Notes

- Retail trading concepts are distractions. We should focus on the open, high, low, and close prices.

- Institutional traders think of relatively equal highs and lows as places where liquidity is located.

- Retail traders think of relatively equal highs as a double top pattern and relatively equal lows as a double bottom pattern.

- Buy stops are placed above the relatively equal highs, and sell stops are placed below the relatively equal lows.

- Remember, price moves to levels where orders reside.

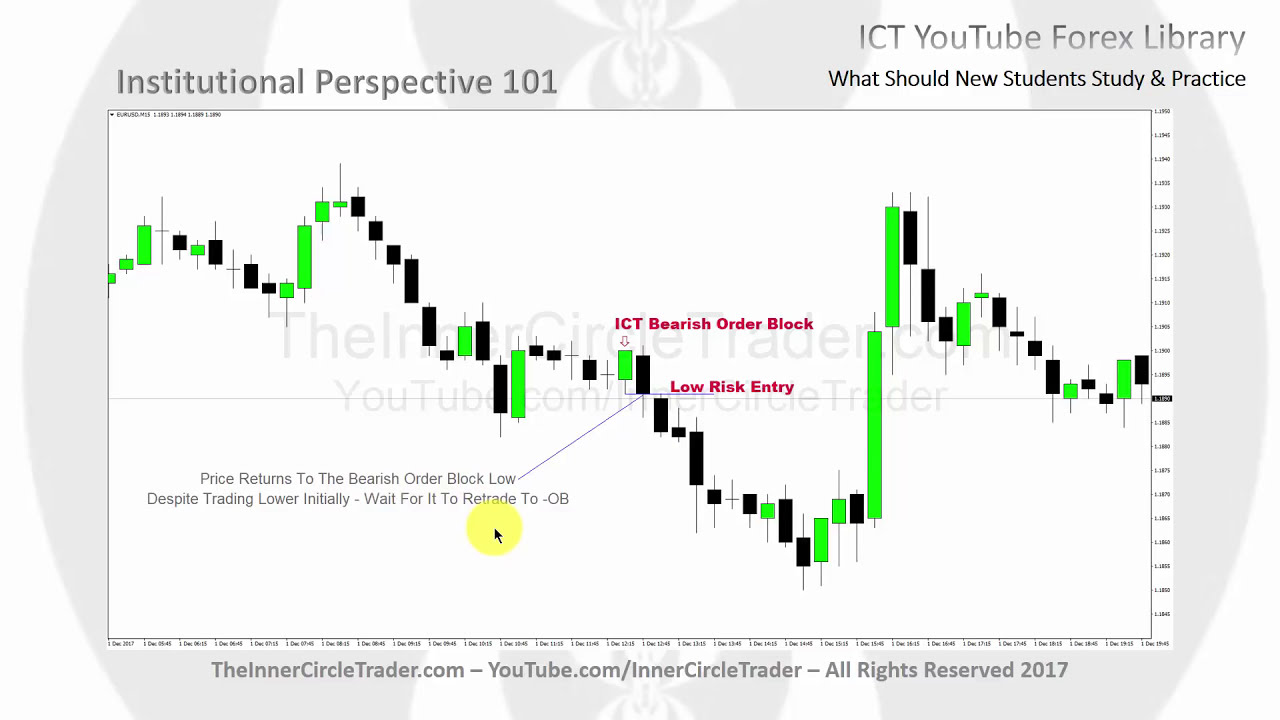

- Every up-closed candle is not a bearish order block, and every down-closed candle is not a bullish order block. We need context behind why price should do what we expect it to do.

- If we miss a trade entry at OTE levels, we can still enter until the high or low, forming our trading range, is broken.

ICT Concepts Used In This Module

Relatively Equal Highs And Lows

Chasing The Price

ICT Bearish Order Block

ICT Bearish Order Block Trade Entry

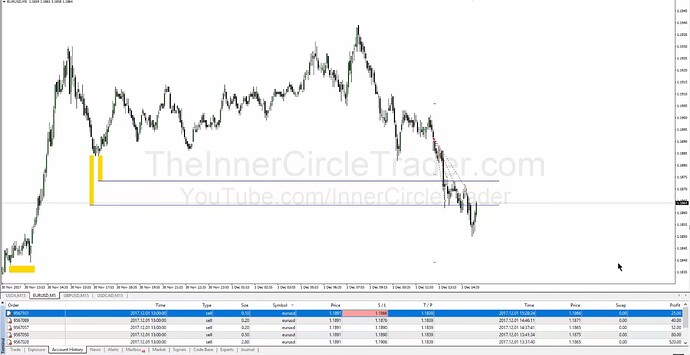

EURUSD Trade Example - Trade Potential

EURUSD Trade Example - Trade Entry

EURUSD Trade Example - Trade Result

Next lesson: ICT Forex - Market Maker Primer Course - Considerations In Risk Management