Notes

- In this lecture, Michael teaches how to hold a position longer for more profit and how to move a stop loss properly.

- The algorithm uses the highs and lows of the last three days. It will utilize these levels repeatedly as reference points, even if the liquidity around them has already been removed.

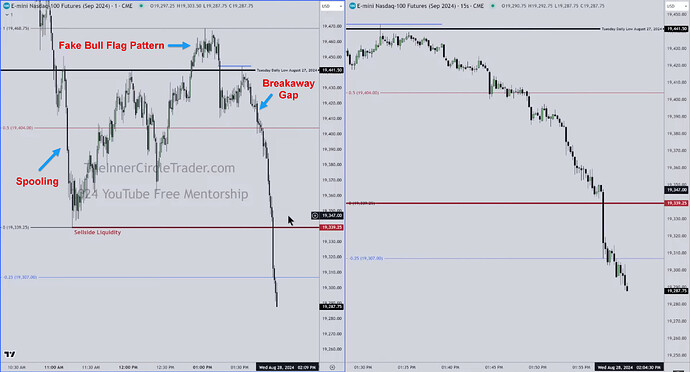

- Whenever a breakaway gap forms, we can expect a rapid move in the established direction. Michael often points this out in his videos with the text "big green/red candles coming)

- If we are bearish and see a bull flag pattern forming above an old swing high or relative equal highs, we should consider this a manipulation and look for an opportunity to enter a short position.

- If we are bullish and see a bear flag pattern forming below an old swing low or relative equal lows, we should consider this a manipulation and look for an opportunity to enter a long position.

NQ - First Presented FVG And Breakaway Gap

NQ - False Bull Flag Pattern And Breakaway Gap

NQ - Breakaway Gap Example

Next lesson: 2024 ICT Mentorship - Lecture 20: August 29

Previous lesson: 2024 ICT Mentorship - Lecture 18: August 27