Notes

- Michael expects key swing points to form in specific sessions.

- Sessions by Power Of Three concept:

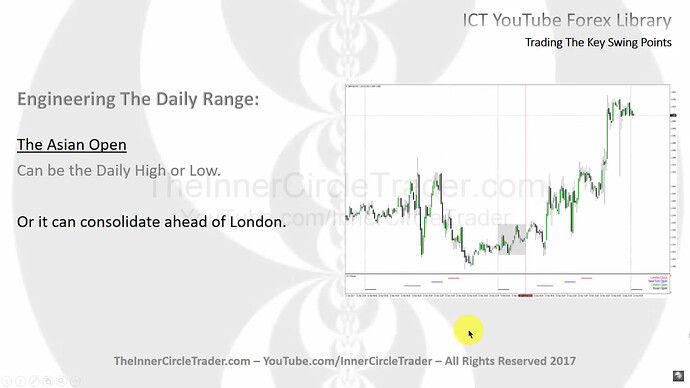

- Asia: Often a consolidation period.

- London: Typically marks the high or low of the daily range.

- New York: Part of the daily expansion phase.

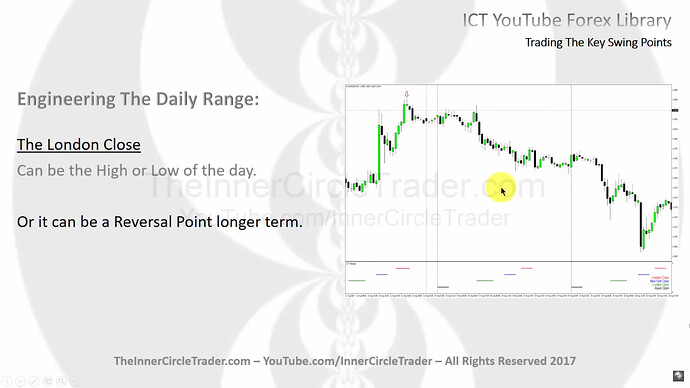

- London Close: Marks the opposite end of the daily range.

- If the market consolidates during the Asian and London Open sessions, then we can expect a breakout of the consolidation and the start of a trend during the New York session.

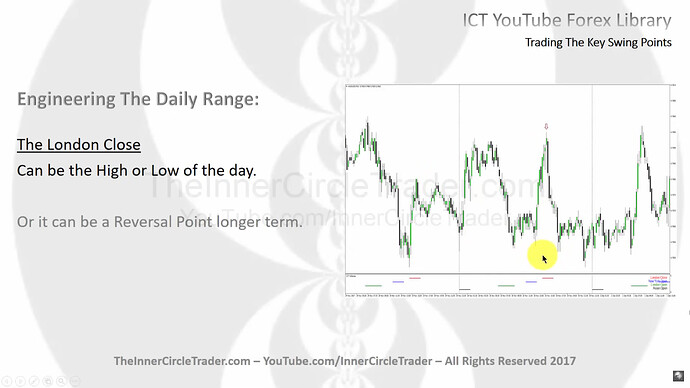

- It is important to align key swing points with higher timeframe resistance or support levels for better trade predictions. For example, if a daily resistance level aligns with the London Close, it suggests a potential short opportunity even if the day is bullish.

