Welcome to my trading journal

I have decided to publicly chronicle my transformation from trading breakout strategies on low-float stocks to trading ICT concepts on stock indices and forex.

Primarily, I intend to focus on trading the ICT 2022 YouTube and Market Maker models, but I don’t rule out that you may also see other strategies here.

I will be journaling both my executed and missed trades.

I also plan to post the results of my backtests here.

So, follow me so you don’t miss anything!

Hopefully, this journal will be one of those legendary ones

Your insights are welcome here

To help you understand my charts, I have drawn a small overview of how I label PD arrays.

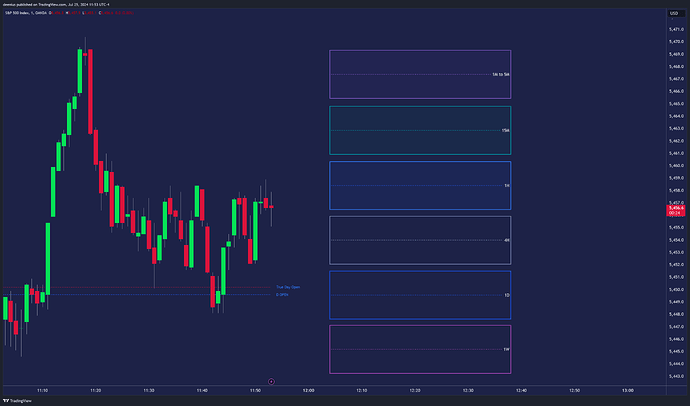

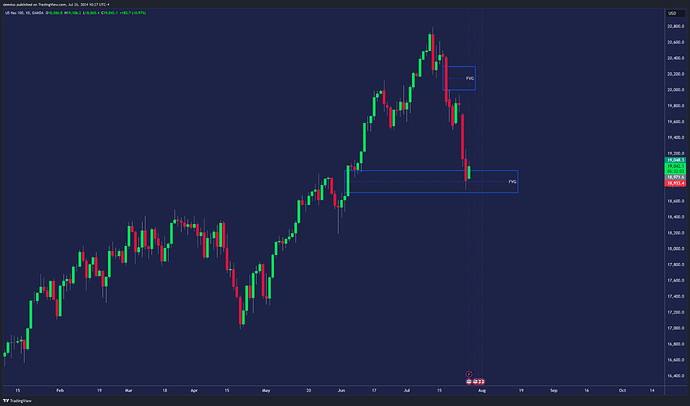

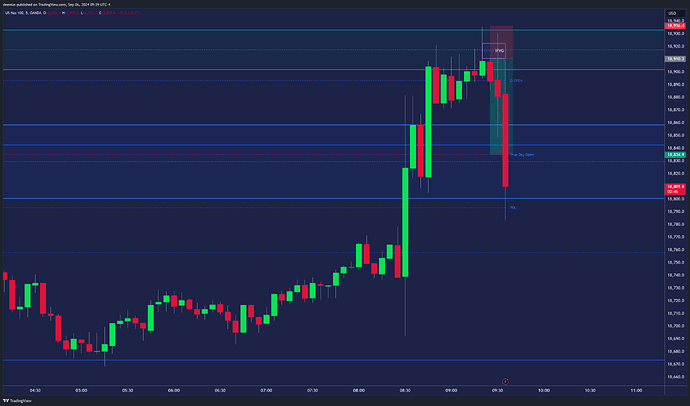

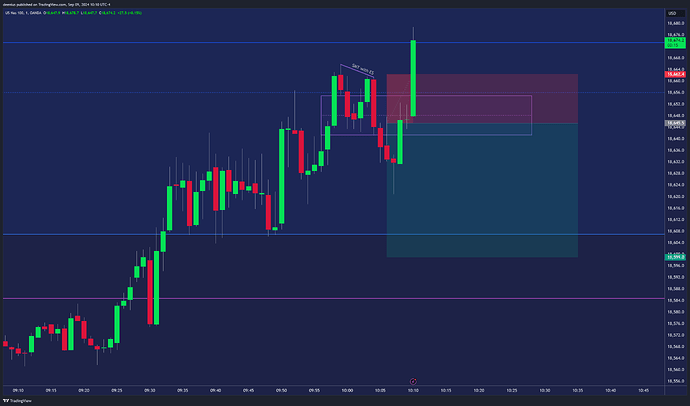

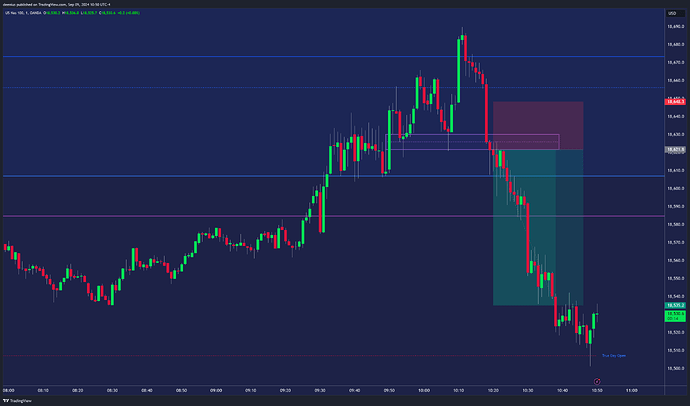

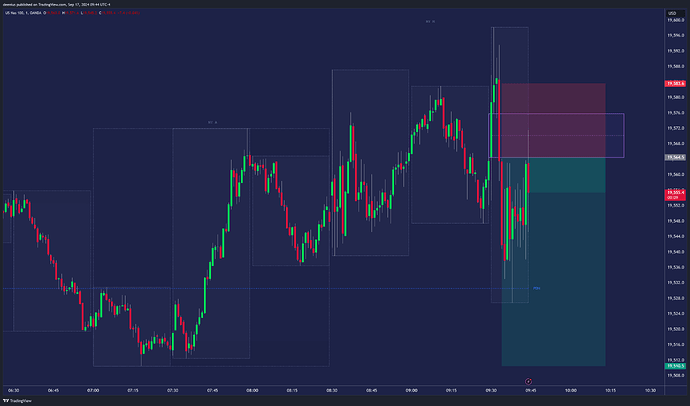

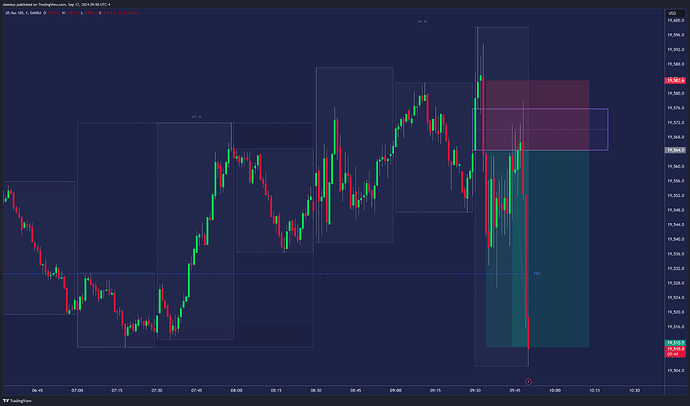

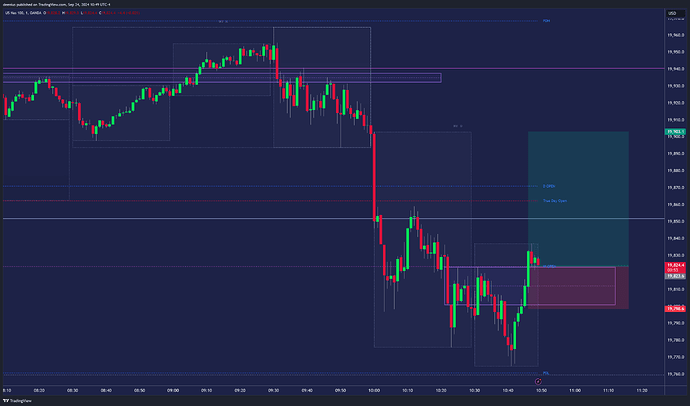

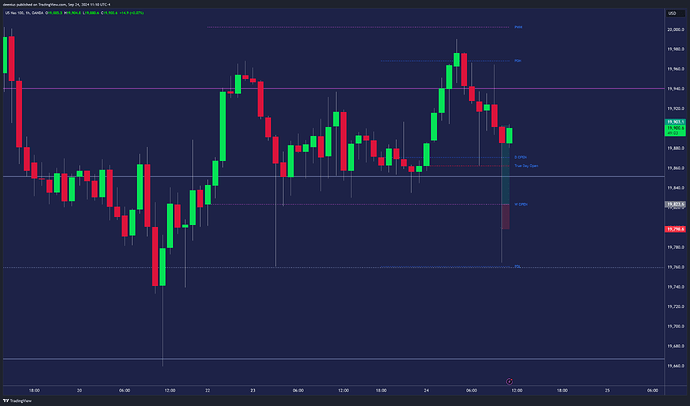

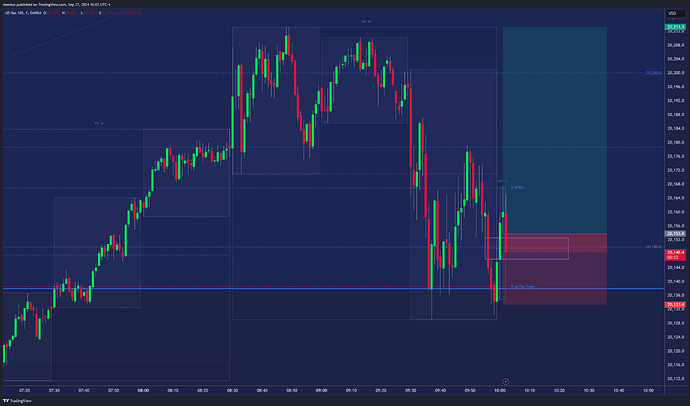

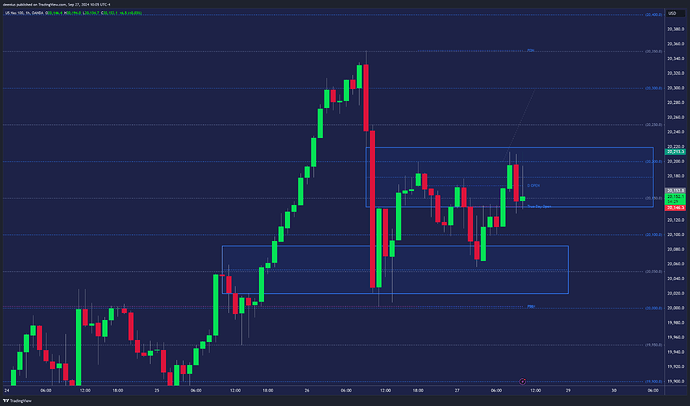

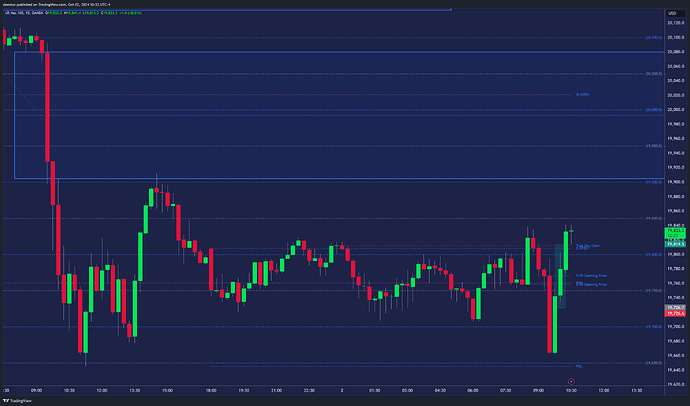

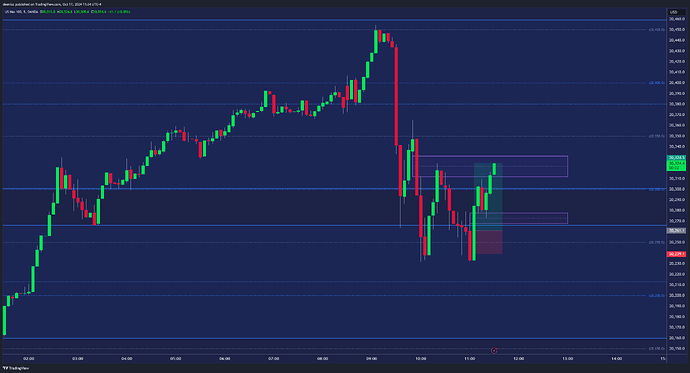

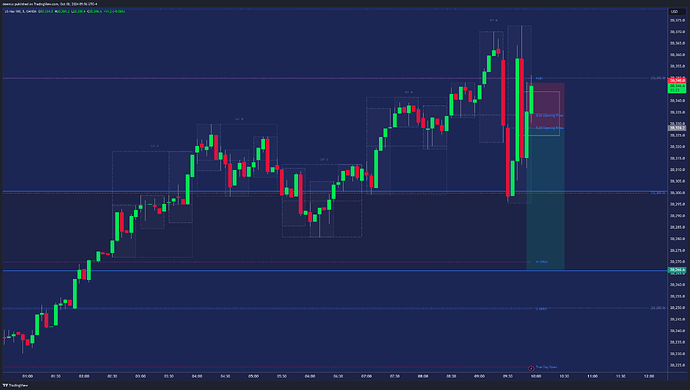

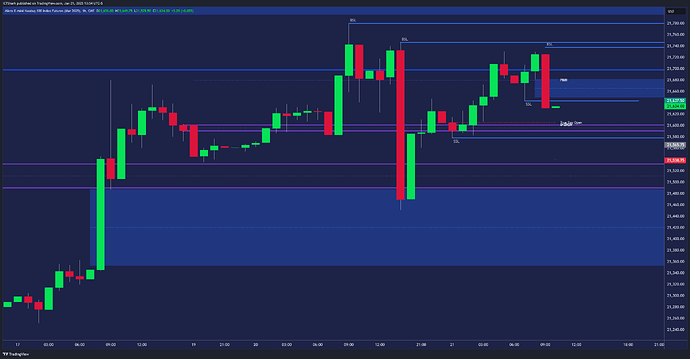

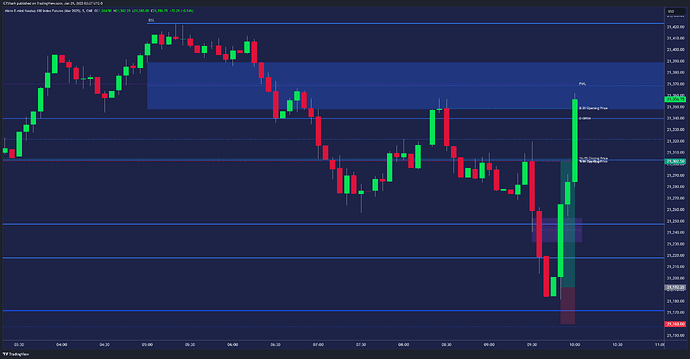

A quick and easy scalp against the HTF trend. In these conditions scalping is the best option in my opinion.

