Notes

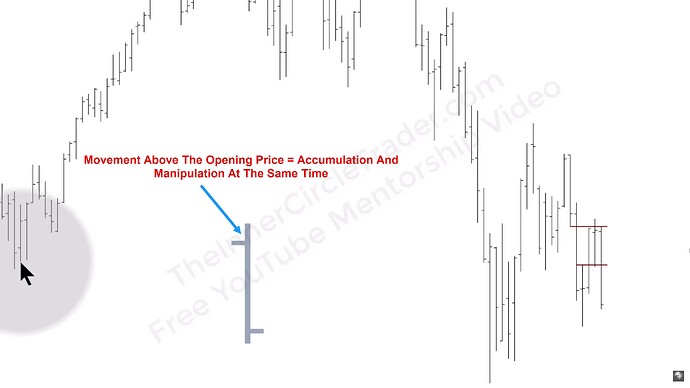

- Power Of Three (PO3) represents the ICT concept of Accumulation Manipulation Distribution.

- In the case of PO3, accumulation and manipulation take place simultaneously. If we are bullish, we expect accumulation and manipulation below the opening price. If we are bearish, we expect accumulation and manipulation above the opening price.

- In general, we expect the end of the distribution phase around the time of market closure.

- Every strategy Michael teaches uses the PO3 concept.

- We can use the same model during the London Open Kill Zone.

- If Michael were forced to choose only one time frame for trading, he would select the 15-minute chart because it can be used for day trading, swing trading, or scalping.

- If brokers are increasing margins, it’s a sign that big monstrous moves are coming.

- If more than one FVG is formed in the leg that caused the MSS, we must expect that the price will want to test the outermost one.

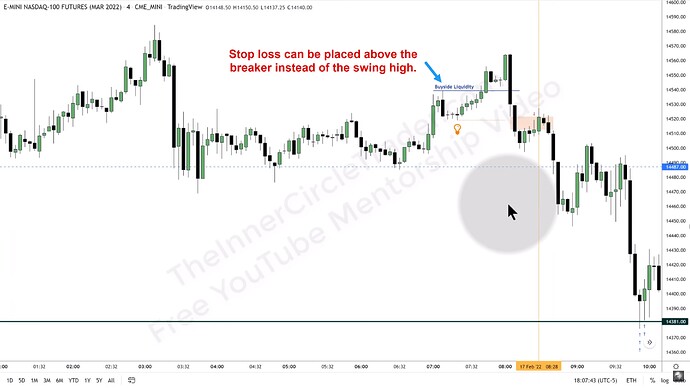

- If there is a breaker at the time of our entry, we can use it to place a stop loss and reduce the size of the risk.

ICT 2022 YouTube Model - Power Of Three

ICT 2022 YouTube Model - Power Of Three Example

ICT 2022 YouTube Model - NQ 5-Minute Chart

ICT 2022 YouTube Model - NQ 4-Minute Chart Setup

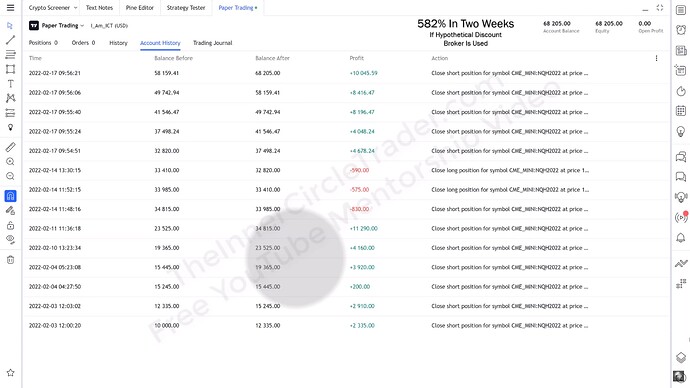

ICT 2022 YouTube Model - Two-week strategy results

Next lesson: 2022 ICT Mentorship - Episode 11 - Overcoming Mental Hurdles & Managing Performance After Large Wins

Previous lesson: 2022 ICT Mentorship - Episode 9 - Power Of Three & New York PM Session Opportunities