Notes

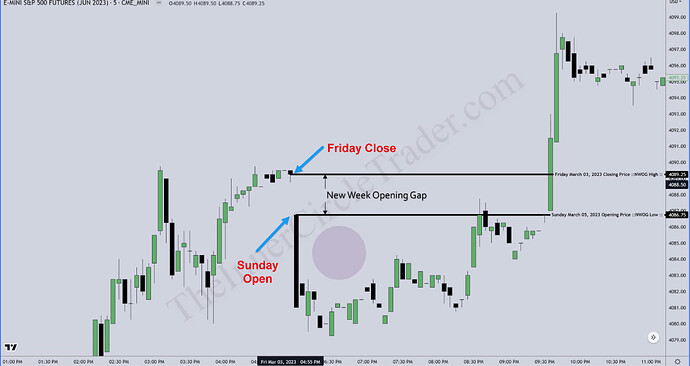

- The NWOG is defined by the price difference between the Friday close and Sunday open.

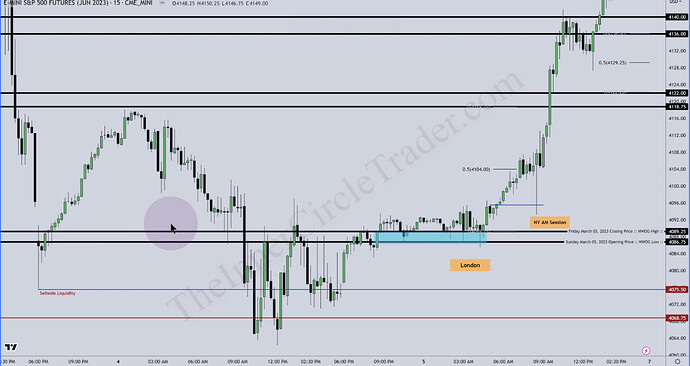

- New Week Opening Gaps act like magnets. The price tends to be drawn to them like the old highs and lows.

- The opening price of the new week (e.g., 6 p.m. New York time) often holds significance throughout the week and even months later.

- Friday closing price and Sunday opening price are not random.

- A market that moves sharply away from a new week opening gap often enters a trending phase.

- Market consolidation occurs when the price fails to move away from the current NWOG.

- When multiple New Week Opening Gaps exist close together, the market will likely be range-bound, ideal for scalpers rather than trend traders.

- Michael recommends plotting all NWOGs that exist 60 days back on the chart. Five NWOGs is the minimum.

- Blending the analysis of NWOGs with other previously taught ICT concepts is a way to get a more accurate picture of the future market direction (bias).

ICT New Week Opening Gap

Sharp Move From NWOG - Trending Environment

Consolidating Market

Price Reactions To NWOGs On Non-Farm Payroll Friday

Next lesson: 2023 ICT Mentorship - NDOG - New Day Opening Gap [Part 1]

Previous lesson: 2023 ICT Mentorship - ES Review & ICT Funded Challenge Discussion: April 5