RR 1:2

This project is really taking up a lot of my time. For the last few weeks, I have been working on finalizing the discord server setup and expanding the content of this forum. I hope you will enjoy it.

Now it’s time to get back to backtesting and consistent journaling.

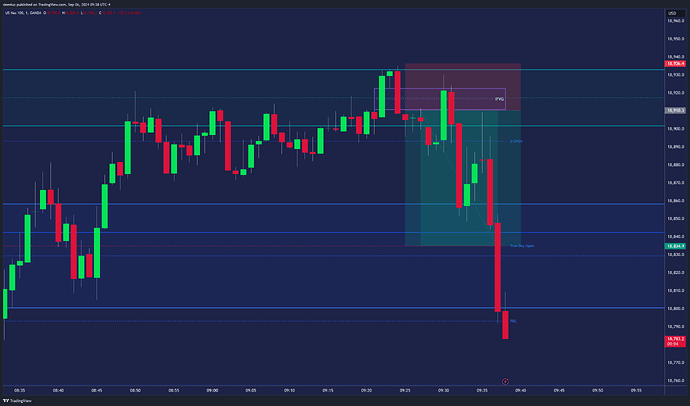

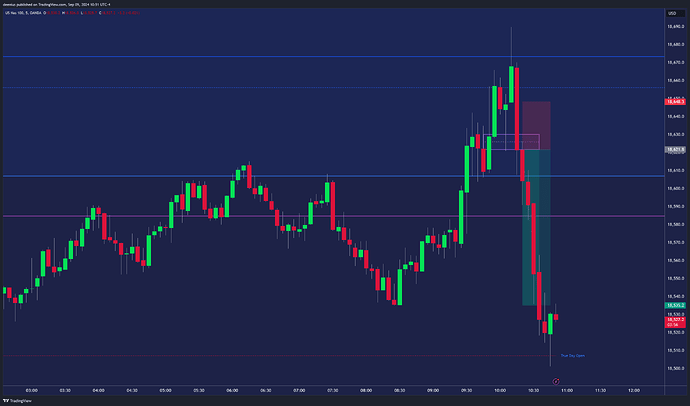

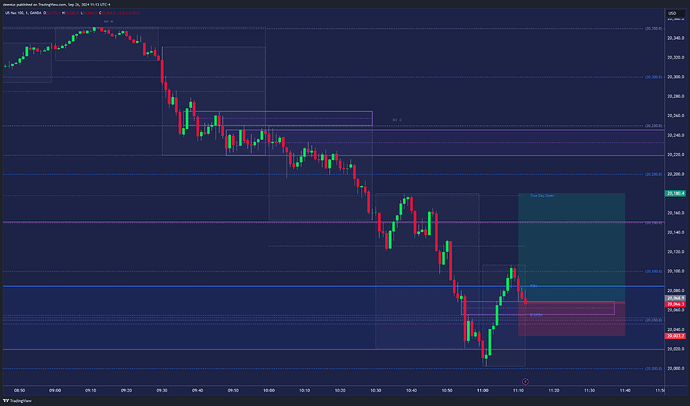

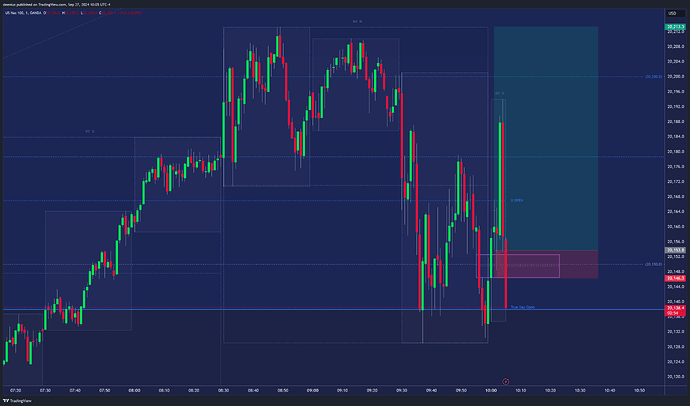

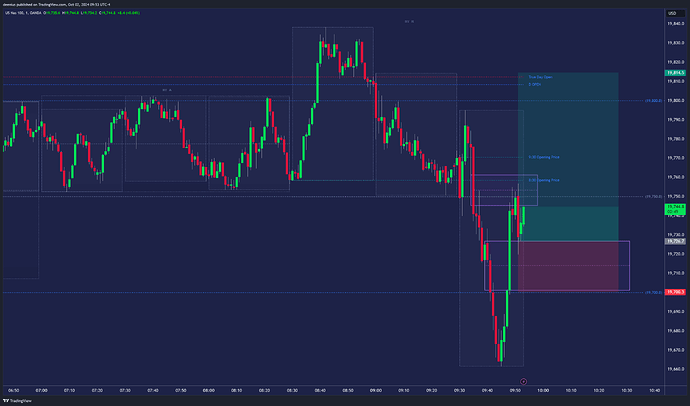

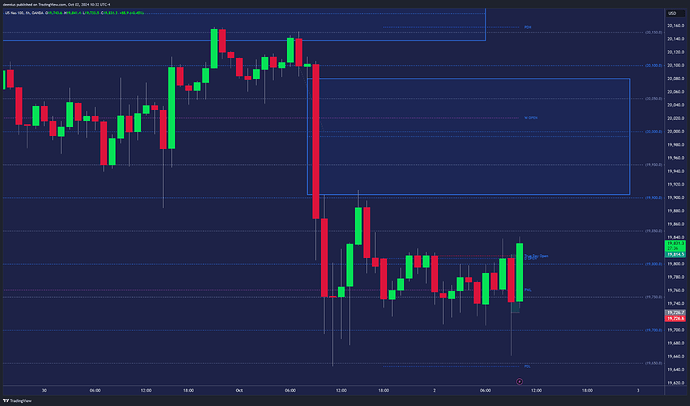

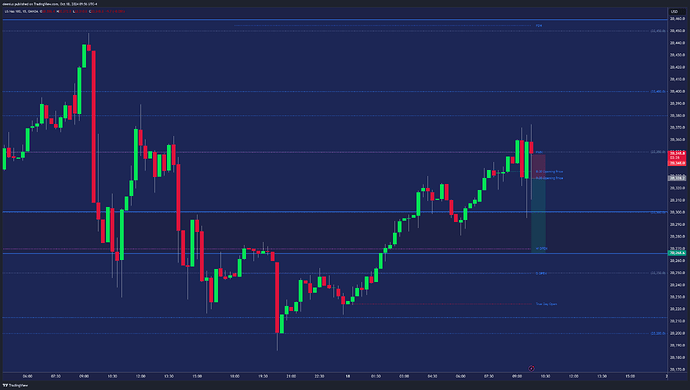

Yesterday was a difficult day. NQ was making very deep pullbacks after breaking previous highs, an environment where you need to take profits faster.

