Notes

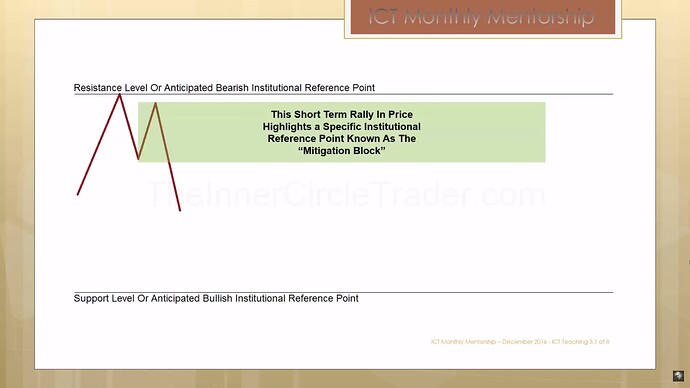

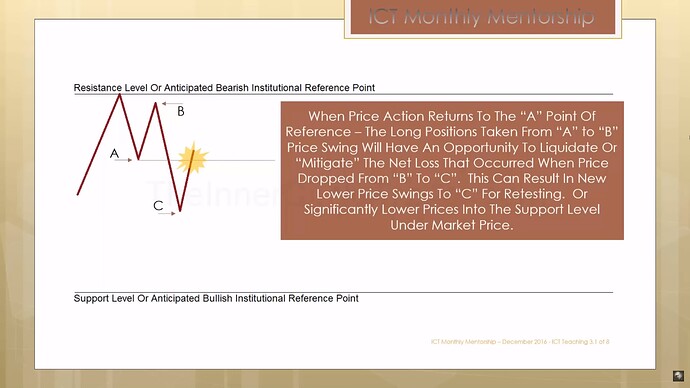

- A mitigation block is a failure swing with a confirmation break in the market structure.

- It is referred to as the M pattern because it looks like a giant M.

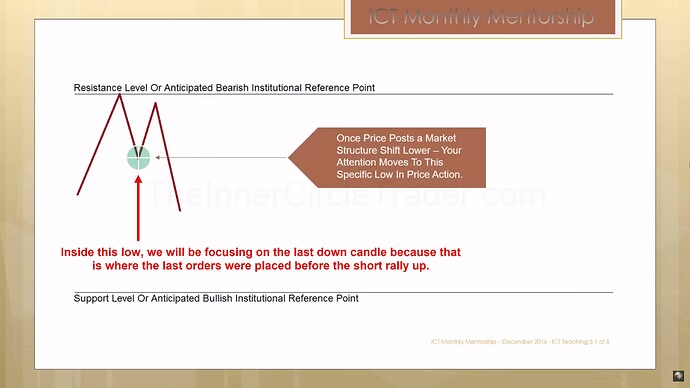

- The bullish mitigation block is made up of the whole up candle, while the bearish mitigation block is made up of the whole down candle.

- If we expect higher prices, we will buy at the high of the bullish mitigation block and place the stop loss below its low.

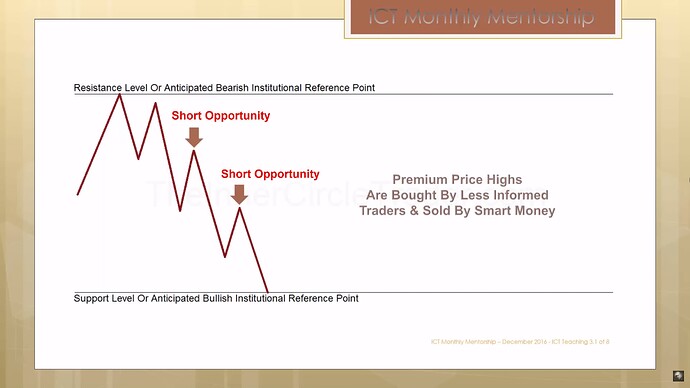

- If we expect lower prices, we will sell at the low of the bearish mitigation block and place the stop loss above its high.

ICT Mitigation Blocks

ICT Mitigation Blocks - Market Structure Shift

ICT Mitigation Blocks - Liquidation And Mitigation Of Positions

ICT Mitigation Blocks - Short Opportunities

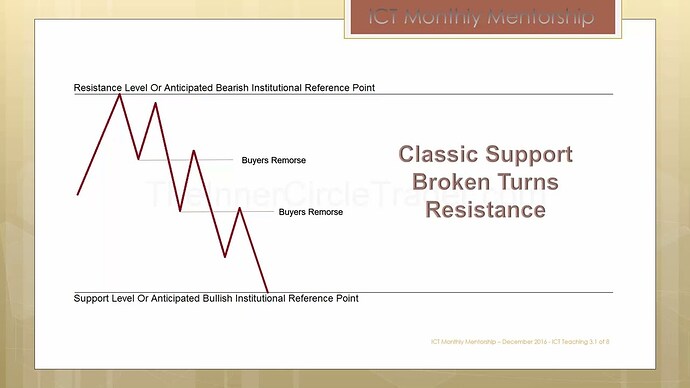

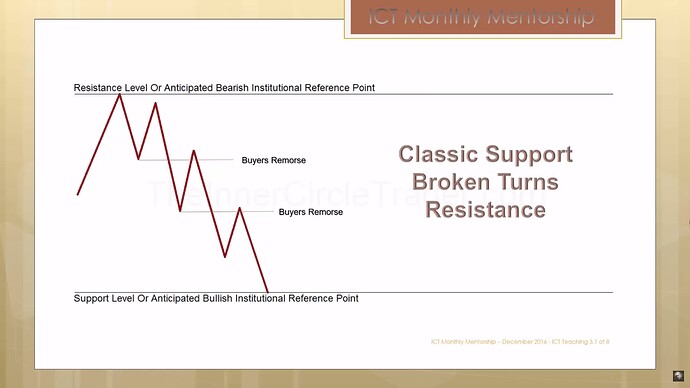

ICT Mitigation Blocks - Classic Support Turns Resistance

ICT Mitigation Blocks - Examples

Next lesson: ICT Mentorship Core Content - Month 4 - Breaker Block

Previous lesson: ICT Mentorship Core Content - Month 4 - Orderblocks