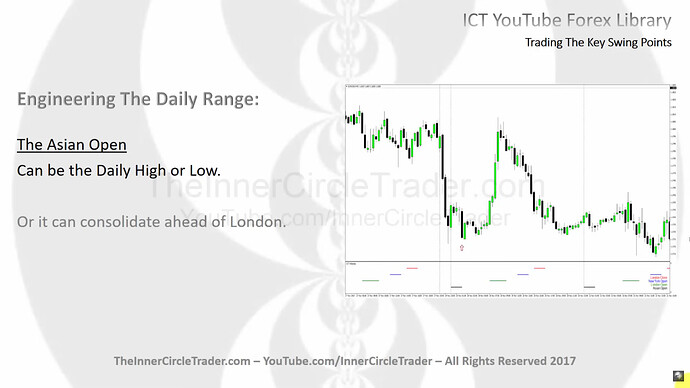

The Asian Open As Daily High Or Low

The Asian Open Consolidation

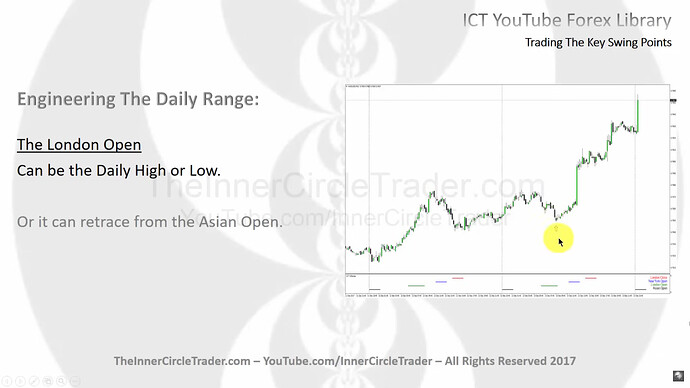

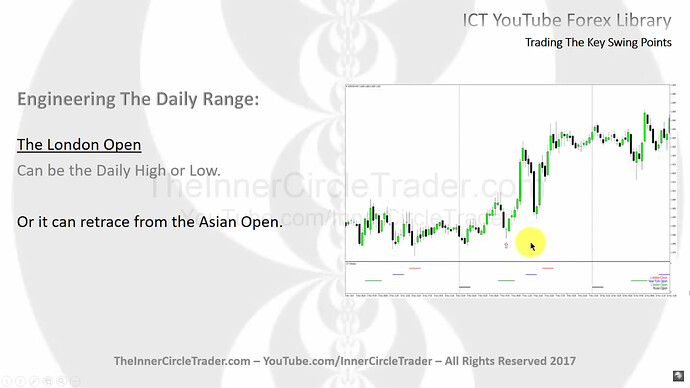

The London Open As Daily High Or Low

The London Open - Retracement From The Asian Open

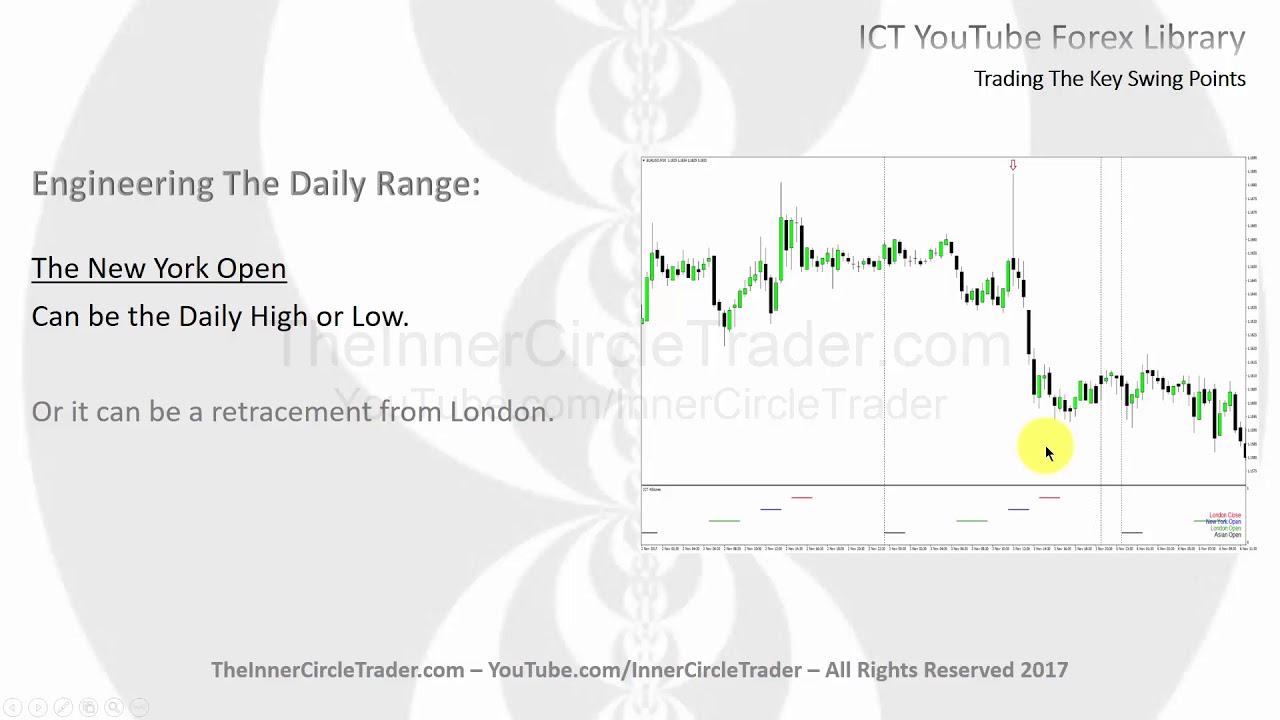

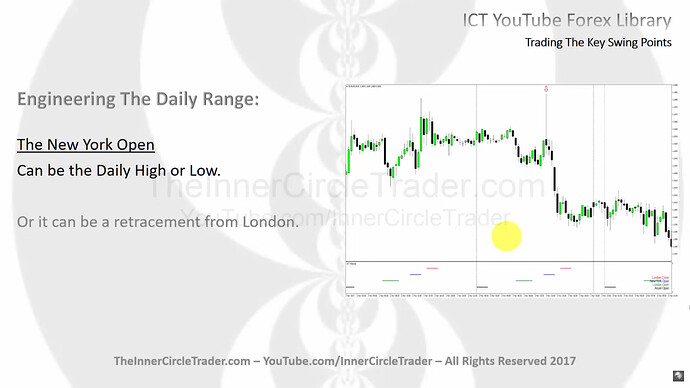

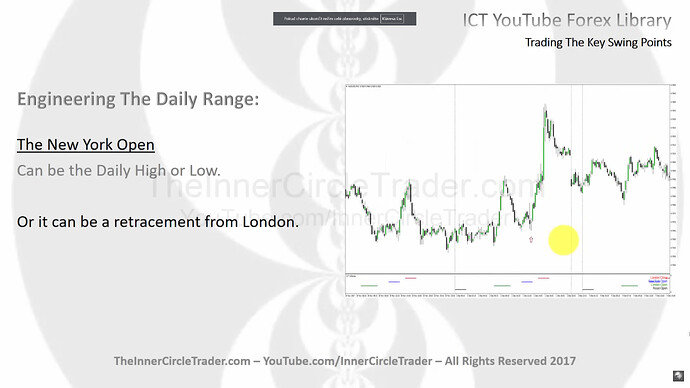

The New York Open As Daily High Or Low

The New York Open - Retracement From The London Open

The London Close As Daily High Or Low

The London Close As Reversal Point

Next lesson: ICT Forex - Market Maker Primer Course - Money Management That Works

Previous lesson: ICT Forex - Market Maker Primer Course - Essentials To Trading The Daily Bias