Total: 2.8R

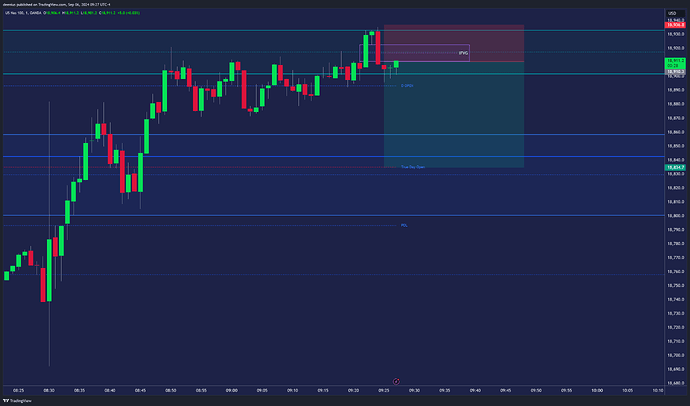

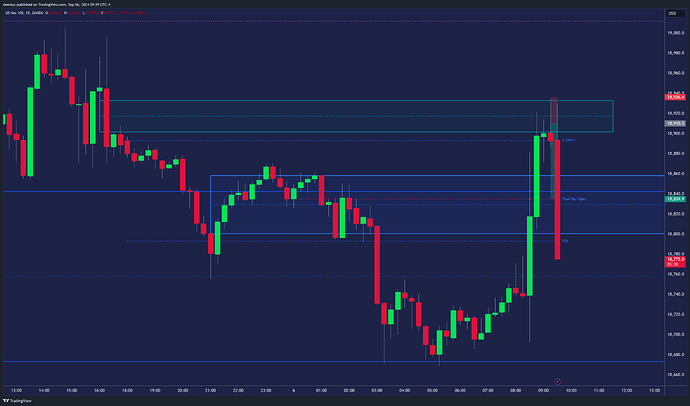

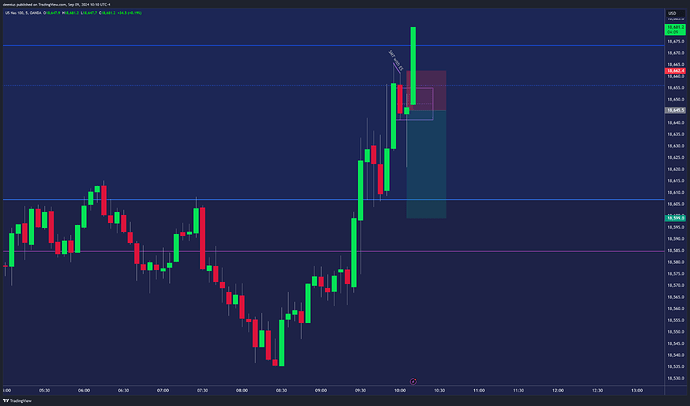

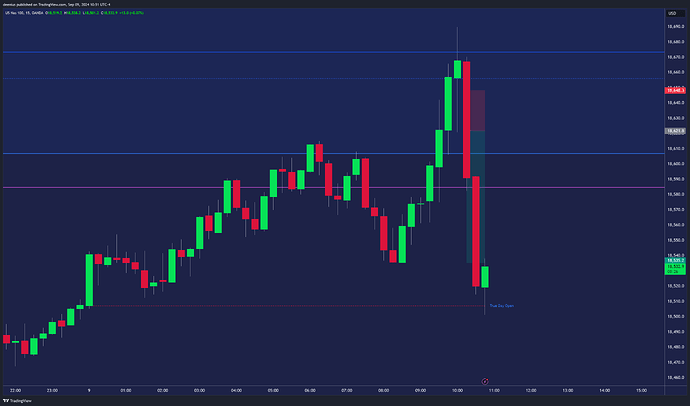

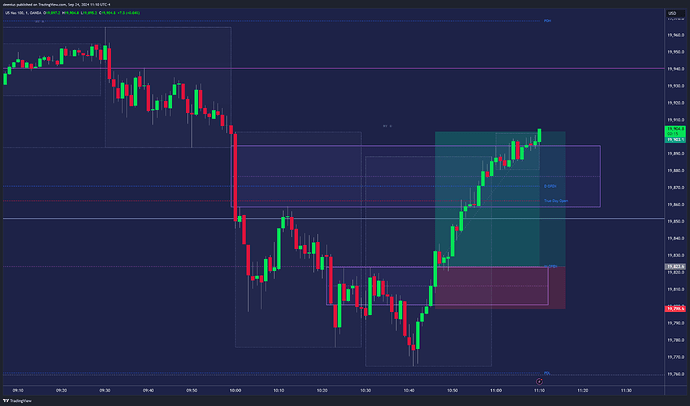

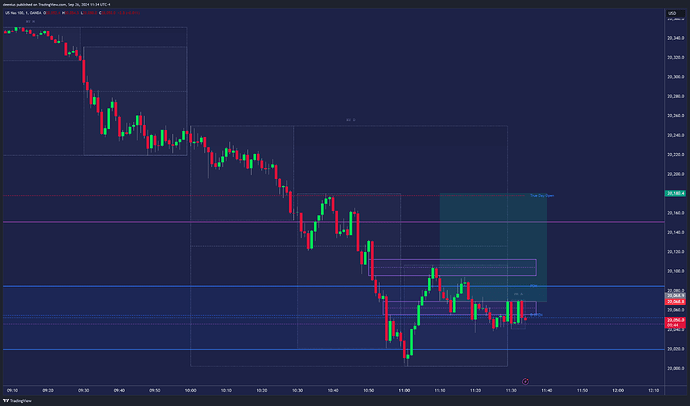

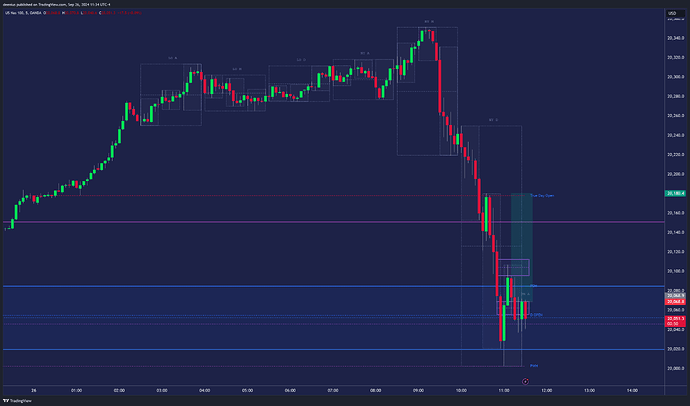

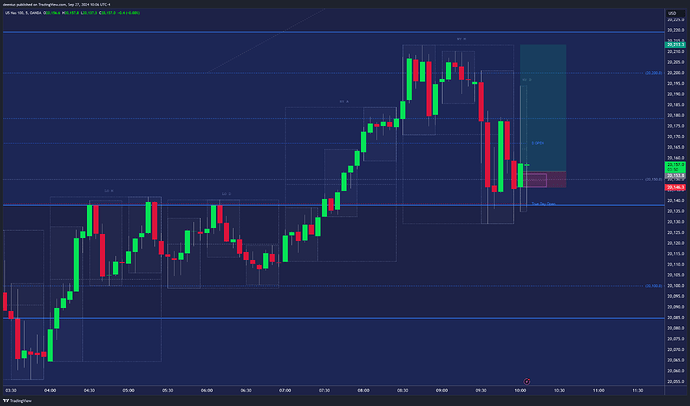

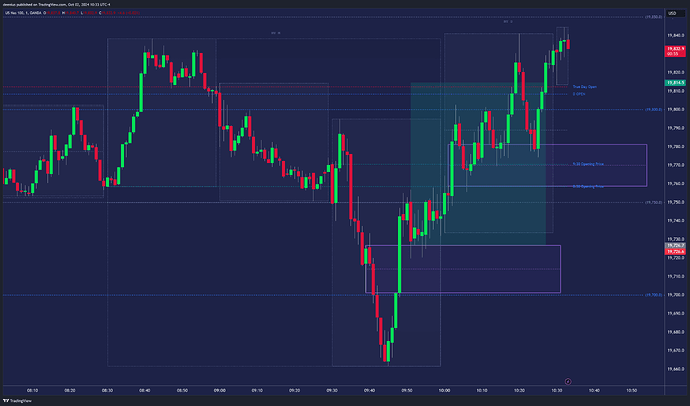

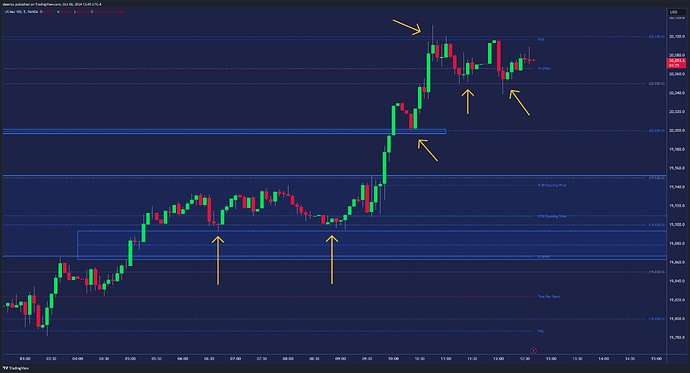

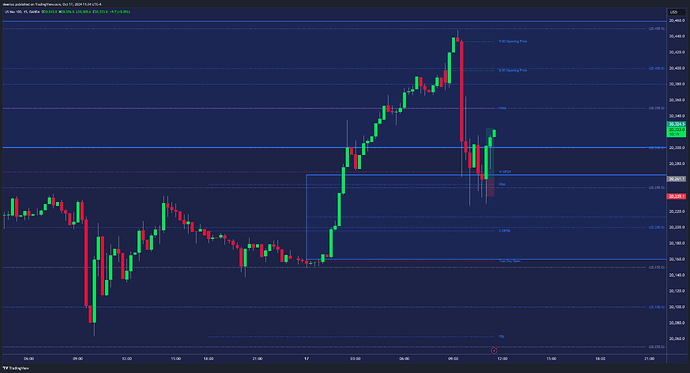

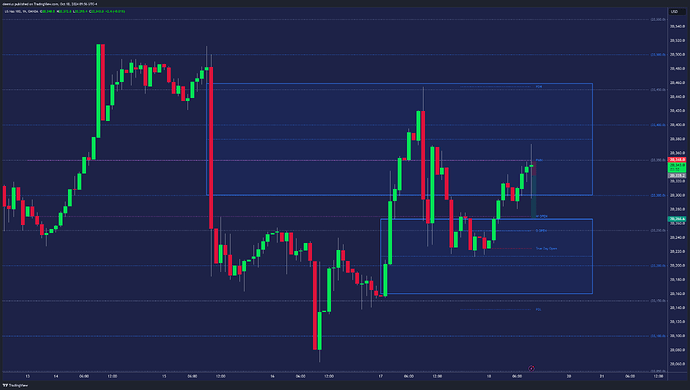

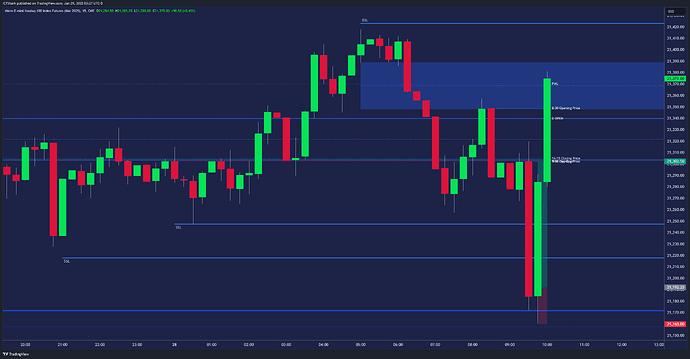

Here’s my trade from Friday.

It’s a simple setup based on what Hydra teaches. The key was creating an IFVG and a specific time period.

Total: 2.7R

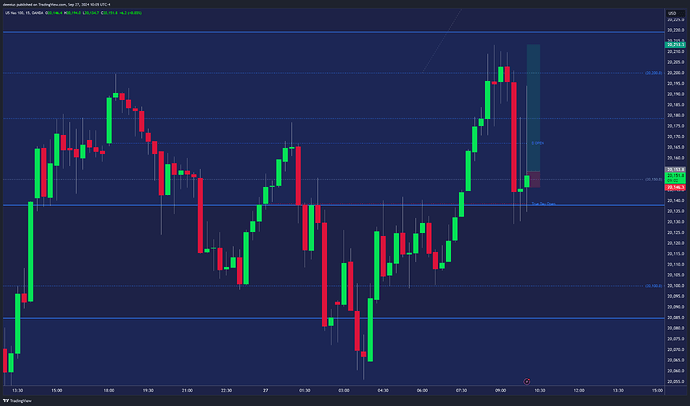

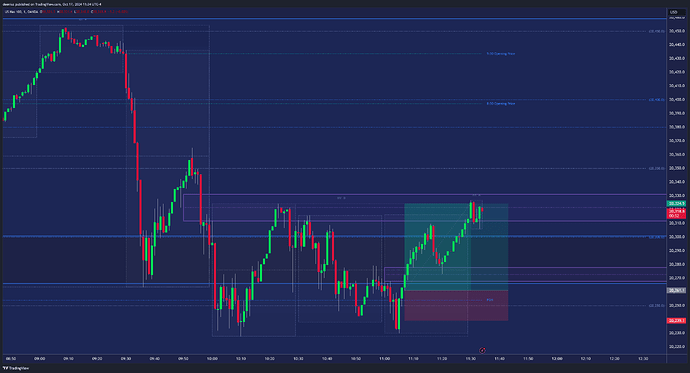

Trade entry

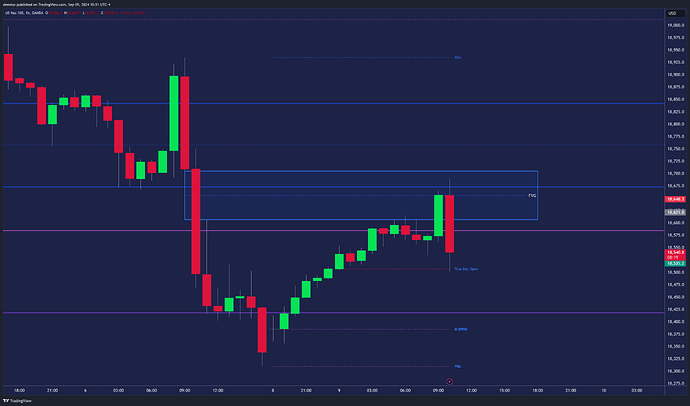

Yesterday I took one loss.

My trading idea was according to my trading plan, so despite the loss, I’m satisfied.

As it turned out later, I estimated the direction correctly. My timing wasn’t right.

This was the second setup that I didn’t trade, though. Unfortunately, I didn’t notice it until it was too late, and I definitely didn’t want to chase the trade.

However, it was a valid entry, so it’s listed here.

