Notes

- During premarket hours (before 9:30 a.m.), the best setups occur between 7 a.m. and 9 a.m.

- Michael wants to trade in the premarket session if the economic calendar doesn’t show any medium-impact or high-impact news on a given day, and he won’t be interested in trading after 9:30 a.m. This rule also applies to Mondays outside the NFP week.

- During the NFP week he trades Monday’s RTH session.

- On days without major news, professional traders are already participating in the premarket session because they expect poor price action (HRLR conditions) after the market opens at 9:30.

- Caleb’s model works with the following time frames:

- 15-second chart.

- 30-second chart.

- 45-second chart.

- 1-minute chart.

- Caleb is instructed to seek a first presented FVG on the above time frames after 9:31 a.m.

- NDOG and NWOG clusters consist of two or more overlapping gaps. For example, two overlapping NDOGs.

- NDOG and NWOG clusters serve as Draw On Liquidity (DOL). In other words, they draw price like a magnet.

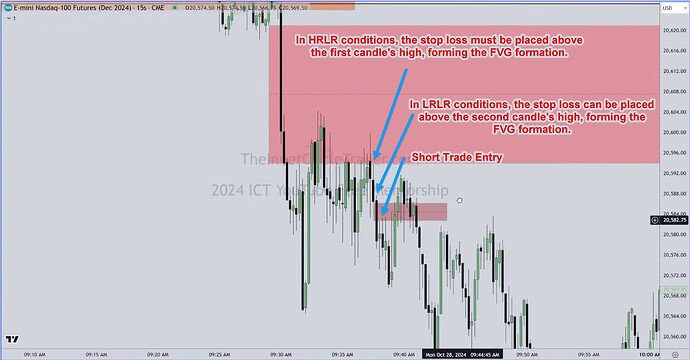

- If we are bearish in HRLR conditions, the stop loss must be placed above the first candle’s high, forming the bearish FVG.

- If we are bearish in LRLR conditions, a stop loss can be placed above the second candle’s high, forming a bearish FVG.

- If we are bullish in LRLR conditions, a stop loss can be placed below the second candle’s low, forming a bullish FVG.

- If we are bullish in HRLR conditions, the stop loss must be placed below the first candle’s low, forming the bullish FVG.

- Opening Range Gap can be defined as the price range of the first 30 or 60 minutes after the opening. Caleb’s model works with a 30-minute range.

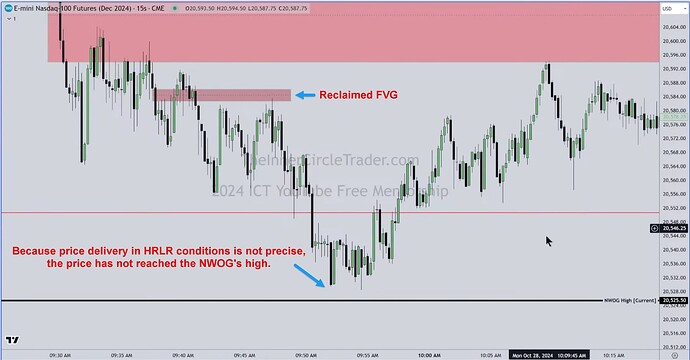

- Reclaimed FVGs typically form in the High Resistance Liquidity Run environment.

- Each of Michael’s PD arrays can have reclaimed variants.

- In the HRLR conditions, the individual candles overlap a lot, while in the LRLR conditions, their overlap is minimal.

NQ - NWOG Cluster

NQ - Reclaimed FVG

NQ Trade Example - Placing Stop Loss In HRLR And LRLR Conditions

Next lesson: 2024 ICT Mentorship - New Week Commentary For NQ Futures: December 1

Previous lesson: 2024 ICT Mentorship - How ICT Picks Winning FVG’s & Orderblocks: October 25