Notes

- The focus of this lesson is on Time and Price Theory in relation to market conditions specifically applied to the GBP/USD.

- Viewers should have watched volumes 1, 2, and 3 before watching this video.

- We focus on buying at or below the opening price of each day, specifically on Monday, Tuesday, and Wednesday (classic Power Of Three).

- Michael claims there’s a 70% chance that the low of the week is likely to form on Monday, Tuesday, or by Wednesday’s New York session.

- We avoid buying on Thursday and Friday in bullish weeks and selling on bearish weeks as these days tend to finalize the weekly range.

- Optimal Trade Entry is associated with the time of day, i.e., kill zones.

- Important times:

- London Kill Zone: 2 a.m to 5 a.m. New York time.

- New York Kill Zone: 7 a.m. to 10 a.m. New York time.

- New York Session: 8:30 a.m. to 11 a.m. New York time.

- We look for trade entries during these kill zones for higher probability trades.

- For new traders, avoiding trading during FOMC announcements is advisable due to high volatility.

- Buying and selling setups:

- Retracement to OTE levels.

- Retracement to order block.

- Turtle soup (stop run).

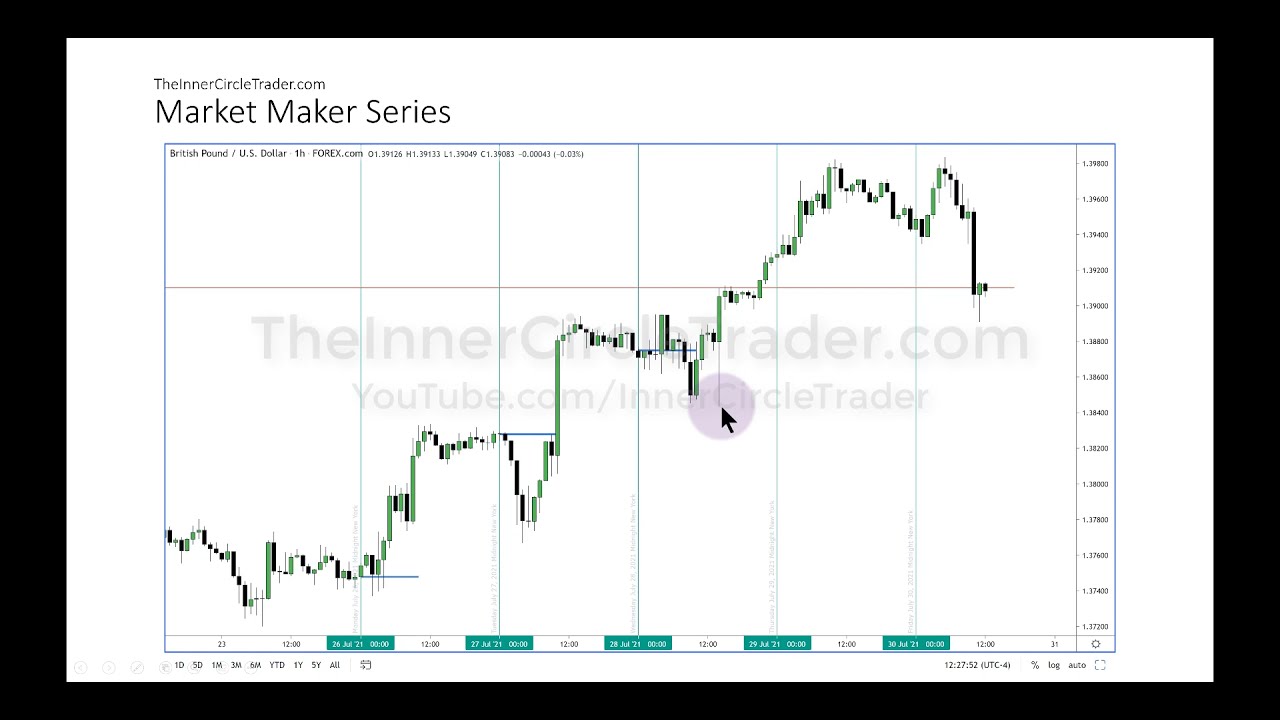

GBPUSD Market Maker Buy Model Example - Hourly Chart

GBPUSD Market Maker Buy Model Example - Hourly Chart Detail

GBPUSD Market Maker Buy Model Example - Buying Opportunities

GBPUSD Market Maker Buy Model Example - 15-Minute Chart

Next lesson: ICT Forex - Market Maker Series - Volume 5

Previous lesson: ICT Forex - Market Maker Series - Volume 3