I look forward to your trade breakdowns, Jim! ![]()

No problem , they might not be the best , but they will be breakdown of trades ![]()

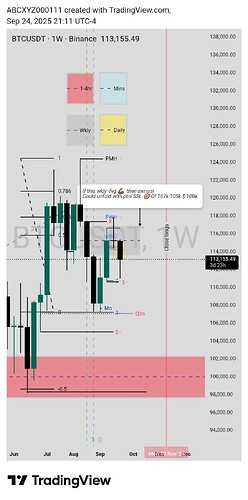

25th September 2025 btc

Missed entry, relative to my analysis from yesterday failed ,I realised that in a Distibutio.cycle you don’t get that much of a deep retracement OTE ,

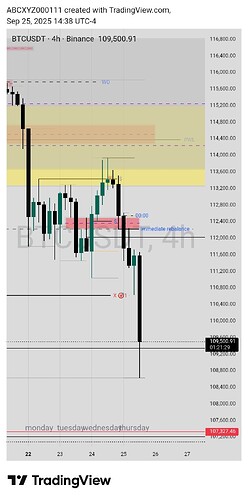

But I did get an entry I that 4hr -fvg

Especially with that liquidity inside been raided and rejected but I close too soon ,for fear of loss, as I had very limited capital on bybit could have used my demo

It’s very obvious price isn’t going back there ,it was a clean trade setup yet I missed,or gave it up . For a swing trade the 4hr is where my setup should form and it did , but I ,fear ,and lack of confidence,I still feel bad ,but Ill wait for another entry rather than chasing

Also there was a 90min. SMT between BTC& ETH after that 4hr lq raid

though the day just began, I expect the today’s news drivers to expand price lower

Let’s see if price trades above/ close to the midnight open price

September 25, 2025

Trade #: Trade 1

Asset/Pair: BTC USD

Entry Price: 11555

Exit Price: 108500

Position: short

Trade Outcome: Profit ()/r:r 1:1

Reason for Trade: LQ raid on 1H chart into fp.fvg

What Went Well: price expanded as expected, DOL was good .

What to Improve: Could’ve taken a smooth & better entry if I had left emotions out

![]() When I’m bearish, I’ll only focus on PDAs that should resist price vice versa

When I’m bearish, I’ll only focus on PDAs that should resist price vice versa

Notes: because I was emotional I was seeking something that was technically illogical at moment (expecting price to trade back above a pdh that raided lq and rejected, in a strong bear trend

I absolutely love this style of post. This is what a trading journal entry should look like.

When you look back on this with some distance, you’ll be amazed at how much you’ve learned and what mistakes you’ve made. In other words, you’ll see how far you’ve come.

Keep it up! ![]()

![]()

![]()

Thanks for your words of encouragement, I’m moved to keep learning and sharing