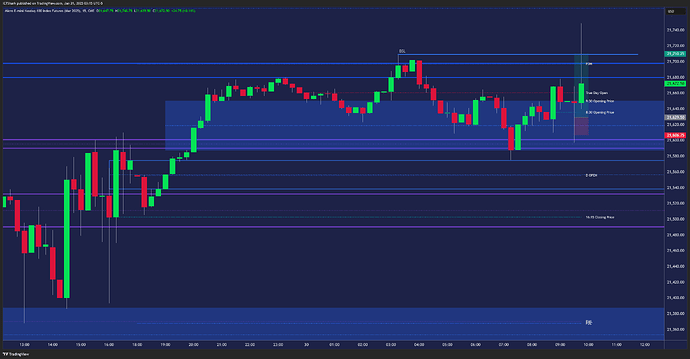

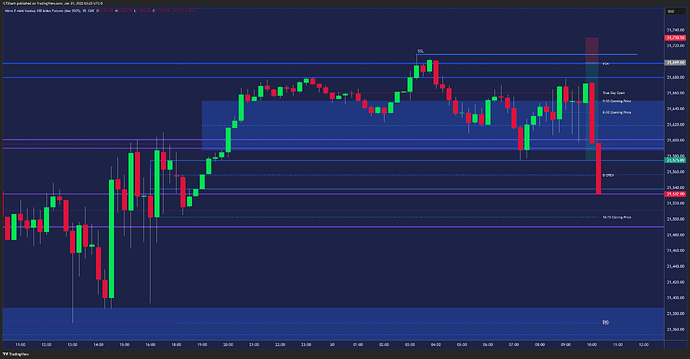

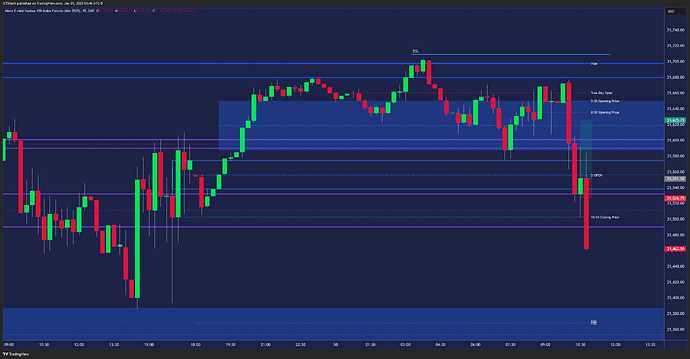

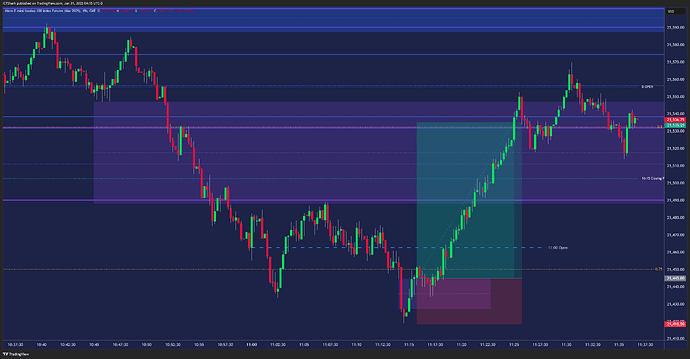

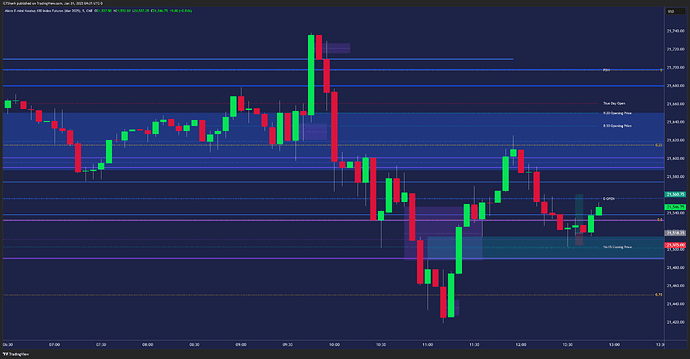

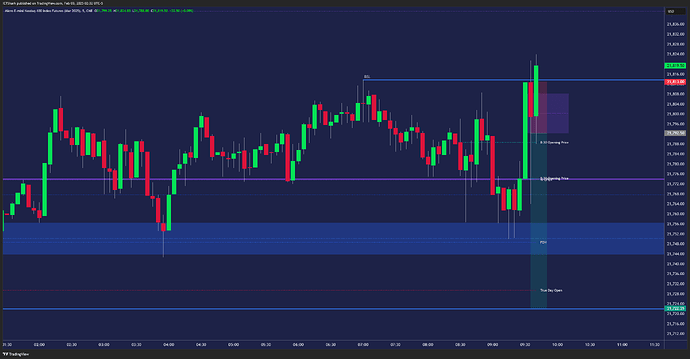

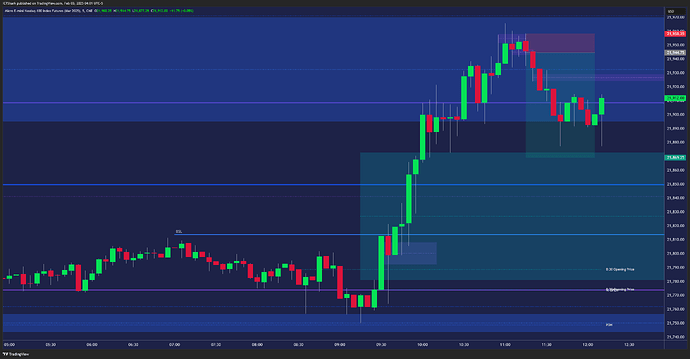

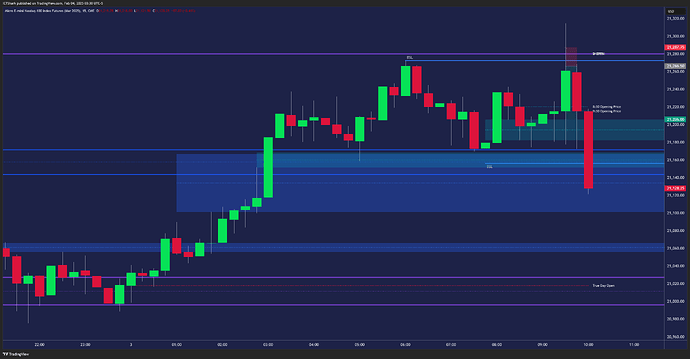

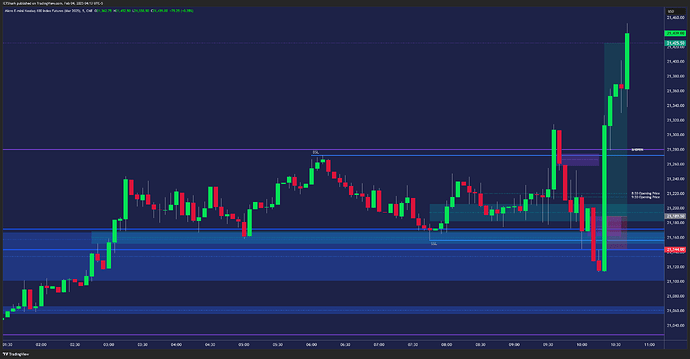

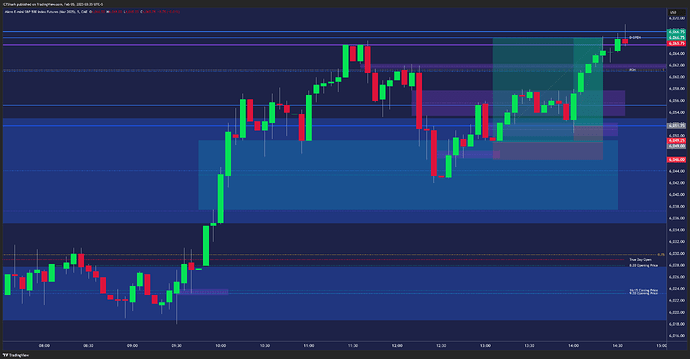

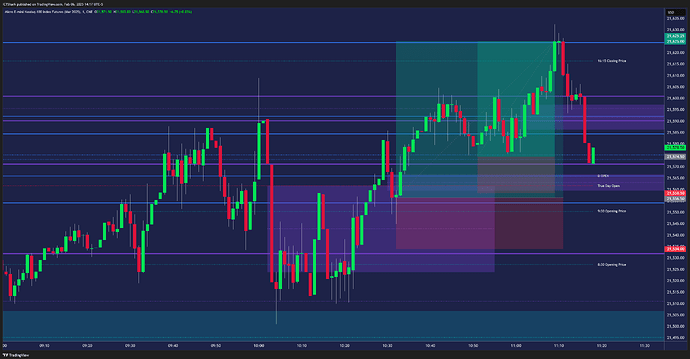

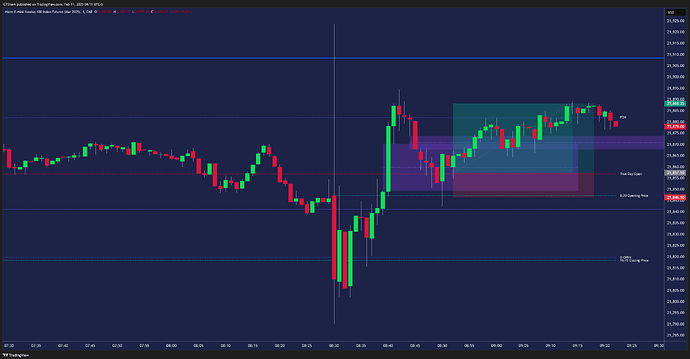

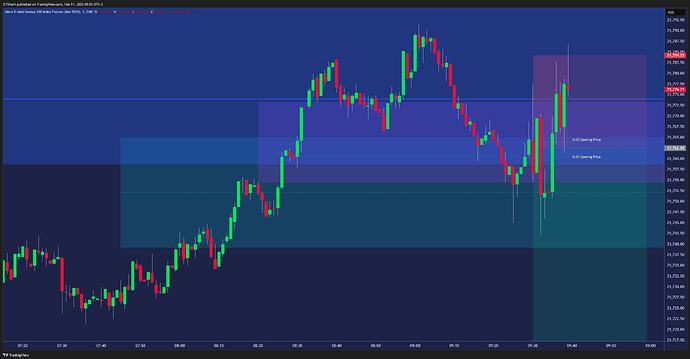