Total: -1R

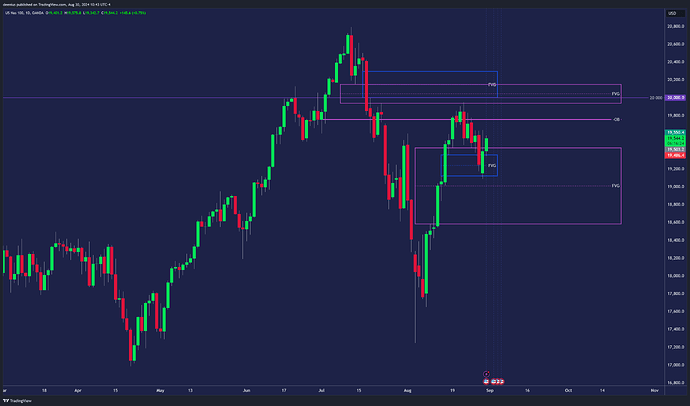

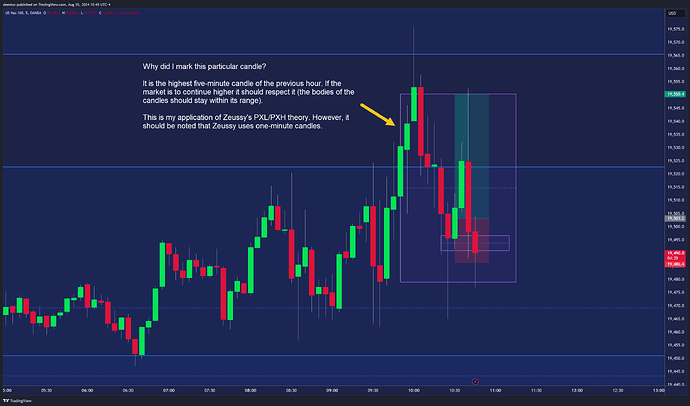

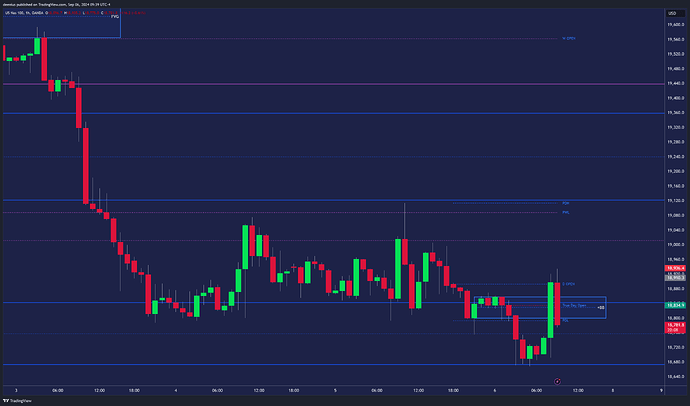

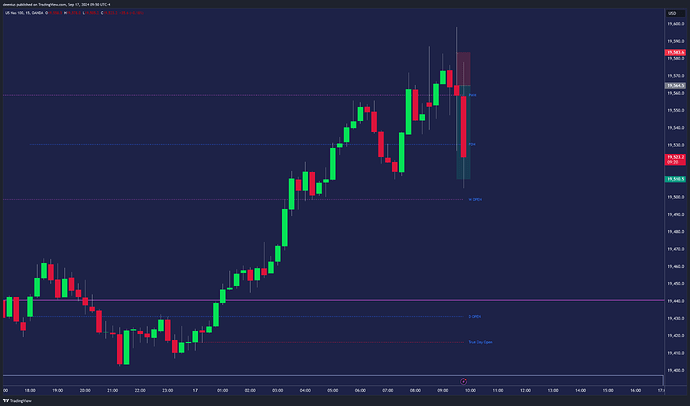

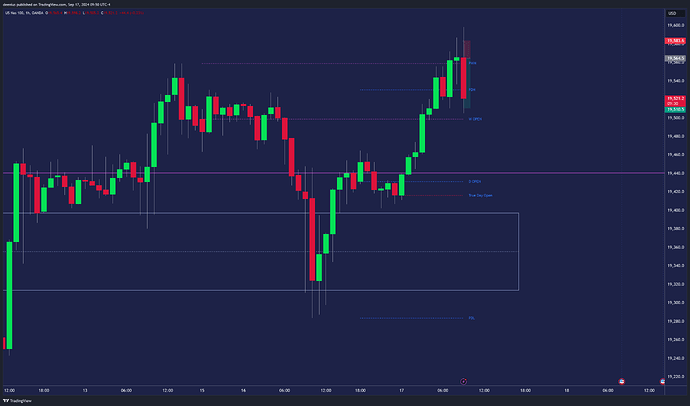

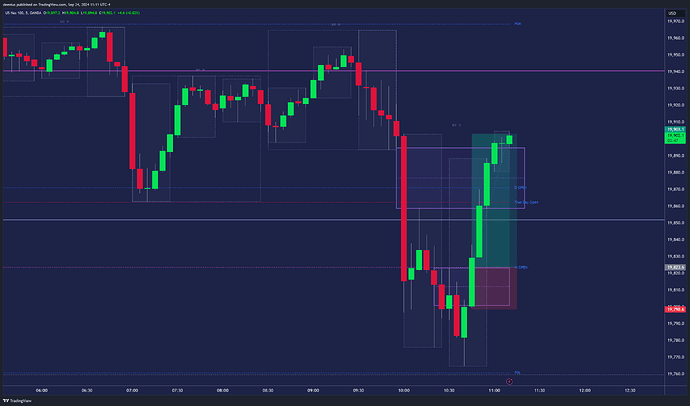

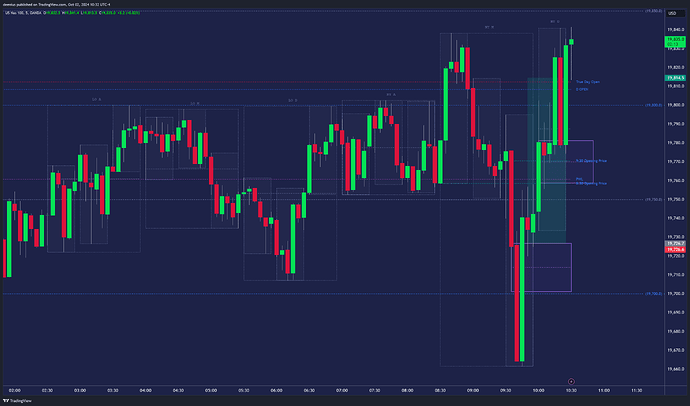

I started using Zeussy cycles again. They make judging the current order flow much easier.

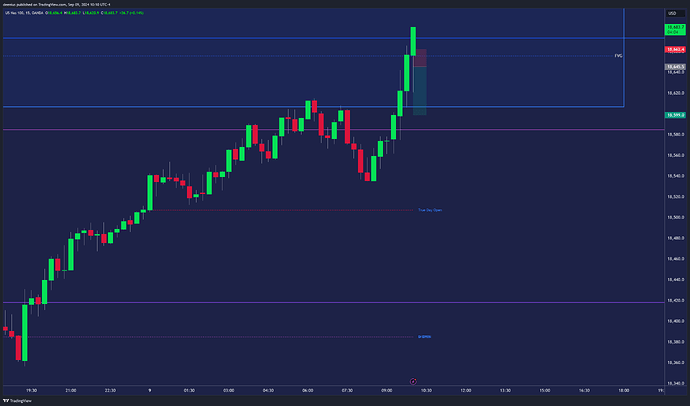

As for trading, I realized one profit yesterday. It was a simple setup based on an inverse FVG.

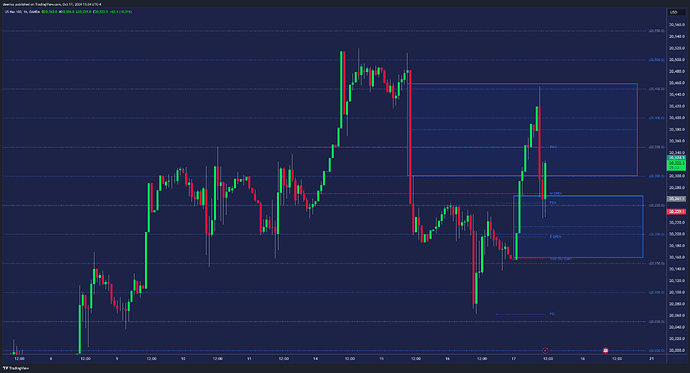

This was an excellent trade. I was bullish, so I was looking for a setup on the long side. Once the price got below yesterday’s daily RTH low and the Asian session low, I knew this would be a great buying opportunity.

Also, the 4h FVG prevented the price from going further down.

The entry setup was straightforward. Enter the long position after testing (touching) the inverse FVG.

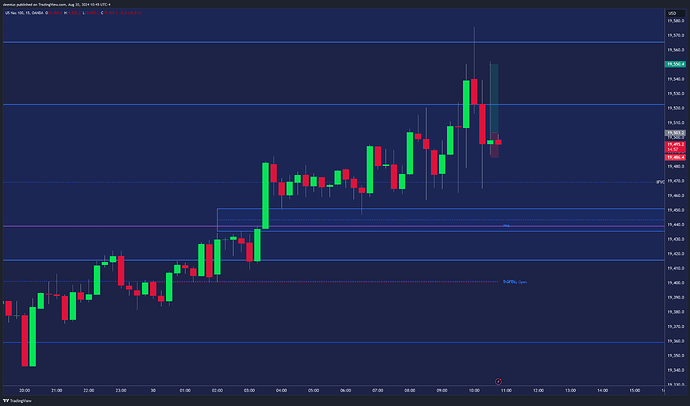

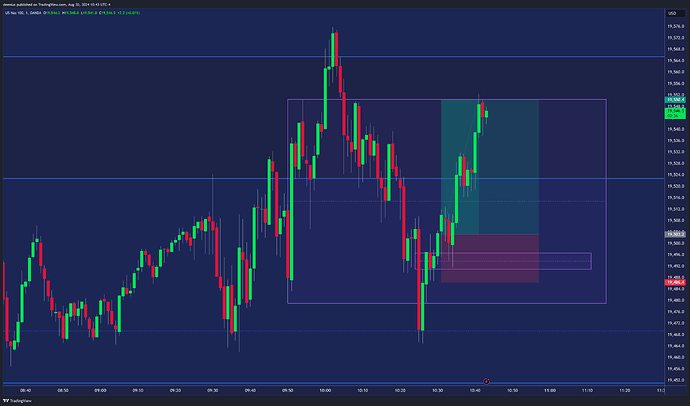

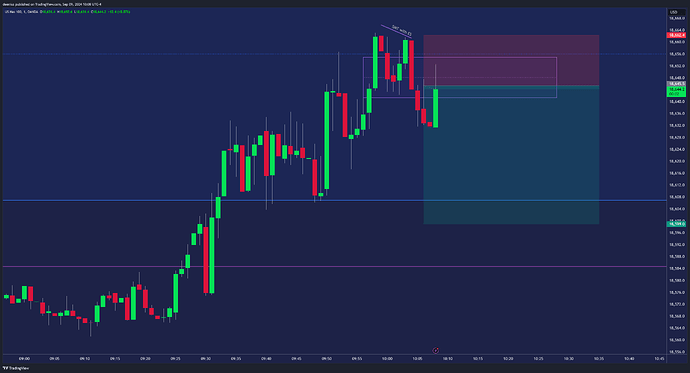

This is my Thursday deal.

After my entry, the market showed signs of a chop, so I got out at the entry price. Overall, this was a B/E trade.

I was expecting higher prices as the hourly order flow was bullish. However, after my entry, the price first went in my direction for about 2R, and then there was a sharp reversal.

Thanks to my trade management, the trade ended with only a tiny loss, approximately 0.3R.

Thanks to ICT, Zeussey, and Hydra, trading is becoming easier and easier for me. I’m happy that I found these traders.

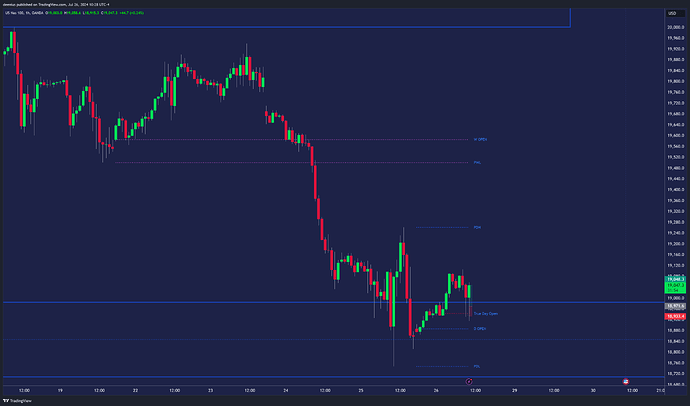

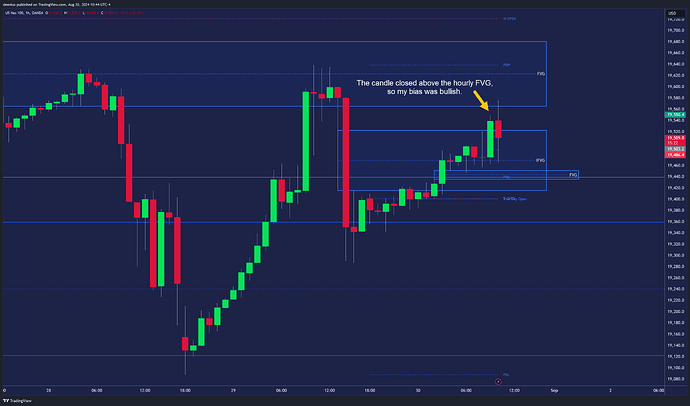

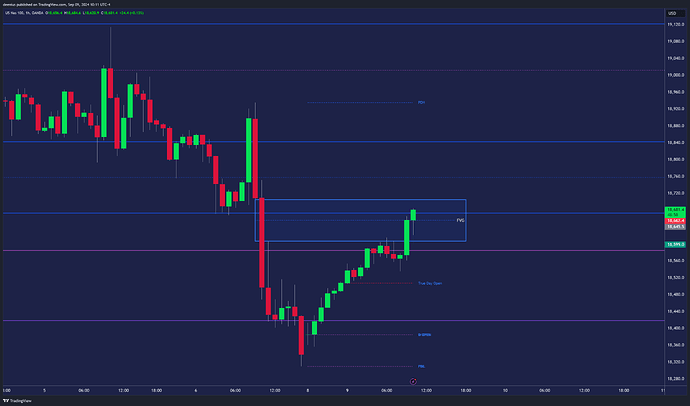

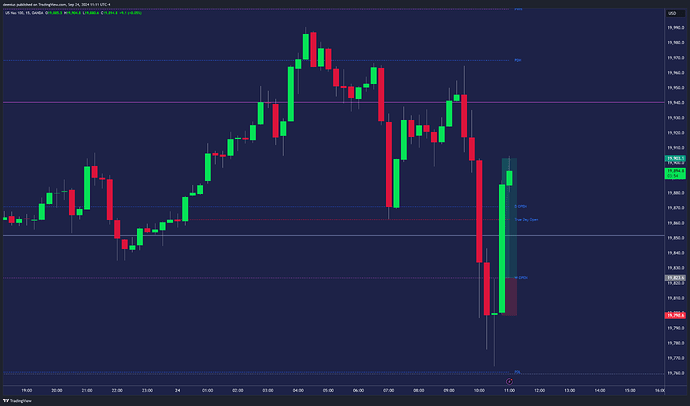

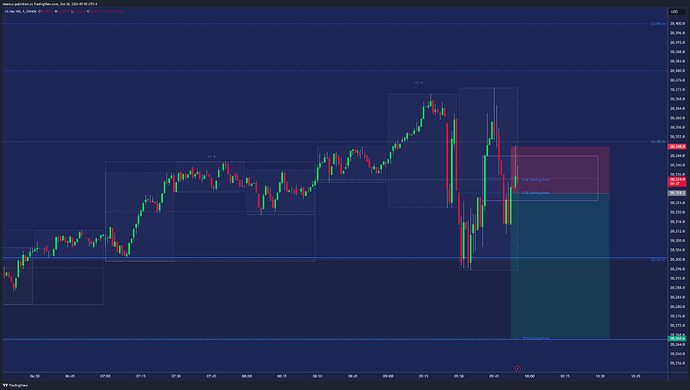

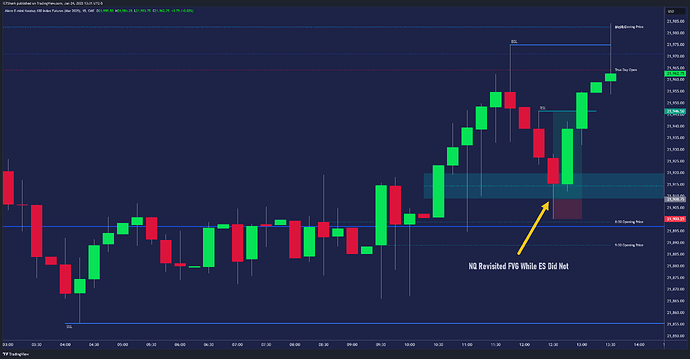

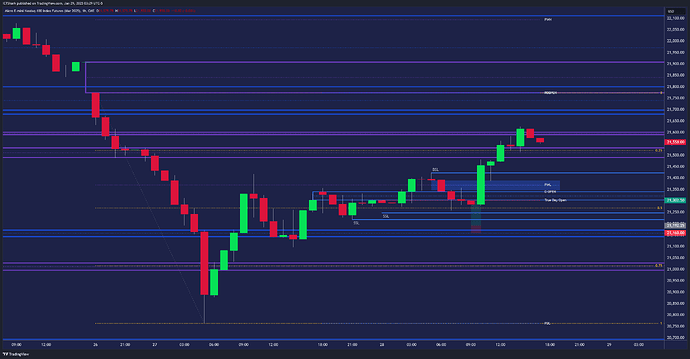

Today’s trade was easy. I was looking to enter a long position when I saw a clear divergence between NQ and ES on the hourly chart. While ES broke the previous day’s low, NQ didn’t, a clear signal that the market is bullish.

