Notes

- We look for the Judas swing, which is a false move against the main trend to grab liquidity.

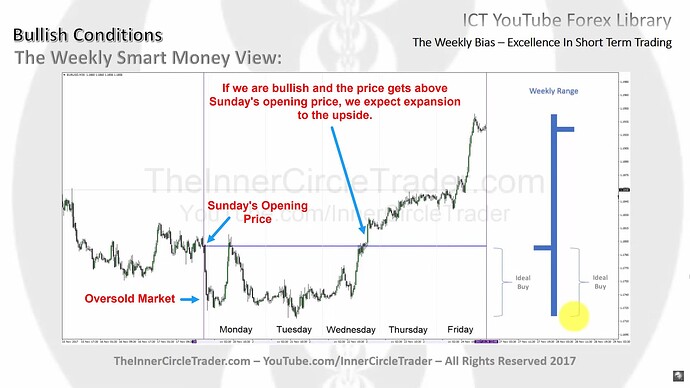

- If we are bullish, we want to enter below Sunday’s opening price (Power Of Three ICT Concept).

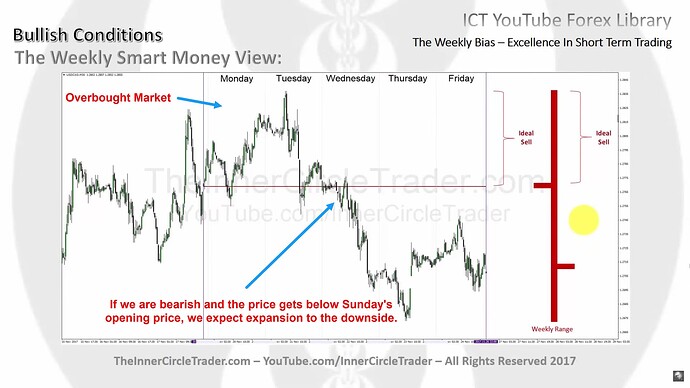

- If we are bearish, we want to enter above Sunday’s opening price.

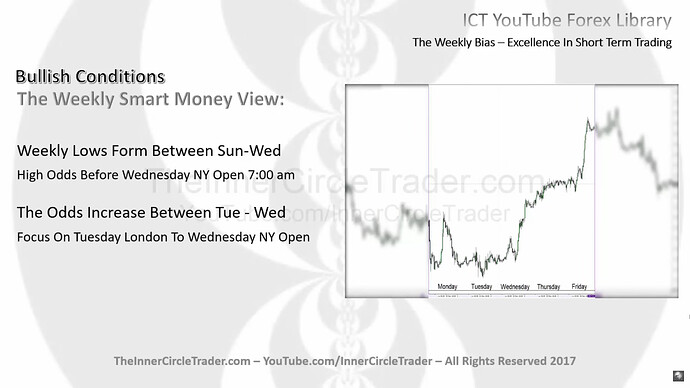

- We expect the high or low of the week to form on Tuesday or Wednesday.

- Sometimes, a high or low of the week is formed on Monday, but we can still enter a continuation trade on Tuesday or Wednesday.

- We expect the price to expand away from the opening price starting from Wednesday.

- Traders not monitoring intraday charts can use the weekly candle for short-term or swing trades.

- If we are bullish and cannot watch intraday charts, we will place a sell limit order 30 pips above Sunday’s opening price. If we are bearish, we will place a buy limit order 30 pips below Sunday’s opening price. Our stop loss is 150 pips, and our target is 150 to 300 pips.

- If the price has moved 100 pips in our favor, we should consider taking partial profits and adjusting stop-loss to break-even.

- Market behavior can change midweek. Hence, taking partial profits helps safeguard against reversals.

- Larger weekly ranges can occur during volatile periods or when significant news is expected.

- Using specific levels in price action can refine entries beyond just a set number of pips above or below Sunday’s opening price. For example, sell limit orders above recent highs can provide better entry points with reduced exposure.

The Weekly Bias - Bullish Conditions

The Weekly Bias - Bullish Conditions Example

The Weekly Bias - Bearish Conditions

The Weekly Bias - Bearish Conditions Example

Next lesson: ICT Forex - Market Maker Primer Course - Time & Price Theory

Previous lesson: ICT Forex - Market Maker Primer Course - The ICT London Close Killzone