Notes

- This lesson is an introduction to analyzing interest rate differentials and COT data.

- Central banks are the market makers for the currency market, not investment bank dealers or brokers like Goldman Sachs or UBS.

- The central banks always establish and manage a country’s currency price, both autonomously and manually.

- Currency prices are 100% controlled and manipulated by the central banks.

- Dealers and brokers do business with the price feeds set and delivered by central banks.

- Central banks establish and manage currency prices, not influenced by retail trading indicators or strategies (e.g., Wyckoff, Elliott Wave).

- Central Banks do not follow retail indicators or flawed retail logic. There are no Wyckoff, Harmonic, Elliot Wave, VSA, S&D Zones, etc.

- High-tech algorithms used by central banks determine price feeds unrelated to supply and demand concepts.

- Quantitative analysis is essential for understanding market maker concepts. It’s statistical, measurable, and not subjective, unlike qualitative analysis.

- Important macro data for determining future market direction:

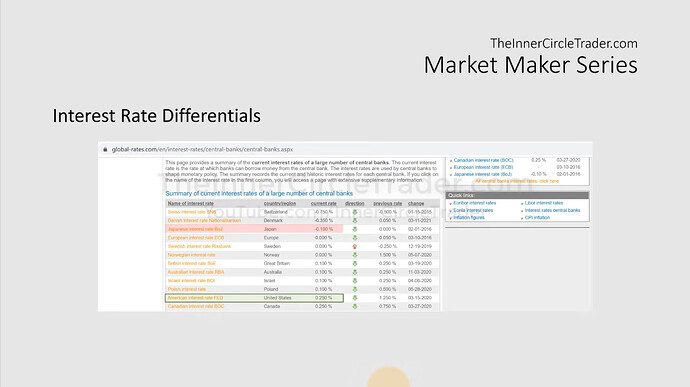

- Current and historical interest rates of the major central banks worldwide

- Large flows (hedge funds, investment banks) always seek yields, making interest rate differentials critical.

- Commitment of Traders

- We always analyze future contracts with the largest Open Interest.

- We are bullish on currencies with high interest rates and bearish on currencies with low or negative interest rates. The choice of currencies depends on the overall interest rate differential.

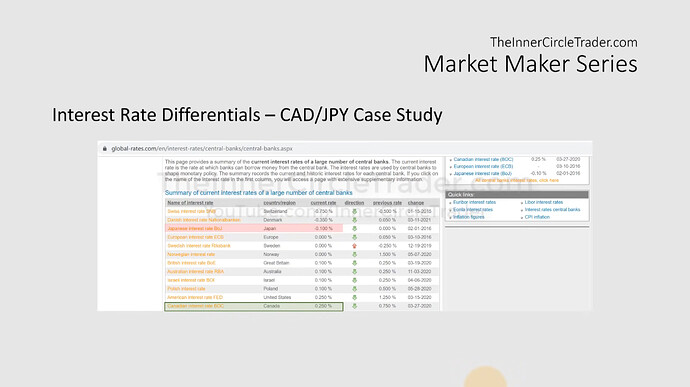

CADJPY Interest Rate Differentials Example

CADJPY Interest Rate Differentials Example - Canadian Dollar

CADJPY Interest Rate Differentials Example - Japanese Yen

CADJPY Interest Rate Differentials Example - Daily Chart

USDJPY Interest Rate Differentials Example

USDJPY Interest Rates Differentials Example - Dollar Index

USDJPY Interest Rate Differentials Example - Japanese Yen

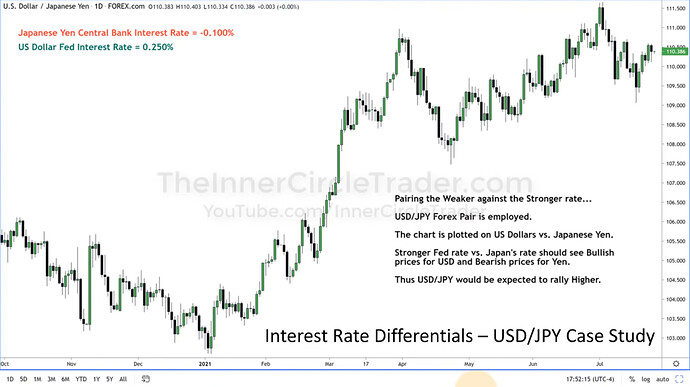

USDJPY Interest Rate Differentials Example - Daily Chart

Next lesson: ICT Forex - Market Maker Series - Volume 2

Previous lesson: ICT Forex - What Every New & Or Aspiring Forex Trader Wants To Know - Volume 5