Notes

- Key Levels are defined by higher time frames such as monthly, weekly, daily, and 4-hour charts.

- Key levels can be old highs and lows or the tops and bottoms of trading ranges.

- These levels are crucial as they guide large fund traders who do not operate on lower time frames (like 15-minute charts).

- Michael stresses that we should study these concepts with the historical data and backtest them.

- Market Maker models provide a framework for understanding market movements.

- If we’re bearish (MMSM - Market Maker Sell Model), we look for a retracement into a bearish order block or OTE levels.

- If we’re bullish (MMBM - Market Maker Buy Model), we look for a retracement into a bullish order block or OTE levels. We can also enter during runs on sell stops (bullish turtle soup entry).

- Consolidation is an area where the price stays within a range for a prolonged period, indicating potential upcoming movement. We can also enter during runs on buy stops (bearish turtle soup entry).

- We look for a retracement or sharp rejections at consolidation boundaries.

- SMT (Smart Money Technique or Smart Money Tool) is a divergence between correlated markets (e.g., EUR/USD vs. GBP/USD).

- The Smart Money Technique indicates a strong disparity and possible market reversal. For example, if EUR/USD makes a higher low while GBP/USD makes a lower low, it suggests a divergence and potential reversal.

- Experience and continuous study are essential for mastering these concepts and applying them in live trading.

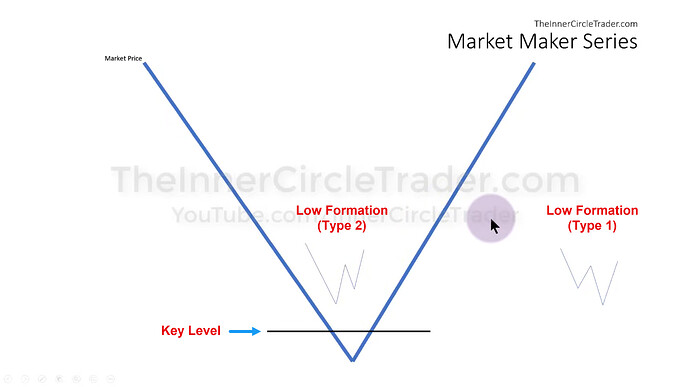

Market Maker Buy Model - Low Formations

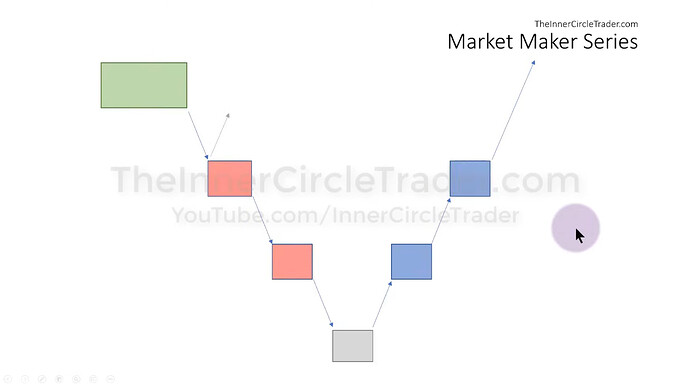

Market Maker Buy Model Diagram

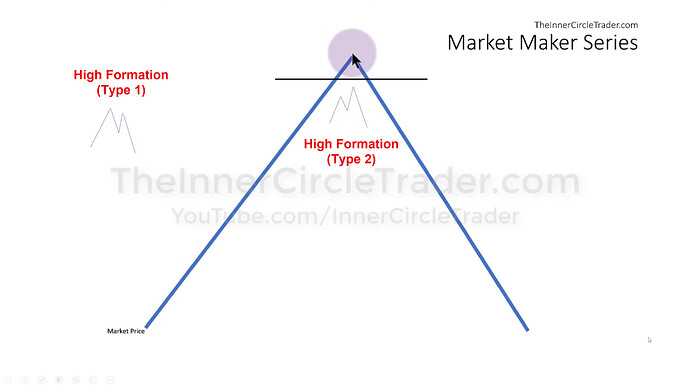

Market Maker Sell Model - High Formations

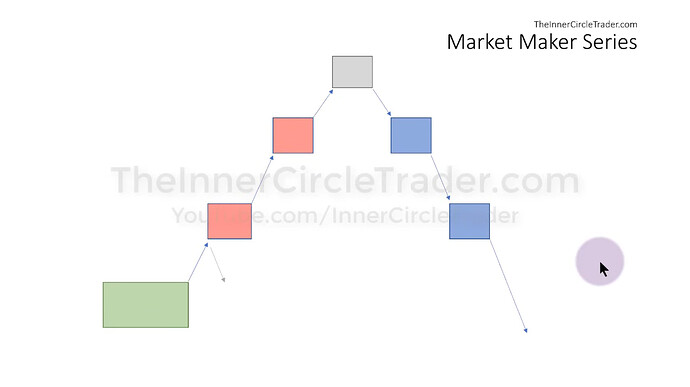

Market Maker Sell Model Diagram

GBPUSD Market Maker Buy Model Example - Daily Chart

GBPUSD Market Maker Buy Model Example - Hourly Chart

GBPUSD Market Maker Buy Model Example - Smart Money Technique (SMT)

Next lesson: ICT Forex - Market Maker Series - Volume 4

Previous lesson: ICT Forex - Market Maker Series - Volume 2