My entry was on a retracement into the breaker. Overall, the trade generated a little over 3R.

I have to put this screenshot here as a reminder that nothing happens randomly in these markets.

How can anyone even argue that price delivery is not algorithmic?

These are my two trades from Thursday and Friday.

The first ended with a profit of 2.8R, the second with a loss of -1R.

In the case of the first trade, I was expecting at least a short-term retracement to the upside after the initial price drop. Then, when I saw a clear SMT between NQ and ES, I just waited for IFVG to form. This appeared on the 15-second chart, which I, unfortunately, don’t have a screenshot.

The second trade was a mistake. On Fridays with no medium or high-impact news, it’s better to stay away. Even though my bias was bullish, I wanted to see an opportunity for a short-term price expansion to the downside. All I was looking for was a 2R trade. Unfortunately, my bullish bias was correct  No matter, there will be many better opportunities next week.

No matter, there will be many better opportunities next week.

Trade #1

Trade #2

I’m back, guys!

Unfortunately, I haven’t had enough time for journaling in the last two months as I have devoted all my time to backtesting, trading, and this project. However, this is changing now. I will start publishing my trades here again, both executed and missed.

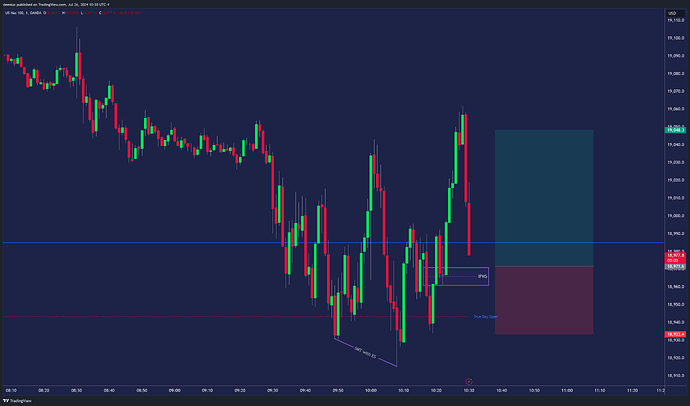

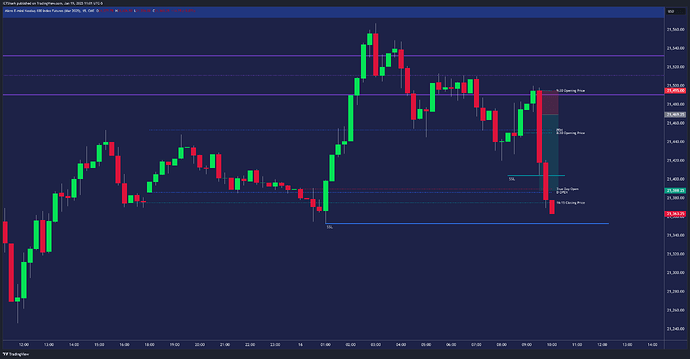

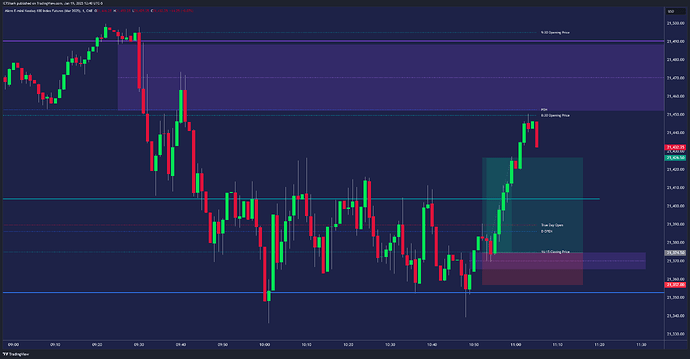

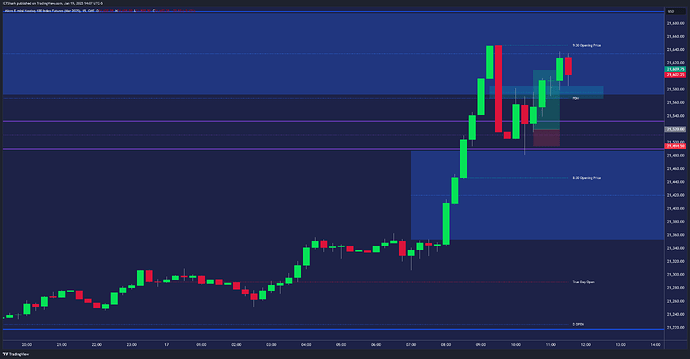

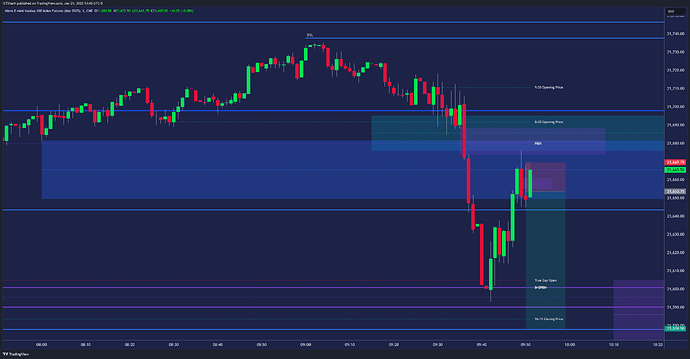

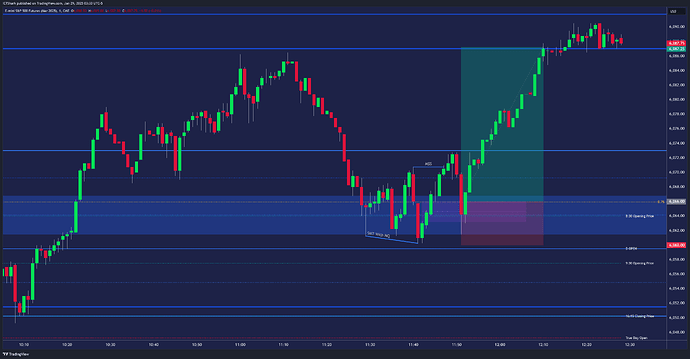

Here are my trades from Thursday, January 16.

Trade #1

Price made a 5-minute FVG after the open and relatively equal lows on the minute chart. Then, below was the old 5-minute breakaway gap sell-side liquidity below the low of the hourly swing. To me, this was an obvious trade. I made just under 3R, however the trade offered the potential for up to 4.5R.

Trade #2

The basis for my second trade was the divergence on the 15-minute chart between NQ and ES. Once I identified it, I used the BPR area to enter. Unfortunately, I noticed that ES did not follow NQ’s downward move after my entry, which was the signal to exit immediately. Even so, I was able to make a little over 1R, which counts

Trade #3

The divergence from the previous trade served as a clue to me that the price would go up. Moreover, the liquidity above the relatively equal highs above was too much of a lure to remain untouched. I exited slightly earlier than I should have, but the trade delivered 2.8R.

6.8R in total.

This is a perfect example of momentary inattention.

The market was slow on Friday, January 17, so I took a moment to open the Porsche website to look up some information. What a mistake!

It was only ten minutes; however, my entry setup took place during that time, and I missed the best time to open the trade.

A few minutes later, I still had one more opportunity to enter, but unfortunately, the price did not touch my limit order, and I was left without a trade that day. Never mind, the markets offer plenty of opportunities every week.

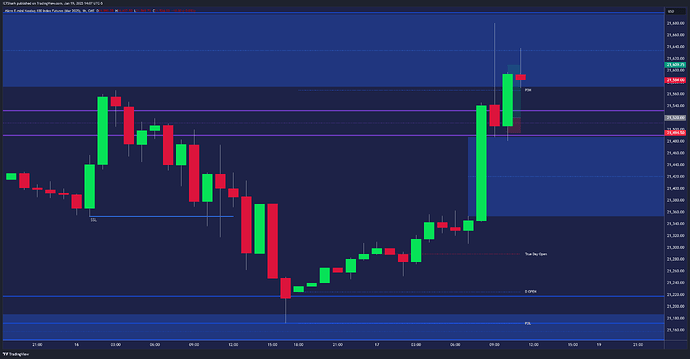

My missed trade

I really like this setup. While NQ tested FVG on the hourly chart, ES did not. This creates what is known as an FVG SMT (Divergence) setup. Once you see this in the market, immediately start looking for a reason to enter on a lower time frame. In this case, a bullish breaker and FVG have formed on the minute chart, which some call a Unicorn setup. A great buying opportunity!

This trade offered potential over 4R, which is very decent.