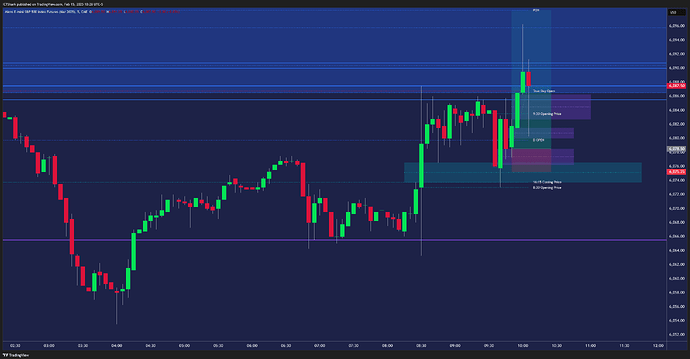

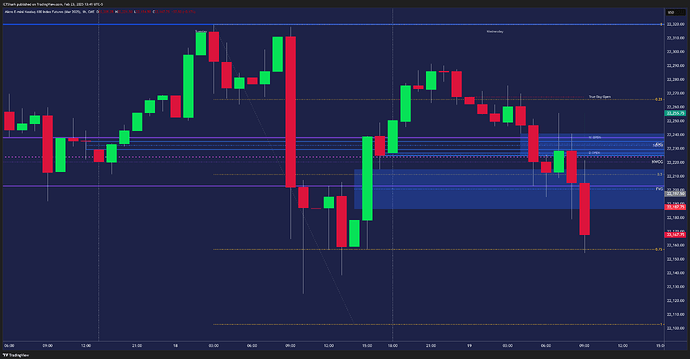

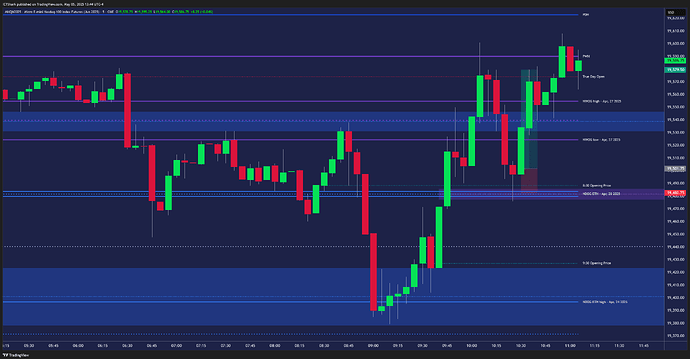

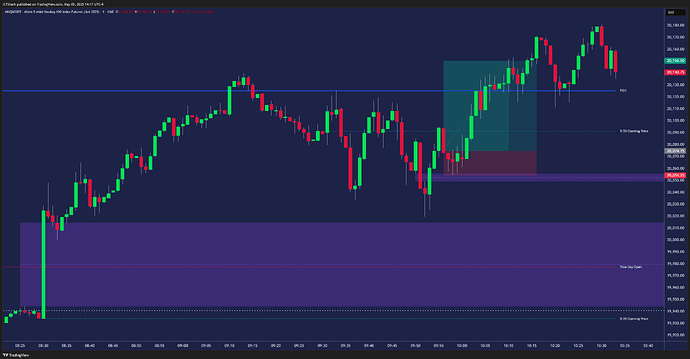

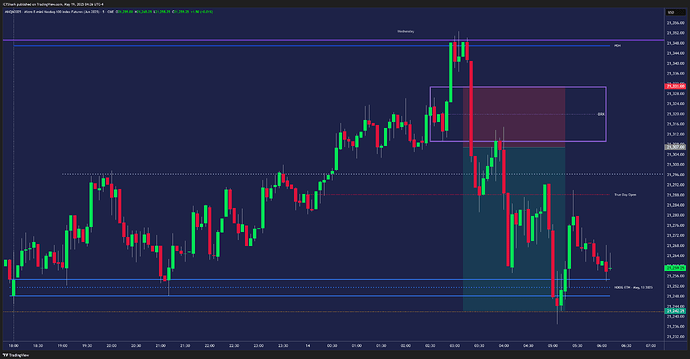

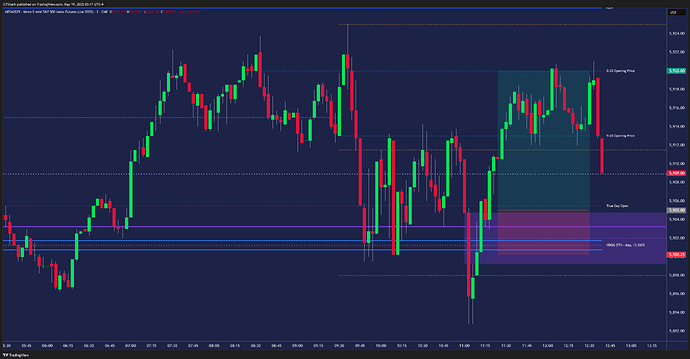

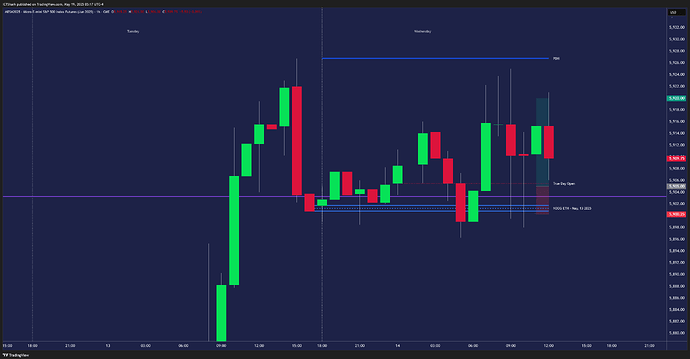

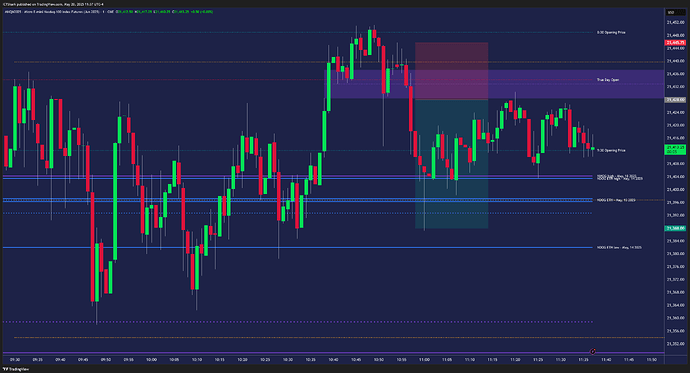

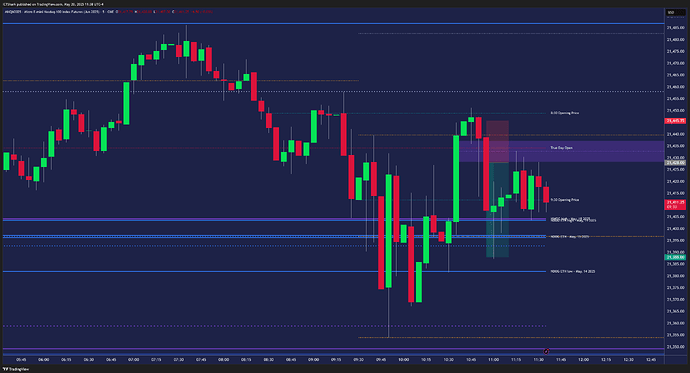

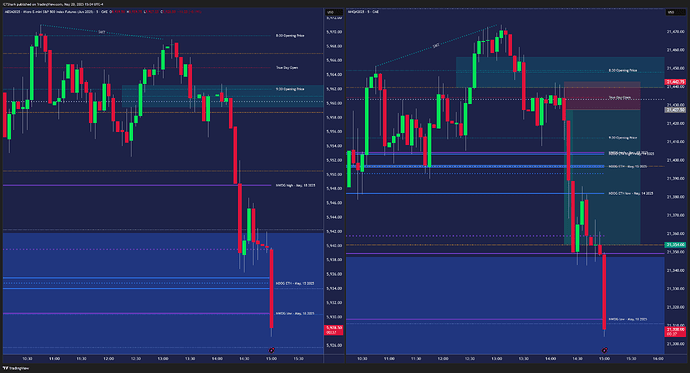

Trade #1

The main reason I entered this trade was the belief that the price would not want to trade below the previous day’s low. Just look at the hourly chart and what the price did during the previous (FOMC) day, and you will understand why.

The logic behind my long trade was as follows. While the NQ removed liquidity below the current low of the day, the ES did not. My entry took place on the bullish FVG, which, together with the marked IFVG, formed the BPR.

Price started moving in my direction after my entry and allowed me to move my stop loss. Unfortunately, it then reversed and hit it.

This long trade ended with a loss of 0.5R.

