Notes

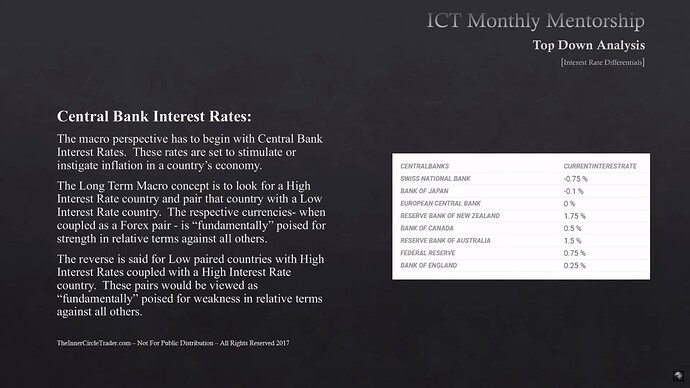

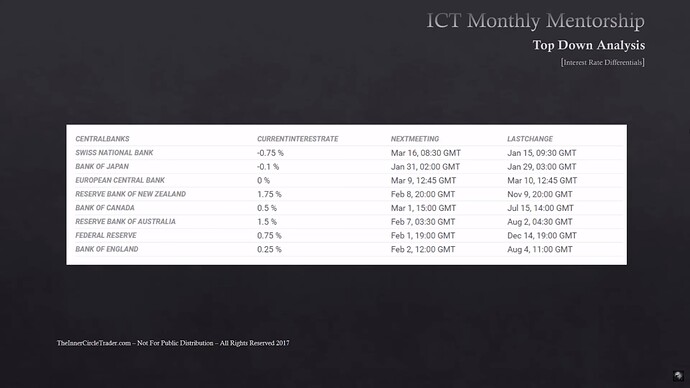

- Current central banks’ interest rates:

- Funds seek to trade high-yielding currencies against weak-yielding currencies. Remember, money always looks for a yield.

- There is no need to pair only the currencies with the highest and lowest interest rates. The difference between the currencies’ interest rates is what is significant.

- A currency with a low or negative interest rate is considered weak, while a currency with a high interest rate is considered strong.

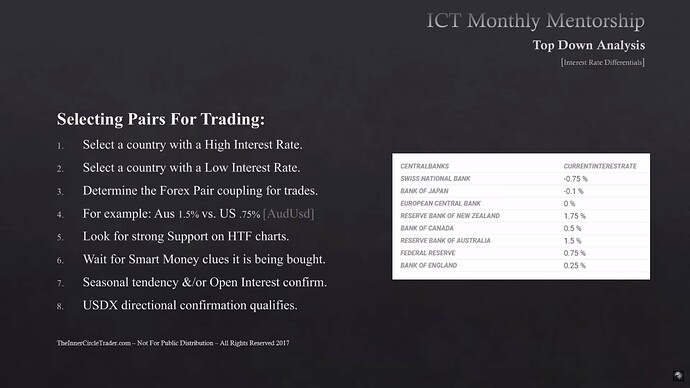

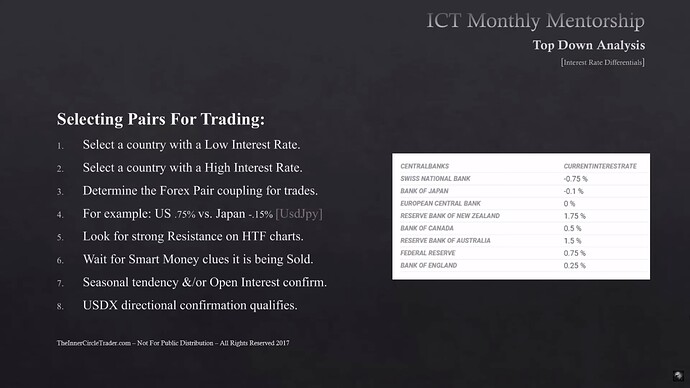

- High-probability trades occur when the fundamentals line up with the technicals.

- Always analyze open interest around support and resistance levels defined by institutional order flow.

Interest Rate Differentials - Central Bank Interest Rates

Interest Rate Differentials - Central Bank Interest Rates Example

Interest Rate Differentials - Selecting Pairs For Trading Long Position

Interest Rate Differentials - Australian Dollar Example

Interest Rate Differentials - US Dollar Index Example

Interest Rate Differentials - Selecting Pairs For Trading Short Position

Interest Rate Differentials - Japanese Yen Example

Next lesson: ICT Mentorship Core Content - Month 5 - How To Use Intermarket Analysis

Previous lesson: ICT Mentorship Core Content - Month 5 - Qualifying Trade Conditions With 10 Year Yields