Notes

- This lesson is designed to help traders determine trade direction.

- Each trading style requires a different approach and understanding of time frames.

- New traders should start with short-term trading or day trading. These styles provide immediate feedback and help build confidence.

- Scalping is an inappropriate trading approach for a novice trader.

- Trade duration by trading style (according to Michael):

- Position trades - 6 months to a year.

- Swing trades - One week to 6 months.

- Short-term trades - From one day to a week.

- Day trades - Less than a day.

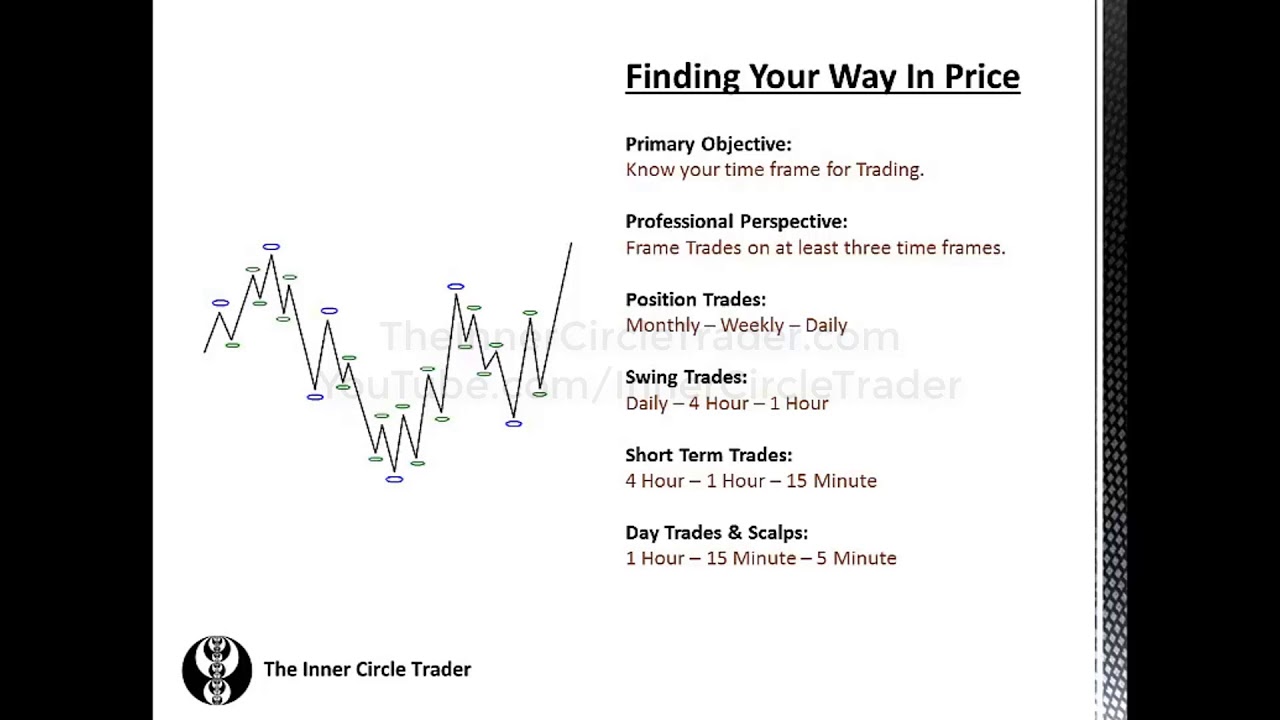

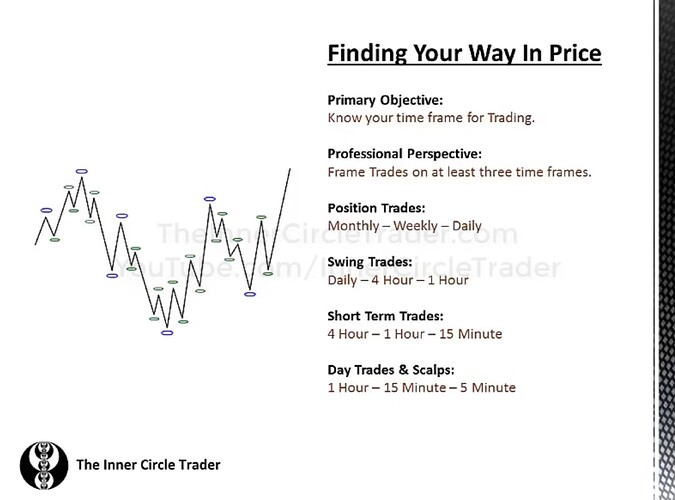

- Trades need to be framed using at least three time frames.

- Recommended time frames by trading style:

- Position trades: Monthly, Weekly, Daily.

- Swing trades: Daily, 4-Hour, 1-Hour.

- Short-term trades: 4-Hour, 1-Hour, 15-Minute.

- Day trades & scalps: 1-Hour, 15-Minute, 5-Minute.

