Notes

- Emotional desire to “beat the market” can lead to poor decisions.

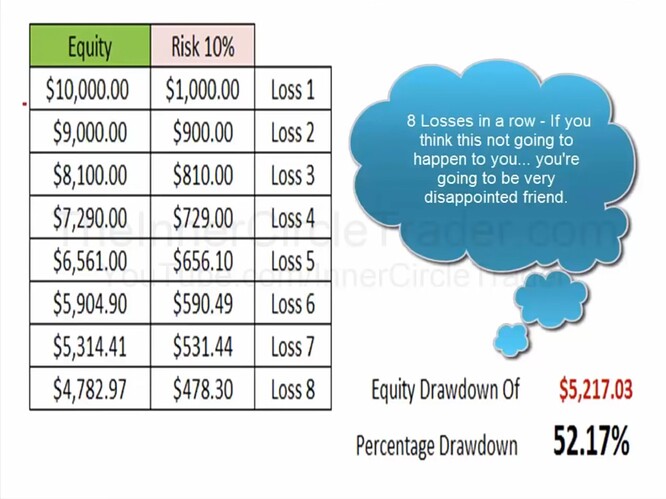

- Controlling risk is crucial to avoid severe drawdowns.

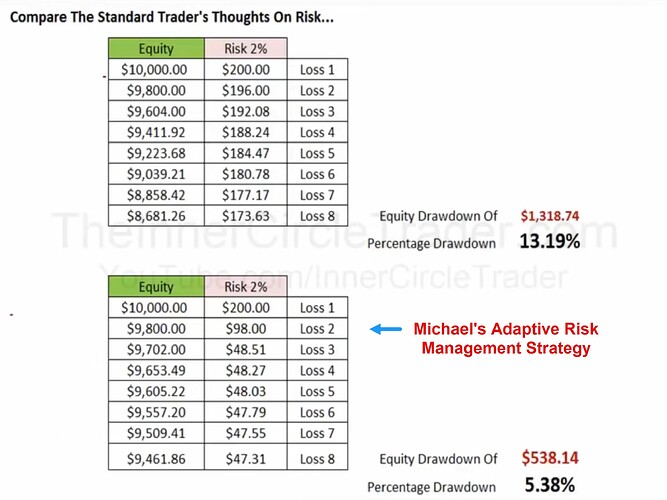

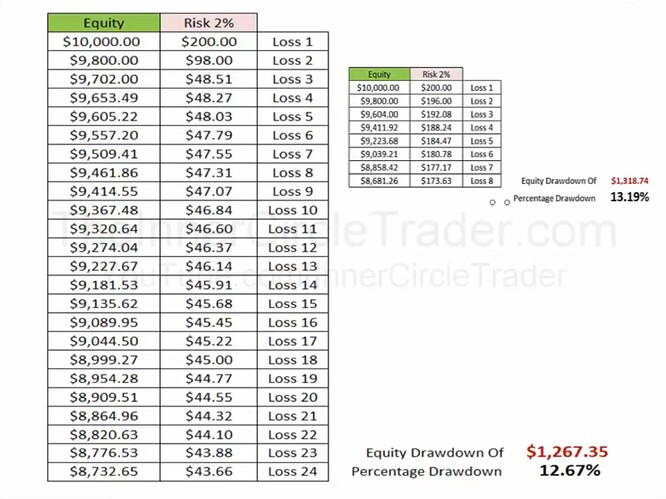

- Michael’s Adaptive Risk Management Strategy:

- Start with 2% risk. Cut risk in half after each loss.

- First Loss: 2%.

- Second Loss: 1%.

- Further Losses: Reduces to 0.5% risk, then 0.25% if necessary.

- This risk management strategy is discussed in the thread: ICT Money Management Vs. One Percent Per Trade

- Michael shows that adaptive risk management can significantly limit losses and preserve equity.

- A trader should stay at reduced risk levels until equity recovers by 50% of the drawdown.

- Risk management should be a core part of our trading strategy.

We need to understand that all traders face losses, and the key to success is in how we manage those losses.

Considerations In Risk Management - Risk 10%

Considerations In Risk Management - Risk 5%

Considerations In Risk Management - Risk 2%

Considerations In Risk Management - Adaptive Risk Management

Next lesson: ICT Forex - Market Maker Primer Course - Essentials To ICT Market Structure

Previous lesson: ICT Forex - Market Maker Primer Course - What New Traders Should Focus On