Notes

- This lesson focuses on the foundations of institutional order flow and understanding liquidity.

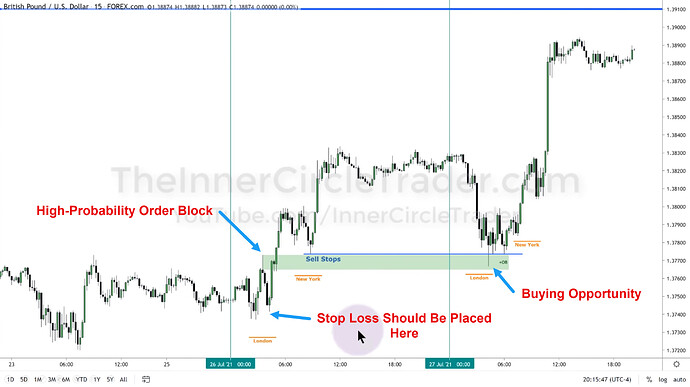

- By analyzing weekly, daily, and hourly charts, traders can anticipate market movements and align their trades with institutional order flow.

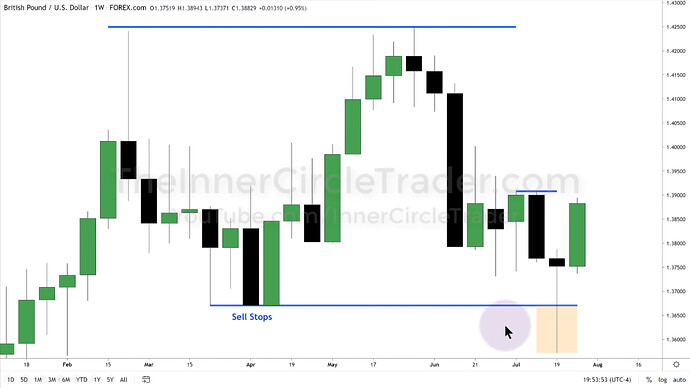

- Smooth and clean levels are likely to get swept by the market.

- Traders place sell stop orders below the clean lows and buy stop orders above the clean highs. Institutions target these levels to trigger the orders to accumulate liquidity.

- Areas with clustered stop orders act as magnets for price.

- We should start our week by identifying likely draw on liquidity for the week.

- If we are bullish, we expect upward movement every day until the nearest opposite liquidity pool is reached.

- If we are bearish, we expect downward movement every day until the nearest opposite liquidity pool is reached.

- If we are bullish, we look for buying opportunities on Monday, Tuesday, and Wednesday.

- If we are bearish, we look for selling opportunities on Monday, Tuesday, and Wednesday.

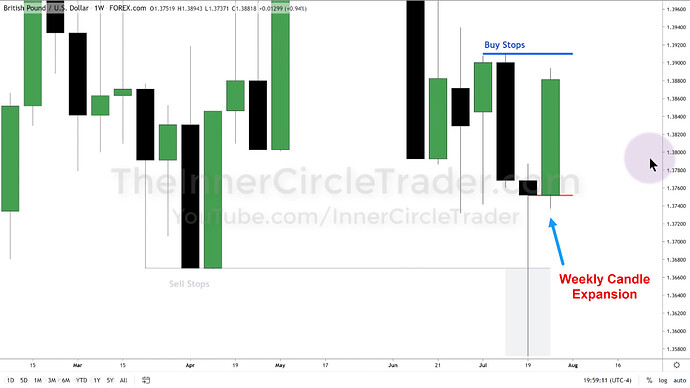

Weekly Candle Expansion

Liquidity Pools On Weekly Chart

ICT Bullish Order Block Example

High-Probability Order Block

Next lesson: ICT Forex - Market Maker Series - Volume 3

Previous lesson: ICT Forex - Market Maker Series - Volume 1