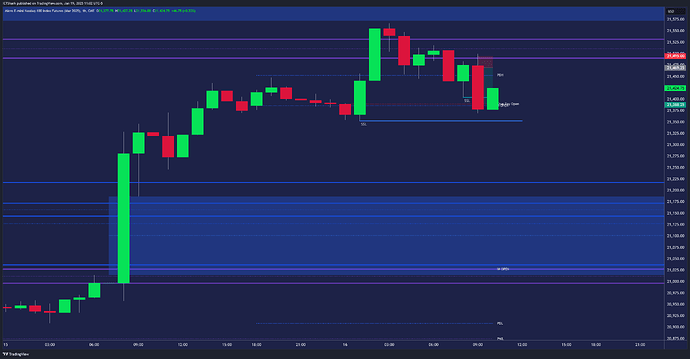

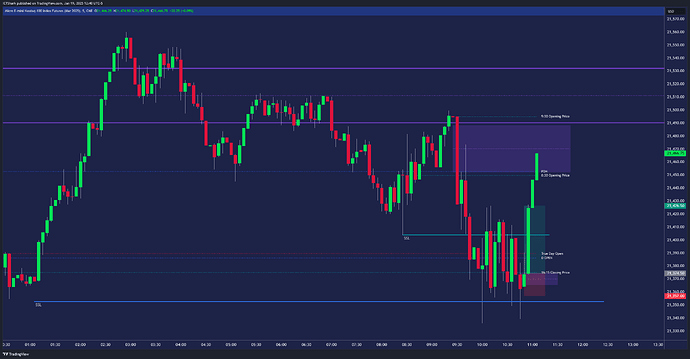

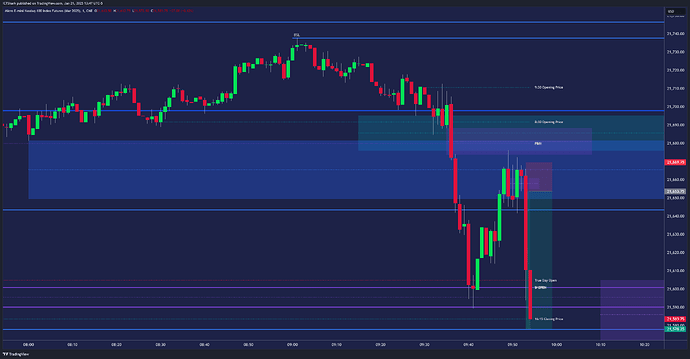

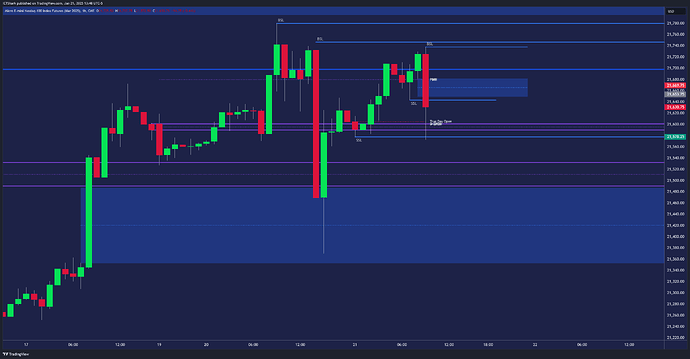

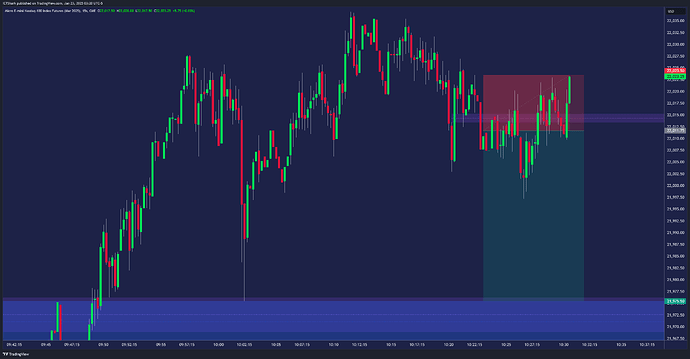

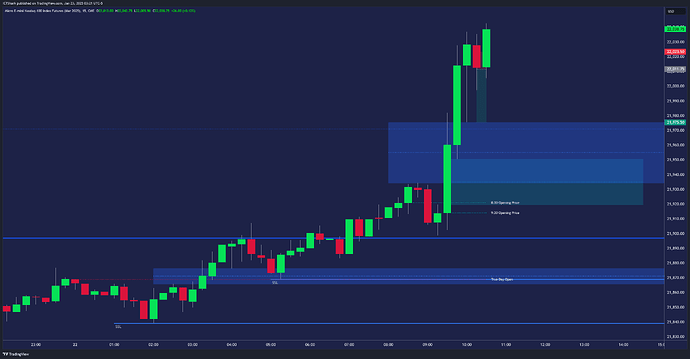

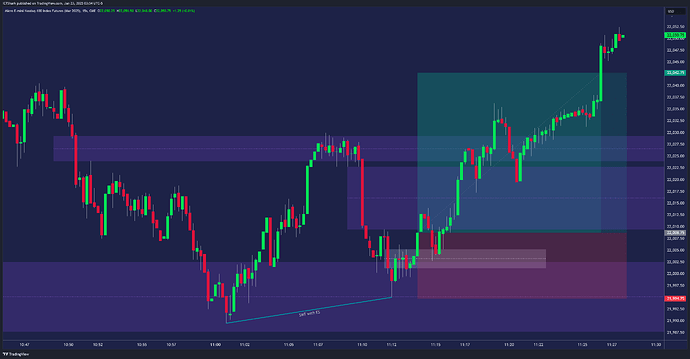

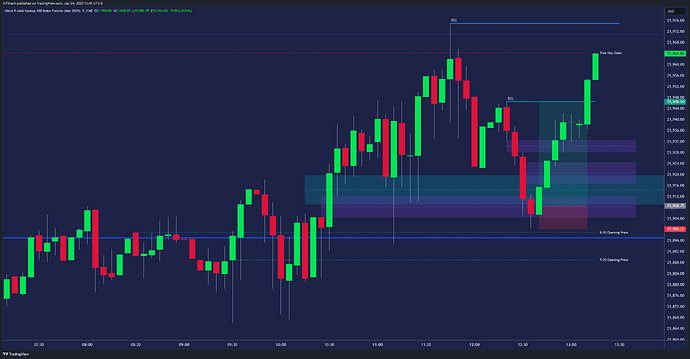

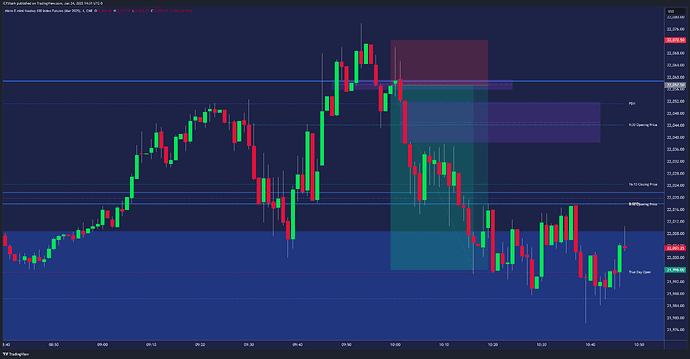

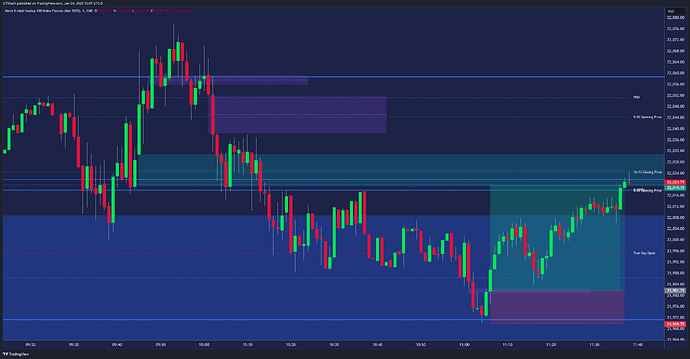

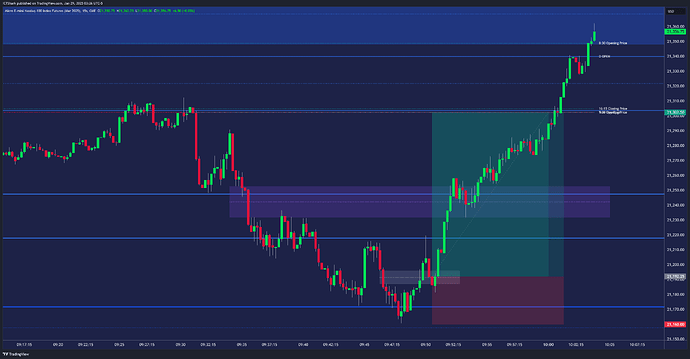

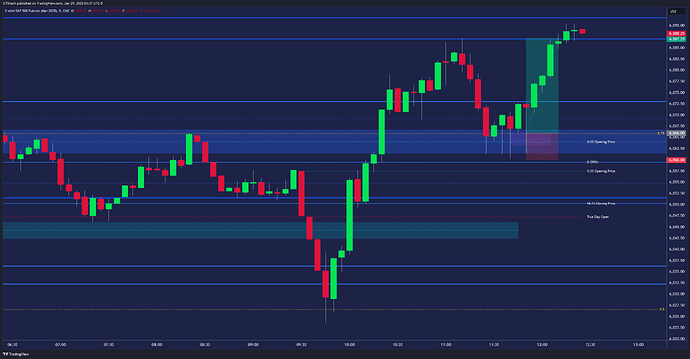

These are my trades from Tuesday, January 21.

My trade

I originally wanted to enter this trade at the 1-minute FVG marked on the chart, but I wasn’t fast enough. For this reason, I was looking to enter on the 15-second chart, where I found an opportunity to enter a short trade on the old FVG. Unfortunately, my stop loss was too tight, and the trade ended with a small loss of -0.5R.

However, this did not upset me, and I waited for a re-entry. After my second entry, the price went down so fast that I didn’t even have time to move my default limit order lower, which I usually set at 160 ticks. Instead of cashing in a profit of 4.7R, I only made 2.7R. Well, whatever. A profit is a profit.

Missed trade

This will sound silly to you, but even today, I didn’t pay attention to the markets for a while and missed an opportunity to enter a long trade.

I know, I know. I need to work more on my concentration

After removing sell-side liquidity, NQ created a divergence with ES on the minute chart and broke the bearish FVG, a classic setup for entering a long position. Above, there were relatively equal highs, which was a clear clue as to where the price was highly likely to go.

In addition, the liquidity left behind above the old swing highs on the hourly chart was clearly visible. These highs are a strong magnet and a reason to hold part of the position longer.

Today’s total profit is 2.2R

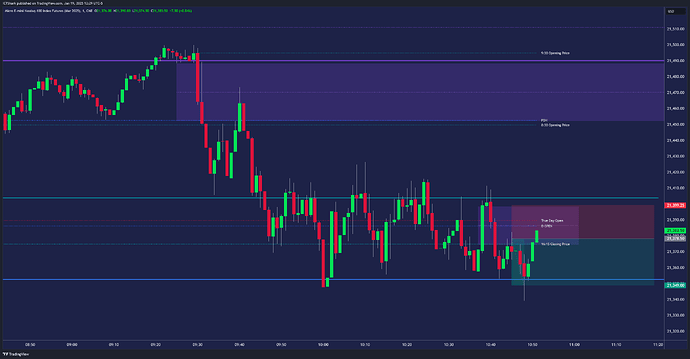

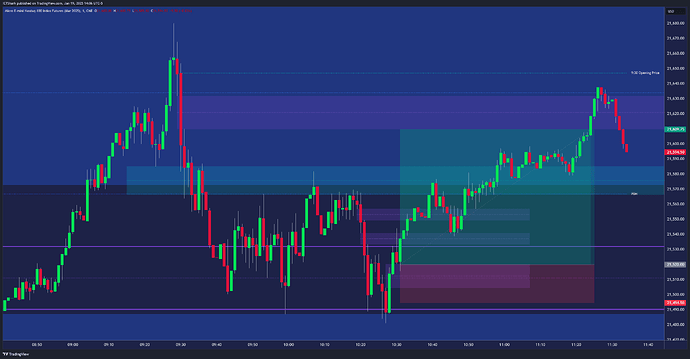

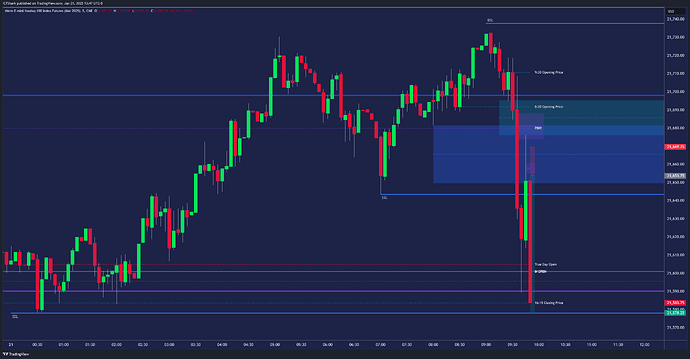

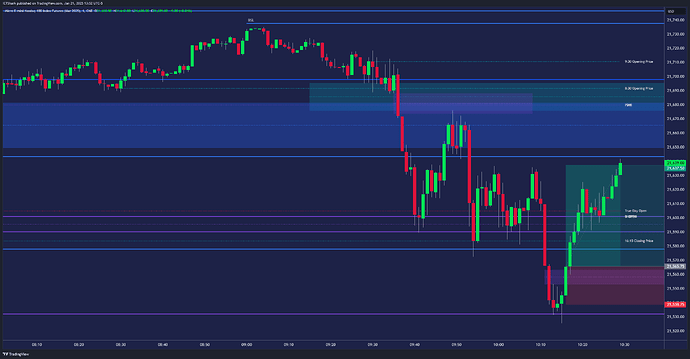

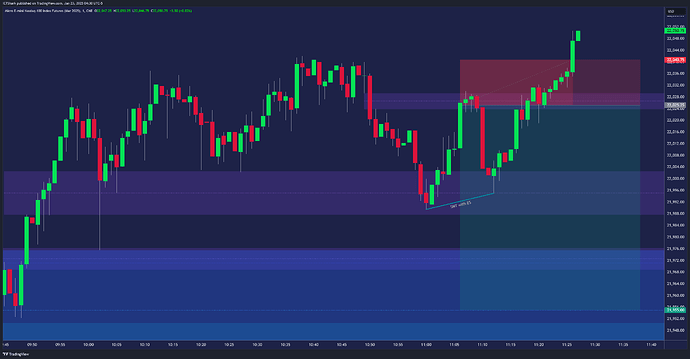

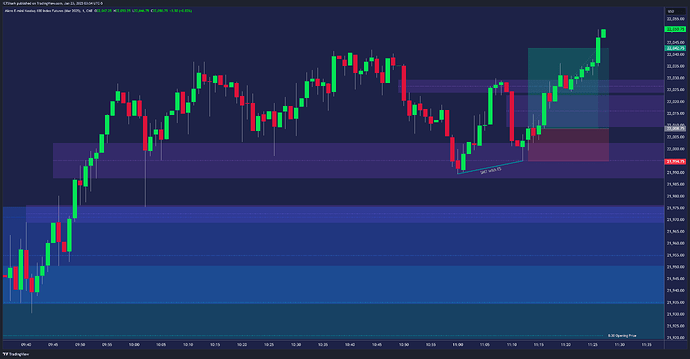

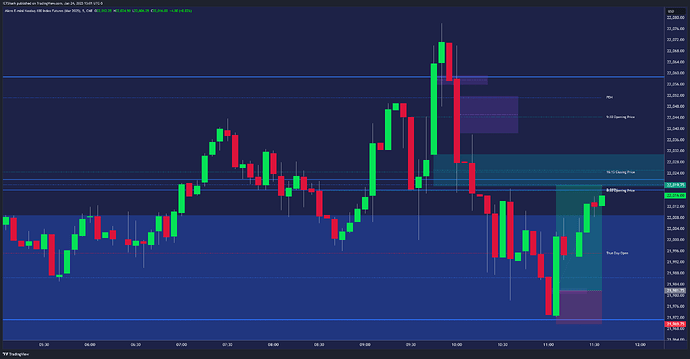

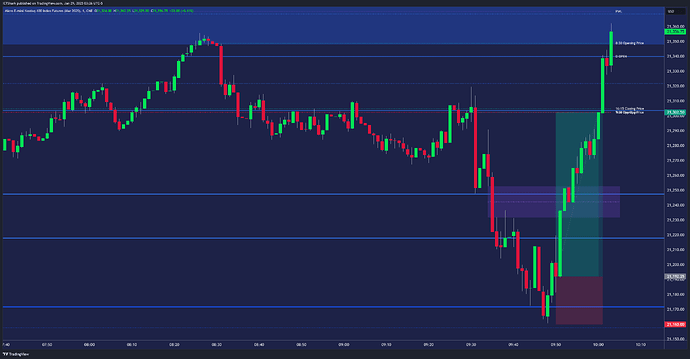

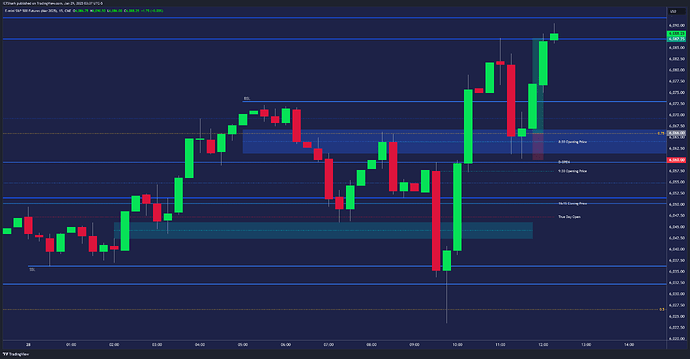

Yesterday, I was unable to read the price action correctly, which showed in the overall result.

Trade #1

This trade was riskier than the ones I usually trade. The markets trended up during the Asian and European sessions, so I expected some form of retracement. I viewed the next move up after the market opened as a manipulation for the subsequent sharp move down.

My entry took place when the price got below the opening price of the 10:00 candle and a BPR (two overlapping FVGs) formed on the 15-second chart. Unfortunately, my judgment was wrong and the trade ended with a loss of -1R.

Trade #2

My second trade was based on the same logic as the first. For the entry, I found an FVG in the premium area. These FVGs tend to trigger a move in the opposite direction, at least for some time, so I have confidence in this type of entry.

Shortly after the trade took off in my direction, the price formed a divergence between NQ and ES. Although I was aware of this information, my conviction of further downside was so strong that I did not react in any way. Unfortunately, the price reversed and ended my trade at a break even. Next time, I must realize at least some profit in a similar situation. Lesson learned.