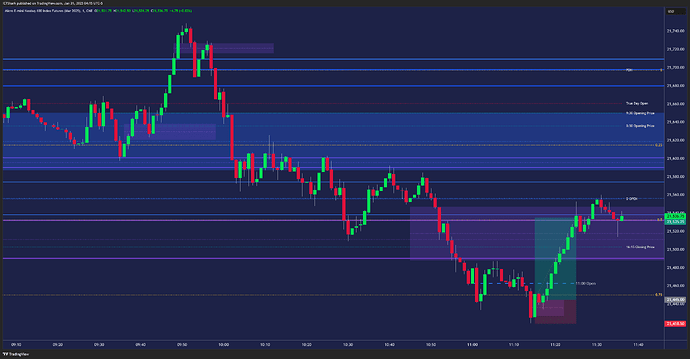

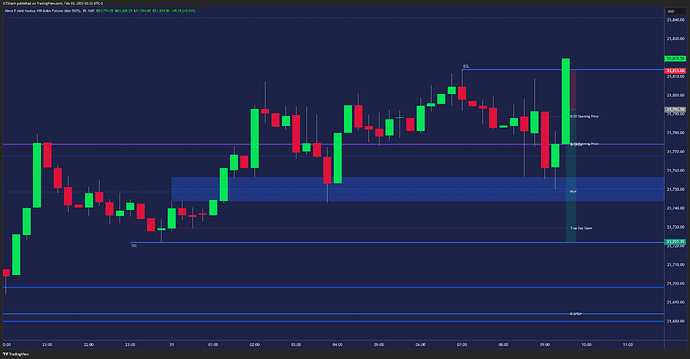

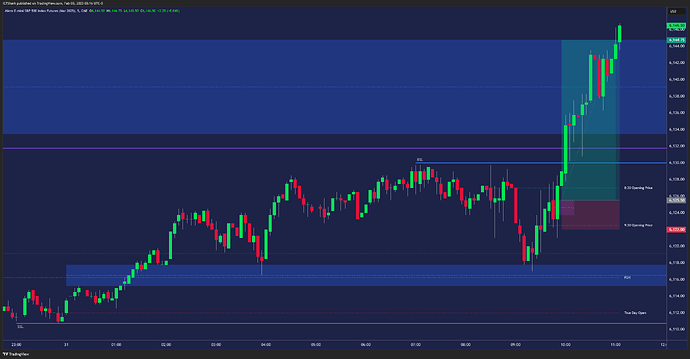

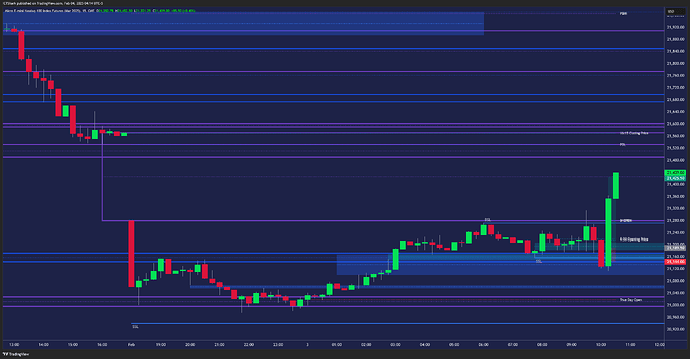

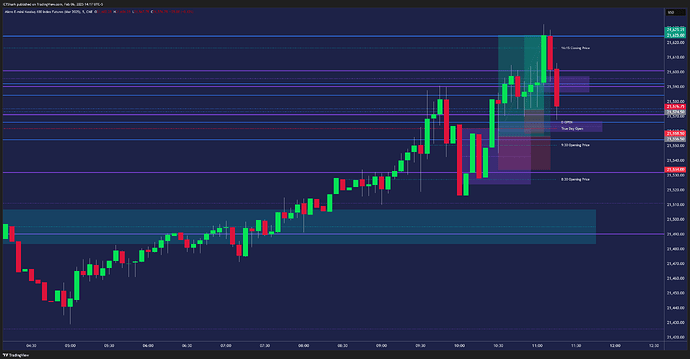

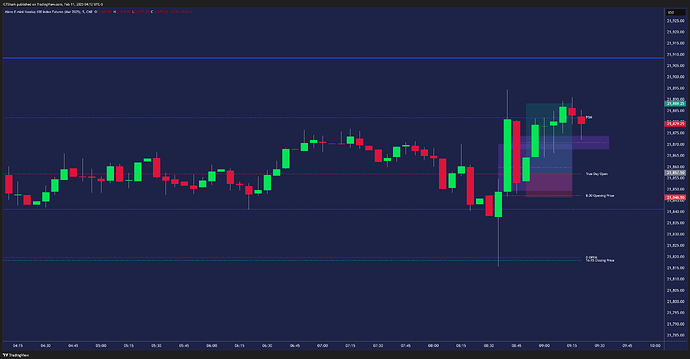

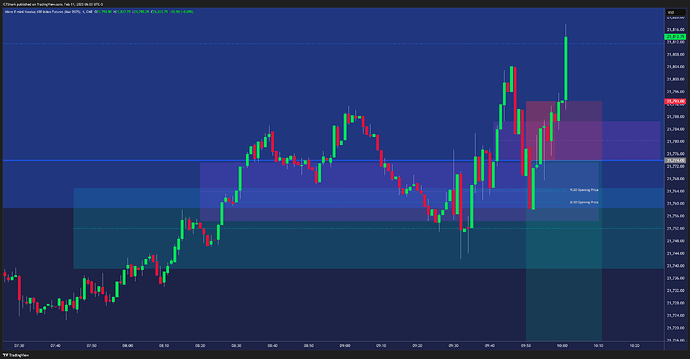

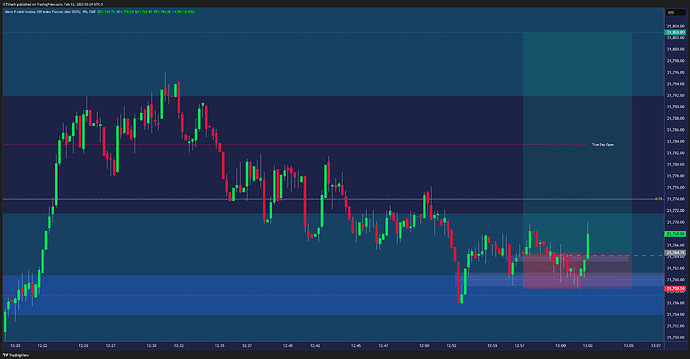

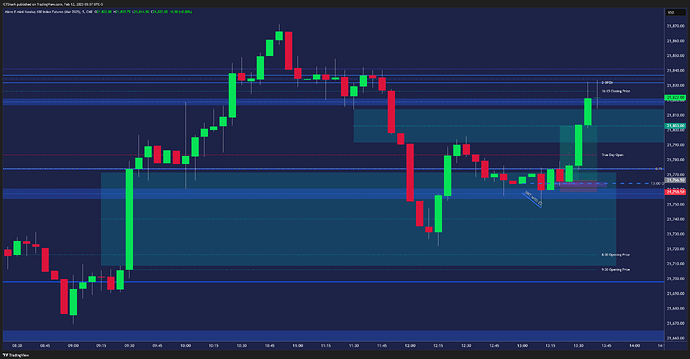

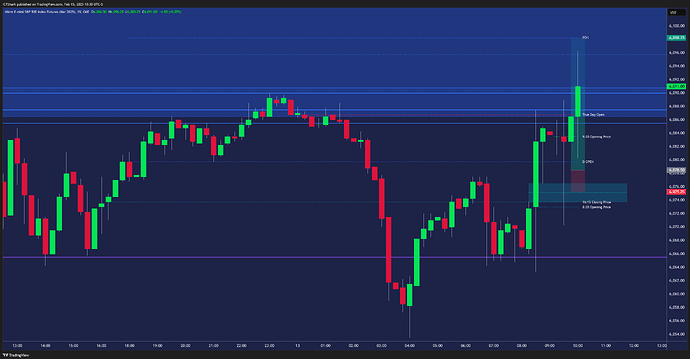

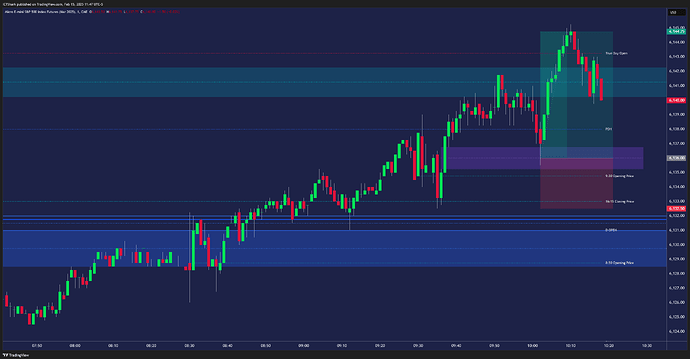

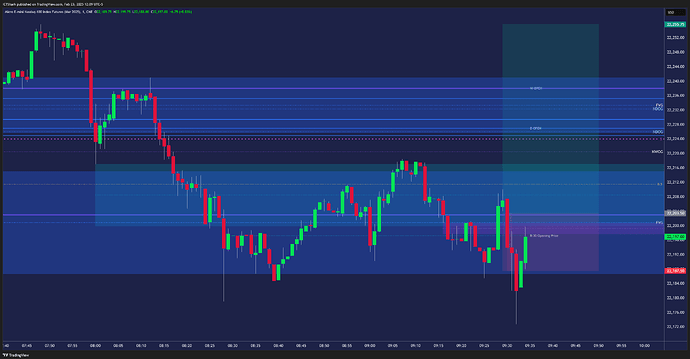

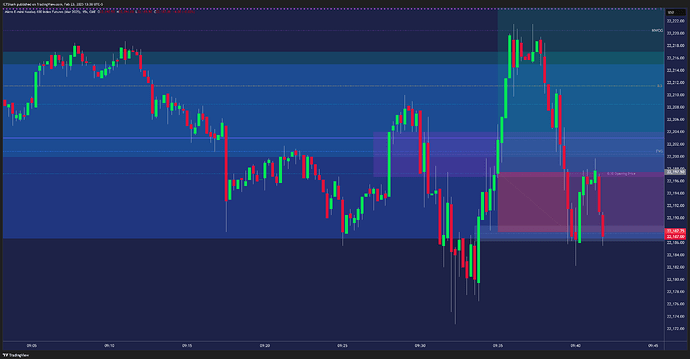

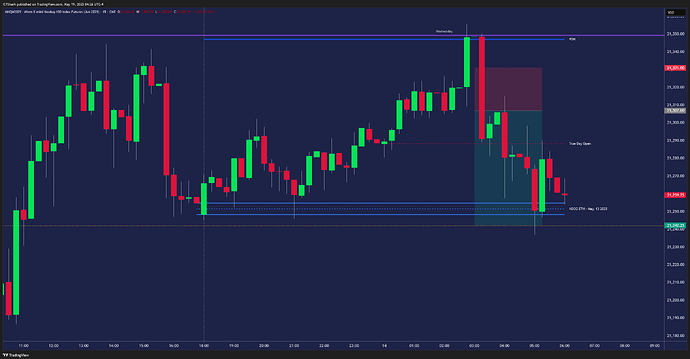

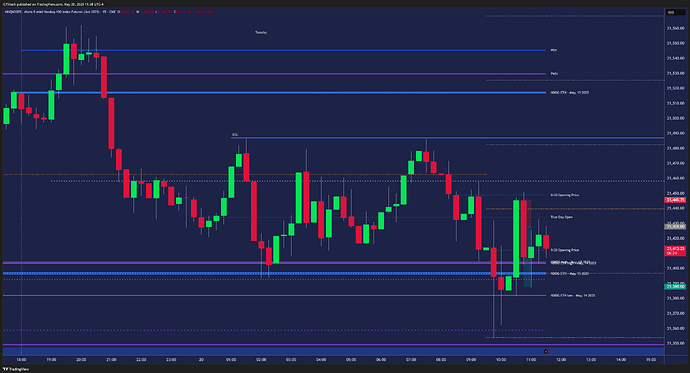

Missed Trade #3

I really, really, really wanted to enter this long trade. Unfortunately, I didn’t identify any divergence to confirm this price reversal and had to watch the price go in my expected direction without me.

Michael has always stated that divergence (SMT) is only used to confirm a trade idea and not as the main reason to enter. Many of his trades are not preceded by divergence. However, I feel much more confident when some form of manipulation occurs before my entry.

I guess this is an area I will have to explore in more detail. I often identify a great spot where the price turns in my expected direction, but no divergence precedes these price reversals.

My reason for entering this long trade is as follows. Both ES and NQ have removed liquidity below the current low of the day and were around 75% of the retracement of yesterday’s range (also an OTE level). As I stated, I did not expect a break of the previous day’s low, and it was approaching lunchtime when at least a retracement, if not a complete reversal, could be expected. So, this is the main reason (logic) behind this trade idea.

As you can see from the screenshots, my thinking was correct. An entry on IFVG would be perfect.