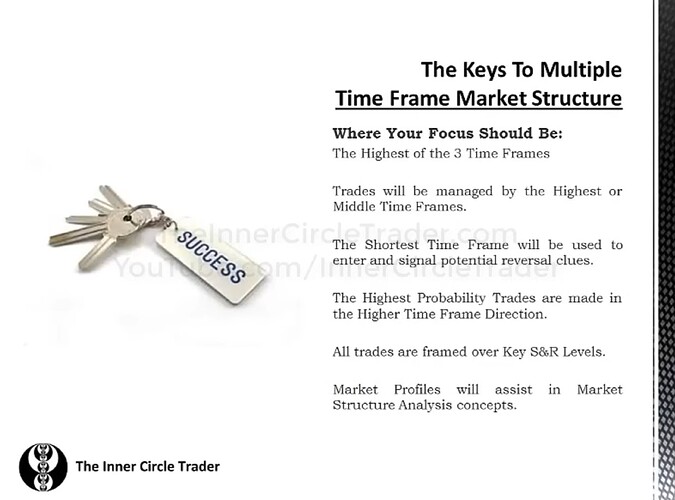

- The highest time frame determines the overall trend (directional bias). It can also serve for trade management.

- The medium-term timeframe is used to manage trade.

- The shortest time frame is intended to time the trade and identify signs of a possible reversal.

- Understanding support and resistance levels is crucial for determining directional bias.

- Market profiles (trending, reversal, consolidation) are essential for analyzing market structure.

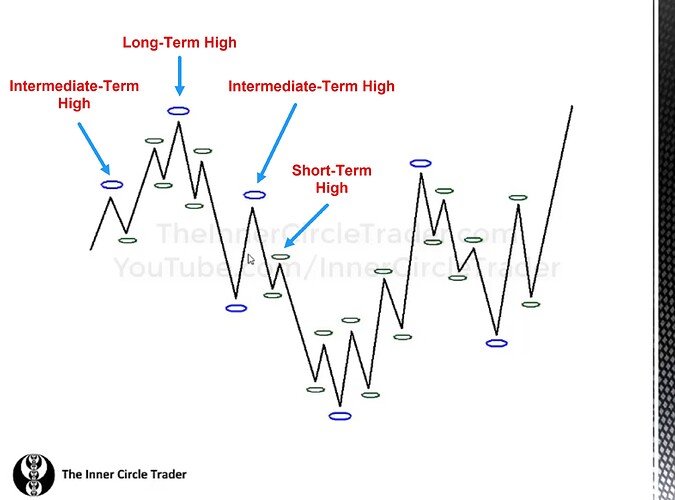

- Market structure shifts are indicated by breaking short-term swing lows or highs.

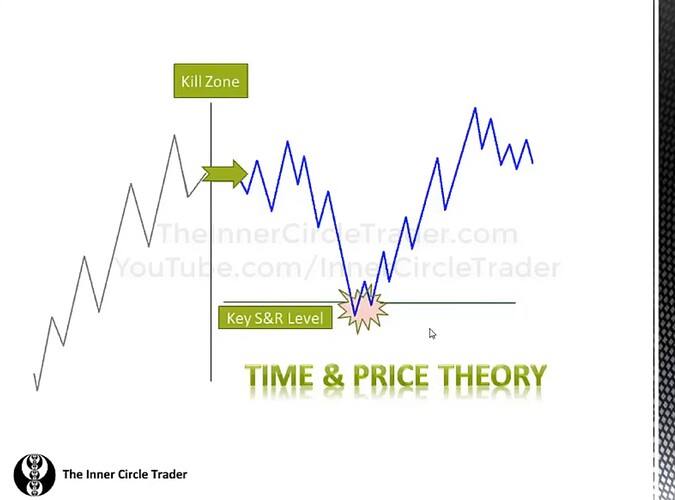

- Higher time frame resistance or support levels help anticipate future price movements. These are the places where we look for price reversals.

- We use higher time frames to identify significant levels and refine them with mid- and shorter-term charts.

- In bullish scenarios, we look for buying opportunities at key support levels within kill zones.

- In bearish scenarios, we look for selling opportunities at key resistance levels within kill zones.

- When the price reaches key levels, various entry techniques, such as Optimal Trade Entry, Reflection, Grail, or Stinger, can be used.

- Directional bias helps avoid overcomplication.

- Bias does not guarantee accuracy or profitability. Trading is about probabilities, not certainties.

- Both long and short trades can be profitable on the same day, depending on the trader’s style and time frame.

- Living in the gray area:

- Be comfortable with uncertainty in trades.

- Don’t expect perfect scenarios or 100% accuracy.

- Focus on consistent, controlled profits with realistic expectations.

Essentials To ICT Market Structure - Time Frames

Essentials To ICT Market Structure - The Keys To Multiple Time Frame Market Structure

Essentials To ICT Market Structure - Advanced Market Structure

Essentials To ICT Market Structure - Time And Price Theory

Essentials To ICT Market Structure - Avoid The Over-Complicating

Next lesson: ICT Forex - Market Maker Primer Course - The ICT Asian Killzone

Previous lesson: ICT Forex - Market Maker Primer Course - Considerations In Risk Management