Missed trade

The situation from the previous trade also created an opportunity to enter a long trade, which I did not realize at the time. This trade offered the potential for the high of the day, i.e., 2.5R.

Today’s result: -1R

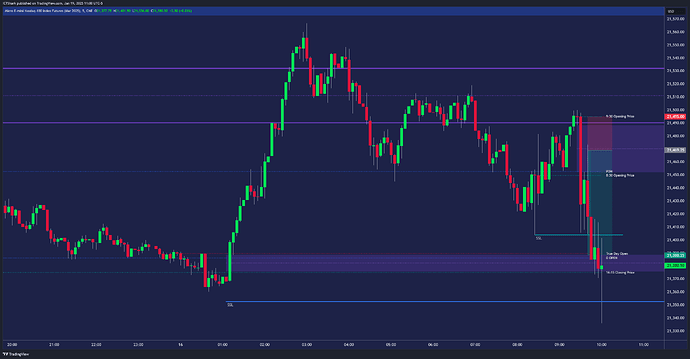

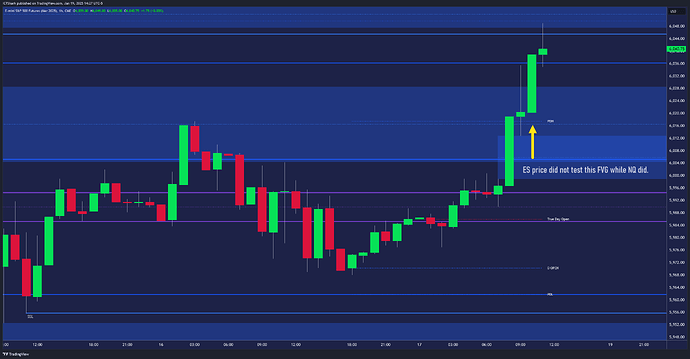

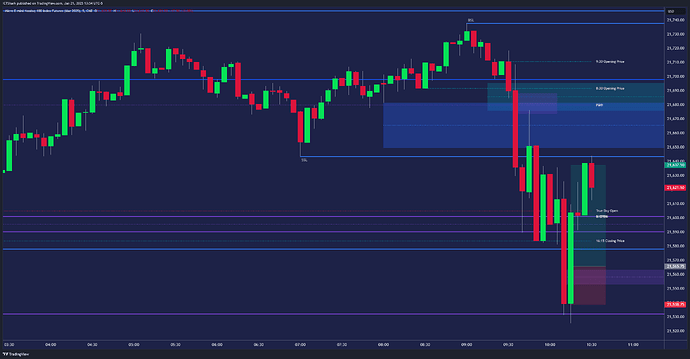

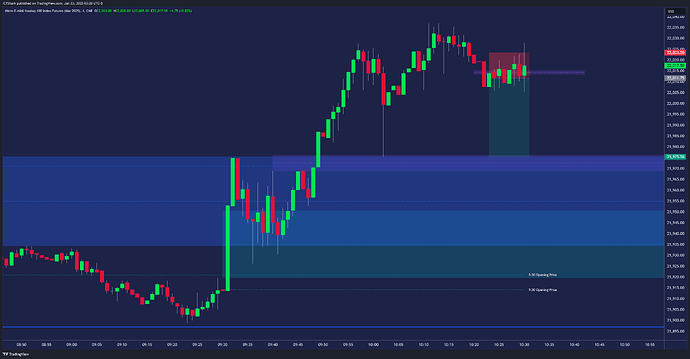

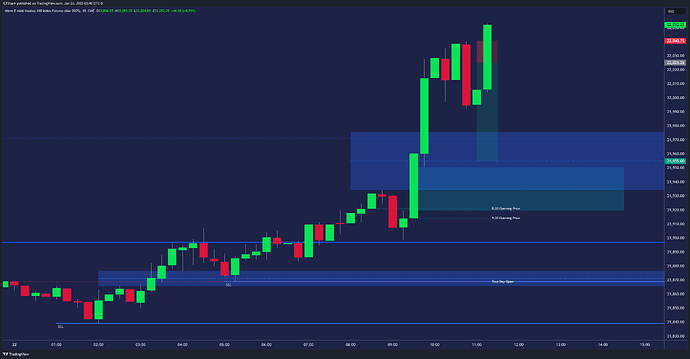

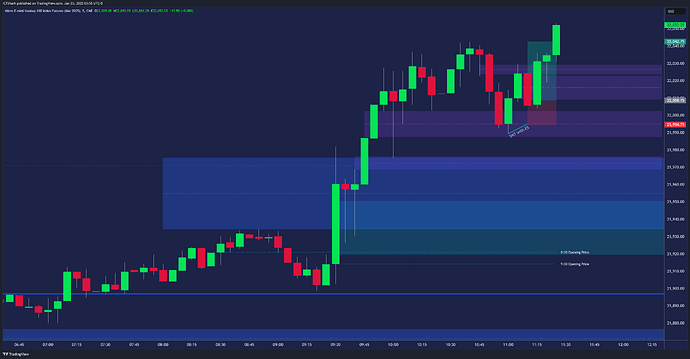

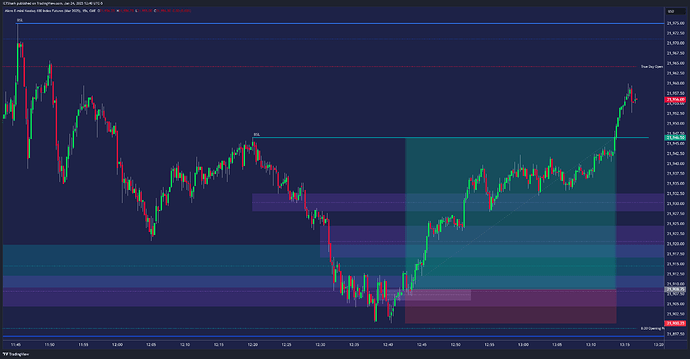

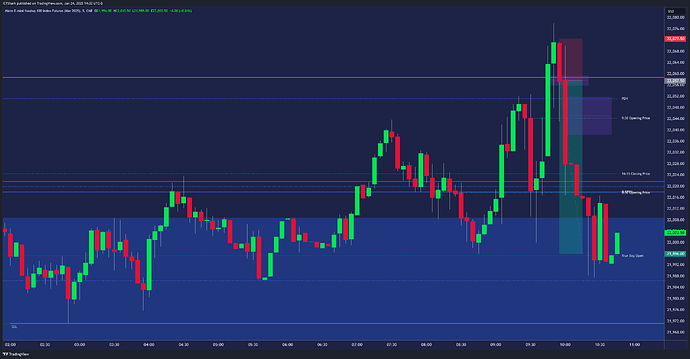

The morning session on Thursday, 23 January, was one of the worst in several months. This was due to President Trump’s speech, announced at 11:00. Such terrible price action was expected, so I didn’t start paying attention to the charts until after 11:00.

My trade

The main reason for entering this trade was that the ES price was near PDH and I expected it to get above that level, which would also help the NQ price rise.

At the same time, my favorite 15-minute FVG SMT pattern was forming. While the NQ revisited the FVG, the ES was already higher and preparing to break the previous day’s high.

I timed the entry on the 15-second chart using the old FVG and the bullish breaker.

The trade ended with a gain of 4.4R. However, it could have been much more. Unfortunately, I didn’t realize I could hold part of the position to NDOG, which is a strong price magnet. It was also not far above the hourly swing, making it a highly probable target. Either way, I’m happy with the outcome.