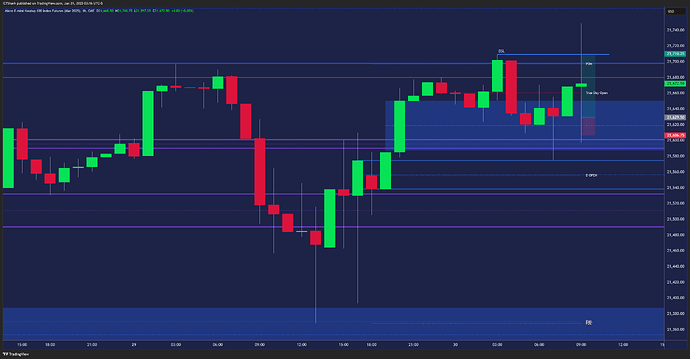

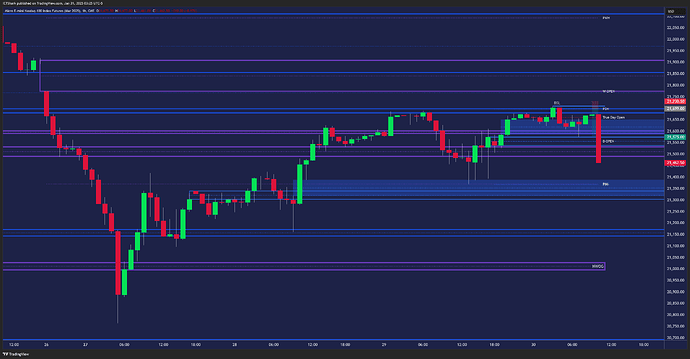

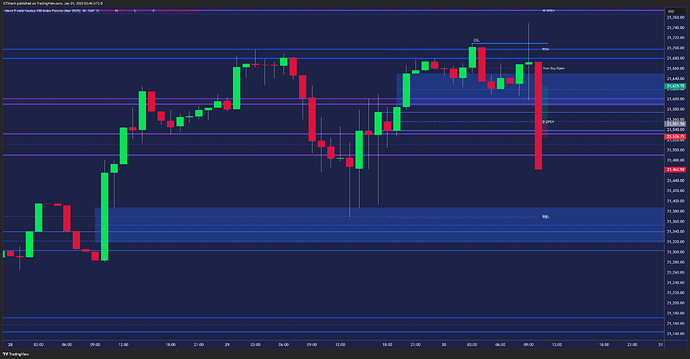

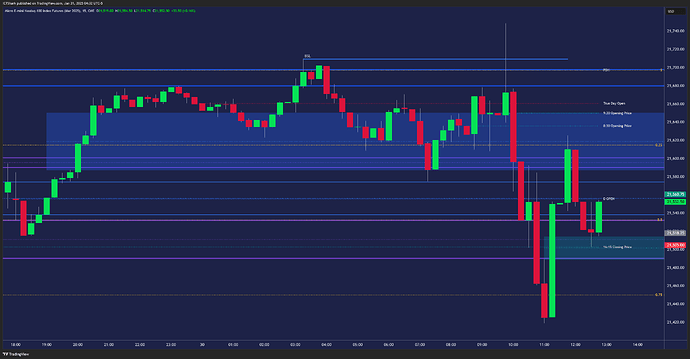

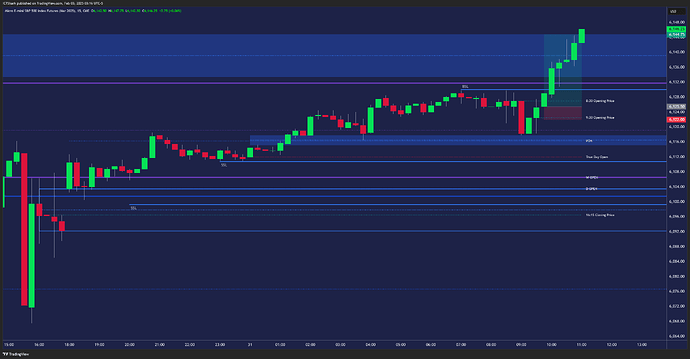

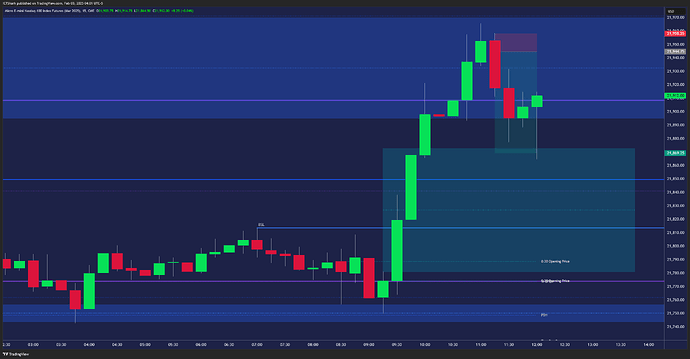

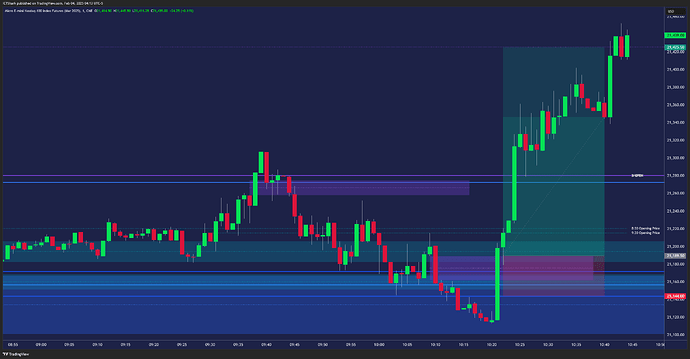

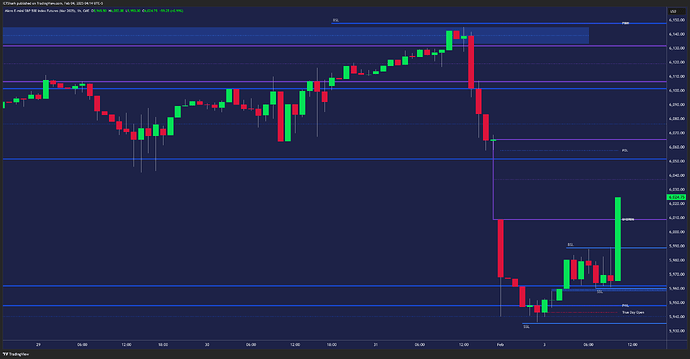

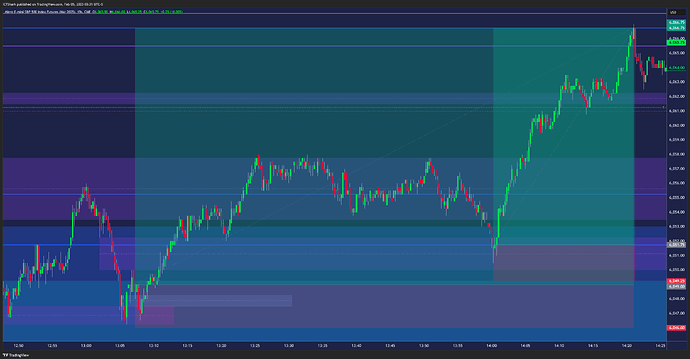

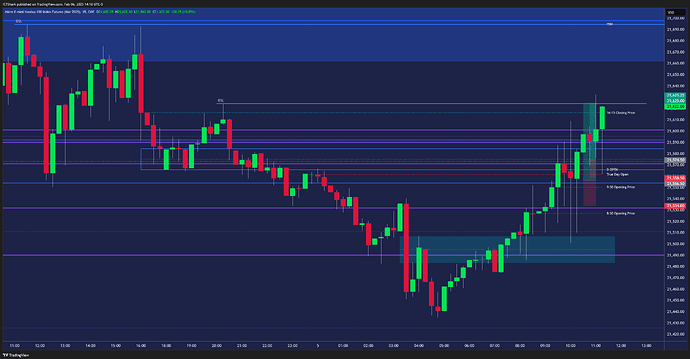

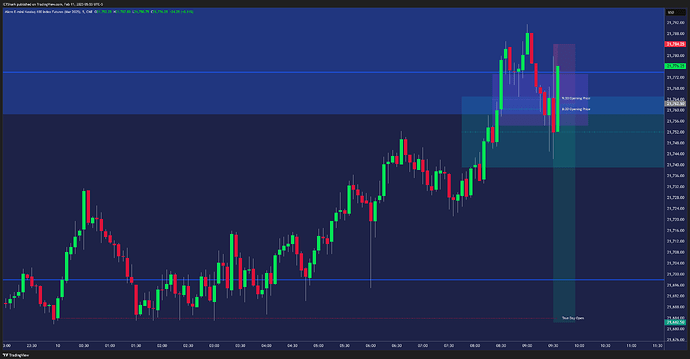

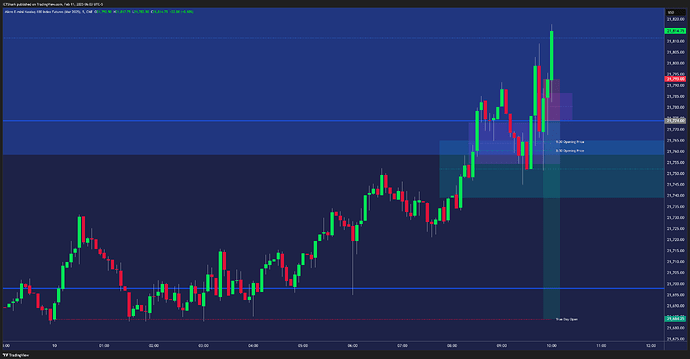

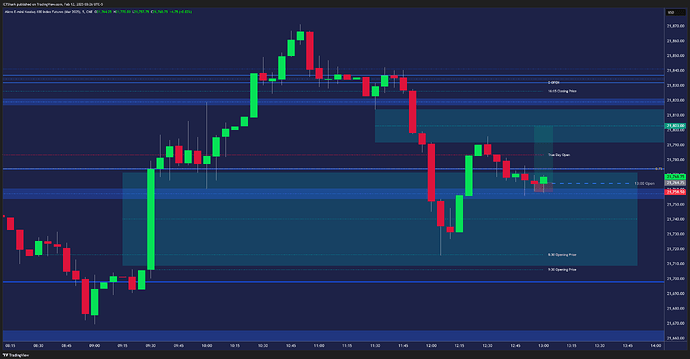

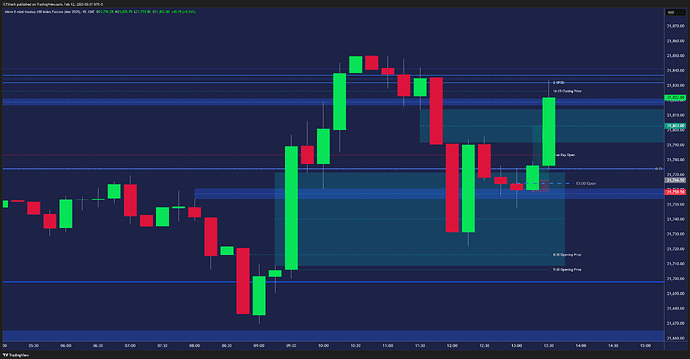

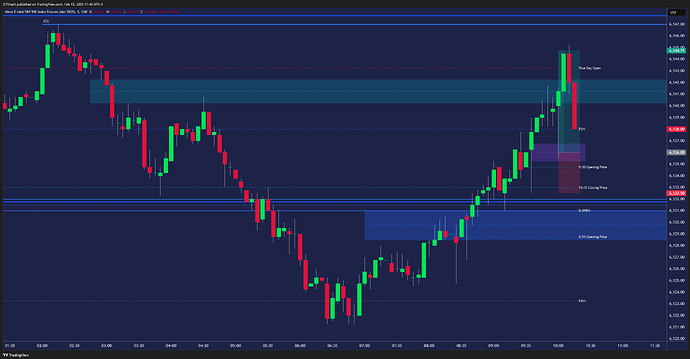

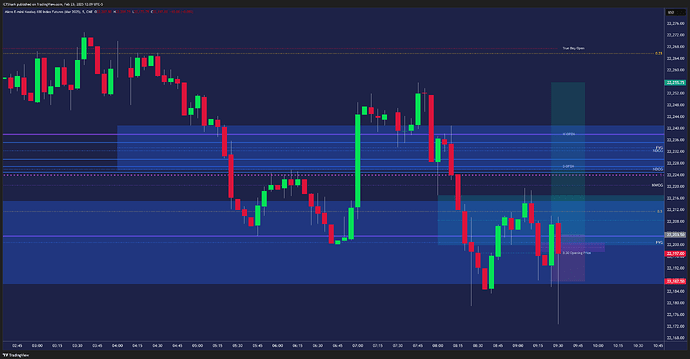

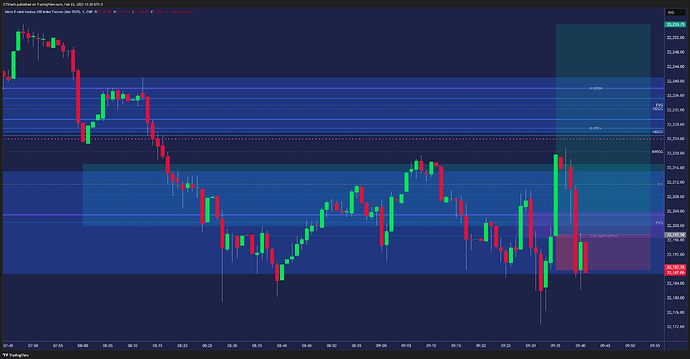

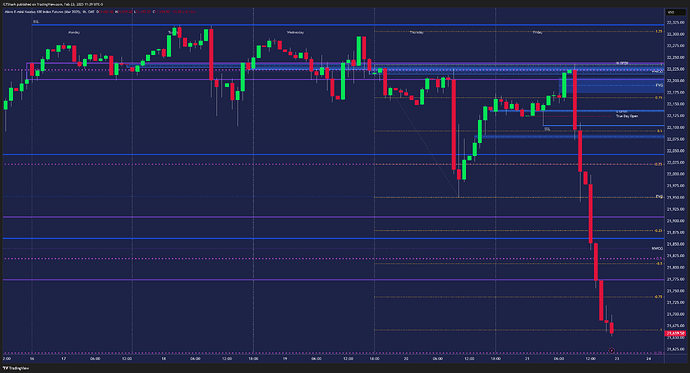

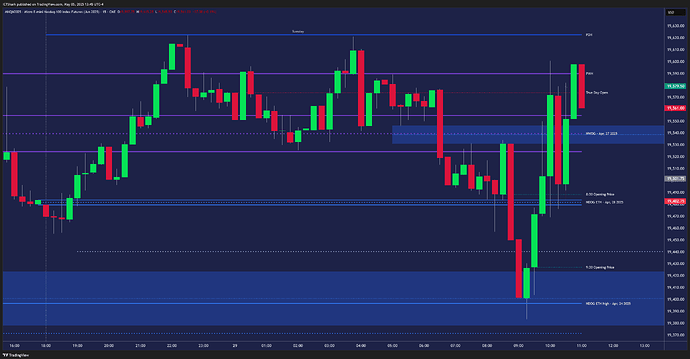

