Notes

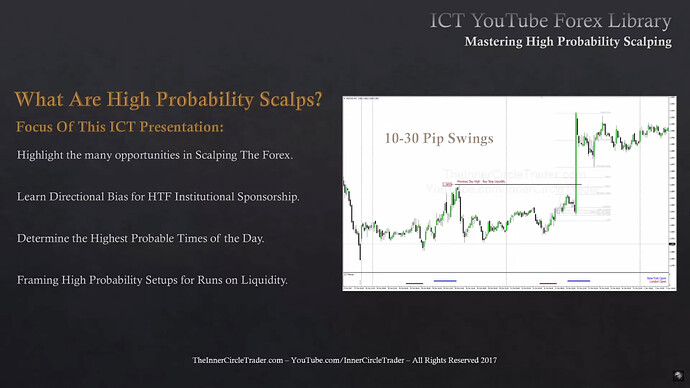

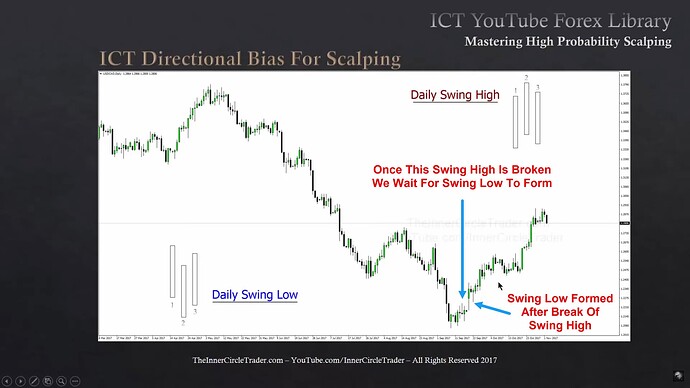

- This lesson teaches how to establish directional bias for higher time frame institutional sponsorship (institutional order flow).

- High-probability scalps are defined as trades targeting 10- to 30-pip price swings.

- Michael specializes in day trading and short-term trading, targeting weekly and daily highs and lows.

- This scalping model offers a trading opportunity every day.

- Each currency pair generates several scalping setups per week. However, we cannot expect it to form every single day on the same currency pair.

- In order to trade this setup daily, we need to form a basket of several currency pairs and monitor them.

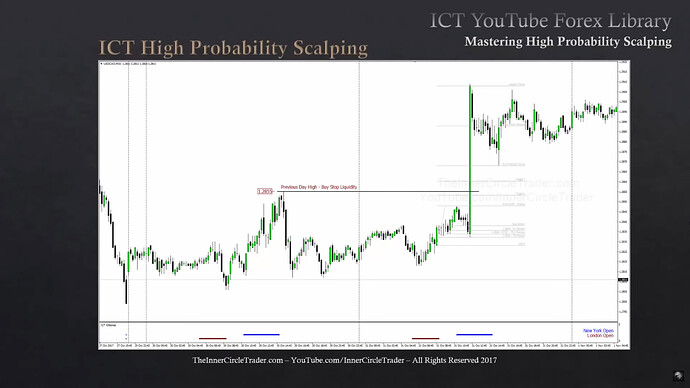

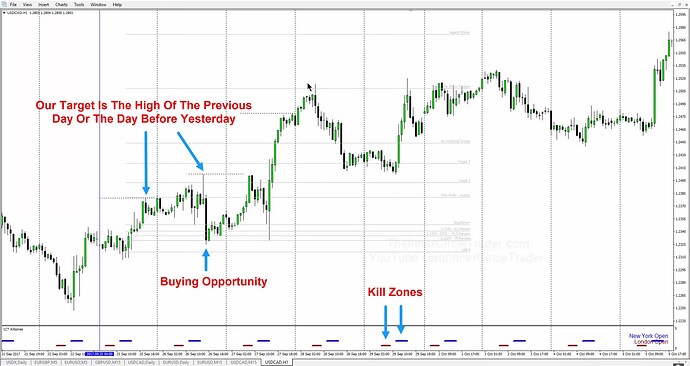

- If we are bullish, we look for a move above the high of the previous day or the day before yesterday.

- If we are bearish, we look for a move below the low of the previous day or the day before yesterday.

- We use OTE levels to determine where to enter the trade.

- We should focus on trading during high-probability time windows, particularly in the London Open and New York Open kill zones.

Mastering High Probability Scalping - What Are High Probability Scalps

Mastering High Probability Scalping - USDCAD Scalp Trade Example

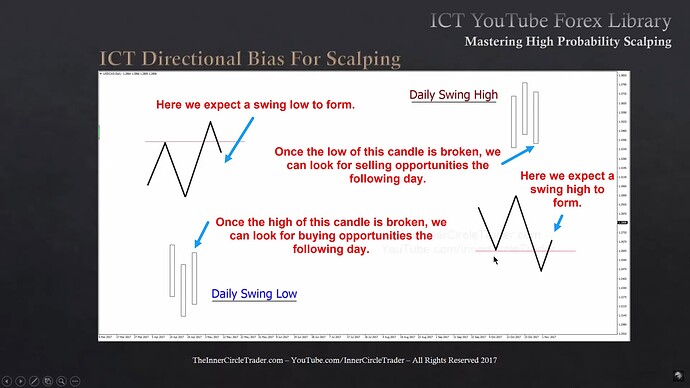

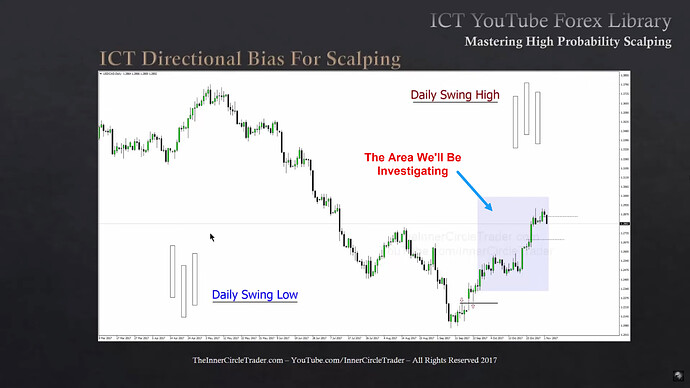

Mastering High Probability Scalping - Directional Bias For Scalping

Mastering High Probability Scalping - Swing High And Low

Mastering High Probability Scalping - Area To Investigating

USDCAD OTE Scalp Trade - First Trade Entry

USDCAD OTE Scalp Trade - Second Trade Entry

Next lesson: ICT Forex - Mastering High Probability Scalping - Volume 2

Previous lesson: ICT Forex - Market Maker Series - Volume 5