Notes

- We use daily charts to identify swing highs and lows.

- The daily chart provides the structural basis for identifying high-probability scalp trades.

- We look for buying and selling opportunities during retracements, ideally during the London Open or New York Open Kill Zones.

- Timing trades during key times (kill zones) increases the likelihood of successful trades.

- For precise entries, we use a 15-minute time frame.

- Michael tries to get 20 to 25 pips per setup.

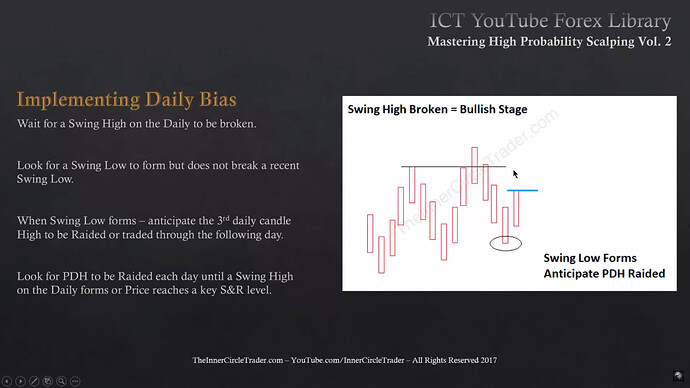

Implementing Daily Bias - Bullish Bias

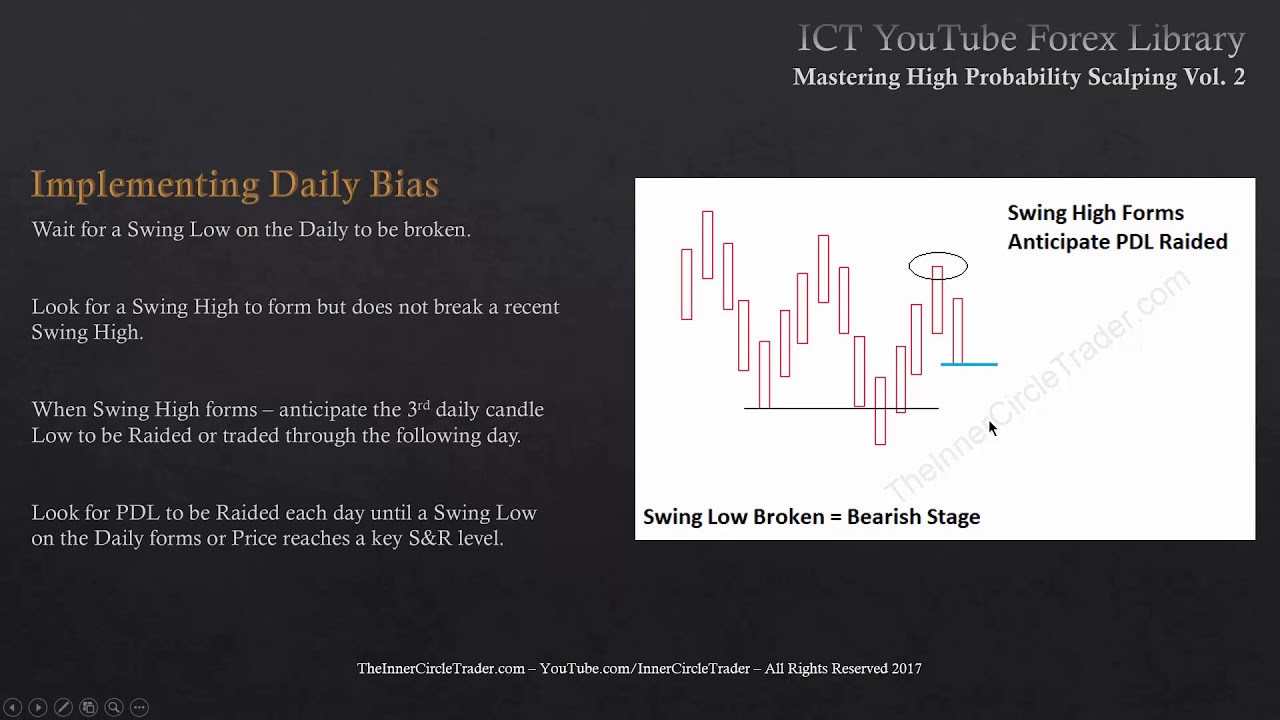

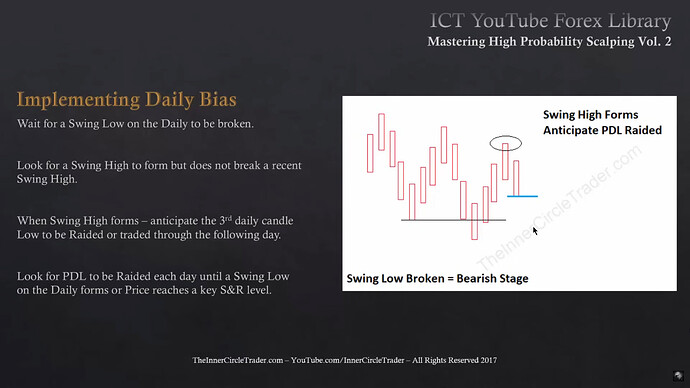

Implementing Daily Bias - Bearish Bias

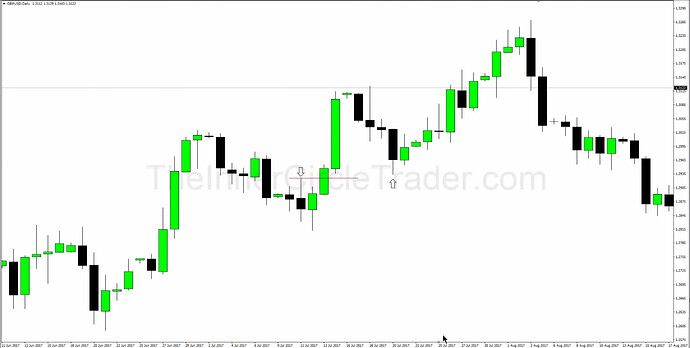

GBPUSD Scalp Trade Example - Daily Chart

GBPUSD Scalp Trade Example - OTE Buying Opportunity

Next lesson: ICT Forex - Mastering High Probability Scalping - Volume 3

Previous lesson: ICT Forex - Mastering High Probability Scalping - Volume 1