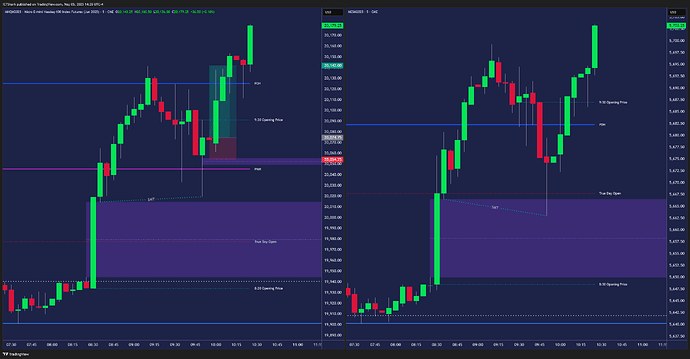

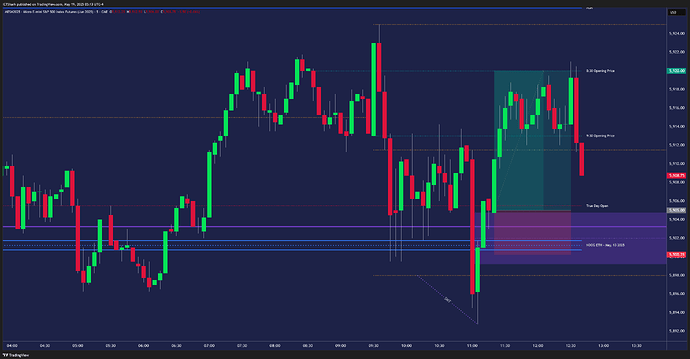

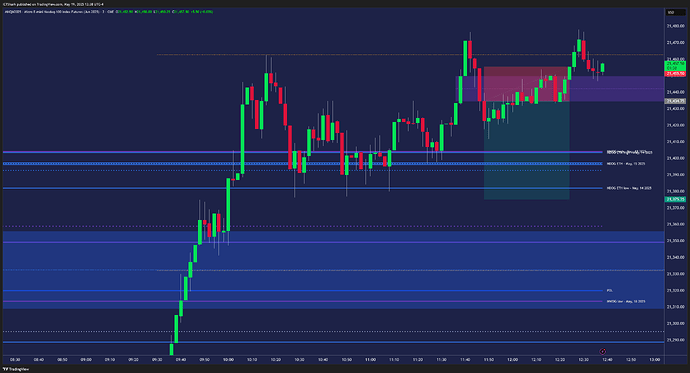

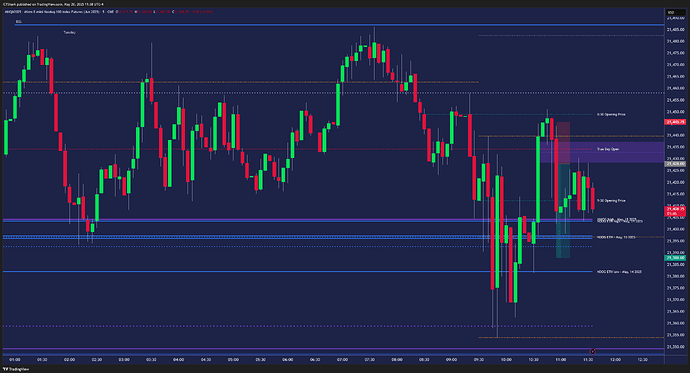

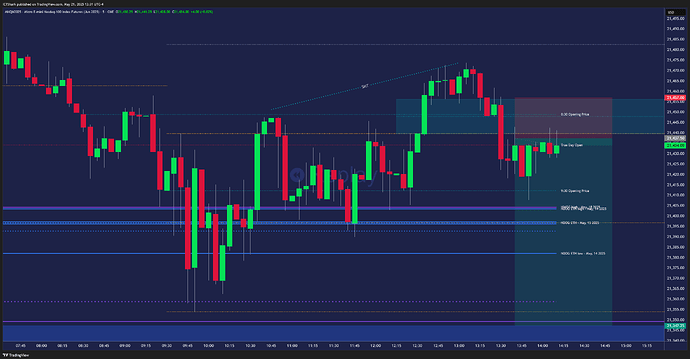

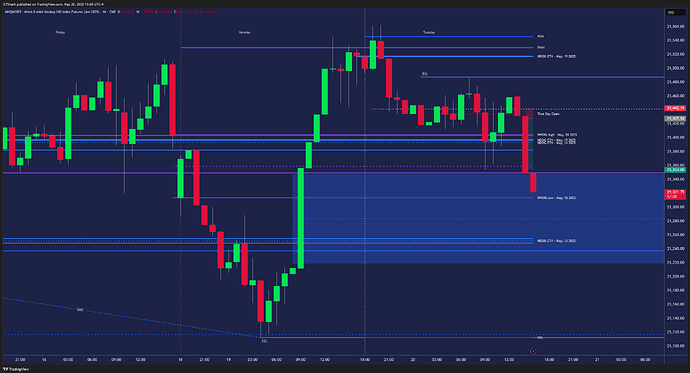

Trade #2

I finally found a trade opportunity that fit my criteria.

I was still convinced the price would rise toward the day’s high, so I entered a 15-second bullish FVG, preceded by a divergence with the ES. My POI was the 15-minute FVG that formed in the same area (during the same time) in the ES market.

Although I was confident that the price would rise to the current high of the day, my target was the 5-minute FVG above, which provided a solid 1:3 RRR. My trades are often between 1:2 and 1:4, so I was happy with that risk/reward ratio.

As you can see in the screenshot, the price briefly after my entry headed in my direction, so I moved my stop loss below the relatively equal lows with the expectation of seeing a sharp move up. However, instead, the NQ price formed a divergence with the ES, reversed sharply, and wiped out my moved stop loss.

Do you see how a divergence can foreshadow a price reversal? That’s the real reason I like them so much.

Either way, the trade ended with a minor gain of 0.6R.

Looking at the charts now, I can see that it was possible to re-enter using the 15-second IFVG since the narrative remained the same. However, I was so tired by then that I didn’t even think about it.

I’m getting very good at estimating where the price is headed. Now, I just need to hone those trade entries ![]()

Total gain: 0.1R