Notes

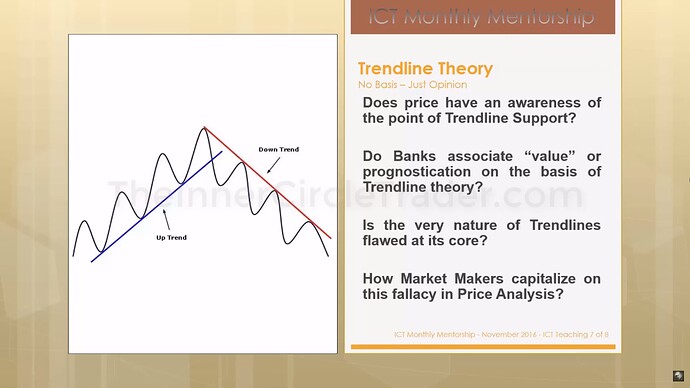

- Trendlines are based on opinions with no statistical edge.

- The market sees where a large pool of liquidity is, i.e., new buy stops, new sell stops, or old buy stops and sell stops.

- Large traders are the prey of the market. That’s where the market will go.

- If the trendline looks too obvious, it is probably a trap.

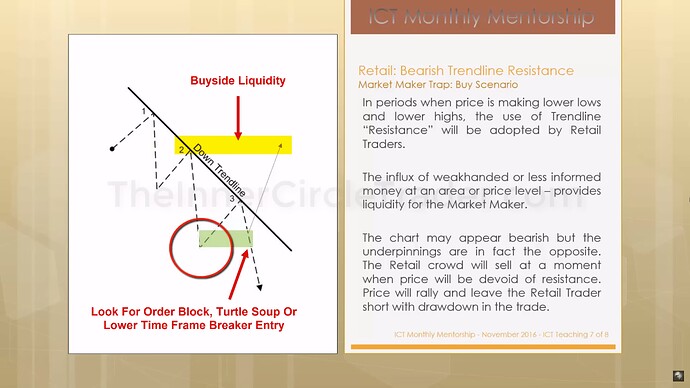

- If we expect higher prices, we look for an entry around the swing low that formed between the second and third touch of the bearish trendline.

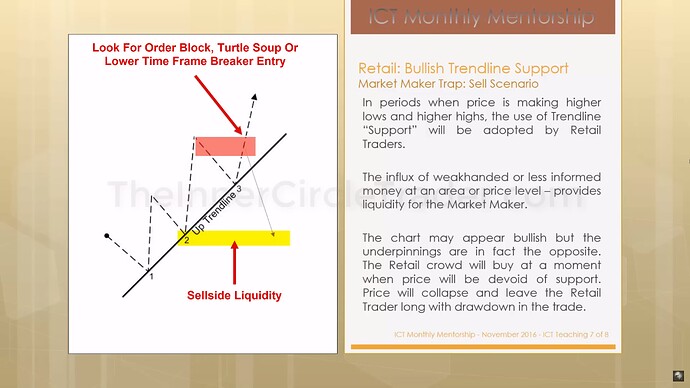

- If we expect lower prices, we look for an entry around the swing high that formed between the second and third touch of the bullish trendline.

Trendline Phantoms - False Trendlines

Trendline Phantoms - Trendline Theory

Trendline Phantoms - Bullish Trendline Support

Trendline Phantoms - Bearish Trendline Resistance

Trendline Phantoms - Bullish Trendline Examples

Trendline Phantoms - Bearish Trendline Examples

Trendline Phantoms - Trendline Examples - Triangle Pattern Example

Next lesson: ICT Mentorship Core Content - Month 3 - Market Maker Trap - Head & Shoulders Pattern

Previous lesson: ICT Mentorship Core Content - Month 3 - Macro Economic To Micro Technical