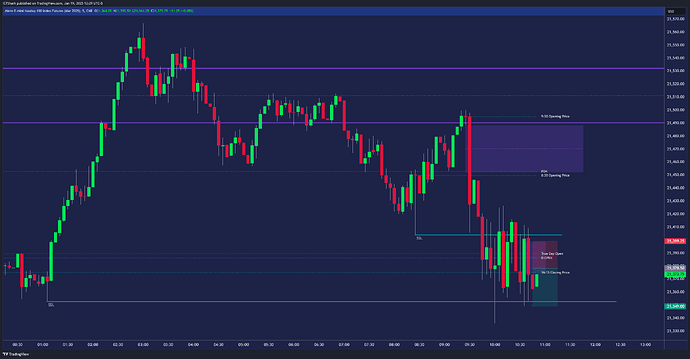

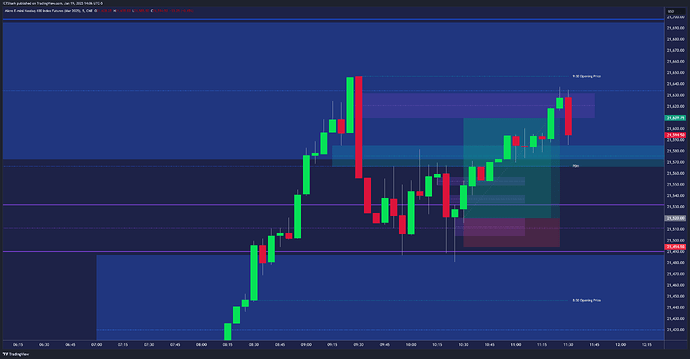

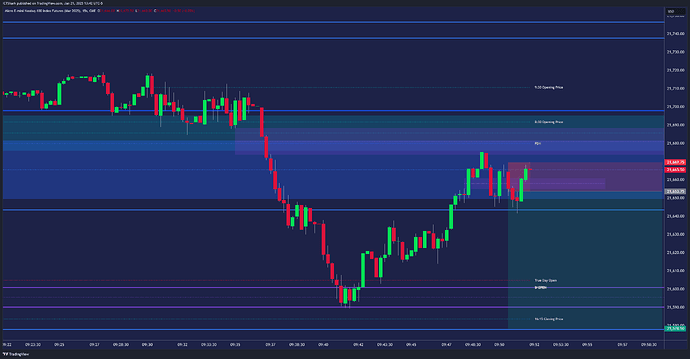

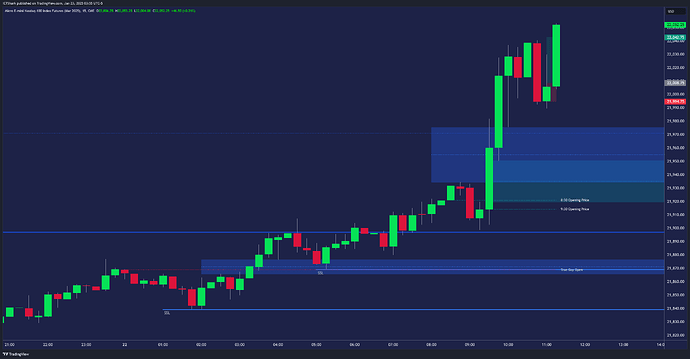

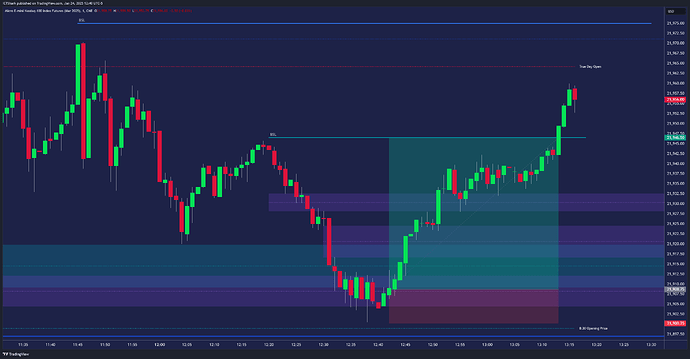

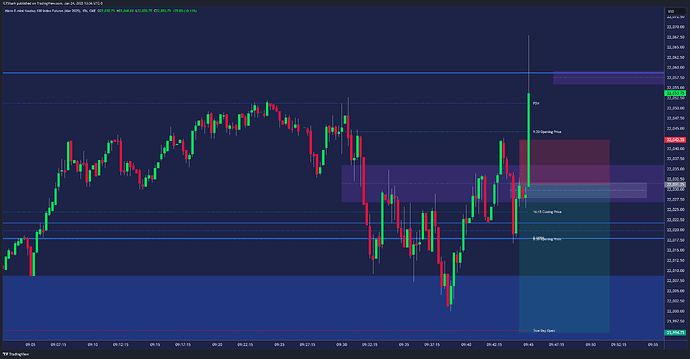

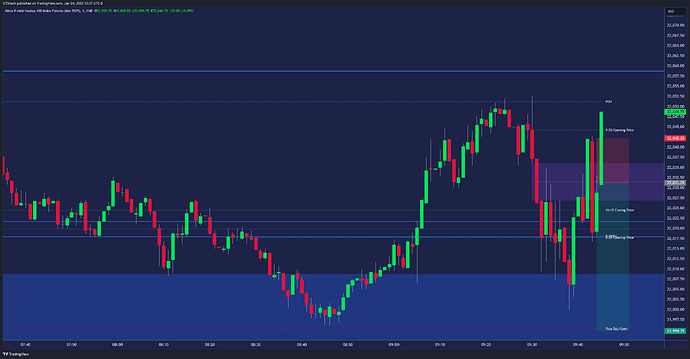

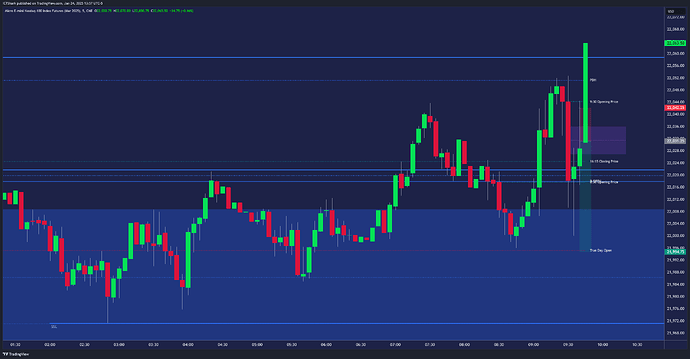

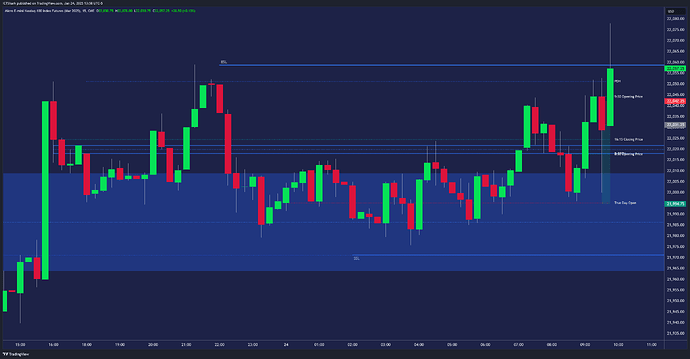

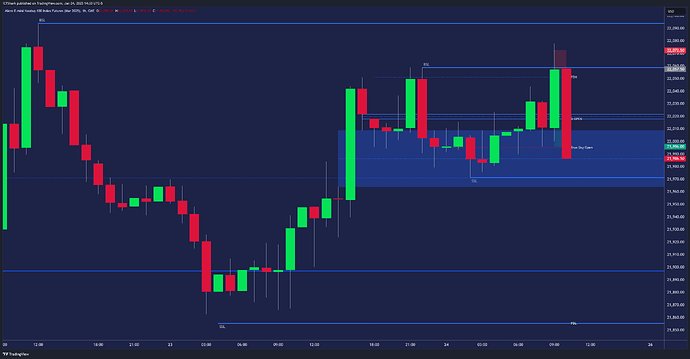

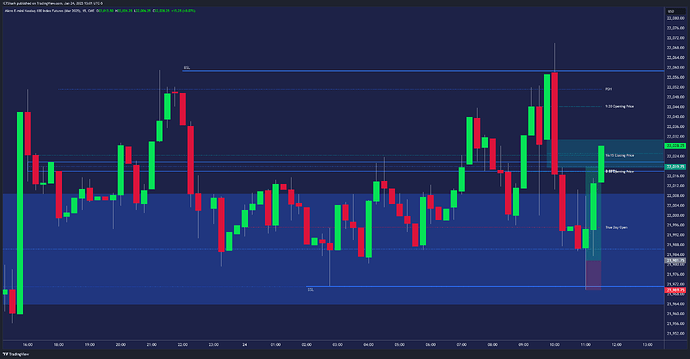

Here are my trades from Friday, January 24.

Trade #1

This is what happens when you forget that high-impact news is being announced.

Since NQ took out buy-side liquidity above the previous hourly swing, I expected a move to the downside where there was a lot of sell-side liquidity. Unfortunately, the 9:45 report decided that the price would not look at my target so soon.

This was really an unnecessary loss, as I had checked the economic calendar before the market opened and was well aware of this report. However, I was so focused on the charts that I forgot about it. What can I say? As my brother says, shit happens

Trade #2

While ES and NQ removed buy-side liquidity from the Asian and European sessions, YM did not. This is a significant divergence and a reason to look for a short setup.

My entry was based on a bearish breaker and IFVG. I was almost stopped out as I chose a tight stop loss, but luck was with me.

The trade offered a profit of up to 4R, but I ended most of the position around NDOG, where the price threatened to reverse. So, in the end, I cashed in 2.5R.

Trade #3

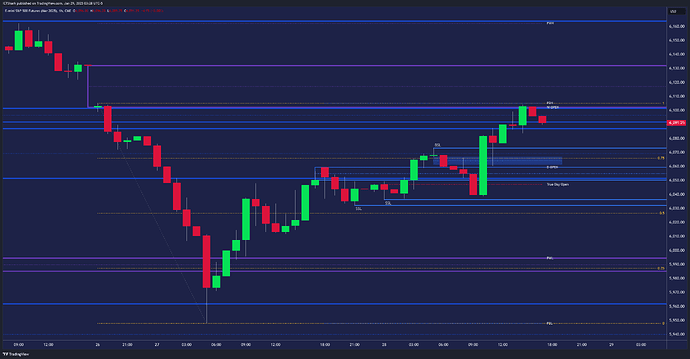

My last trade was based on the divergence between ES and NQ, clearly visible in the 15-minute charts below.

I entered immediately after seeing that the price respected the 15-second IFVG. I placed my profit target on the edge of the 15-minute FVG, which also overlapped with the NDOG. What a coincidence, right?

The trade offered more than 3R, but I took a few partial profits on the way up, cashing in 2.4R.

Total Profit: 3.9R

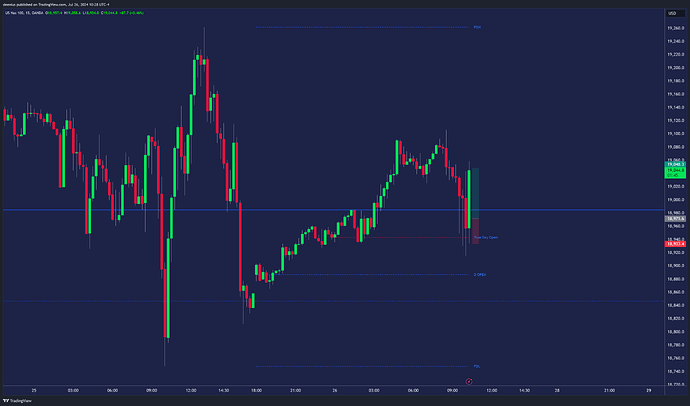

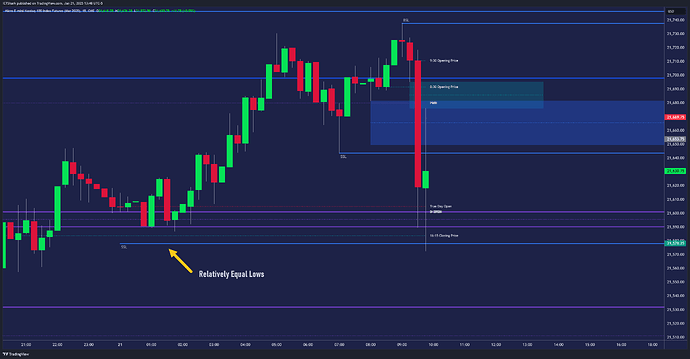

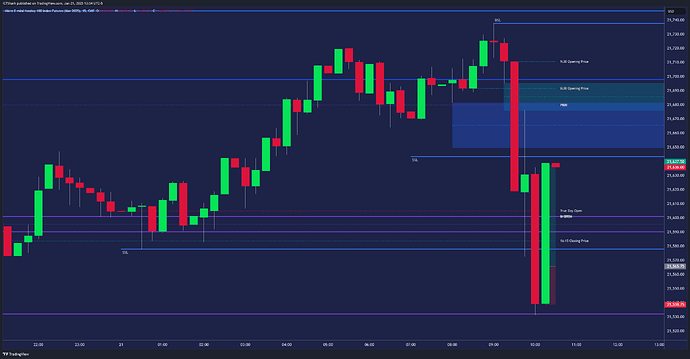

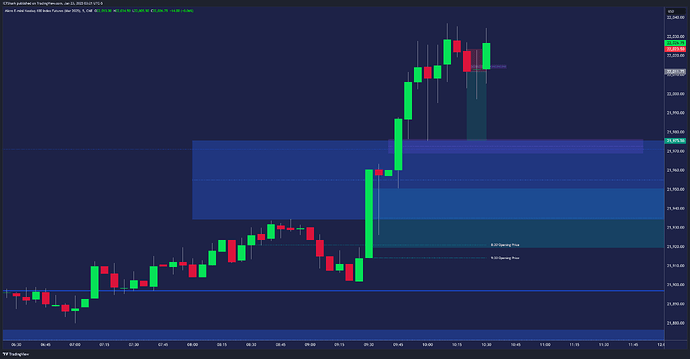

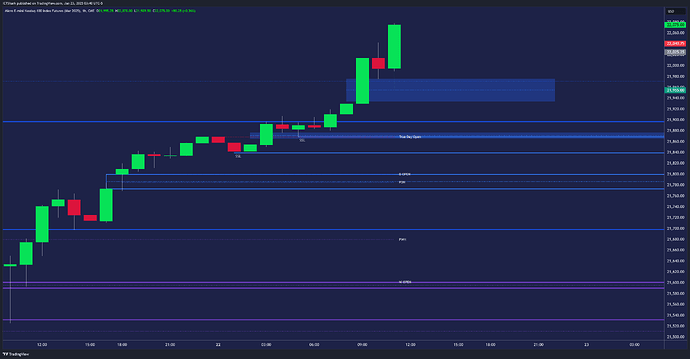

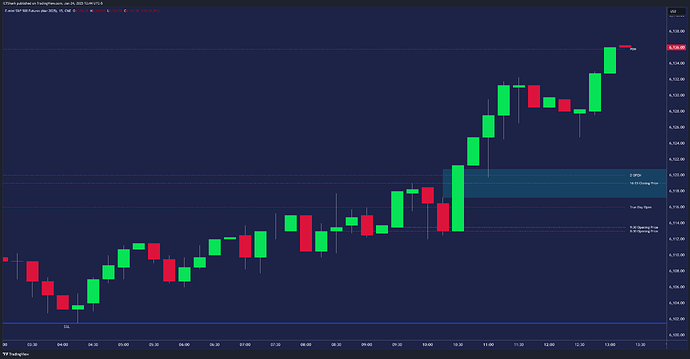

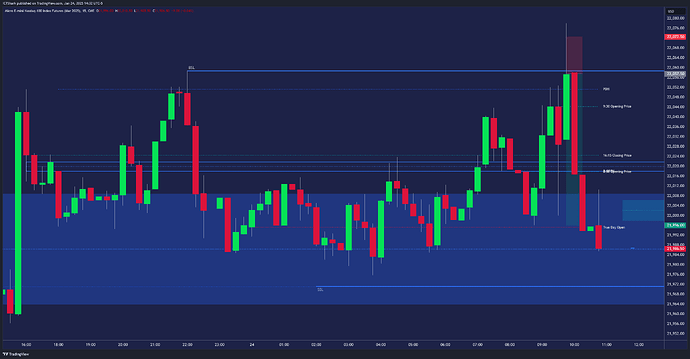

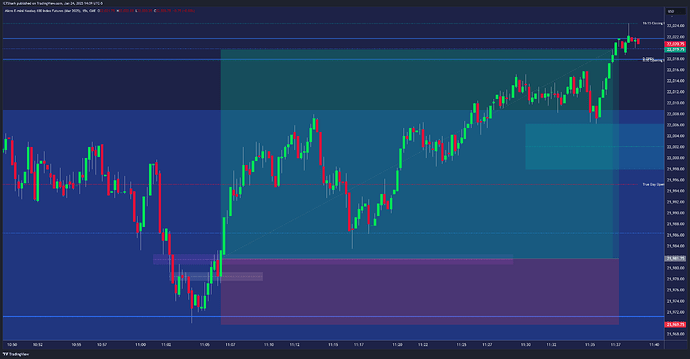

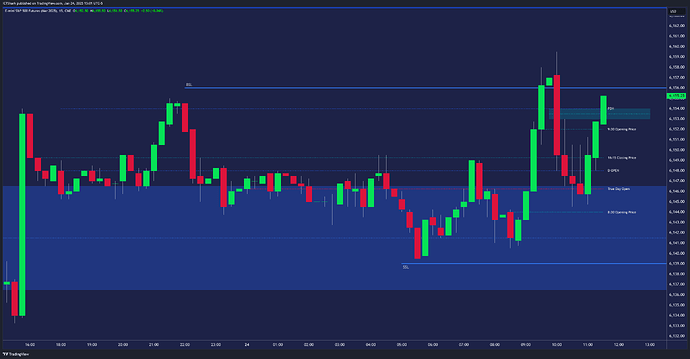

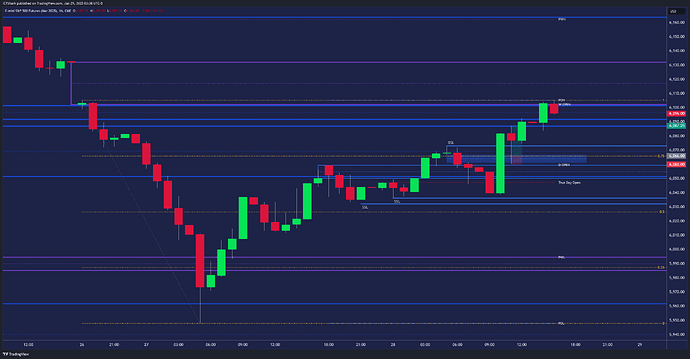

January 28 was a good day for trading, which I expected. As soon as I looked at the charts at 8:00 AM New York time, I knew where the market was headed and where the obvious liquidity pools were. It’s really easy to trade on days like this.

My trade

Since I was bullish, I wanted to see NQ take liquidity lower first before heading higher. Both markets were around 50% of their yesterday’s range, so I expected them to head up from that point, which they did.

My entry was based on the 15-second IFVG, but it was possible to enter on the 1-minute IFVG a little later.

My target was very conservative given that a high-impact report was expected to be announced at 10:00. I therefore exited a few minutes before this event with a gain of 3.4R.

Missed trade

After I exited my profitable trade, I stopped paying attention to the markets and started backtesting. However, there was an entry opportunity in the ES market which I want to record here.

This classic ICT 2022 YouTube setup offered the potential for at least a high of the day. Also, the previous day’s high was still untested, so the probability of the price continuing in the established direction was high.

This trade offered potential for a minimum of 3.5R to the high of the day and 6R to the high of the previous day.

Total gain: 3.4R

![]()

![]()

![]()